Market Recap

Global stock markets displayed a wide dispersion of performance across regions and styles over the first quarter of the year. After making a new all-time high in mid-February, U.S. stocks suffered their first 10% correction since 2023 before recovering to end the quarter down 5% (this slide continued into early April). Smaller-cap U.S. stocks, which tend to be more volatile than their larger-cap counterparts, declined further, ending the quarter down 10%. Large-cap growth stocks, which have led the market higher for several years, finally lagged this quarter as investors rotated into U.S. large-cap value and foreign stocks amid economic uncertainty. In contrast to the U.S., many European and Asian markets rose sharply. Developed international stocks gained nearly 7%, driven in large part by a fiscal policy shift in Germany focused on increased defense spending. Emerging market stocks also fared well, finishing the quarter up 3%. Interest rates experienced significant volatility throughout the quarter, fluctuating amid shifting inflation expectations, Federal Reserve policy signals, and broader market uncertainty. Overall, the 10-year treasury rate declined from 4.57% at the start of the year to end the quarter at 4.36%. The decline in rates benefited investment-grade bonds, which gained 3%. Performance in the first quarter was a great reminder of the benefits of diversification. Unexpected losses in U.S. stocks (growth stocks in particular) were offset by gains in U.S. large cap value stocks, foreign stocks, and investment grade bonds.

Investment Outlook

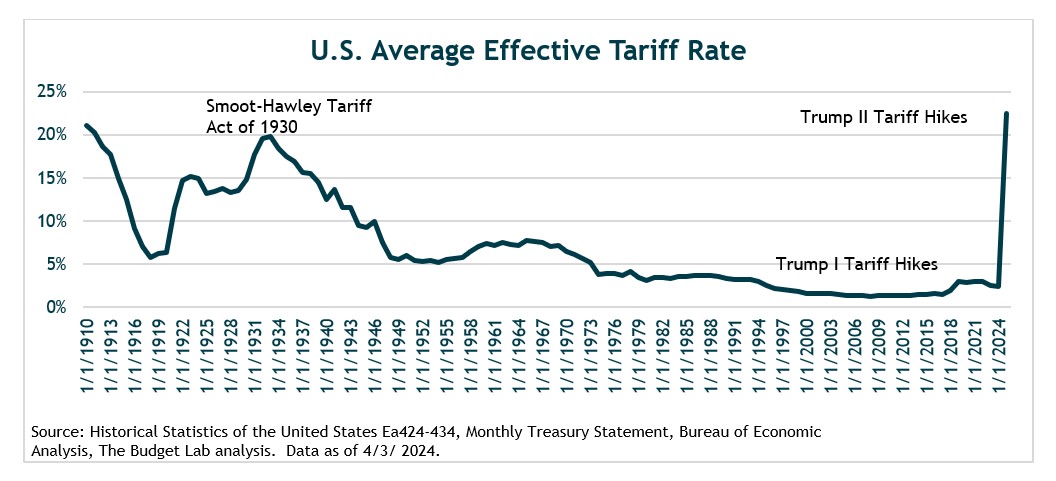

Heading into the year, caution was expressed that elevated stock market valuations, especially for U.S. technology companies, combined with policy uncertainty, could leave the market vulnerable to volatility. Indeed, this is what transpired over the first quarter of the year. After hitting new highs in mid-February, U.S. stocks suffered their first “correction” since 2023, with a decline of 10% through mid-March. The narrative around U.S. stocks started to shift in late-January on a tech-AI related sell-off, that was exacerbated in early February amid tensions around trade, tariffs and policy uncertainty. President Trump further shocked investors on April 2 (declared “Liberation Day”) by announcing a comprehensive set of much higher-than-expected reciprocal tariffs. These included a 10% baseline tariff on all imports and unexpected and significantly higher tariffs for certain trade partners, such as 54% for China and 20% for the European Union. These tariffs in aggregate, if implemented and maintained, would result in the effective tariff rate on all imports rising to 24%, putting it at a 125-year high.

In response to Trump’s announcement, equity markets suffered sharp declines, with U.S. stocks suffering their second correction of the year, dropping roughly 10% in the two days following the announcement. Longer-term interest rates plummeted over fears of an economic slowdown. The term “reciprocal tariffs” was a bit of a misnomer because they do not truly reciprocate the existing tariff levels imposed on the U.S. by other countries. Instead, a formula was used based on an economy’s exports and its trade balance with the U.S. In some cases, countries with larger trade surpluses with the U.S. are being subjected to higher tariffs—whether or not they impose high tariffs. In this way, the tariffs seem to be more of a blunt tool aimed at reducing trade deficits. Perhaps this suggests the administration doesn’t intend for the tariffs to be in place for long or to be significantly reduced.

Looking ahead, one increasing plausible outcome is that these tariffs, if left intact, will push the global economy into recession causing further declines in global stock markets. According to the IMF and Ned Davis Research, a 10% universal tariff, coupled with retaliation abroad, would reduce global economic growth by 0.5%. This latest announcement puts the tariff at least double that (i.e., 24%). The global economy’s one saving grace is that it was in reasonable shape prior to the tariff announcement. Our expectation is that some trade partners will retaliate to varying degrees. However, we believe there is a valid possibility, given President’s Trump’s penchant for bargaining, that reduced tariffs will be negotiated over the coming months that could lead to a more optimistic outcome for all involved. The administration has already signaled an openness to negotiations.

