Market Recap

It was far from a quiet summer for the financial markets, which have been volatile as investors parsed through economic data attempting to gauge whether the economy will slow, and how much the Federal Reserve would need to lower interest rates to prevent a recession. Toward the end of the quarter, the Fed opted for a bold start to its shift in policy, reducing rates by a half percentage point. This was the first cut since 2020. Year to date, the economy has proven resilient thanks to strong consumer and federal spending, lower inflation, and healthy corporate earnings.

Despite the volatility, the domestic stock market reached new highs, gaining 5.9% in the third quarter. Notably, there was a rotation out of large-cap growth tech stocks and into a broader range of sectors and styles. Outside of the U.S., developed international stocks gained 7.3%. Emerging markets stocks were relatively quiet for most of the quarter but rose sharply in the last week of the period after China announced their boldest stimulus in years in an attempt to boost their ailing economy. Emerging-markets stock finished the quarter up 8.7% thanks to an impressive, but not historic, 23.5% gain for China during the month of September. Within the bond markets, returns were positive across most fixed-income segments. The benchmark 10-year Treasury yield declined from 4.36% to 3.81% amid lower inflation and recession concerns. In this environment, domestic bonds gained 5.0%. Overall, domestic economic and corporate fundamentals remained relatively healthy in the quarter, although rich valuations remain a risk. Looking ahead, the expectation is that the Fed will continue to cut rates this year and next in an effort to guide the economy to a soft landing and avoid a recession.

Investment Outlook and Portfolio Positioning

The Fed’s half-point rate cut in September came after one of the most rapid series of hikes in history that were an effort to combat the highest level of inflation since the early 1980s. The question now is the pace of cuts going forward. The Fed expects another 150 basis points of cuts by the end of 2025 and more modest cuts in 2026. Overall, economic data remains generally healthy. Our view is that a slowing economy is the most likely outcome for the U.S. economy and that current conditions should be mildly positive for both bonds and stocks, although we expect the pace of gains to slow given stretched valuation’s. We believe the Fed’s recent shift puts us at a turning point in the fixed-income market, and the more accommodative stance will start a new chapter for bonds. As the Fed lowers short term rates, yields will move lower, and reinvestment risk comes into play for short-term instruments. Investors will increasingly start to look for higher returns elsewhere.

In our portfolios, we have meaningful exposure to core investment grade bonds which will act as ballast in the event of a recession or traditional “flight-to-safety” market shock. Our strong preference, however, remains for flexible, shorter-duration and credit-oriented fixed-income allocations, which we think will generate better yields over time. Importantly, we do feel that we are not “stretching” for yield, i.e., taking on excess risk to achieve attractive returns. Many of our exposures are investment-grade or are conservatively positioned within the high-yield space.

Stocks have posted one of the strongest year-to-date returns through September since the 1990s, with the majority of returns due to expanding valuations. While it is normal for short-term equity returns to be driven by valuation expansion or contraction, we believe that earnings growth is the more reliable driver of long-term returns. With valuations now near historic highs, earnings growth will need to do the heavy lifting for investors to realize similarly strong returns as they have in recent years. While it is not out of the realm of possibilities, such an outcome will be harder to come by given historically high profit margins and valuations. Within our U.S. equity allocation, we remain balanced across our style and market cap exposures. Earlier this year, we increased exposure to U.S. larger-cap value stocks and U.S. smaller-cap stocks based on our belief the equity market rally would broaden out beyond large-cap growth tech stocks (i.e., the “Magnificent Seven”). The rotation out of technology into a broader range of sectors was evident in the third quarter and we believe there is more room for it to run. Similarly, our analysis continues to suggest attractive long-term return potential for foreign stocks given their attractive valuations.

