By M. Ray Perryman, PhD, CEO and President – The Perryman Group

Outlook for the US Economy – 4th Quarter 2024

By M. Ray Perryman, PhD, CEO and President

The Perryman Group

Employment

The United States economy has stabilized and even gained some momentum in recent months. The December jobs report from the US Bureau of Labor Statistics (BLS) indicates that 256,000 jobs were added, an increase that was significantly higher than most analysts were expecting.

While most of the net new positions continue to be concentrated in three sectors (health care and social assistance, leisure and hospitality, and government), there were also some positive signals from additional industries. Tens of thousands of jobs in the manufacturing segment have been lost over the past year, and a notable turnaround in these basic industries would be a more compelling signal of resurgence.

Another aspect of changes in the labor market is that as worker shortages have subsided in some segments of the economy, employees are more likely to be faced with related erosion in their bargaining power. Back-to-the-office mandates and reductions in perks are becoming more widespread. In addition, BLS data indicates that the numbers of workers voluntarily quitting their jobs (which is an indicator of confidence that they can find another potentially better position) is dropping.

Monetary Policy

Although the resilience of the labor market is clearly good news, it may also slow the pace of Federal Reserve decreases in the target interest rate. Minutes from recent Fed policy meetings indicate some concern over the potential for increasing inflationary pressures (such as if President Trump implements significant tariffs), and many officials now prefer to wait for further cuts.

Economy

Projections of global economic performance are becoming more positive as central banks relax restrictive monetary policy. Additional investment is expected, leading to increased business activity. At the same time, geopolitical tensions continue to lead to uncertainty. Serious talks by Israel and Hamas related to a cease fire agreement enhance hope of a peaceful way forward, and other changes in the region may also help to diffuse the recent high levels of potential escalation. Calming of these and other tension would be good news for economic growth, while intensification or spreading of the conflicts could cause notable disruptions. There are currently many sources of uncertainty facing the economy, including significant potential policy changes. However, on balance, moderate growth is expected.

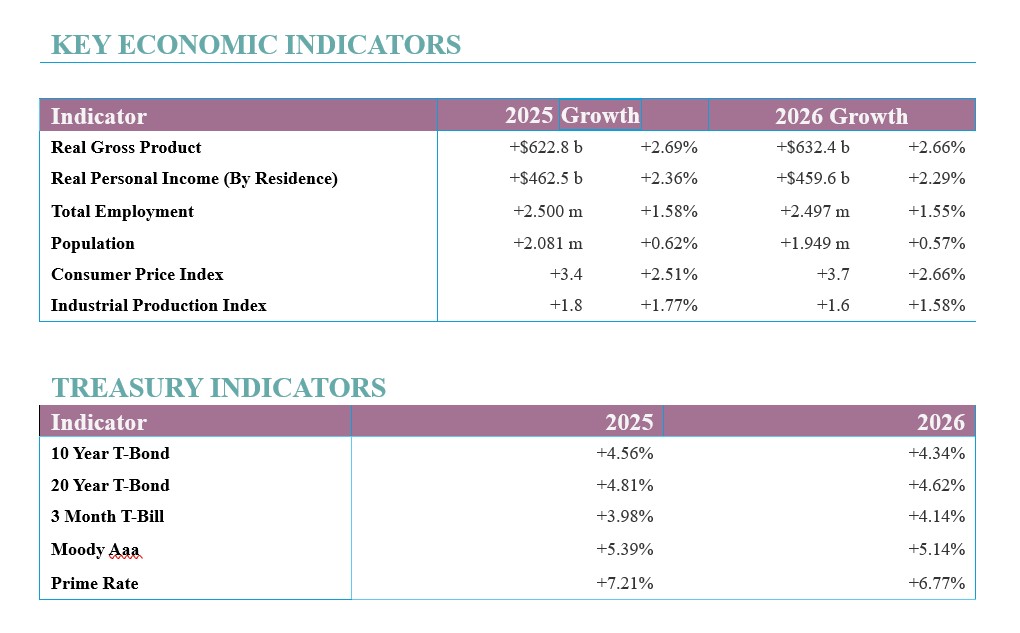

The Perryman Group’s most recent projections indicate real gross product is expected to expand by 2.69% this year on a year-over-year basis, with 2.66% growth in 2026. Job gains are projected to be 2.5 million through 2025, with a slightly smaller increase next year.

About Dr. M. Ray Perryman and the Perryman Group

About Dr. M. Ray Perryman and the Perryman Group

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com). He also serves as Institute Distinguished Professor of Economic Theory and Method at the International Institute for Advanced Studies.