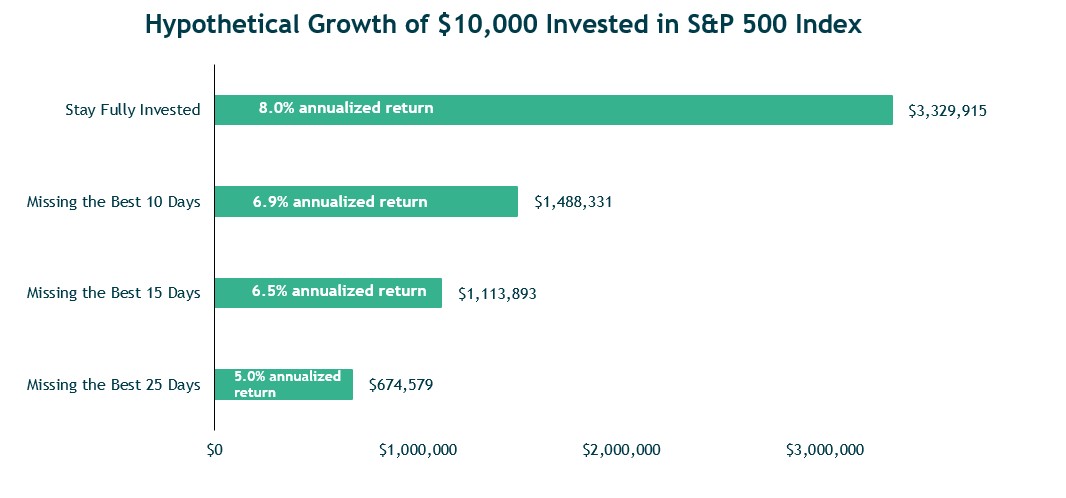

The decline in stocks and increased uncertainty has led to heightened anxiety, but history suggests that corrections (and volatility) are a normal part of long-term investing and do not always signal a crisis. Since 1950, the U.S. stock market has experienced 34 corrections of this magnitude, yet only about a third have escalated into bear markets with losses exceeding 20%. During periods of heightened volatility, we find it valuable not to overreact to the latest headline that could tempt investors to sell their equity exposure. Historically, stock market corrections recover within a few months, and investors who stay the course often benefit as markets rebound. As illustrated in the chart below, panic selling during risk-off markets can be a significant drag on long-term returns – as the old saying goes, “time in the market is more important than timing the market.”

Leading up to the tariff announcement, economic conditions in the U.S. were reasonable and the overall economic backdrop was relatively stable. Despite ongoing volatility and concerns about slowing economic growth, we still saw some supportive underlying economic fundamentals. Corporate earnings continued to surprise to the upside, with many companies exceeding expectations and maintaining strong profit margins. GDP is still expanding, albeit at a slower pace, reflecting a resilient economy even in the face of higher interest rates. Also, the labor market remains in decent shape, with unemployment at historically low levels and consumer spending has remained relatively steady and businesses have yet to signal any broad distress. That said, rising uncertainty among consumers and businesses acts as a significant headwind to economic growth. The consistently ever-changing tariff landscape is clearly weighing on consumer sentiment adding to overall uncertainty. Without details, the long-term market impacts are unclear, and the broader investment implications will take time to play out. To put it simply, the stock market hates uncertainty. And uncertainty around trade and tariffs will continue to be a headwind for U.S. stocks.

Portfolio Positioning

Portfolio Positioning – At the portfolio level and within our equity allocation, we remain diversified across U.S. and foreign stocks, and across growth and value stocks. The benefits of this diversification were apparent in the first quarter, as European stocks were a bright spot, significantly outperforming U.S. stocks – their widest quarterly outperformance gap versus U.S. stocks in 40 years. In addition, the allocation to high-quality and attractive yielding fixed-income investments (yields ranging from 5.0% to 6.5%) in our balanced portfolios provided a positive return during this volatile period and a cushion to the overall portfolio. Another key part of our diversification has been our allocation to alternatives and real estate. We believe well-managed strategies in these areas can improve risk-adjusted returns as part of traditional stock/bond balanced portfolios and are especially valuable in volatile periods.

Crises, as painful as they are, often create opportunities. So as we move forward and if stock weakness continues, we will consider the process of rebalancing portfolios – trimming overweight exposure to sectors that have performed well as of late (i.e. – fixed-income, alternatives, etc.) and increasing the allocation to sectors that have fallen dramatically (i.e. – domestic large and small-cap stocks) and potentially offer better return potential in the future.

Closing Thoughts

It goes without saying that tariffs and trade policy injected a big dose of additional uncertainty into the financial markets, and we understand that such developments can be worrying. There are still many lingering questions remaining. Until there is more clarity, the volatile environment will likely continue for some time. The long-term goal of the administration to level the global trade imbalance is admirable and a long time coming. However, the strategy, path and execution have not always been the clearest. Currently, it seems like stock prices are at least reflecting some of the bad/unexpected news regarding tariffs. In time, this too shall pass as negotiations evolve and global trade adjusts. This environment reinforces the importance of diversification, patience, and a clear investment process. History has shown that after these types of significant declines, investors who stay the course are rewarded. We thank you for your continued confidence and trust!

The Water Valley Investment Team