Markets …and Politics

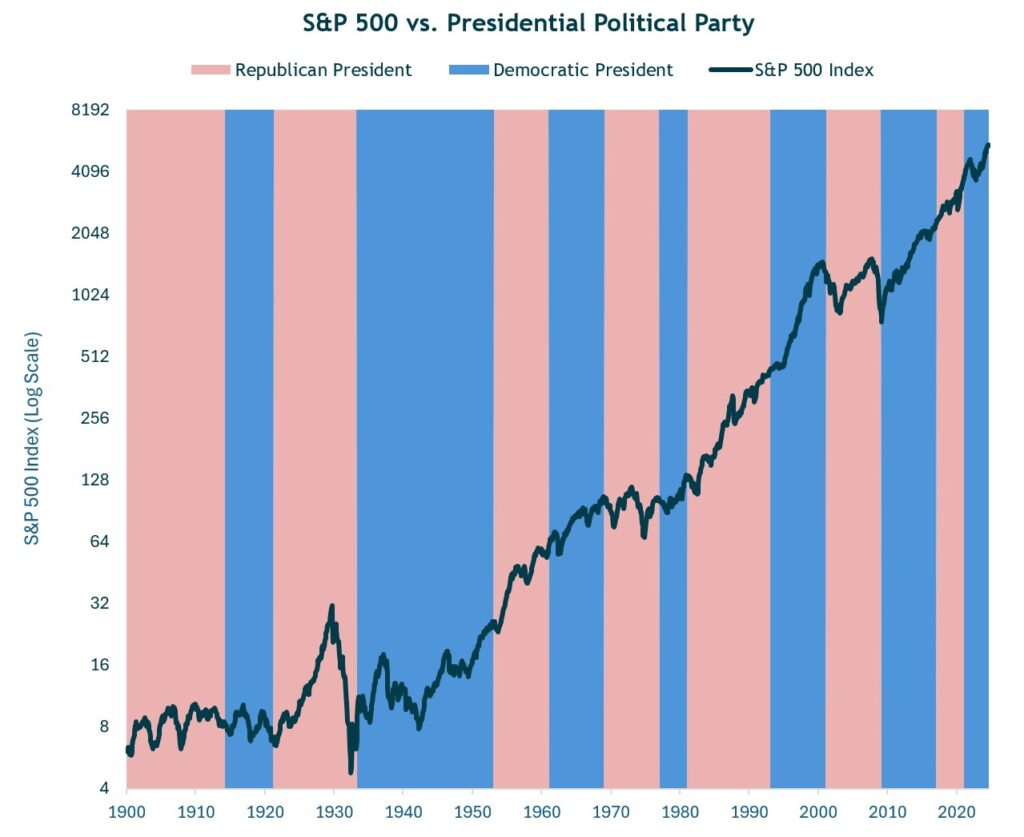

With the U.S. presidential election one month away, we want to reiterate our long-held view that portfolio positioning should be guided by an analysis of longer-term risks and rewards, not election outcomes. We recognize that it’s natural for investors on both sides of the aisle—especially in today’s polarized environment—to believe that an election outcome could have a big impact on the financial markets. This intuition, however, is not supported by the historical data and we provide some evidence in the included chart that stocks have historically trended higher regardless of the political party of the President. Ultimately, the market is driven by economic fundamentals, such as the fed funds rates, corporate earnings, valuations, fiscal imbalances, interest rates, inflation expectations, among other factors. Undoubtedly, elections and headlines will influence short-term market fluctuations but longer-term, fundamentals are what drive market performance. Our intention is not to minimize the significance of the election, but to point out that the gears of the economy are not overhauled based on an election outcome.

As for market performance around elections, there have been elections that resulted in stock market volatility and declines, notably when incumbents lose (a result that begs the question of whether a bad

economic backdrop is what led the incumbent to lose). While technically there is no incumbent in this election, markets typically see a strong rebound in the year following any post-election declines. This shows that historically, elections have not had a meaningful or long-lasting effect on investment performance. That means investors are wise to remain focused on the longer-term drivers of markets and even be prepared to take advantage of any post-election market declines.

Closing Thoughts

Although we have serious longer-term concerns with the exploding level of federal debt, we remain cautiously optimistic about the current investment landscape. While there are promising signs in the economy, we are also acutely aware of the potential risks that could impact market stability. Our focus will continue to be on identifying opportunities to improve long-term returns in line with the risk targets for the portfolios we manage. By staying disciplined and opportunistic, we aim to navigate the complexities of the market and position our investments for long-term success. We thank you for your continued confidence and trust. Please find the enclosed economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team