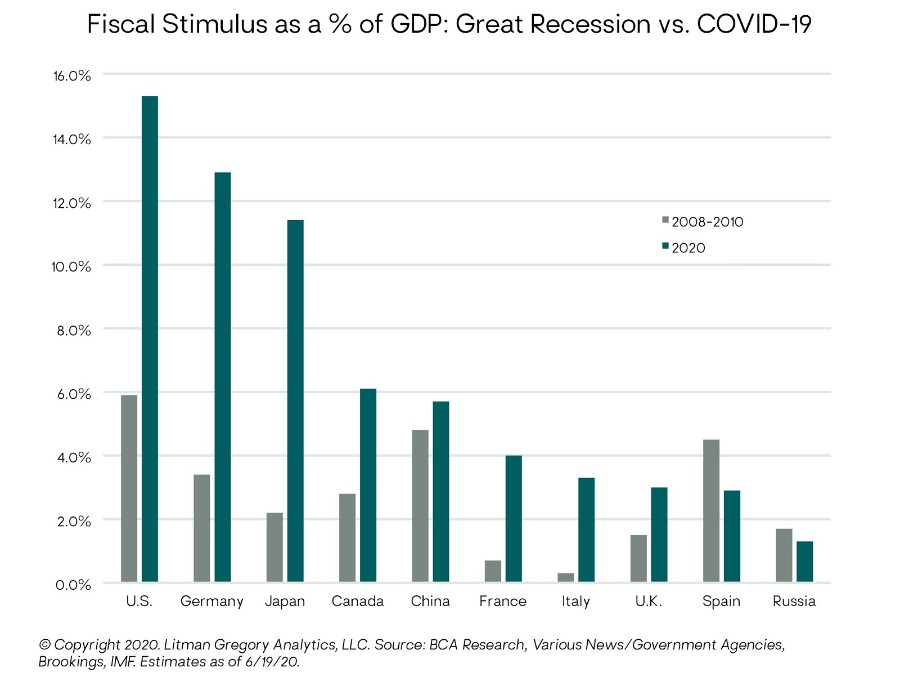

Investment Commentary – For most of the second quarter, financial markets seemed to defy grim economic news, the continued spread of COVID-19, and worldwide protests against racial inequality. Global equities performed strongly for the quarter and rewarded investors who remained invested. From the March 23 low, the U.S. equity market soared 40%, recording its best return ever over any 50-day period! Enormous levels of money printing and government spending certainly helped the investor mood. Central banks around the world provided unprecedented support to markets and economies. On the fiscal side in the United States, trillions in direct payments and loans have been or are going to be delivered to impacted citizens and businesses. The level of stimulus globally already surpasses by far what was issued during the 2008 financial crisis.

In the second quarter, larger-cap U.S. stocks gained 21% and smaller-cap stocks climbed 25%, despite the medical, economic, and social turmoil all around! However, there is a distinct style bifurcation beneath the surface – growth stocks are up 10% on the year, while its value stock siblings are down 16%. That is a stunning 26-percentage-point difference! Or, from another angle, the technology sector is up 12% on the year, while the financials, industrials, and energy sectors are down 24%, 14%, and 35%, respectively. Looking overseas, developed international stocks rose 17% and emerging market stocks gained 19%. For the year, they are down 11% and 10%, respectively. In the fixed-income markets, high-quality bonds gained almost 3% for the quarter, as Treasury yields dropped slightly and spreads narrowed, rallying along with the equity markets.

