09 Apr 2025

1st Quarter Newsletter 2025

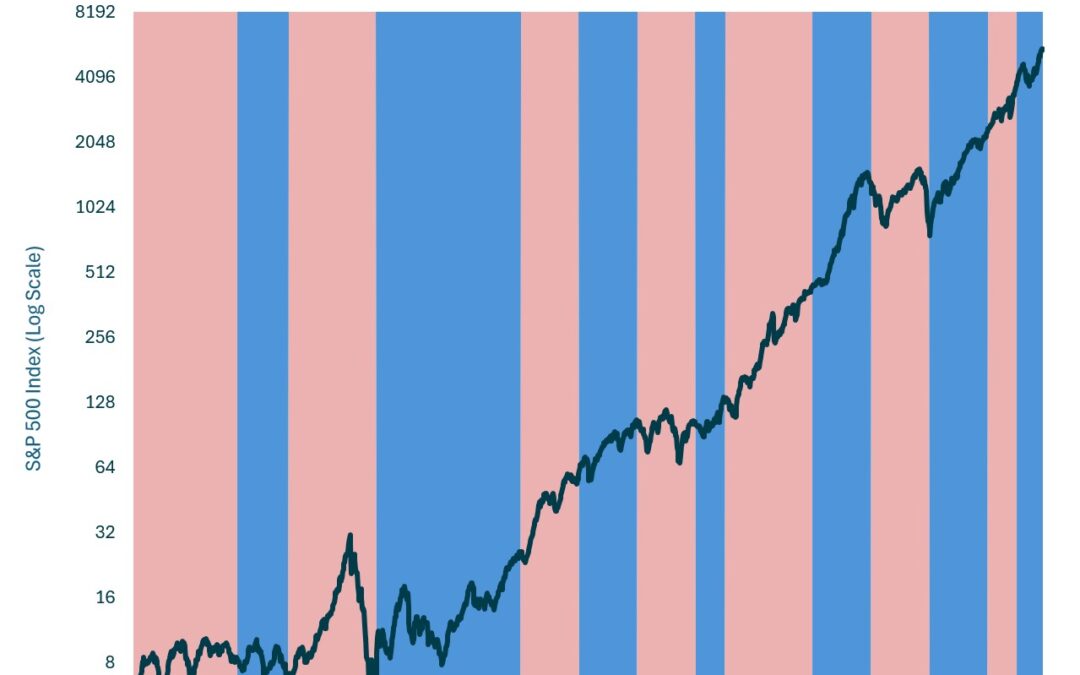

Market Recap Global stock markets displayed a wide dispersion of performance across regions and styles over the first quarter of the year. After making a new all-time high in mid-February, U.S. stocks suffered their first 10% correction since 2023 before recovering to end the quarter down 5% (this slide continued into early April). Smaller-cap U.S. […]

Read More

Apr 9, 2025 | Newsletters

Market Recap Global stock markets displayed a wide dispersion of performance across regions and styles over the first quarter of the year. After making a new all-time high in mid-February, U.S. stocks suffered their first 10% correction since 2023 before recovering to...

