Market Recap

Equities around the globe continued to surge in the second quarter. The U.S. and developed international markets led the way, with the U.S. stock market gaining 8.5% and developed international stocks rising 5.7%. Emerging-market stocks trailed in terms of progress on the COVID-19 front and in turn rose by a more modest 4.9%. Within the U.S. stock market, the rotation from growth to value stocks took a pause, but smaller-cap value stocks have been the top-performing segment of the U.S. market this year. In fixed-income markets, 10-year Treasury yields dipped to 1.45% at the end of June, down from 1.75% at the end of March, despite higher inflation readings during the quarter. This contributed to a solid 2.0% return for core bonds this quarter, but they remain down 1.6% for the year as a result of the first quarter selloff.

Investment Outlook

As COVID-19 vaccinations and immunity spread across the globe, we continue to expect a strong global economic recovery contributing to healthy corporate earnings growth. This should bode well for riskier but higher-returning asset classes over the near term (next 12 months). Credit markets should benefit as well. While the Federal Reserve is now signaling it is moving closer to beginning to taper its quantitative easing asset purchases, monetary policy and interest rates should continue to remain accommodative for some time. Our portfolio positioning reflects this view, with a modest overweight to global equities in most models. We believe non-U.S. equities, which are generally more economically sensitive and trading at cheaper valuations, are likely to outperform and we have a tactical overweight to emerging-market stocks. We also have meaningful allocations to flexible bond strategies that we expect to do better than core bonds, as well as floating-rate loan funds that are not sensitive to rising rates.

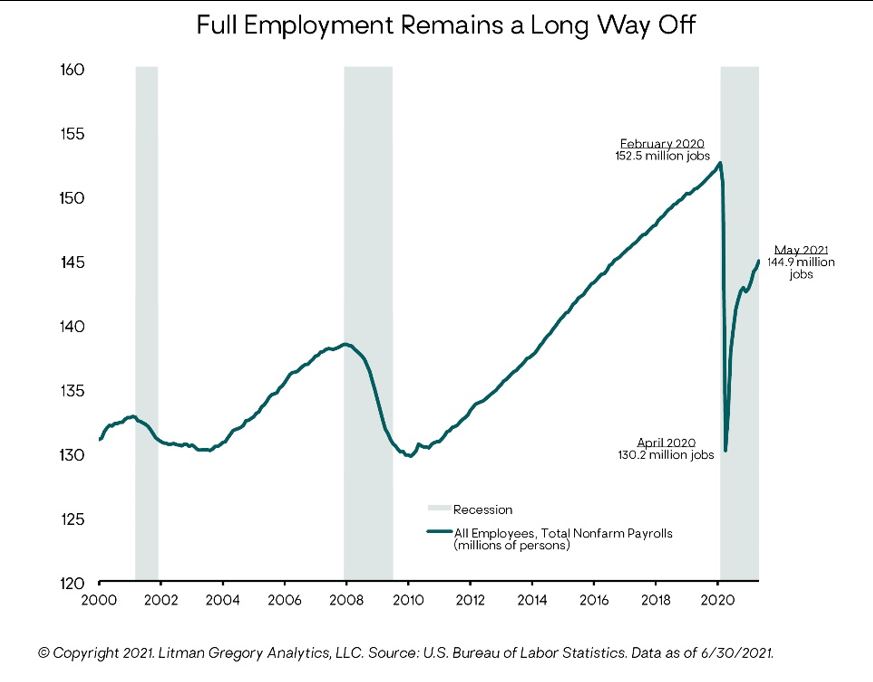

On the major question of whether recent signals are harbingers of a sustained period of meaningfully higher inflation, we believe it is too early to tell. However, our current base case is that inflation does increase significantly, but not get totally out of control. The U.S. economy still appears to have some slack before aggregate demand would start overwhelming the economy’s productive capacity (the supply side), leading to the economic “overheating” that could cause significant, sustained, and broad-based inflation. The labor market is a key supply-side indicator. There were nearly 8 million fewer nonfarm jobs at the end of May compared to February 2020. Meanwhile, more than 9 million people are currently unemployed and potentially available to work immediately. While there have been recent reports of businesses unable to hire enough workers, this looks to be driven by temporary factors related to COVID-19 and generous unemployment benefits that should end over the next several months. As long as there is slack in the labor market, wage inflation is unlikely to surge. This means there is relatively low risk of a wage-price spiral such as the United States experienced in the 1970s.

Meanwhile, consumer price index (CPI) inflation numbers have been surprisingly high, and longer-term CPI inflation expectations have increased from their pandemic lows. Digging deeper into the numbers reveals that some of the bigger drivers (like spiking used car prices and a sharp rebound in prices for travel and leisure services) are clearly driven by pandemic disruptions. In all, we think it is more likely that most of the recent sharp price increases will prove somewhat transitory, as current supply shortages eventually catch up to demand as the pandemic recedes.

The path of fiscal policy in the United States is less certain, given the political dynamics and polarization. The expiration of the pandemic support programs will turn from a fiscal boost to a fiscal drag later this year and in 2022. With the likelihood of a U.S. recession very low—absent a severe external shock—we see low risk of a near-term bear market. Of course, 10%-plus stock market corrections can always occur. And as we move further into the U.S. earnings cycle, the odds of a typical mid-cycle market correction increase. But despite elevated stock market valuations and a likely deceleration in corporate earnings growth, we believe global equities have additional return potential in this cycle. As always, though, equity investors should be prepared for a bumpy ride. Our longer-term view is a bit more uncertain, as the ramifications of an extraordinary level of Federal spending play out (i.e. – a weakening U.S. Dollar, potentially higher interest rates, etc.). As always, we will be prepared to adjust strategies and portfolios accordingly.

Closing Thoughts

While our base case is positive, the range of possible outcomes is always wide, and these are far from ordinary times. As a result, we do not make aggressive bets on a single outcome even if our analysis suggests it is more likely. However, we are tilted modestly toward reflationary, return-generating assets. But we acknowledge there are scenarios that could drive inflation to be higher and occur sooner than we expect. There could also be shorter-term deflationary shocks like more-dangerous COVID-19 variants or political unrest that leads to a market correction or worse. While a sustained period of high inflation would be bad initially for most equities, over time many areas our clients are invested in would likely do well, including emerging-market stocks, value stocks, real estate and alternatives. And in the event of a macro shock and deflationary pressure, we maintain meaningful positions in core bonds, which would help offset declines elsewhere. Put simply, we are diversified, as always.

We thank you for your continued trust in us and wish you a blessed summer season. Please find the enclosed additional economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team