Market Recap

In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings, and a convergence of market participants’ aggressive forecast of rate cuts with the Fed’s own projections. These factors provided a supportive backdrop for stocks. Domestic stocks continued to reach new highs throughout the quarter, gaining 10.6% in the three-month period. Developed international and emerging-market stocks also posted gains of 5.8% and 2.4%, respectfully. Bond returns were mixed as the benchmark 10-year Treasury yield rose from 3.9% to 4.2%, with market expectations for rate cuts tempered in terms of timing and magnitude. In this rising-yield environment, core intermediate term bonds declined 0.8%, while high-yield bonds were up nearly 1.5% as spreads narrowed. Turning to alternatives, managed futures had a strong first quarter, gaining 12.2%. This is a reminder that managed futures strategies aren’t just negatively correlated to the stock and bond markets but can also produce attractive returns across different market environments.

Investment Outlook and Portfolio Positioning

The U.S. economy has continued to prove resilient despite the Fed maintaining a higher level of interest rates for longer than most expected. A main driver of this better-than-expected economic growth has been the continued strength of the U.S. consumer. The combination of robust job gains and steady real income growth has allowed consumers to continue spending despite higher rates. The strong consumer has also benefited corporate earnings. And after a decade of near-zero interest rates, companies are generally well positioned financially with balance sheets that are healthier than they have been in past tightening cycles.

Inflation (CPI) has declined meaningfully over the past year, falling from 6% to just over 3%, though still above the Fed’s long-term target of 2%. Our expectation is that inflation will continue to trend lower, but the last mile to the 2% goal could be challenging. This sticky inflation environment may force the Fed to maintain rates at current levels for a period longer than most anticipated – so higher for longer may be a new theme. We have seen this reflected in the market’s expectations for the Fed Funds rate during the quarter. At the beginning of the year, the market was anticipating six to seven rate cuts. But as of the end of March, the market’s expectations have tempered, and the consensus is for three cuts bringing the top end of the range to 4.75% at the end of 2024. For now, U.S. economic data seems supportive of growth, but that which is slowing. Although economic growth should weaken, we do not foresee a severe recession in the cards, given the large amount of unspent stimulus monies still in the system. However, the Fed will have to monitor the potential risky scenario of slower growth and high inflation – slugflation – and do their best to prevent this from happening.

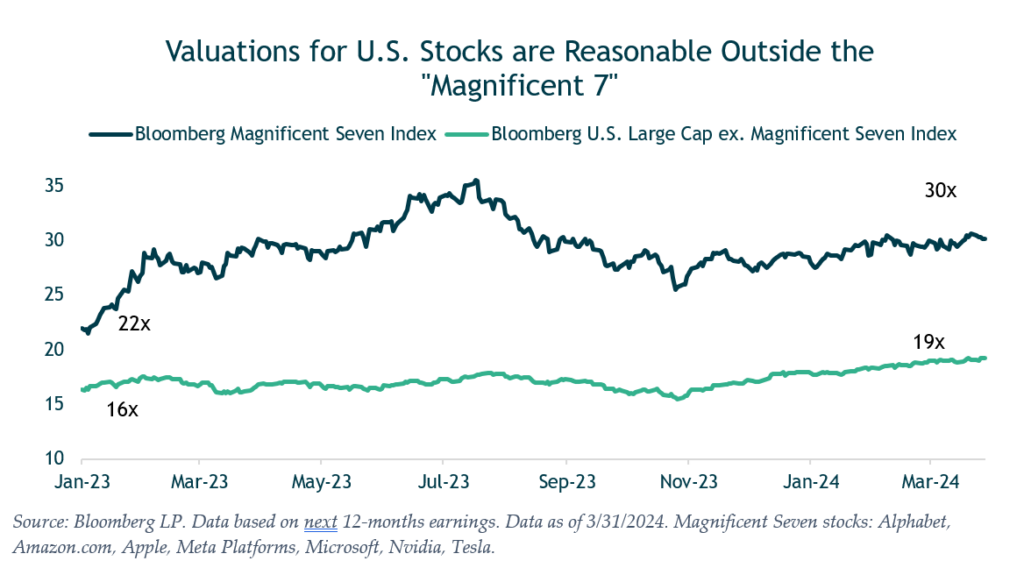

Turning to our portfolio positioning, after a deep dive on emerging markets we are continuing to reduce our allocation to emerging-market stocks, mainly due to the level of cyclical and structural headwinds the Chinese economy faces. At the same time, we have been increasing our weighting to domestic value and blend stocks. We view these sectors as relatively more attractive than domestic growth stocks due to the strong returns over the past year and a half and significantly higher valuations. In total we believe this move marginally reduces the portfolios’ overall equity risk, as U.S. stocks would likely outperform the historically more volatile emerging markets in a downturn. There continues to be a high level of concentration in the “Magnificent Seven” stocks, which comprise about a quarter of the value of the S&P 500. In our view this creates relative opportunity in the remaining 493 stocks in the S&P 500, which have not seen valuations so stretched.

As for fixed-income portfolio positioning, we continue to believe that short-term interest rates have peaked but may stay elevated for most of the year. For corporate bonds, we do not foresee a near-term risk of a spike in default rates given the still-attractive corporate fundamentals. In this environment we continue to take advantage of the inverted yield curve, balancing shorter-term higher-yielding securities with yields in the 6.5% to 7% range, while also maintaining some exposure to longer-term bonds with yields around 4.5% to 5%, which can also provide protection in the event of a stock-market downturn. Finally, we continue to have exposure to alternative strategies that include managed futures and real estate, which have historically been a solid hedge and able to generate positive returns during periods of stock/bond losses.

Closing Thoughts

As we look ahead, we anticipate there will be pockets of choppiness given headline risks related to Fed policy, geopolitical events such as the ongoing wars in Europe and the Middle East, and the upcoming U.S. presidential election. Given this, we think that it will be more critical than ever to be ready to take advantage of market dislocations. At the same time, we continue to believe that taking a disciplined long-term view is the path to successful investing. We will maintain a balance of offense and defense, seeking attractive risk-reward opportunities that are supported by thorough analysis. However, we are optimistic for the return potential over the next several years for balanced/diversified portfolios given reasonable valuation for most stocks and much more attractive fixed income yields.

The Water Valley Investment Team