Market Recap

Global stocks continued to power upward this quarter from their pandemic bear market low on March 23, 2020. The U.S. stock market gained 6.3% and international stocks gained 4.5%. The U.S. stock market is now up an astonishing 80.6%, since the bottom and its best one-year trailing return since the 1930s. Clearly, it paid not to panic and get out of the markets last spring! While the social media–fueled speculation stocks (like GameStop) caught investors’ imagination earlier this year, we think the recent “reflation rotation” will be the more enduring equity market trend. As of late, investors have been betting on the more economically sensitive small caps and value stocks and eschewing previously highflying growth stocks. The reflationary winds tore through the bond market as well. The prospect of higher growth/inflation caused interest rates to jump. The 10-year Treasury yield more than tripled from the historic low it set last August. Correspondingly, the bond market fell 3.6%, suffering its worst quarter since 1981.

Investment Outlook

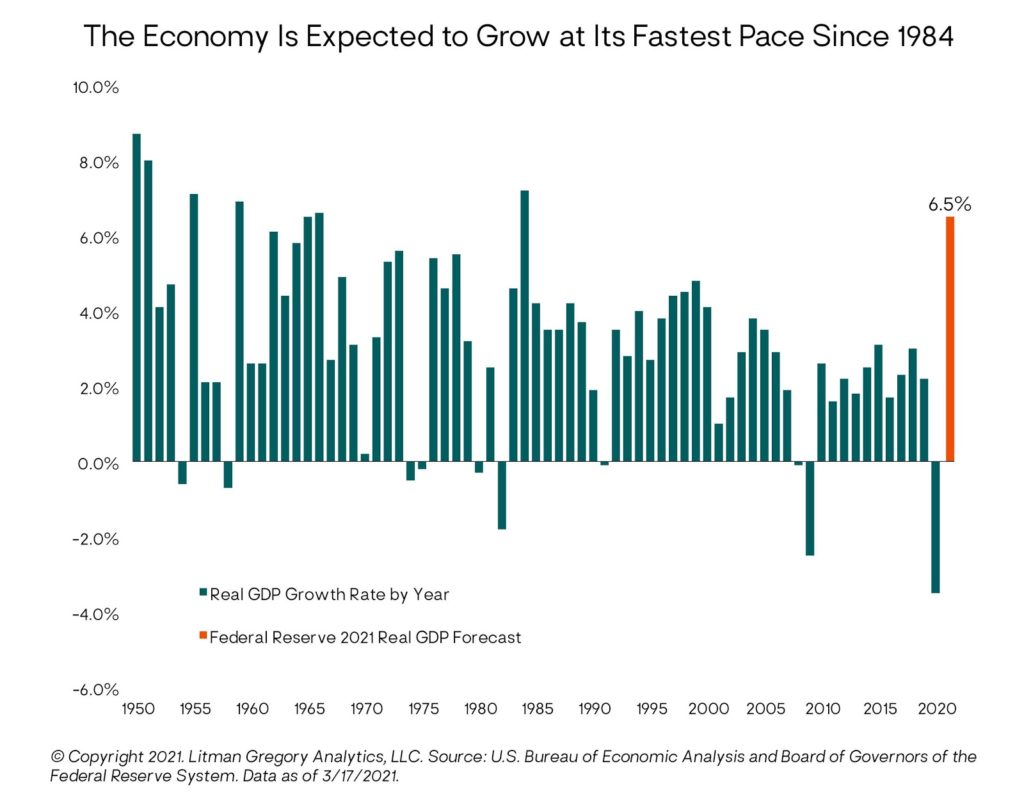

The primary variables that will determine the direction of the economy and markets remain COVID-19 developments and the fiscal/monetary policy response. These currently imply a base case for a strong economic rebound, particularly in the United States but also globally. This should support the fundamentals underpinning higher-returning asset classes (stocks, credit sectors of the bond market, etc.)—as long as interest rates do not move sharply higher. Substantial progress has been made on the vaccine rollout and at the current vaccination rate, experts estimate the United States could achieve herd immunity by late summer. Overall, the light at the end of the pandemic tunnel certainly appears brighter and may enable us to start getting back to normal lives, boosting economic activity. Growth forecasts had already reflected a rebound. Now they are being revised higher with the massive American Rescue Plan Act fiscal stimulus signed into law. The Federal Reserve forecasts the U.S. economy will grow at its fastest pace since 1984. Economic growth should feed into company earnings. The Wall Street consensus expects S&P 500 earnings to grow over 40% in 2021.