22 Jan 2025

4th Quarter Newsletter 2024

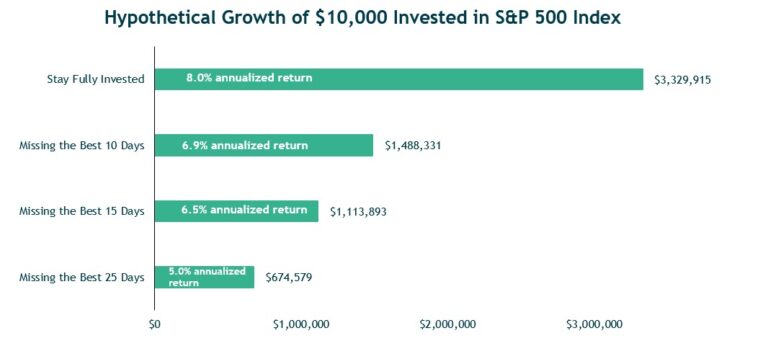

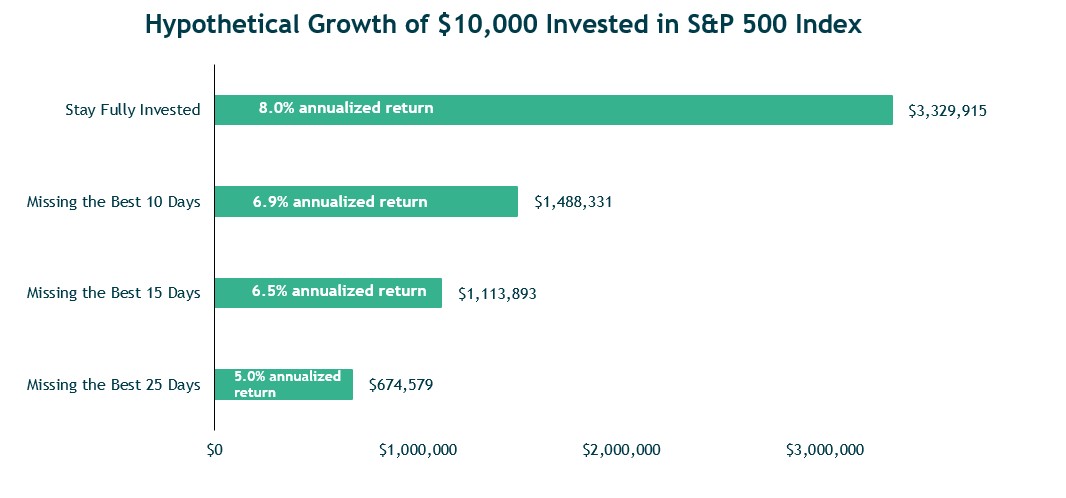

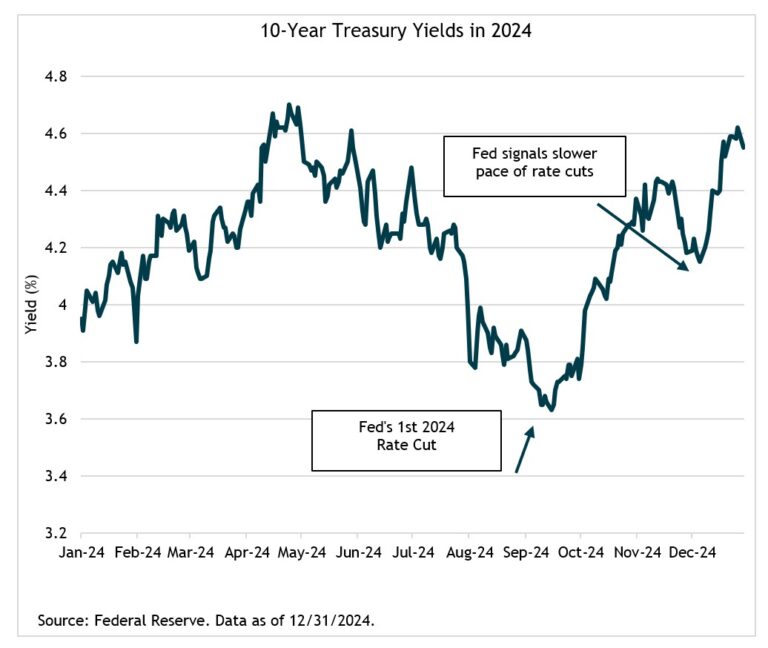

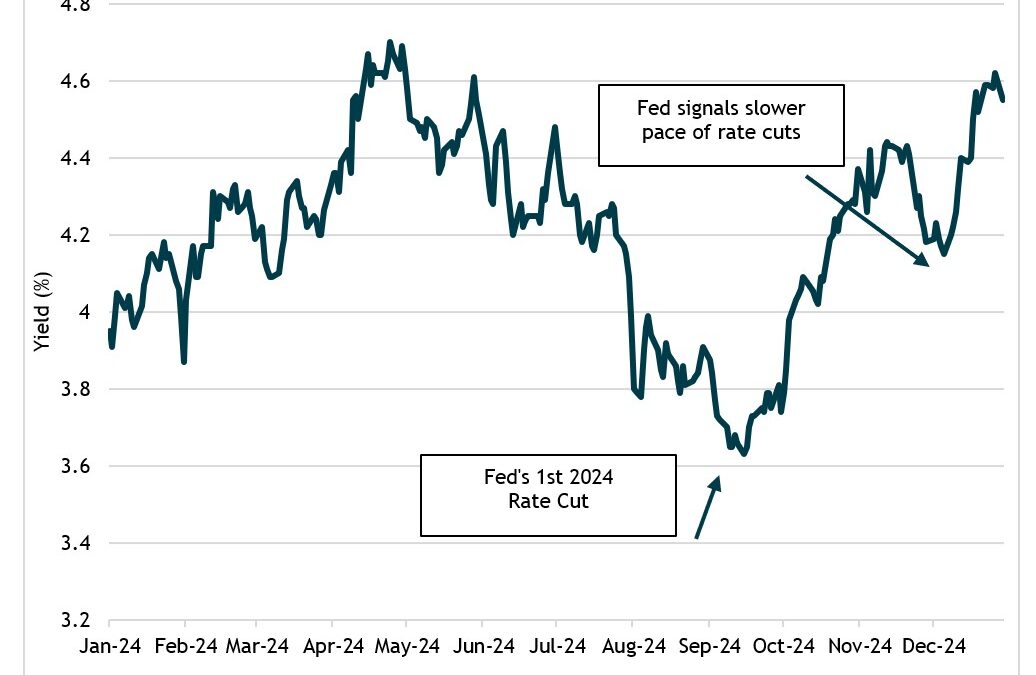

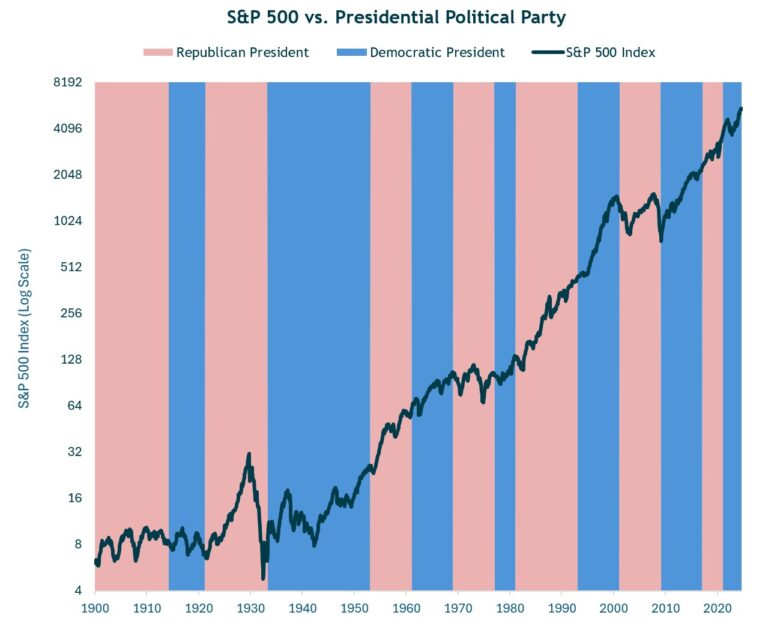

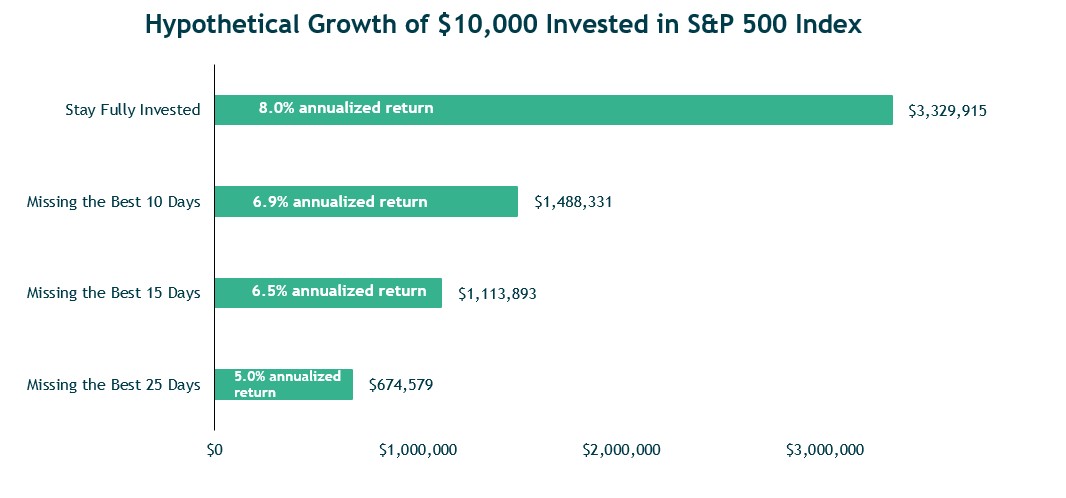

Market Recap The U.S. economy and the stock market proved much stronger than many had anticipated in 2024, with the market marching higher throughout the year finishing up 25%, while notching 57 new all-time highs, the sixth most since 1928. The robust gains in U.S. stocks were driven by a healthy U.S. economy, moderating inflation, […]

