Investment Commentary – We are living through an extraordinary period in history that none of us will ever forget. The impact on our families, communities, and country has been profound. While several weeks ago we had reason for cautious optimism The United States and world are now facing the dual threats of a health crisis and an economic crisis. Both need to be fought with monumental government policy responses and individual behavioral changes. That the coronavirus might be largely contained to China, it is now obvious that is not the case.

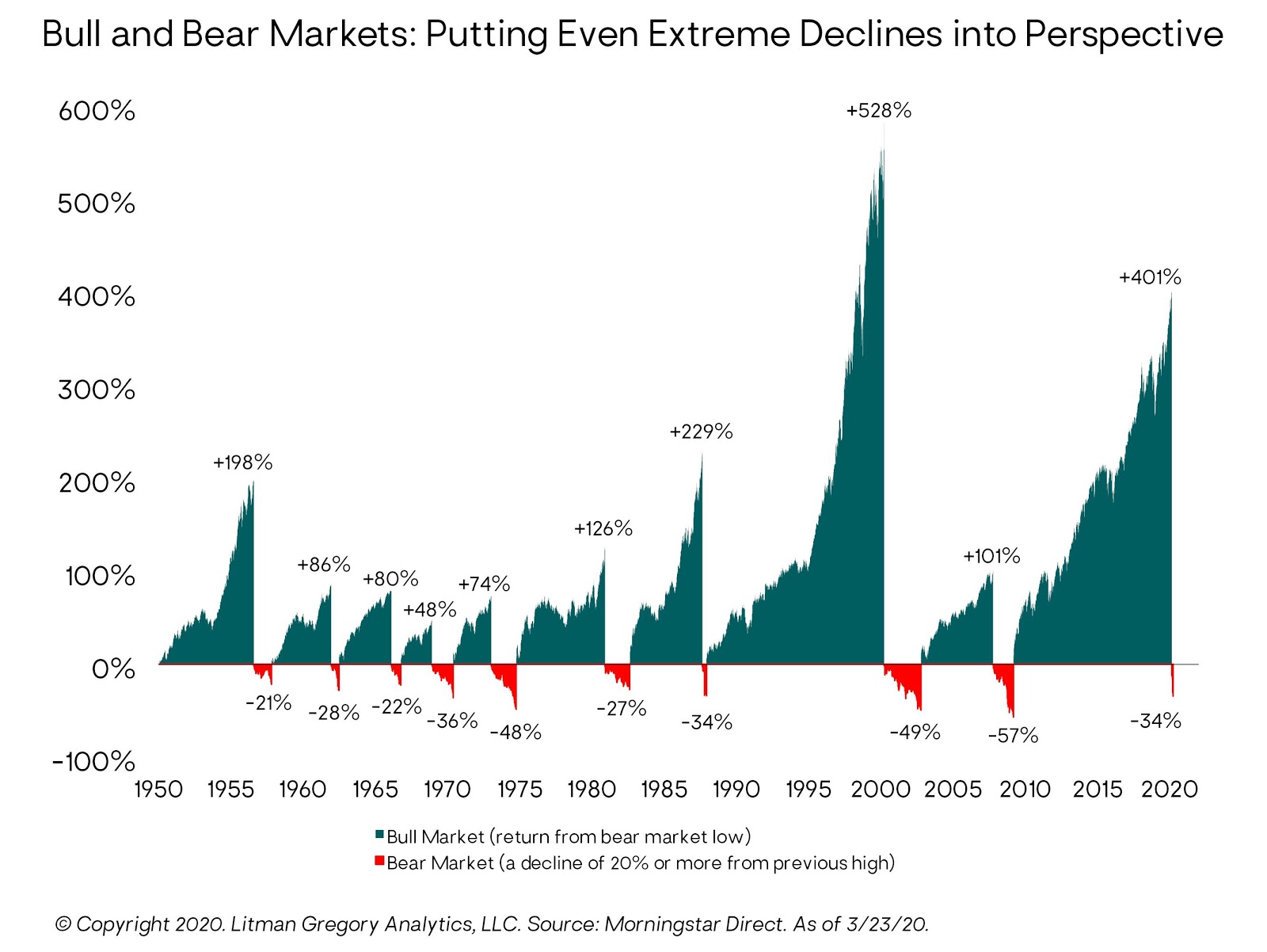

We have stated that recessions and bear markets are inevitable phases within recurring economic and financial market cycles. We have also said there is always the risk of an unexpected “external shock” or “black swan” event to the markets and economy. Investors need to be prepared for both to happen, but their precise timing is consistently unpredictable. We will get through this crisis period and things will improve and recover. Most importantly, we pray you and yours are able to remain healthy and manage well through this challenging period.

