Market Recap

A lot has happened since our year-end letter, with the biggest macro event being Russia’s brutal invasion of Ukraine. While the human impact has been devastating and tragic, our job here is to focus here on the economic and financial market impact of this event…..and it was a rough first quarter across the board, with stocks and bonds, domestic and foreign, all hurt by rising interest rates, inflation, and the war in Ukraine. The U.S. stock market dropped 4.6%, compared to a 5.9% loss for developed international markets. The modest declines for the full quarter masked the intra-quarter volatility, where peak-to-trough declines were much larger. The damage was worse in the U.S. core bond market than the U.S. stock market, which is rare, with the broader U.S. bond market down 5.9%. This was the second-worst quarter for bonds since Q1 of 1980, when Paul Volcker’s Fed was in full-bore tightening mode.

Portfolio Update and Positioning

A period of rising inflation and rising interest rates creates challenges for both bonds and stocks, and in turn for a traditional balanced portfolio comprised largely of those asset classes. Diversification into other asset classes, market segments and alternative strategies can be particularly valuable in such an environment. To that point, our alternative managed futures strategies were the standout performers in our portfolios posting double digit gains. Our exposure to commercial real estate also provided slightly positive returns to portfolios. In terms of our fixed-income allocation, our tactical positions in flexible, actively managed bond funds and floating-rate loan funds again added value relative to the core bonds, only posting slight losses despite Treasury yields sharply rising and corporate bond spreads widening. On the downside, our tactical overweight to emerging market stocks detracted from relative performance.

Crises, as painful as they are, often create opportunities. However, the equity and fixed-income markets have reacted quickly to the headlines, and as currently priced are not offering any compelling new tactical asset allocation opportunities. However, we continue to believe our portfolios are well positioned in this inflationary environment with multiple investments (i.e. – emerging markets, alternatives, real estate, etc.) that historically have been solid inflation hedges.

Investment Outlook

The war in Ukraine has had wide-ranging but diverse impacts on the global economy and individual regions. Besides Ukraine itself, the most direct and damaging economic impact is on Russia. Given that Russia’s economy is less than 2% of global GDP and that our portfolios had close to zero exposure to Russian stocks or bonds, it is immaterial. However, Russia is a major producer and exporter of oil and natural gas—to Europe in particular, accounting for roughly 50% of Europe’s natural gas imports and 25% of its oil imports—and certain agricultural commodities and base metals. As such, the war and the sanctions imposed on Russia by the West are having a material impact on global economic growth and inflation. In a nutshell, the war is a “stagflationary” supply-shock: it fuels higher inflation via sharply rising commodity prices, while also depressing economic growth via negative impacts on consumer spending. It is also triggering various government and central bank policy responses, which create additional risks and uncertainties for the economy and markets. As a prime example is the Federal Reserve. In response to broadening and persistence inflation, the Federal Reserve has finally begun raising interest rates and are talking an aggressive path for rates.

