By M. Ray Perryman, PhD, CEO and President – The Perryman Group

Outlook for the US Economy – 3rd Quarter 2024

By M. Ray Perryman, PhD, CEO and President

The Perryman Group

Overview

The US economy has remained remarkably stable in the face of geopolitical uncertainty and the effects of Federal Reserve actions needed to tame inflation. With the recent sizable cut in target interest rates by the Fed and the expectation of additional decreases, there is growing potential for a more robust expansion in the coming months. The key question in the near-term outlook is the geopolitical situation, particularly as it might impact energy markets.

Employment

The September jobs report indicated that US nonfarm payroll employment increased by 254,000. Although one month of strong growth should not be overemphasized, it is nonetheless encouraging. Employment levels were largely unchanged for the month in many industries including (among others) manufacturing, professional and business services, and transportation and warehousing. The sectors leading the gains were food services (up by 69,000), health care (+45,000), government (+31,000), social assistance (+27,000), and construction (+25,000).

Strong job growth would tend to slow the pace of further rate cuts, but some of the details within the latest release are less encouraging. It is noteworthy that the labor market has weakened significantly over the past year and that some of the expanding sectors are those supported by various federal spending programs. The number of job openings is down by 1.3 million over the past 12 months, standing at 8.0 million at the end of August. In addition, the number of people choosing to quit their jobs (an indicator of how optimistic they are about finding better ones) continues to decline. It is also notable that the employment survey occurred prior to the onset of Hurricane Helene.

Economy

Consumer sentiment has taken a sharp downturn recently according to the widely tracked index from The Conference Board. Both assessments of the current situation and expectations for the future fell. The weakening job market is a likely cause, in addition to general uncertainty related to the presidential election and geopolitical conflicts. Because in normal times about 70% of economic activity is driven by consumer spending, continued pessimism could affect future growth. Nonetheless, the US economy has been quite resilient and appears poised for future growth.

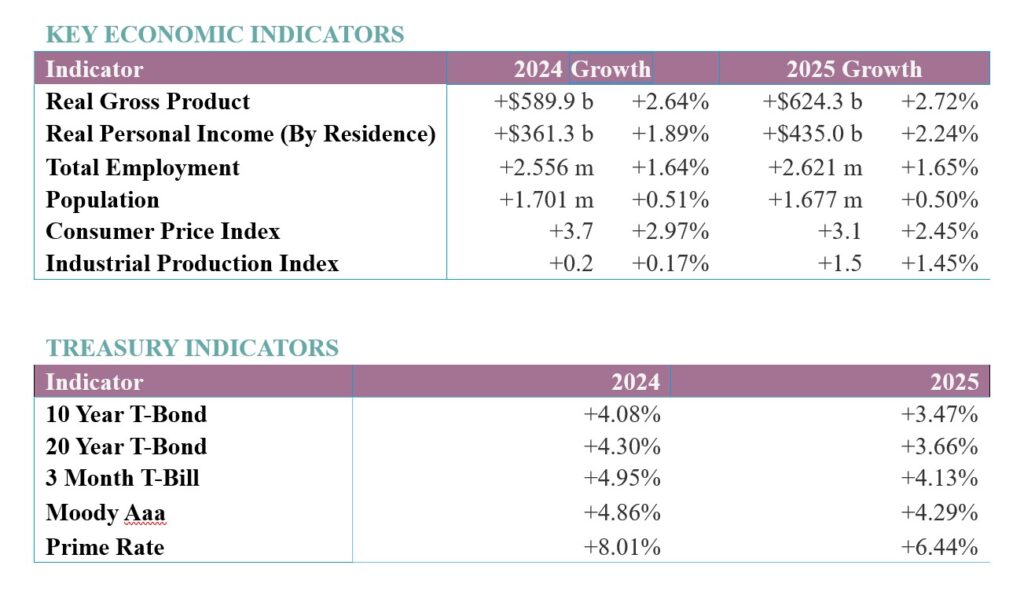

The Perryman Group’s latest projections indicate real gross product is expected to expand by +2.64% this year on a year-over-year basis, with +2.72% growth in 2025. Job gains are projected to be just under 2.6 million through 2024, with a slightly larger increase of over 2.6 million jobs next year.

About Dr. M. Ray Perryman and the Perryman Group

About Dr. M. Ray Perryman and the Perryman Group

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com). He also serves as Institute Distinguished Professor of Economic Theory and Method at the International Institute for Advanced Studies.