Read More

Jan 22, 2025 | Newsletters

Market Recap The U.S. economy and the stock market proved much stronger than many had anticipated in 2024, with the market marching higher throughout the year finishing up 25%, while notching 57 new all-time highs, the sixth most since 1928. The robust gains in U.S....

22 Jan 2025

4th Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 4th Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy has stabilized and even gained some momentum in recent months. The December jobs report from the US Bureau […]

Read More

Jan 22, 2025 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 4th Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy has stabilized and even gained some momentum...

25 Oct 2024

3rd Quarter Newsletter 2024

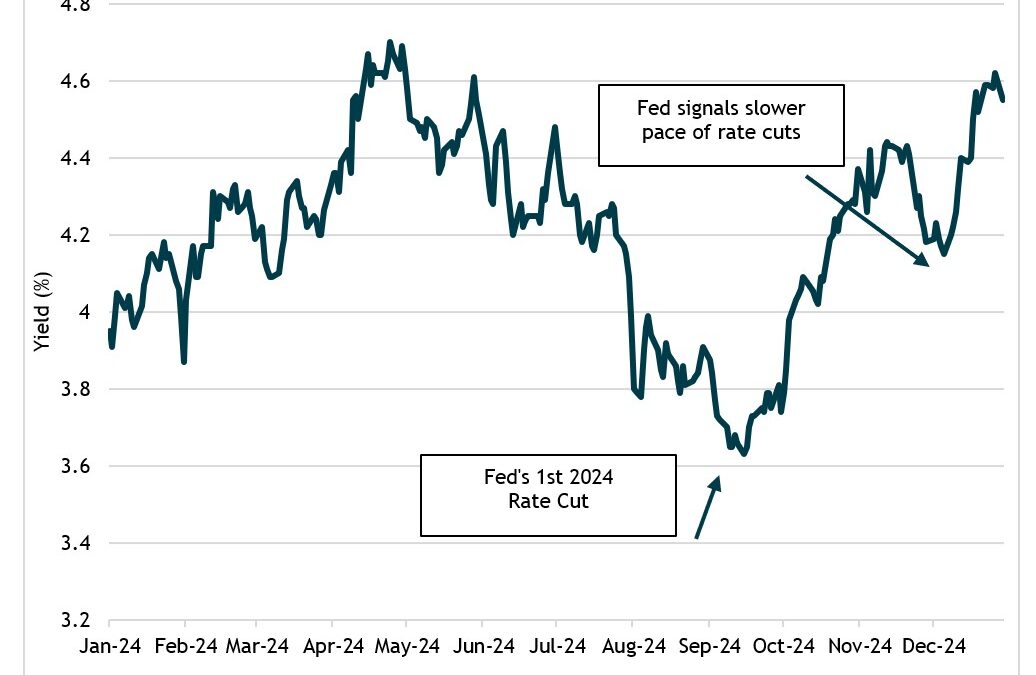

Market Recap It was far from a quiet summer for the financial markets, which have been volatile as investors parsed through economic data attempting to gauge whether the economy will slow, and how much the Federal Reserve would need to lower interest rates to prevent a recession. Toward the end of the quarter, the Fed […]

Read More

Oct 25, 2024 | Newsletters

Market Recap It was far from a quiet summer for the financial markets, which have been volatile as investors parsed through economic data attempting to gauge whether the economy will slow, and how much the Federal Reserve would need to lower interest rates to prevent...

