Market Recap

Despite the stress in the banking system, including the failure of Silicon Valley Bank, global equity markets held up remarkably well and posted solid returns for the quarter. The domestic stock market gained 7.5% in the first quarter. Developed international stocks did a bit better, rising 8.5% for the quarter and emerging markets stocks gained 4.0%. Underneath the calm market surface, there was a wide dispersion in returns across sectors, market caps and styles. Large-cap growth stocks gained 14.4% in the quarter, while the large-cap value stocks returned 1.0%. Nasdaq stocks surged 17.0%, while small-cap value stocks dropped 0.7%. Fixed-income markets had a solid quarter as longer-term bond yields fell, generating price gains and investment-grade bonds returned 3.0%.

The Silicon Valley Bank Failure – By now, the story of the Silicon Valley Bank (SVB) failure is well known. But we think a quick recap is worthwhile as it provides context for our investment outlook and portfolio positioning that follows. In a nutshell, SVB was the victim of a classic “bank run” – too many depositors wanted their money back simultaneously and SVB didn’t have the cash on hand to meet customer withdrawals. Importantly, SVB had unique characteristics that made it particularly susceptible to such a run that don’t necessarily apply to the broader banking industry. This is one reason we do not see the failure of SVB as the beginning of a replay of the Great Financial Crisis of 2008. But there clearly will be broader economic and financial market impacts. While the banking system is not out of the woods and there may be more smaller bank takeovers, it seems these steps and subsequent actions from authorities have stemmed the risk of a widespread bank-run contagion.