Second Quarter Actions – The incredible rebound in risk-asset markets—stocks, corporate bonds, and other credit markets—in the second quarter provided a strong tailwind for our portfolios. As a reminder, in mid-March, as the stock market plunged 25%, we rebalanced portfolios by adding to selective stock sectors and reducing exposure to lower-risk assets, such as bonds, alternatives, and real estate. While the odds of U.S. stocks revisiting their March lows appear greatly reduced given the actions and policies of the Federal Reserve, we do not rule it out. If this occurs, we are ready to act again as compelling opportunities arise. In the meantime, we are comfortable with current portfolio positioning, which balances a variety of shorter-term risks against attractive medium- to longer-term return opportunities, across a range of macroeconomic scenarios and potential market outcomes. However, if the stock market continues to advance without supportive fundamentals and becomes overvalued, we may consider rebalancing again – this time by reducing stock exposure and increasing exposure to lower risk assets – the opposite strategy taken in March. As of quarter-end, our balanced portfolios are slightly underweight to equities overall—comprising an underweight to U.S. stocks, a neutral allocation to developed international stocks, and an overweight to emerging market stocks.

Asset Class Review – We continue to expect superior returns from international and emerging market stocks over our five-year tactical time horizon. First, overseas stocks are more reasonably priced. For example, emerging market stocks’ P/E ratio is near its lowest point in 35 years! Second, foreign economies and their markets are generally more sensitive to global growth, so as the world recovers from the pandemic, foreign stock prices should outperform U.S. stocks. Finally, in a sustainable recovery, we would expect the U.S. dollar to decline, as it is generally a safe-haven currency that depreciates in the face of strong global growth. A falling dollar would further enhance foreign stock returns. Our portfolios’ fixed-income exposure remains well-diversified, including high-quality bonds and flexible, actively managed credit- and income-oriented funds, including a tactical position in floating-rate loans. Other asset class represented in portfolios are alternative strategies and real estate. The negative correlation and performance of these investments reflects their beneficial portfolio role as diversifiers and hedges to the stock market. This was very evident during this past bear market, as these sectors were providing positive returns while the stock market hit its lows in March.

Closing Thoughts – So where does this leave us? The successful containment of COVID-19 is not a foregone conclusion. The resurgence of cases in the southern and western United States, not to mention in several emerging market countries like Brazil and India, is concerning. Local U.S. authorities have so far refrained from large-scale rollbacks of their reopening efforts. But if strict, widespread lockdowns return, the global economic recovery will be more drawn out, which would be a negative surprise for markets. There are also other uncertainties around the November election or the ongoing U.S.-China dispute that could disrupt financial markets.

But we also hold a cautiously optimistic view that with the recent uptick in COVID-19 cases, the overall social policy response won’t need to be as draconian. Therefore, the economic impact should be less extreme than during the first wave. If a more benign public health scenario plays out against a backdrop of extremely loose fiscal and monetary policy, there is a good chance we’ll get a sustainable, albeit uneven, global economic recovery. It’s unlikely to be a sharp V-shaped recovery, but something more gradual, with fits and starts along the way and with some sectors and industries doing much better than others. If so, corporate earnings are likely to rebound as well.

Measured against very low interest rates—and with fears of severe recession (or worse) off the table thanks to the policy response—this would support the view that equities and fixed-income credit sectors are relatively attractive compared to high-quality bonds. Our meaningful portfolio exposures to non-core, flexible, and actively managed bond funds should do quite well in this event. Furthermore, within the equity universe, a global economic recovery, likely accompanied by a declining dollar, would be a tailwind for international and emerging market stock markets relative to U.S. stock markets, for the reasons discussed earlier. Our globally diversified equity exposure and overweight to emerging market stocks should boost portfolio returns. In our portfolios, we would not be surprised to see value investing and value/cyclical stocks take the leadership reins from growth stocks, potentially marking a new cycle of relative performance in favor of value. Our portfolios would benefit from this change in leadership, as we have adjusted our weightings to these sectors given the valuation discrepancies.

In sum, we see several ways for our portfolios to perform relatively well over the next five to 10 years. But we should also steel ourselves for a potential significant market correction, most likely caused by disappointing developments on the virus/medical front. As always, it is paramount that our investment management be guided by a strategy that meets the risk/return profile of the clients we serve. And we need to keep a long-term perspective with an eye on near-term risks so that we remain disciplined through the inevitable downdrafts when fear in the markets is palpable. As always, we appreciate your continued confidence and trust, as we do our best to continue to earn it.

The Water Valley Investment Team