By M. Ray Perryman, PhD, CEO and President – The Perryman Group

Overview

The Perryman Group

Outlook for the US Economy – 2nd Quarter 2024

By M. Ray Perryman, PhD, CEO and President

The Perryman Group

Employment

While still expanding, the US economy is showing definitive signs of slowing. Unemployment rates and the number of unemployed are up compared to a year ago, and the number of job openings is down. These outcomes are the inevitable result of actions taken by the Federal Reserve to slow inflation, especially with regard to higher interest rates.

Inflation/Interest Rates

At the beginning of this year, it appeared that the Federal Reserve would be able to cut rates quickly and that there would be multiple cuts. However, the job market has proven resilient (though there are, as noted, signals that it is weakening) while inflation persisted. Last year, the resilience of the economy was surprising, but it looked like the point where inflation dropped closer to target levels was approaching. However, the first half of this year has passed without reaching the point where the Fed feels comfortable cutting rates, although recent signs are encouraging.

The Federal Reserve will likely continue to take a wait and see approach. The job market remains relatively stable (though weakening), and available information may not fully reflect everything that is occurring. At the same time, inflation is approaching satisfactory levels in recent releases. At this point, one or more rate reductions this year remain probable.

The big question over the next few months is whether the point at which the Fed can finally back off record high interest rates is reached. The sooner that can happen, the more of a growth bump will occur during 2024 and early 2025.

Consumer spending continues to rise, though inflation is part of the reason. With extra stimulus cash largely spent, many households are struggling to meet daily needs. Surging expenses for insurance, property taxes, home maintenance, and a variety of other items is also putting pressure on family budgets. Consumers are likely to be increasingly negative about the economy given the rising prices they are faced with every day. Since consumer spending is 70% of the economy during normal times, a major retrenchment would involve notable economic fallout.

Economy

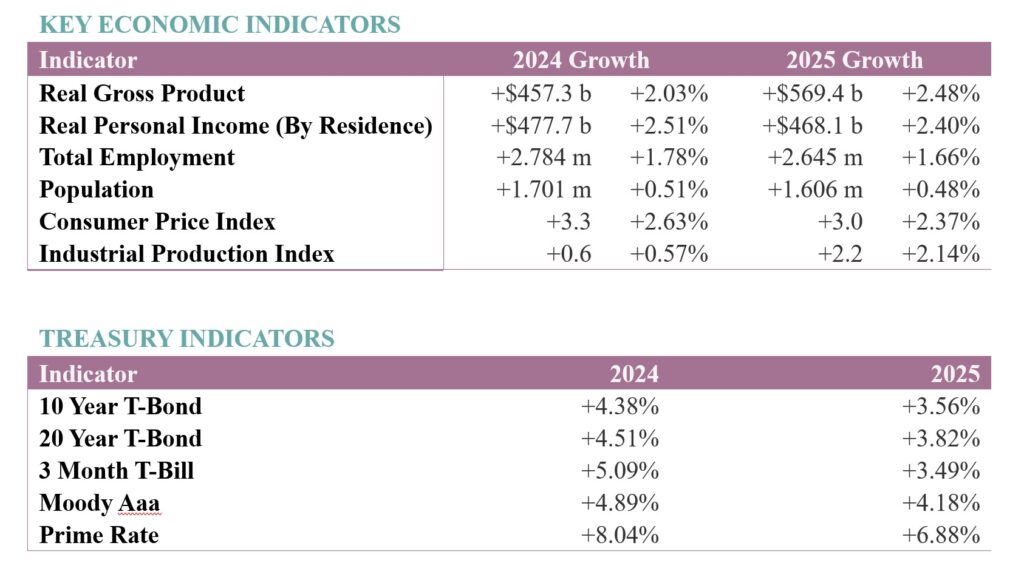

The Perryman Group’s most recent projections indicate real gross product is expected to expand by 2.03% this year on a year-over-year basis, with 2.48% growth in 2025. Job gains are projected to be approximately 2.78 million through 2024, with an increase of 2.64 million next year.

About Dr. M. Ray Perryman and the Perryman Group

About Dr. M. Ray Perryman and the Perryman Group

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com). He also serves as Institute Distinguished Professor of Economic Theory and Method at the International Institute for Advanced Studies.