Market Recap

Over the past few months, the economic backdrop has worsened with sustained high inflation, slowing growth, a tightening Federal Reserve, the continued Russian war on Ukraine, China’s zero-COVID lockdowns….and so on! Given that economic back drop, the stock and bond markets have reflected those challenges with some of the worst starts to a year in history. Domestic and developed international stocks are down 20% for the year, while emerging market stocks held up a bit better, down over 17.6%. “Safe-haven” core investment-grade bonds have been pummeled, down an incredible 10.3% for the year to date — its worst first-half ever! Taken together with the equity bear market, this is by far the worst first-half performance for a traditional “60/40 portfolio” (60% domestic stocks/40% core bonds) in modern history, down 16.1%. The previous worst first half was 1962, down 12%.

Economic Environment

In response to disappointing May inflation data, the Fed turned more hawkish, hiking the federal funds rate a larger-than-expected 75 basis points. Tighter financial conditions in turn depress consumer and business spending, reducing aggregate demand in the economy. Lower demand (lower GDP growth) should reduce overall price pressures and hence inflation. That’s the Fed’s playbook and toolkit. Although the latest inflation figures reported remain historically high, we are starting to see several commodities rollover having fallen significantly from their recent highs (i.e. – natural gas -33%, cotton -60%, lumber -55%, etc.). Elevated inflation may persist for some time, but it is possible we may be seeing evidence of “peak” inflation presently occurring and that future inflation figures may begin to gradually reflect this with lower reported numbers. Balancing these and many other data points, we expect a continued deceleration in economic growth driven by rapidly tightening monetary policy in response to sustained high inflation. Our view at this point is that if the U.S. economy does fall into a recession, it is likely to be a more mild cyclical recession rather than like the 2008-09 financial crisis or the 2020 COVID recession. This is due to the cash flush consumer ($2 trillion in excess savings), solid corporate balance sheets, strong banking system and tight labor markets.

Investment Outlook & Portfolio Positioning

The sharp stock and bond market declines we’ve already experienced this year, leads us to a relatively positive outlook for financial markets and asset class returns going forward over the next several years. Lower valuations offer a margin of safety for investors, as a lot of bad news and negative sentiment is already priced into these markets. Things don’t have to be great to generate strong returns from here – they just need to get better from currently depressed levels. We see equities, including domestic, developed international and emerging markets, offering attractive valuations and solid long-term return potential. In terms of our fixed-income positioning, we have maintained our significant underweight to traditional core bonds, reflecting our concerns about rising interest-rates and very low starting yields. Though our fixed-income exposure has had better relative performance as interest rates have shot higher, they have not been immune to the recent broad fixed-income price declines. However, with the significant increase in yields over the past several months, there are sectors within the fixed income market that are starting to look attractive and provide reasonable yields to investors.

A key part of our diversification has been our allocation to alternatives and real estate. We believe well-managed strategies in these areas can add beneficial diversification and improve risk-adjusted returns as part of traditional stock/bond balanced portfolios. Given the current macro risks and market backdrop, we think they are especially valuable. Portfolio diversification into these “non-traditional” asset classes can be particularly valuable in an inflationary environment as we have seen this year. These strategies have performed well this year, posting double-digit positive returns.

Given all this, we are beginning the process of rebalancing portfolios – trimming overweight exposure to sectors that have performed well as of late (i.e. – alternatives, real estate, etc.) and increasing the allocation to sectors that have fallen dramatically (i.e. – domestic and foreign stocks) and potentially offer better return potential in the future.

Closing Thoughts

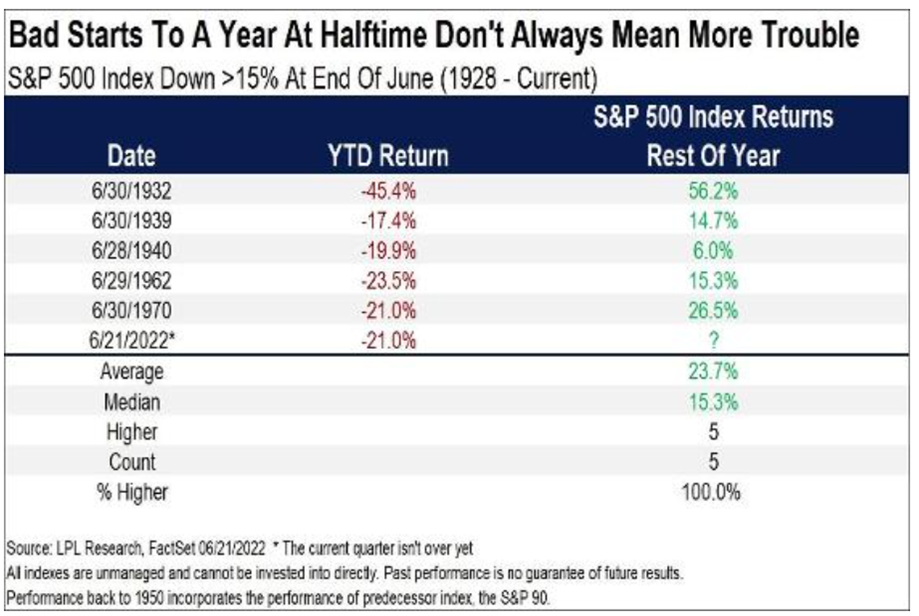

As the table above reflects, history has shown that after these types of dramatic declines, the stock market has rebounded well and rewarded investors who stay the course! However, all is not rosey and it could be an investing grind for some time. Given this, it is prudent to be prepared for more possible downside and volatility for the stock market over the next several months or quarters. Whether further declines happen or if the economy avoids recession and the markets rebound, we believe we are well-positioned. While tilting towards our highest-conviction tactical views, our portfolios remain strategically balanced and well-diversified across multiple global asset classes, investment strategies, equity styles and risk-factor exposures. We believe the quality investments we own for clients at current valuations are poised to provide rewarding and competitive returns over time.

We sincerely appreciate your continued confidence and trust. Please find the enclosed additional economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team