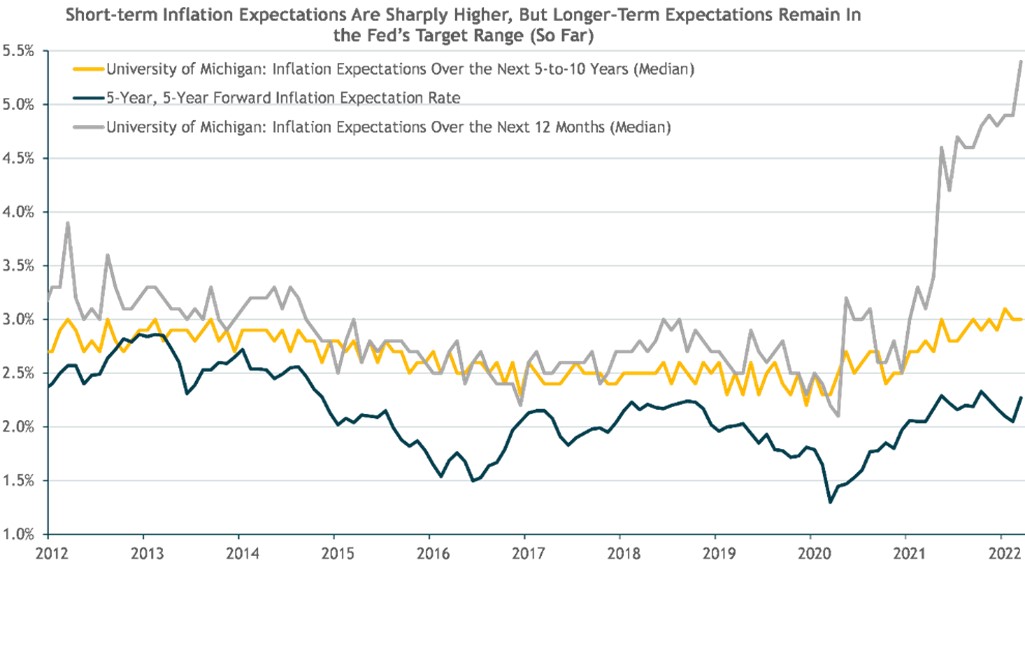

Short-term inflation expectations have spiked higher, consistent with the recent sharp rise in gasoline prices and overall CPI, but over the medium-to-long-term expectations are that inflation will moderate. Should the longer-term measures move higher, we’d expect the Fed to accelerate its tightening pace. The COVID-19 pandemic is another wildcard but here the news has been getting better. This should both support economic growth and mitigate some of the inflationary pressures the U.S. and global economy experienced over the past year caused by supply-chain bottlenecks and supply/demand mismatches for durable goods (e.g., autos).

Taking all these factors into account, our base case shorter-term (12-month) economic outlook is for decelerating economic growth and still-high but moderating inflation. Absent a recession, which of course we can’t rule out, and even given the current challenges, this macroeconomic backdrop should be generally supportive for “risk assets” (i.e. – global equity and credit markets) and a headwind for core bonds in the face of rising government bond yields.

I Bonds

A Review of I Savings Bonds – As part of our continual effort in presenting new investment ideas to our clients, we wanted to inform you how I Savings Bonds have become a very attractive investment. What are US Series I Savings Bonds? They are bonds issued by the United States Treasury and must be purchased from the US Treasury.

An I Savings Bond is a US Government issued bond that carries a fixed rate of interest, plus an additional inflation adjustor, which is very favorable now. About one year ago these bonds were yielding 3.54% on an annualized basis. In November of 2021, the rate was adjusted upward to 7.12%. In May the rate will be adjusted upward to 9.62%. This rate varies every 6 months when the government announces new CPI data. This rate can go up or down.

How do I Bonds work?

- You must hold them for a minimum of 12 months. You cannot cash out of them before then.

- If you cash out between 12 months and 5 years you will lose your prior three months interest as a penalty.

- You can only buy $10,000 per year per social security number and you must buy them on-line. If you are married, each spouse can buy $10,000 per year.

- You can also purchase up to $5,000 of these bonds with any tax refunds.

- Even if inflation goes negative, I bond interest will never drop below 0.0%

I Bonds have become very attractive due to the high inflation numbers and could earn a very attractive rate over CD’s, saving accounts and money market accounts. So they may be something to consider as an alternative for cash savings, emergency funds, etc. See the link below to learn more about I Bonds or create an account. Every person’s financial situation is different so these may not be for you. Please discuss with your one of our team and your CPA.

https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm

If you have further questions regarding I Bonds, or are looking for assistance, please let us know.

Closing Thoughts

The war in Ukraine has caused massive human suffering. From an economic and investment perspective, it has added to already-high uncertainty, degraded the near-term growth outlook, and added additional fuel to the inflationary fire. While tilting towards our highest-conviction tactical views, our portfolios remain strategically balanced and well-diversified across multiple global asset classes, investment strategies, equity styles and risk-factor exposures. This should enable them to be resilient should a risk scenario or shock outside occur and enable us to continue to navigate whatever macro and market environments come our way. As investors we need to be prepared for worse, even as we hope for better. We sincerely appreciate your continued confidence and trust. Please find the enclosed additional economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team