Market Recap

An extremely difficult year in the financial markets ended with a thud for U.S. stocks. Following a solid early fourth quarter rally, domestic stocks slumped in December and closed out the year with an 18.1% loss, its largest annual decline since 2008. Developed international stocks were down 14.5%, while emerging market stocks were down 20.1%. These annual returns were despite the U.S. dollar appreciating 8.3% for the year, which reduces dollar-based foreign equity returns one-for-one. Turning to the fixed-income markets, core investment-grade bonds had their worst year in at least 95 years, dropping 13.0%. The key driver, of course, was the sharp rise in bond yields; the 10-year Treasury yield ended the year at 3.9%, up from just 1.5% a year prior. High-yield bonds and municipal bonds were down 11.2% and 8.0% for the year, respectively. Alternative strategies generally outperformed traditional stock and bond indexes. Trend-following managed futures strategies gained roughly 27% for the year, while returns for commercial real estate were generally in the 10% range.

Investment Outlook and Portfolio Positioning

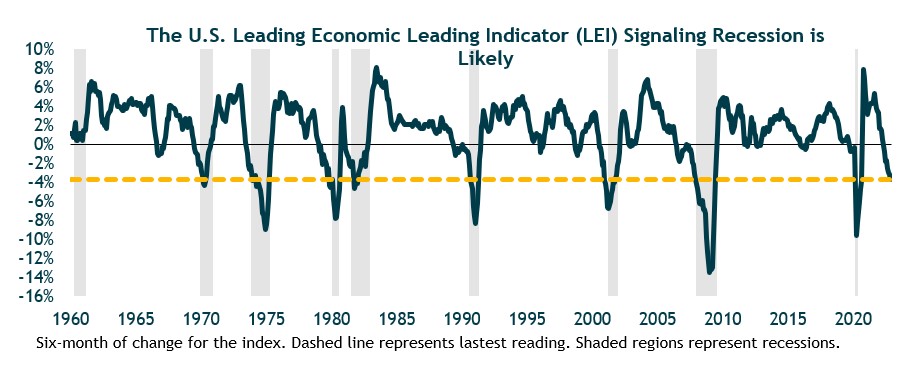

Inflation and monetary policy remain the financial markets’ key macro focus. U.S. headline inflation data have improved, suggesting we’ve seen the peak in inflation for this cycle. Various measures of core inflation have flattened, but remain at 5%-6%, far above the Federal Reserve’s 2% target. The Fed’s message has been clear that it intends to maintain restrictive monetary policy throughout 2023. Indeed, at its December 14 meeting, the Fed raised the fed funds rate by 0.5% to a target range of 4.25% to 4.50%. It also forecasted 75bps of additional rate hikes in 2023. Inflation is not just a U.S. problem. Nearly all the other major global central banks (except Japan and China) are also continuing to hike interest rates in their countries. These synchronized global rate hikes will further depress global aggregate demand and economic growth over the shorter term. It’s also typically a headwind for stocks. On the economic growth front, key leading indicators deteriorated further in the fourth quarter. The Leading Economic Indicator (below), which has a long track record of “calling” recessions, has fallen for nine consecutive months (and likely will again in December). This has never happened without an ensuing recession.

While we weigh the evidence as leaning towards recession, there are some positives supporting the economy that should mitigate the severity of a U.S. recession if and when it happens. First and foremost, the labor market remains strong, enabling consumer income and spending growth. Households also still have huge “excess savings” stemming from the pandemic – about $1.5 trillion (down from $2.3 trillion) that can support additional spending even as the Fed tightens. Business balance sheets are also generally in good shape, with many firms having refinanced their debt at low rates prior to this year’s sharp rise. More broadly, there don’t appear to be any major, systemic, economic/financial icebergs lurking under the surface, e.g., unlike in 2007-08 with the housing/mortgage derivatives market. In addition, we’d add a significant new development in the fourth quarter: the unexpected and sudden abandonment of China’s highly restrictive zero-COVID policy. Zero-COVID has been the key driver of China’s economic slump the past two years. The reopening of China’s economy for domestic consumers should be a catalyst for a growth rebound in 2023. Although not a foregone conclusion, the bottom line is that the odds favor a modest U.S. recession sometime in the next 12 months.

At present, we believe the current price of U.S. Stocks are reasonably valued, but could struggle for a time during an economic and corporate earnings recession. Foreign stock markets and earnings are also at-risk from a U.S. and global recession next year. However, return estimates for developed international and emerging market stocks are reasonably attractive relative to U.S. stocks and core bonds. Turning to our outlook for fixed income, given the sharp rise in yields, bonds haven’t been this attractive in over a decade. When estimating returns for core bonds over longer periods of time, the starting yield is a good approximation of subsequent returns. At year-end, bond investments we utilize were yielding 5%-6%. Moreover, we expect core bonds to deliver a positive return if a recession plays out, providing valuable downside protection against riskier assets. Beyond core bonds, there are other segments of the bond markets, including high-yield and floating rate loans, that offer attractive risk/return potential. Finally, we maintain core positions in alternative or non-traditional investments, such as managed futures, commercial real estate, etc. Alternative returns have been strongly positive this past year as traditional bond and stock funds have plunged. These investments have different return and risk drivers, and we believe will continue to provide tactical and longer-term strategic benefits to our balanced portfolios. They are much less dependent than traditional investments on which type of macro environment (e.g., deflation, stagflation, inflation, or growth) unfolds over the coming years.

Closing Thoughts

As 2022 has reminded investors, we should “expect the unexpected, and expect to be surprised.” This is expressed in our portfolio construction and investment management via balanced risk exposures, diversification and forward-looking analysis that considers a wide range of potential scenarios and outcomes. While markets are challenging at times, it is critical for long-term investors to stay the course through these rough periods that are often a grind. We believe 2023 will likely present us with some excellent long-term investment opportunities, as the return outlook for a diversified portfolio has improved with improved stock valuations and higher bond yields that should reward patient investors in due time. Please find the enclosed economic newsletter from Dr. Ray Perryman. We sincerely appreciate your continued confidence and trust and wish you and yours a blessed New Year!

The Water Valley Investment Team