By M. Ray Perryman, PhD, CEO and President – The Perryman Group

Outlook for the US Economy – 3rd Quarter 2025

By M. Ray Perryman, PhD, CEO and President

The Perryman Group

Employment

Although total non-farm employment has changed little since April, looking over the past 12 months (ending in August), some 1.34 million net new jobs have been generated. This annual growth rate of 0.85% represents a definitive and significant slowing in the labor market. Over the past year, the educational services, health care, and social assistance industries featured both the largest increases in workers (847,000) and the highest rise in percentage terms (3.22%). The largest losses occurred in the manufacturing sector, down 85,000 workers from August 2024 to August 2025. The seasonally adjusted unemployment rate in August increased modestly to 4.32%, up 0.13 percentage points from a year prior.

The sluggish labor market is likely to remain another weak spot. While reduced immigration and the resulting decrease in available workers will work to keep the unemployment rate fairly stable, workers are having increasing difficulties landing jobs.

Looking ahead, tariffs continue to be a source of increased costs and uncertainty. However, deals have been struck with major trading partners including the European Union and Japan, which is helping provide some clarity (although the higher levies are beginning to make their way into higher prices). The situation with China remains a major question mark given the volume of trade and reaching a meaningful agreement that does not dramatically increase costs would provide a boost to the economy.

Inflation/Monetary Policy

The inflation rate has edged up slightly over the past few months, though it continues to trend slightly below 3%. Even with price increases due to tariffs (which are now beginning to escalate), reductions in some categories such as gasoline are helping keep overall inflation from rising excessively at this time.

The Federal Reserve will continue to face difficult choices in interest rate policy. Inflation remains well below the 2% target, and tariffs could escalate upward price pressures (particularly if the situation with China deteriorates). However, the labor market’s weakness and the fallout from the government shutdown should encourage additional interest rate reductions assuming no major spikes in prices occur.

Economy

Encouraging signs for the economy include the recent improvement in the Middle East, and ongoing investment in AI-related initiatives which could enhance future prosperity. There are also some signs of onshoring manufacturing operations with positive implications for future manufacturing employment.

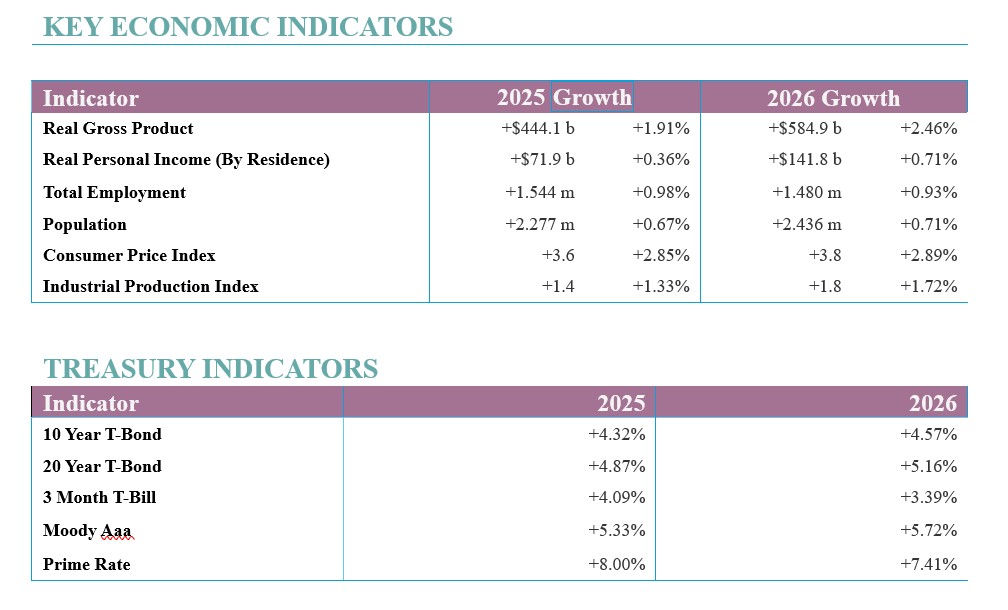

Despite the difficulties the US economy is facing, The Perryman Group’s most recent projections continue to call for growth over the next two years, though the pace is expected to be uneven. Real gross product is expected to expand by +1.91% this year on a year-over-year basis, with +2.46% growth in 2026. Job gains are projected to be about 1.54 million through 2025, with an increase of 1.48 million jobs next year.

About Dr. M. Ray Perryman and the Perryman Group

About Dr. M. Ray Perryman and the Perryman Group

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com). He also serves as Institute Distinguished Professor of Economic Theory and Method at the International Institute for Advanced Studies.