Market Recap

In the second quarter of 2025, global markets faced a complex mix of encouraging economic data, ongoing geopolitical uncertainty, and evolving global central bank policies. Nonetheless, the U.S. stocks posted a strong gain, reaching a new all-time high, and fixed-income markets were positive across most segments. The broader domestic market gained 10.9% in the second quarter, driven by continued earnings resilience in the technology and communication services sectors. Year to date, the market is up 6.2%. Internationally, developed market performance was also strong gaining 11.8% for the quarter and 19.5% year to date. Importantly, most of this return is due to currency effects, specifically a weaker U.S. dollar. Emerging markets rose 11.99% benefiting from improving sentiment around China’s fiscal stimulus and currency stabilization efforts. Geopolitical risks, including ongoing instability in Eastern Europe and the Middle East, remain potential catalysts for volatility.

Within fixed-income markets, our expectation has been that rates will remain volatile and range bound, which played out in the second quarter. The 10-year Treasury yield started the quarter at 4.23% and ranged between 4.01% and 4.58% before ending the quarter at 4.24%. In the period, investment-grade core bonds ended the quarter up 1.2%. Lower quality high-yield bonds were up 3.6% as investors’ appetite for risk increased.

Economic Outlook

At their mid-June meeting, the Federal Reserve held the federal funds rate steady at 4.25–4.50%, marking the fourth consecutive meeting without a change in rates. Chair Powell again emphasized a data dependent approach, citing risks from tariffs and global uncertainty, particularly inflation pressures from U.S. tariffs. The Fed also updated their summary of economic projections where the key takeaway was that the median forecast is still for two quarter-point rate cuts by the end of 2025. However, we did see some division within the Fed, where seven of 19 officials now see no cuts this year, implying that they believe the economy is stable and rates are not too restrictive. The Fed’s rate decisions are based on their dual mandate of stable prices and maximum employment. Our view is that inflation, from a structural perspective, remains under control. For example, the Consumer Price Index (CPI) ex-shelter, has been below the Fed’s 2% target in 19 of the past 24 months, underscoring the disinflationary trend in much of the economy. While upcoming tariffs may temporarily push inflation higher, the Fed is likely to look through these shorter-term effects and focus on the underlying structural picture, which remains benign.

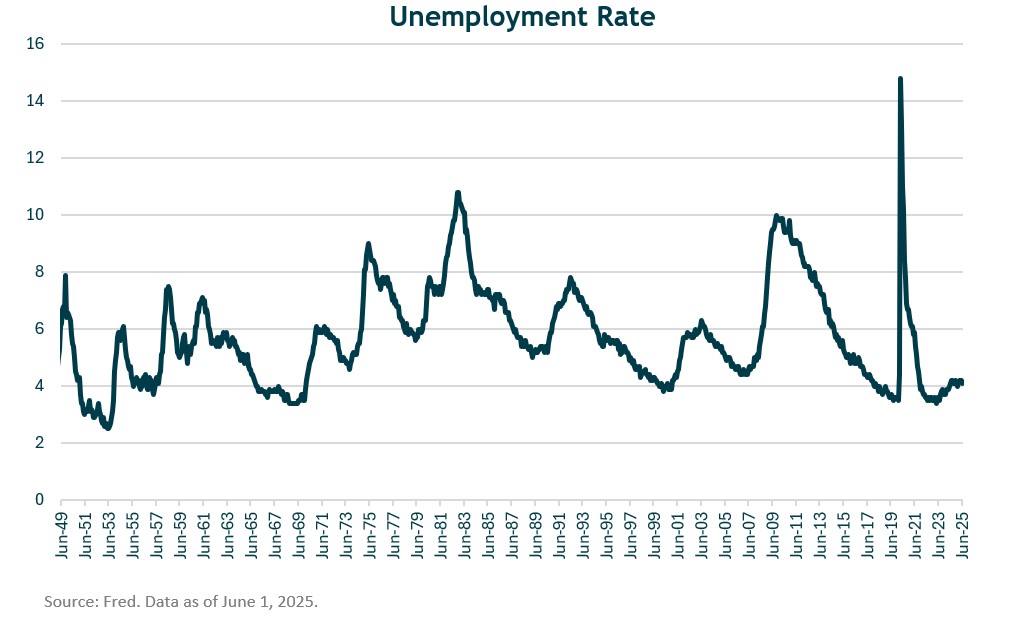

As for the labor market, it is showing signs of slowing. Unemployment ticked up modestly to 4.1% in June, and job openings have declined across several sectors. Fed officials expect unemployment to rise to 4.5% this year (from 4%) and settle at 4.4% in 2027. Wage growth remains above pre-pandemic trends but has decelerated, which could provide relief for the Fed’s inflation mandate in the coming quarters.

