Market Recap

Global equities continued to rally in the second quarter, led by surging U.S. mega-cap technology stocks, particularly anything related to Artificial Intelligence (AI). Domestic stocks gained 6.6% in June and 8.7% in the second quarter, driving its year-to-date return to 16.9% overall. Outside the U.S., developed international stocks are up 11.7% for the year – a solid start to the year, but lagging domestic stocks. Moving to the fixed-income markets, core bond returns were slightly negative for the quarter as interest rates rose slightly and prices fell. The benchmark 10-year Treasury yield ended the second quarter at 3.8%, up from 3.5% at the end of March.

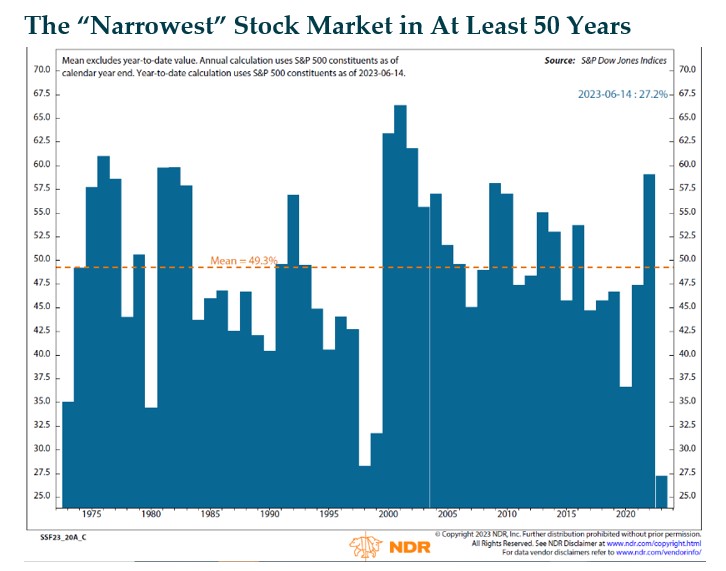

The Narrowest Stock Market in at Least 50 Years – The domestic stock market’s rally this year has been one of the narrowest on record, with less than 28% of the index’s constituents beating the overall index return. As shown in the chart below, in an average year around 49% of the index’s 500 companies beat the overall index. (The only other year comparable to this year was 1998, as the Tech/Internet stock bubble was inflating. That didn’t end well, but it took another 15 months before it started to burst). More granularly, with the sudden frenzy in all things AI, the average YTD return for Amazon, Google, Meta, Microsoft, NVIDIA, and Tesla is 96%. The gains in these six mega cap tech stocks are responsible for almost the entire return for the year. Also, the combined market cap of these six stocks (plus Apple), now comprises over 27% of the market, the largest concentration in history for the top seven stocks.

It remains to be seen whether this extremely narrow market rally resolves via the rest of the market catching up or the seven companies mentioned above “catching down,” but improved market breadth would be a positive indicator for the market’s continued bull run.

Investment Outlook and Portfolio Positioning

The current macroeconomic data continues to send mixed signals. On the one hand, the U.S. economy has been more resilient than many expected. The economy has grown, albeit at a subpar rate. The labor market has remained very strong, supporting consumer spending; and headline inflation has dropped meaningfully, thanks to a sharp decline in energy prices. On the other hand, key leading indicators of an impending recession are still flashing red, including a deeply inverted yield curve and tightening credit conditions, among others. Moreover, although the Federal Reserve paused its aggressive interest rate hiking campaign in June, core inflation remains stubbornly high, with the Fed signaling it will resume rate hikes later this year, further raising the likelihood of a recession. As we read the muddy economic tea leaves through our cloudy crystal ball, we maintain our view that a modest recession is a probable outcome over the next few quarters. Historically, the odds are unfavorable for the economy avoiding a recession after the Fed has been aggressively tightening. And we have yet to see the full (lagged) impact of this cycle’s monetary tightening on the real economy. However, a near-term recession is not a certainty. Each cycle is somewhat different and this one is considerably so due to the pandemic dislocations and historical fiscal stimulus of the past several years. There have been three instances (out of 13) where the Fed tightening cycle ended without a recession. So, a more benign near-term outcome is certainly possible.

Just as the U.S. economy has been more resilient than expected in the face of the ten aggressive Fed tightenings over the past year, the U.S. stock market has been as well — and then some — gaining nearly 17%. There are always multiple factors driving the markets, but we think the key drivers of this year’s strength include the fact that the economy and corporate earnings have held up better than many expected, the markets are optimistic that the Fed will soon end it’s tightening cycle, and most importantly, investor euphoria around Artificial Intelligence. Specific to the last point, we’d argue that while it is likely Ai will have a huge impact on the global economy that doesn’t necessarily mean the current AI stock frenzy is justified by underlying earnings fundamentals. It may be in some cases, but we can also remember the tech/internet stock bubble in 1998–2000. The internet obviously has had huge economic impact over the past 25 years, but very few tech stocks were priced appropriately in early 2000.

While our portfolios maintain significant exposure to U.S. stocks overall and many of the mega cap tech stocks mentioned previously, we remain slightly underweight U.S. stocks in favor of foreign stocks that are far less expensive and setting them up for attractive medium-to-longer term expected returns. We also have a positive view of the U.S. fixed-income markets. With rising yields over the past year, most bond market sectors now offer attractive expected returns relative to their risk with yields in the 4-7% range. In addition to our core bond exposure, we continue to have a meaningful allocation to higher-yielding, actively managed, flexible bond funds run by experienced teams with broad investment opportunity sets and yields in the high single-digits. We also maintain core positions in alternative investments, such as managed futures and real estate. Managed futures returns were very strong in 2022 (up over 20%), while bond and stock investments fell double digits. Commercial real estate also performed well in 2022 with positive returns, although real estate faces a current head wind with higher interest rates. Given this backdrop, we remain confident in the long-term portfolio benefits of alternatives and their non-correlated returns relative to traditional stock and bond holdings.

Closing Thoughts

Despite the solid investment returns this year (possibly stealing some from future returns), we believe there will be headwinds over the next year given a tightening Fed, stubborn inflation, possible recession, etc. However, as we extend our time horizon over the next five years, we see reason for optimism. Within the U.S. stock market there are companies and sectors that are reasonably priced, and the fixed-income landscape is also attractive, thanks to higher yields. We also see strong total return potential from international and emerging market stock markets, given their attractive relative and absolute valuations. We are investors not short-term market traders. By maintaining a disciplined and balanced investment approach, we are well-positioned to weather the inevitable market storms and capitalize on the opportunities that are sure to arise. Thank you for your continued trust and confidence. Please find the enclosed economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team