Market Update – The first quarter of 2020 has proven to be unprecedented for financial markets. U.S. stocks fell into a 20% bear market in the shortest time ever. They continued to drop and declined 30% in a record 30 days! Volatility as measured by the VIX reached its all-time high on March 16. Oil’s 25% drop on March 9 was its biggest one-day drop since the 1991 Gulf War. Finally, 10-year and 30-year Treasury bond yields fell to all-time lows of 0.54% and 0.99%, respectively! For the quarter, larger-cap U.S. stocks fell 22%, having rebounded a bit from their historic 30% drop. Foreign stocks have also suffered significant drawdowns, as developed international stocks have fallen 25%. In the fixed-income markets, core bonds have gained 3%, once again playing their key role as portfolio ballast against sharp, shorter-term stock market declines.

Macro Outlook – We entered the year with an outlook for a moderate rebound in the global economy on the back of reduced U.S.-China trade tensions and extensive global central bank monetary accommodation. Our base case now is that the U.S. economy is headed into recession in the second quarter. It is likely to be a severe one, with a sharp contraction in GDP and an unprecedented rise in unemployment. The near-term economic damage from the United States’ and other countries’ response to the virus now looks almost certain to be severe. We do not forecast economic data, but the current consensus first quarter and second quarter GDP forecasts are for declines in the range of 12% to 30%.

The depth and duration of the recession—and the strength and timing of the ensuing recovery—depend on two key variables: 1) The effectiveness of our medical response and social policy efforts in flattening the curve; 2) And the speed and effectiveness of our fiscal, monetary, and regulatory policy response. Lessons have been learned from the 2008 global financial crisis – policy response needs to be significant and executed quickly! As of this writing, the Federal Reserve seems to have gone “all-in” to support the fluid functioning of credit, lending, and financial markets. In addition, Congress and the Trump administration all seem to be in agreement and moved quickly, passing a $2 trillion stimulus package.

Portfolio Positioning – Some positions, like U.S. stocks, work well in strong up environments like we experienced this past decade, while other positions we have incorporated, such as fixed-income and alternative investments, benefit portfolios during tougher times like the present. Put together, they build resiliency and protect a portfolio from betting on a single outcome, which can be a disastrous financial result if the opposite happens. Our portfolio allocations to fixed-income and alternative strategies have performed well as stock markets sold off, delivering strong absolute returns and significantly outperforming U.S. stocks.

Given this, we continue to rebalance client portfolios. This involves reducing exposure to sectors that have held up relatively well (i.e. – fixed-income, alternatives and real estate) and adding to high-quality beaten up stocks. In essence, incrementally adjusting portfolio allocations in response to changes in asset class valuations, expected returns, and risks can be highly rewarding to long-term investors. The time to be adding to stocks and other long-term growth assets is when prices are low and markets—and most of us personally—are gripped by fear and uncertainty rather than complacency, optimism, or greed. It may seem like the market could just keep dropping with no bottom in sight. But that is exactly where research, analysis, patience, experience, and having a disciplined investment process come most into play.

Closing Thoughts – During these historic times, it is paramount to stay disciplined and recognize when emotion rears its head in investment decision making. If we invest based on emotion, we are very likely to exit the market after it has already dropped meaningfully, locking in losses. By the time the discomfort and worry are gone, the market will already be much higher. That is not a recipe for long-term investment success. Global markets have endured severe challenges and economic downturns in the past and have always weathered the storm. Attempting to time the market’s tops and bottoms is a fool’s errand.

The precipitating event for the recent volatility is something none of us have experienced before: a global pandemic and an extreme societal response. acing this dual medical and economic crisis, the situation may easily get worse before it gets better. We would love to be wrong. But it will get better. The future is uncertain but our investment playbook remains the same: diversify; balance long-term returns with short-term risks; buy low into fear, sell high into greed. Stay the course!

As always, we appreciate your continued confidence and trust, and we do our best to continue to earn it. Please find the enclosed additional economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team

The High Economic Cost of the COVID-19 Pandemic – 1st Quarter, 2020

The High Economic Cost of the COVID-19 Pandemic – 1st Quarter, 2020

By M. Ray Perryman, PhD, CEO and President, The Perryman Group

Overview – The disruptions caused by the coronavirus are wreaking havoc on individuals, families, the private sector, the public sector, the health care system, and the economy and society as a whole. In order to “flatten the curve” and prevent a major spike in infections, drastic measures have been taken. The inevitable result has been and likely will continue to be a strong shock to the economy. Many factors will determine the ultimate effects of the coronavirus on the economy, most of which are highly uncertain at present. The length and severity of the outbreak, the nature and magnitude of the full policy response, and the capacity of businesses to resume normal activities are among myriad phenomena that will play a significant role.

