Our Services

Spectrum of Client Relationships

- Individuals

- Business Professionals, e.g. Medical, Legal, etc.

- Business Owners and Entrepreneurs

- Professional and Collegiate Athletic Coaching

Staff, and Professional Athletes - University Professors and Educators

- Retirement Plans

- Foundations and Non-Profits

- Trusts

- Corporations/Businesses

- Family Farms

Wealth Management

Tax Planning

Retirement Planning

Investment Management

Business Transition Planning

401(k) Management

Asset Strategy

Financial Education

Wealth Management or Financial Planning. We’re Here to Assist You In All Of Life’s Transitions.

Investment Advisory Services

- Sole focus of custom-tailored investment management.

- Daily professional management of the investment portfolio.

- Lead manager for each client.

- Regular investment reviews with client.

- Comprehensive financial advice and retirement planning.

- Consolidated reporting.

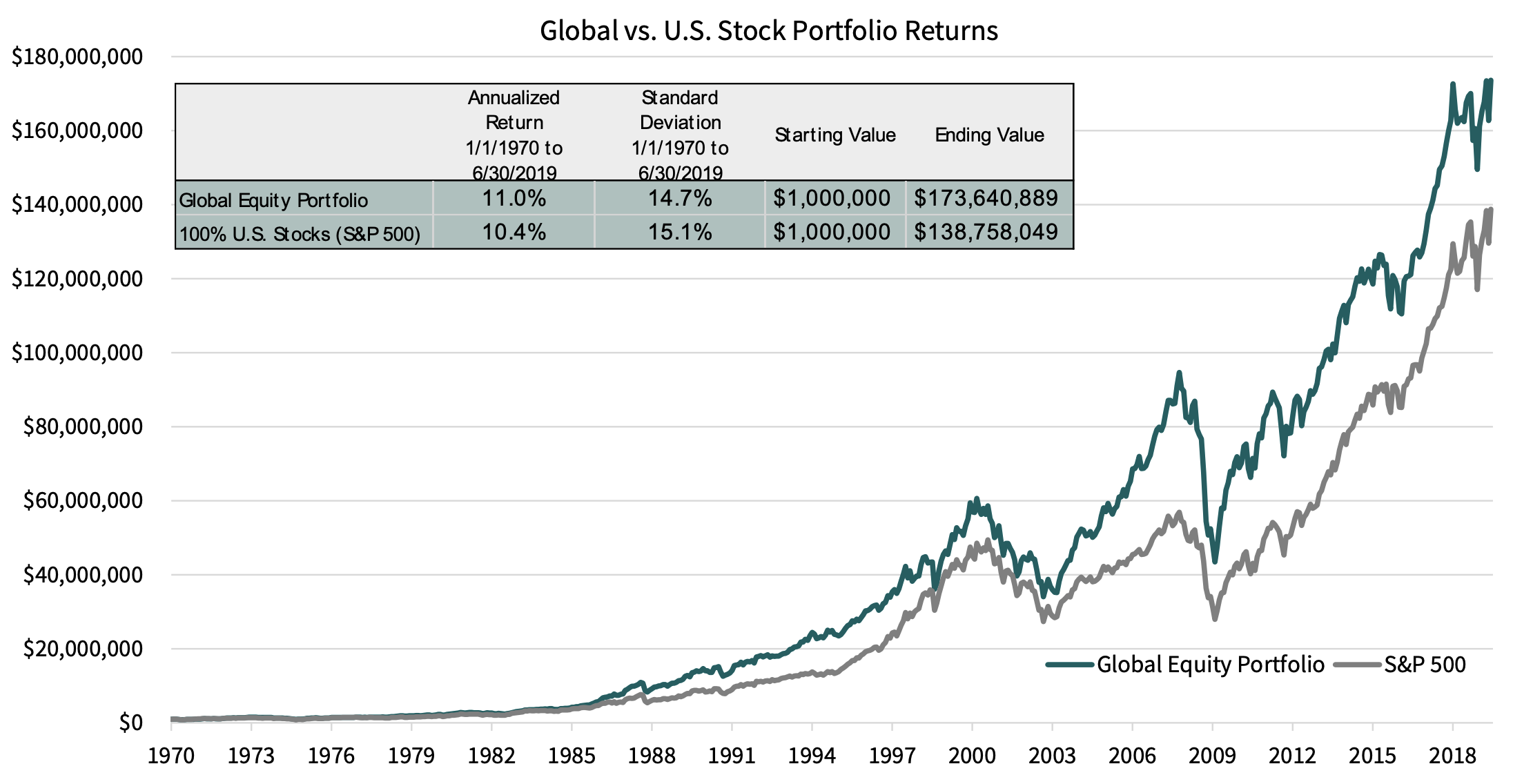

Investment Philosophy

- In-depth analysis of independent research and a disciplined process are critical to finding exceptional value and long-term investment success.

- Tactical movements and diversification among many asset classes (equities, fixed income, real estate, commodities, etc.), styles (conservative, aggressive, stable, etc.), and market capitalization (large, mid, small, etc.) improves returns and reduces risk.

- Patience and a long-term approach allows us to take advantage of undervalued (or overvalued) investments.

- For many clients, using institutional mutual funds and money managers allows us to provide diversified portfolios and access some of the world’s premier investment minds.

- We have access to the full spectrum of mutual fund families.

- Investment portfolios are custom-tailored to meet the objectives of each client.

Asset Allocation Guidelines

Growth

Investment Objective:

Primary objective of long-term growth and secondary objectives of income and capital preservation, in order to enhance the purchasing power of the assets.

Investment Philosophy

A diversified portfolio of marketable securities allocated primarily for capital appreciation and secondarily for income and capital preservation, given a prudent level of risk.

Balanced

Investment Objective:

Primary objectives of long-term growth, income and capital preservation, in order to enhance the purchasing power of the assets.

Investment Philosophy

A diversified portfolio of marketable securities allocated primarily for capital appreciation, income and capital preservation, given a prudent level of risk.

Conservative

Investment Objective:

Primary objectives of income and capital preservation and a secondary objective of long-term growth, in order to enhance the purchasing power of the assets.

Investment Philosophy

A diversified portfolio of marketable securities allocated primarily for income and capital preservation and secondarily for capital appreciation, given a prudent level of risk.