24 Oct 2024

3rd Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

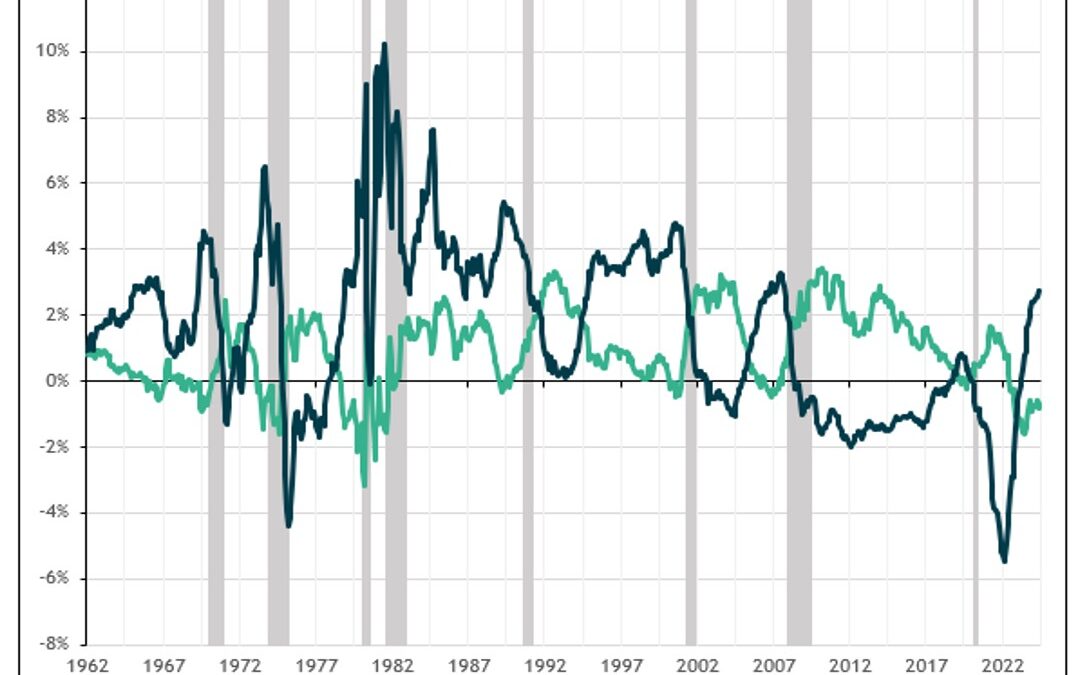

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 3rd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Overview The US economy has remained remarkably stable in the face of geopolitical uncertainty and the effects of Federal Reserve actions needed to […]

Read More

Oct 24, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 3rd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Overview The US economy has remained remarkably stable in the face of geopolitical...

17 Jul 2024

2nd Quarter Newsletter 2024

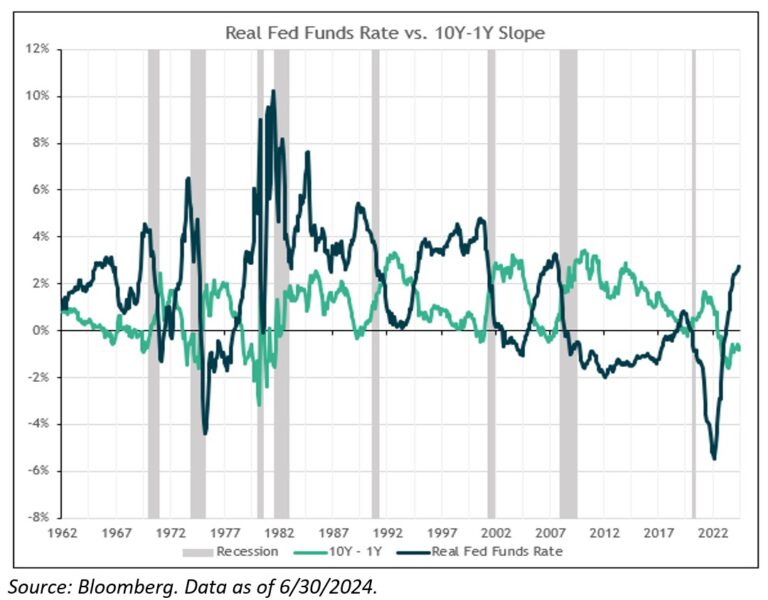

Market Recap In the second quarter of 2024, the U.S. economy remained resilient in an environment where inflation and interest rates remained higher than expectations. Tighter monetary policy was offset by accommodative fiscal policy, and a still strong US consumer. The US stock market gained nearly 4.5% in the quarter, reaching a new all-time high. […]

Read More

Jul 17, 2024 | Newsletters

Market Recap In the second quarter of 2024, the U.S. economy remained resilient in an environment where inflation and interest rates remained higher than expectations. Tighter monetary policy was offset by accommodative fiscal policy, and a still strong US consumer....