Looking at economic growth, U.S. GDP growth in the second quarter is estimated to have reaccelerated to 2.5% annualized after contracting 0.2% in the first quarter (Atlanta Fed estimate). The first quarter’s GDP decline was primarily due to a surge in imports ahead of the tariff announcement (imports are a subtraction in the GDP calculation). The Bloomberg consensus estimate for 2025 GDP growth is 1.4%. Consumer spending, though still positive, has recently shown some signs of fatigue as households continue to adjust to higher borrowing costs and tighter credit conditions. We expect the U.S. economy to slow in the near term, but continue to believe it can avoid a meaningful downturn and ultimately regain momentum over time. With core inflation continuing to trend toward the Fed’s 2% target (albeit slowly) and clearer signs of economic and labor market softening emerging, we believe the Fed now has room to begin cutting rates. The timing and pace of those cuts remains uncertain, but in our view, the case for easing has become increasingly compelling to support the slowing economy.

Investment Outlook andPortfolio Positioning

Given the current macro backdrop for inflation, a slowing but resilient economy, and expectations for policy easing, our outlook remains cautiously optimistic and stocks may continue to climb “the wall of worry”. Given this, we remain positioned with neutral strategic equity allocations across the U.S., developed international, and emerging market stocks. So far, the uncertainty and angst surrounding the tariffs has mainly impacted market sentiment and not corporate fundamentals. First quarter earnings wrapped up with a strong showing, growing over 13% compared to a consensus forecast of mid-single digit growth at the start of earnings season.

Outside the U.S., valuations for international stocks remain attractive, and are currently trading at a meaningful discount compared to U.S. stocks. After gaining 20% through the first half of the year, we see potential for select international exposures to continue performing well, particularly if the U.S. dollar continues to weaken alongside Fed policy shifts.

In fixed income markets, we suspect economic growth will slow. This does not necessarily spell trouble for bond markets. A moderate slowdown can be supportive, as it eases inflation pressures and interest-rate volatility, both of which help maintain credit stability and investor demand. We continue to see opportunities for active management in our fixed income positioning, especially from an asset allocation standpoint. We continue to see attractive yield opportunities in the 5%-6.5% range across credit and securitized markets, allowing us to capture attractive income without overreaching for return and helping narrow the range of portfolio outcomes in an environment of still-evolving macro conditions.

Alternatives continue to offer risk-reduction benefits, while providing solid return potential. Managed futures historically have performed well in high volatility environments, which could easily resurface again as the year unfolds. Commercial real estate appears to be bottoming and providing some interesting upside in selective sectors (i.e. – distribution/logistics, industrial, specialty sciences, etc.), given lower supply and higher demand. Diversification and low-correlation characteristics are additional benefits, as well.

While we are cautiously optimistic on the markets, risks remain – extended tariff wars, inflation uptick, global geo-political conflicts, etc. In addition, U.S. equity valuations are undeniably elevated by historical standards. That alone does not imply an imminent correction, as valuations have long proven to be poor timing tools. Having stated that, we may look to reduce equity exposure if valuations get further extended and market froth gets extreme. Just as we initiated rebalancing strategies (out of more stable investments and into stocks) in portfolios when stocks dropped significantly earlier this spring, we may implement some reverse rebalancing strategies (out of certain overvalued stock sectors and into more undervalued stock, fixed income and alternative sectors).

Closing Thoughts

The second quarter’s equity rebound reflects growing investor optimism that a soft landing remains likely, with inflation easing and central banks, particularly the Fed, gaining room to cut rates. As we enter the second half of 2025, our outlook remains constructive but cautious. We believe markets will continue to be shaped by a tug of war between slowing economic growth and the prospect of rate relief alongside further resolution to the tariff situation and the upcoming legislation. We continue to think economic growth will slow but not collapse. Themes to watch in the remainder of the year will be Fed policy shifts, corporate earnings strength, and geopolitical risks. As always, we remain committed to helping you navigate this dynamic environment with a disciplined, long-term approach.

We appreciate your trust and support. Please find enclosed the economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team