Scenario Analysis -The Perryman Group developed a plausible scenario for the ultimate effects of COVID-19 based on a variety of public and private source materials including, among others, data from sectors that have been particularly affected, information from areas where the pandemic spread earlier (as well as prior pandemics and natural disasters), performance patterns in other economic downturns and recoveries, and historical responses to oil price fluctuations. Reasonable measures of potential direct effects by detailed industrial category were developed through this process. These direct effects were then used as inputs to The Perryman Group’s dynamic and integrated econometric and impact assessment systems to determine total economic costs of COVID-19 as various sectors interact throughout the economy. The simulation accounts for the effects of the stimulus package and the recent actions by the Federal Reserve to stabilize financial markets.

The Perryman Group estimates that the COVID-19 pandemic could cost the US economy approximately $972.6 billion in real gross product and 11.4 million jobs. Note that job losses are reported on an annualized basis; thus, many more individuals are likely to be affected for a portion of the year. Recent estimates of massive job losses associated with COVID-19 are drawing frequent comparisons to the Great Depression. A number making headlines is that unemployment could jump to 32% in the second quarter, an estimate derived by researchers at the St. Louis Federal Reserve Bank. Using detailed occupational data, they analyzed whether various jobs were essential, could be completed remotely, and were salaried to estimate the “high-risk occupations” which met none of these criteria. They also quantified jobs that are high contact. The average of these approaches suggested that about 47 million people could be laid off during the second quarter, yielding 32% unemployment.

This number aligns closely with The Perryman Group’s estimates, which were derived through detailed analysis by industry and simulations of resulting economic interactions using the firm’s large-scale models. The loss of 11.4 million jobs on an annualized basis can alternatively be viewed as 45.6 million if concentrated in a single quarter. The talk of massive layoffs and 30% unemployment has led to ubiquitous comparisons to the Great Depression. However, prior to the Great Depression, there were massive structural problems in the economy, and policy responses were less well understood. The major harm of the Great Depression was not that joblessness spiked above 30%; it was, rather, that it remained there for almost a decade.

Recovery Process – The current situation emanates from a horrific pandemic, but the economic structure is basically sound. The numbers will likely be terrible, but temporary. Once the worst of the virus subsides and social distancing is relaxed, venues will reopen and tens of millions of jobs will quickly be restored. The stimulus package (and perhaps others) and aggressive monetary policy should maintain the fundamentals needed for a rapid recovery. Prominent psychologist Dan Kahneman received a Nobel Prize for work exploring how our behavior interacts with the economy. He demonstrated that how we present things can greatly affect our attitudes and actions. Focusing on peak job losses and drawing inaccurate parallels to the Great Depression can, in and of itself, be harmful.

To the extent a similar historical period exists (and there are myriad differences), it is the Spanish flu outbreak of 1918-19. The population was one-third of current levels, and 600,000 US lives were lost. We must remember, however, that the period immediately thereafter is known as the “Roaring 20s.” If the economic structure remains intact, we can expeditiously rebound from a health-induced crisis. It is impossible to predict how the pandemic will play out and what will ultimately happen, but the similarity and enormity of job loss estimates by The Perryman Group and other researchers suggest that the job market and the economy will endure a powerful jolt.

Outlook – Given the number of aspects of the economy that are being affected, a period of significant contraction for the economy is inevitable. However, because the underlying economy was strong prior to this situation, it is likely to be more of a pause than a fundamental change, with a fairly rapid recovery once the worst of the virus is past. A key aspect of performance is consumer spending, since in normal times such spending drives about 70% of the economy. Uncertainty and job losses are reducing spending for discretionary items ranging from travel to automobiles to clothing and household goods.

Spending will likely increase fairly quickly once the situation improves, with the ultimate economic effects notable for a quarter or two, but not dramatic in terms of long-term performance. Unlike the Great Depression as described previously or even the dot-com debacle, the savings and loan mess in the 1980s, or the more recent Great Recession, there is not an overarching major problem (such as an overheated market ripe for a crash). A combination of unique and unprecedented issues is causing slowing, but as they are dealt with, growth will pick up.

In fact, while The Perryman Group expects economic patterns for the next couple of years to be very different from the firm’s projections prior to the outbreak, there is not yet evidence that the five-year and long-term outlooks should be modified at this time. Unlike many economic issues, much of the solution to this situation must come from the health care and biosciences sectors. The physical wellbeing of the population is of paramount concern, yet the economic consequences must also be addressed as they exert a notable human cost as well. Aggressive monetary and fiscal policy measures can help reduce downstream losses and dampen the ultimate economic costs of COVID-19. Although the situation is changing rapidly and the ultimate outcomes will undoubtedly vary from the losses estimated by The Perryman Group, they provide a guideline for planning and expectations.

In Closing – There is a sharp drop in economic activity at present, but there is no reason to believe the US will enter an extended depression. The basic structure of the economy was sound prior to the outbreak, and the current downturn is essentially fallout from a health crisis (which should be our primary focus). Assuming that through aggressive monetary policy, targeted fiscal stimulus, and other measures the basic economic structure can be kept in place, the recovery should be relatively rapid once the virus risk has abated.

–

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group, which has served the needs of over 2,500 clients over the past four decades.