Market Recap

In the second quarter of 2024, the U.S. economy remained resilient in an environment where inflation and interest rates remained higher than expectations. Tighter monetary policy was offset by accommodative fiscal policy, and a still strong US consumer. The US stock market gained nearly 4.5% in the quarter, reaching a new all-time high. Gains were again led by technology stocks with the Nasdaq gaining over 8.0% in the quarter. Chip-maker Nvidia became the world’s most valuable company in late-June after its share price climbed to an all-time high, making it worth $3.34 trillion, with its price nearly doubling since the start of this year. We also saw the continuing trend of large-cap stocks outperforming small-cap stocks and growth beating value. Overseas, results were mixed with developed international stocks falling 0.2%, while emerging markets stocks rebounded nearly 5.0%. Within the bond markets, returns were positive across most fixed-income segments with the broader bond market gaining 0.3%. The benchmark 10-year Treasury yield ended the quarter close to where it started, but interest rates were volatile in the period. The 10-Year Treasury yield started at 4.20%, rose to 4.70% before coming back to the mid-4.20% range.

Investment Outlook and Portfolio Positioning

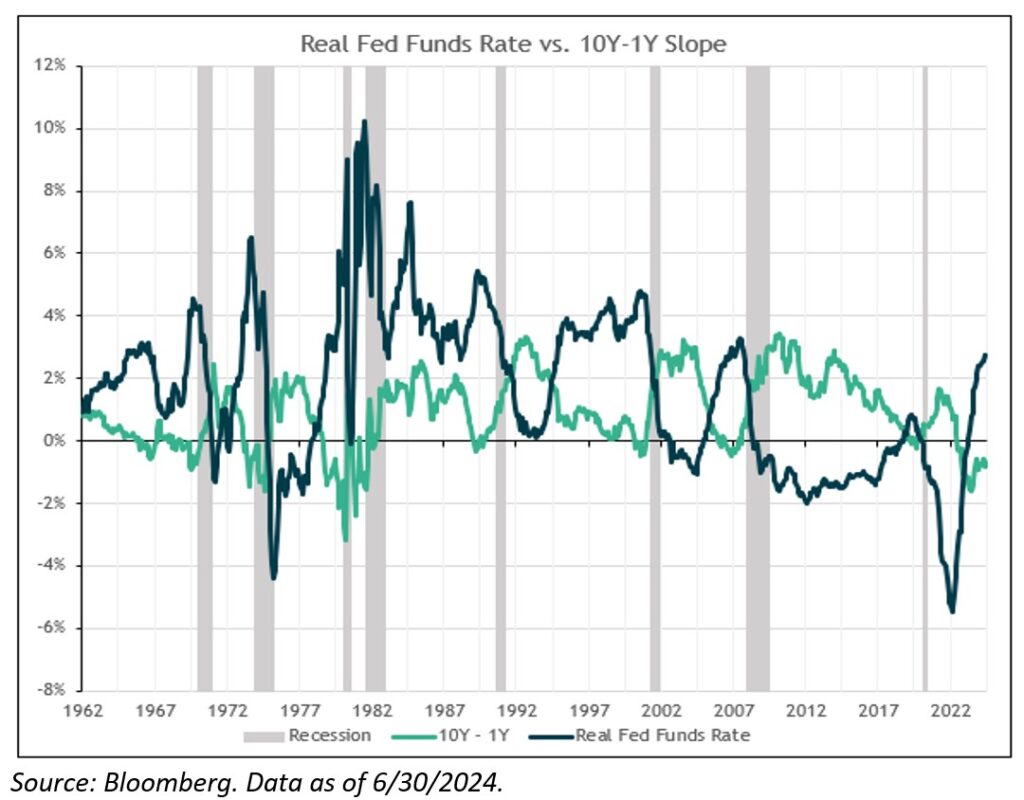

During the second quarter, the U.S. economy began its fifth year of expansion after the brief pandemic-related recession in April 2020. Ongoing economic growth has defied widespread expectations of a recession that were present for most of 2023 and into the beginning of 2024. Concerns about an economic recession were due to the Fed’s rapid and meaningful increase in the Fed Funds rate and the potential negative impact they would have on economic growth. The Fed’s rapid increase in the Fed Funds rate resulted in an inverted yield curve with short term interest rates above intermediate-and-long term interest rates. Historically, an inverted Treasury yield curve has been a reliable predictor of economic recession. However, as we’ve communicated for several quarters, our view was that given the elevated level of inflation, Fed policy may not have been as restrictive as it seemed and thus, a recession was not imminent. Our view was largely based on the level of the real Fed Funds rate (Fed Funds Rate minus inflation) and prior recessions. The chart below shows the real fed funds rate (blue line) and the shape of the Treasury curve (green line). When the green line is above zero it indicates a normally (upward) sloped yield curve and below zero represents an inverted (downward sloped) yield curve. The vertical grey bars indicate a recession.

We can see that while the yield curve has been inverted since July 2022, Fed policy was very accommodative for most of that time (i.e., the real Fed Funds rate was sharply negative when the curve first inverted). It’s only more recently been that Fed policy started to move toward restrictive levels. In prior cycles, real Fed Funds proved restrictive at the 3.5% (or higher) level. To the extent that inflation continues declining, which we think it will, and the Fed keeps rates unchanged, Fed policy will become proportionately tighter, and slow the economy.