Yet the Fed continues to reiterate that it will not preemptively raise interest rates. It intends to wait till it sees inflation above its 2% target for an extended period of time, a new policy that suggests this economic cycle has plenty of room to run. We take the Fed at its word that it won’t be raising rates anytime soon. So high economic growth, strong earnings growth, but low interest rates? Equity investors couldn’t ask for more. However, the main threat is our old friend valuation risk. However, shorter term, historically high valuations need not impede it with all the other positives in place. Stocks remain reasonably attractive relative to bonds despite the rise in longer-term interest rates in anticipation of a higher-growth, more inflationary environment. While rates could rise further leading to greater bond price declines, they should stay contained unless inflation spikes up and stays higher.

What about inflation? –Inflation has been at the top of investors’ list of concerns lately. Governments all over the world have passed large fiscal stimulus packages in the wake of the pandemic. The United States takes the cake: Congress has spent the equivalent of 25% of GDP on the emergency in a single year and may spend even more with an infrastructure plan on tap. That is a lot of potential pent-up spending! Add in an expected economic rebound from the pandemic and the Fed doing everything it can to stoke a healthy level of inflation. An inflation spiral would be bad for stocks, bonds, and pocketbooks. In the coming months, we should in fact see year-over-year inflation increase, most likely to the 3%-plus range. However, what really matters is meaningful, sustained inflation. Fear of inflation can work like a self-fulfilling prophecy. If consumers think future prices will be higher, they will increase their spending today. Increased near-term demand raises prices for goods. Eventually workers will demand higher wages. Then businesses must raise prices to offset these higher costs and off the wage price spiral goes. It’s critically important that the Fed anchors inflation expectations before price trends get out of control. The jury will still be out even after the next couple of months as to whether this higher inflation will be transitory or sustained. Despite the massive federal spending, there are some headwinds that should help keep inflation from getting completely out of control: full employment is several years away and wage spiral inflation is difficult when there is slack in the labor market; the size of the fiscal stimulus is staggering, but it is a one-time injection; not all of it will be spent right away and a meaningful portion will be saved or used to pay down debt; and offsetting structural disinflationary forces such as demographic and technology trends may have accelerated during the pandemic.

Portfolio Positioning

This reflation story reinforces our strong belief that what has worked so well for decades—simple portfolios consisting of U.S. stocks and bonds—won’t work nearly as well over the next five to 10 years.We expect many of the asset markets and market sectors that have been laggards over the past five to 10 years to continue their rebound. Reflation favors non-U.S. stocks (i.e. – emerging markets) and more cyclical/value sectors. We are already accounting for this in our portfolio positioning, as they are tilted toward these stock sectors. Reflation also increases the potential for rising rates and inflation, both negative for traditional bonds. In our positioning and in lieu of core bonds, we own floating-rate loans that have a natural inflation-protection with their resetting coupons. We are also diversified into flexible bond strategies that, with their yield advantage and active management flexibility, should also perform well. Finally, our allocation to alternatives and real estate have historically been solid hedges against inflation and have provided diversification benefits.

Closing Thoughts

As previously stated, we believe the most likely scenario over the next several years is a reflationary one. In the short-intermediate term, the economy and markets should be supported by the historic amount of liquidity and stimulus in the system. Looking further out, we do have concerns with the ramifications and consequences of this massive printing of money. As these unfold and as the macroeconomic regime evolves, we will tactically, but prudently, adapt and adjust our portfolio exposures based on our assessment of risks and potential return. We thank you for your continued trust in us. Please find the enclosed additional economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team