Economic and Investment Outlook

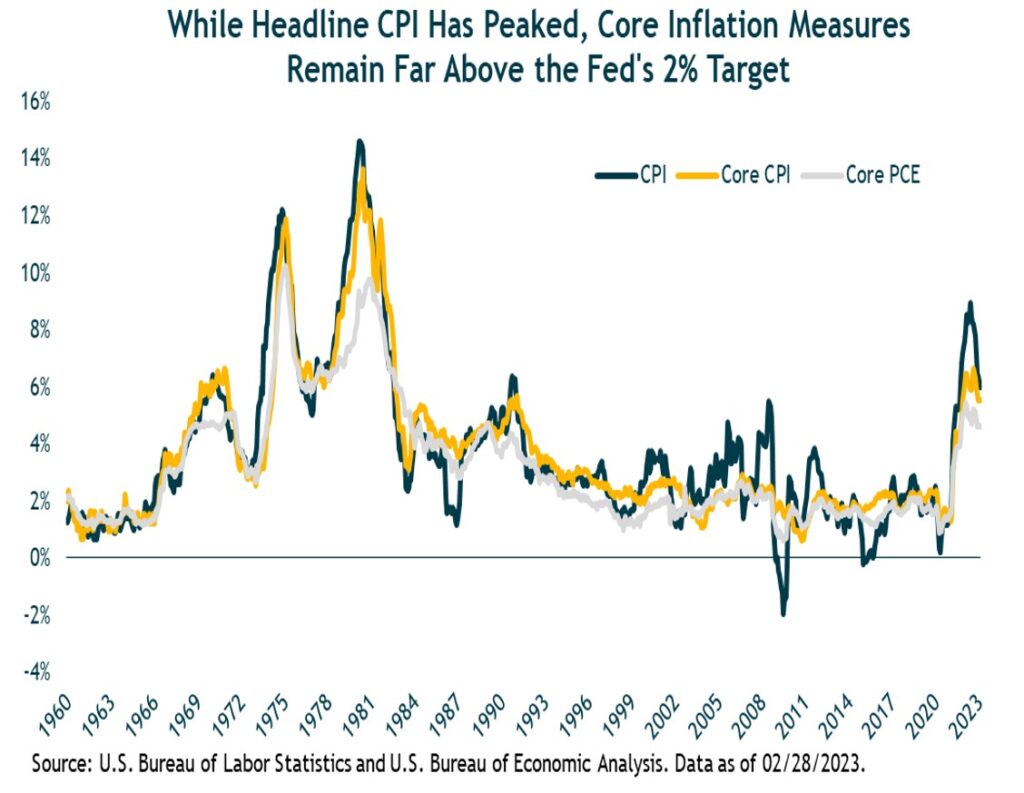

We always consider a range of macroeconomic scenarios when constructing our investment views and diversified portfolios. Our approach is particularly valuable during periods of heightened uncertainty, which we would argue is the case today given the dynamics of inflation, fed policy, and stress in the banking system. While inflation likely peaked last year and has come down, it remains too high relative to the Fed’s 2% long-term target. February’s year-over-year core CPI inflation rate was 5.5%. Given persistently high inflation, the Fed has continued its rate hiking campaign this year, although the magnitude of rate hikes has diminished. The Fed has raised rates a ninth time since March 2022, representing a total tightening of 4.75 percentage points. This is the most aggressive monetary policy tightening campaign since the Paul Volcker days in the early 1980s. It was inevitable something would “break” given the magnitude and speed of the hikes. The Fed is still hoping they can land the economy softly without causing much more damage, let alone a recession.

With above-normal inflation and the Fed sharply tightening, the short-term outlook for economic growth was already poor coming into the year. Add to that the negative impact from tighter credit conditions due to the recent banking stress, and the growth outlook has weakened. How much is not quite clear. But it definitely hasn’t improved the chance of avoiding a recession this year. However, all is not gloom and doom for the economy. Household and business balance sheets remain healthy and supportive of continued spending. U.S. households are still sitting on an estimated $1.4 trillion in pandemic-era savings, billions of unspent Covid stimulus funds and employment remains solid.

In an economic recession, it is almost certain corporate earnings will decline. Corporate earnings typically decline 10% to 20% during economic recessions, depending on how mild or deep they become. If we do experience a significant recession, we could easily experience a meaningful drop in global equity prices. While the odds favor a recession given current economic conditions, we do not rule out the possibility the U.S. economy avoids recession this year experiencing a “soft landing”. Our current view, based on the data, is that we will experience a modest recession given the solid employment conditions and unspent billions in Covid stimulus funds that should provide economic support. However, much still depends on the Fed and how much further they raise interest rates. If the Fed pauses their hiking campaign sooner than later, equities may positively respond, as lower interest rates imply higher P/E multiples. But there are numerous other key variables for the economy and financial markets that are beyond the Fed’s or any policymaker’s control.

Portfolio Positioning

We currently see the domestic stock market as getting close to fairly valued, especially given the current recessionary and earnings risks. We also see more attractive medium-term expected returns from international and emerging markets stocks due to a better earnings outlook and expectations of a weaker U.S. dollar. As such, we have a slight relative overweighting to equities outside the U.S. High-quality bonds are also now attractive. In addition to our core bond exposure, we continue to have a meaningful allocation to higher yielding, actively managed, flexible bond vehicles run by experienced teams with broad investment opportunity sets that offer yields in the 5% to 7% range. There are many fixed-income sectors outside of traditional core bonds that offer attractive risk-return potential. Finally, we maintain core positions in real estate and alternatives, including trend-following managed futures funds. We believe they offer powerful long-term portfolio benefits in providing alternative and non-correlated returns relative to traditional stock and bond holdings. They can perform well whether the macro backdrop is deflationary, inflationary, stagflationary, etc. Our conviction in owning these strategies remains high.

Closing Thoughts

While markets are challenging at times, it is critical for long-term investors to stay the course through these rough periods that are often challenging and a bit of a “grind”. We believe 2023 will likely present us with some excellent long-term investment opportunities, as the return outlook for a diversified portfolio has improved with improved stock valuations and higher bond yields that should reward patient investors over time. This is expressed in our portfolio construction and investment management via balanced risk exposures, diversification and forward-looking analysis that considers a wide range of potential scenarios and outcomes. Please find the enclosed economic newsletter from Dr. Ray Perryman. We sincerely appreciate your continued confidence and trust and wish you and yours an enjoyable spring and summer!

The Water Valley Investment Team