Indeed, recent data suggests that higher interest rates and inflation have started to take a bite out of the US consumer. The University of Michigan Consumer Sentiment Index fell to a seven-month low in June, indicating a pessimistic view of personal finances. In the May retail sales report, growth was positive but slower than expected. This recent data point suggests consumers are exercising more caution amid tighter budgets. At this point, we would describe the slowdown in consumer spending as a normalization after a period of splurging, rather than something more ominous. So far, any concerns around the consumer have not seemed to scare investors as the stock market has made 30 new highs and as the economy has grown at nearly 3% (after inflation) over the past four quarters. Our base-case is for the economy to continue growing, albeit at a slower pace, for inflation to reluctantly grind lower, and the backdrop for risk assets to remain slightly supportive (for at least a while longer). That said, we will closely monitor the labor market and the consumer for signs of further deterioration, which could impact portfolio positioning.

Within US equity markets a handful of U.S. mega-cap technology stocks continue to lead way higher. So far in 2024, the concentration of returns moved even higher. Through late June 2024, only 27% of stocks are outperforming the S&P 500. This is lowest reading on record going back more than 50 years. In addition, the top 10 contributors in 2024 have accounted for 70% of the market’s year-to-date return. While the concentration levels at the index level are noteworthy, it’s possible that this trend can continue. Our portfolios have meaningful exposure to many of these strong-performing mega-cap stocks, which has benefitted portfolio performance. But we remain balanced, also owning larger-cap value and smaller-cap U.S. stocks that are trading at more attractive valuations and offer important diversification benefits. Smaller-cap U.S. stocks, for example, are trading at valuations relative to large-cap stocks that haven’t been seen in years, dating back to the late 1990’s. In our fixed income positioning, we continue to take advantage of the inverted yield curve, maintaining meaningful exposure to shorter-term bonds, emphasizing shorter-term higher yielding securities with yields in the 6.5% to 7% range. At the same time, we’re also keeping healthy exposure to longer-term investment grade corporate bonds with yields in the 4.5% to 5% range, which can also provide a potential hedge in the event of an unforeseen downturn in the stock market. Finally, we continue to have exposure to alternative strategies that include managed futures and real estate, which have historically been a solid hedge and able to generate positive returns during periods of stock/bond losses.

Closing Thoughts

Heading into the second half of the year, we continue to anticipate pockets of volatility given headline risks related to Fed policy, geopolitical events, and the upcoming U.S. presidential election. In the event of volatility, we will look to be opportunistic, taking advantage of any attractive risk/reward opportunities that arise. Looking beyond year-end and over the next several years, we continue to monitor the extraordinarily high and increasing levels of federal government debt and the related annual interest expense. Unless major fiscal changes are made, these issues will continue to grow in significance for the economy and markets. We will do our best to provide protection, diversification and return to portfolios as this story plays out over the next several years.

We thank you for your continued confidence and trust. Please also find the enclosed economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team