By M. Ray Perryman, PhD, CEO and President – The Perryman Group

Overview

Outlook for the US Economy – 3rd Quarter 2023

By M. Ray Perryman, PhD, CEO and President

The Perryman Group

Inflation/Interest Rates

The Federal Reserve has been taking action to slow inflation, including raising interest rates at a historically rapid pace. Even though there have been notable difficulties across a spectrum of industries, the economy has shown remarkable resilience. The Perryman Group’s latest analysis indicates that while the pace of growth has certainly slowed and a downturn is still possible, a path to a “soft landing” was becoming clearer as inflation trended downward without extreme negative effects for the labor market. A major escalation in the conflict in the Middle East could change the situation, making it more difficult to deal with inflation.

Rising costs have had a significant negative effect on household and corporate budgets. There have been wage increases, but they have been insufficient to keep real (inflation-adjusted) wage rates from falling. Much of the surplus money available to households due to pandemic-related stimulus payments is now dissipated, and credit card and other debt levels have risen. Even so, consumer spending continues at a relatively healthy pace, driving a substantial component of the economy.

Although Federal Reserve actions to slow inflation have clearly been necessary, higher interest rates are causing problems in industries ranging from banking to real estate development. The housing market is also struggling with a lack of homes for sale, as owners who locked in extremely low mortgage rates are finding it difficult to afford to sell and purchase different homes at current interest levels. The recent pause in rate hikes indicates a “wait and see” approach to upcoming data releases.

Economy

While the US economy is facing some significant challenges, a major recession appears increasingly unlikely unless several risk factors converge. In addition to the tragic loss of life, the recent invasion of Israel by Hamas has caused both an increase in uncertainty and increases in oil and other fuel prices. If the conflict spreads to other parts of the Middle East, the economic fallout will worsen.

The fact that the economy has been able to maintain an expansionary pattern despite challenges to date is notable, and The Perryman Group’s latest projections indicate that growth is likely to continue (barring a major escalation in the Middle East). Business cycles are inevitable, and the path may be somewhat bumpy, but a major meltdown currently appears unlikely.

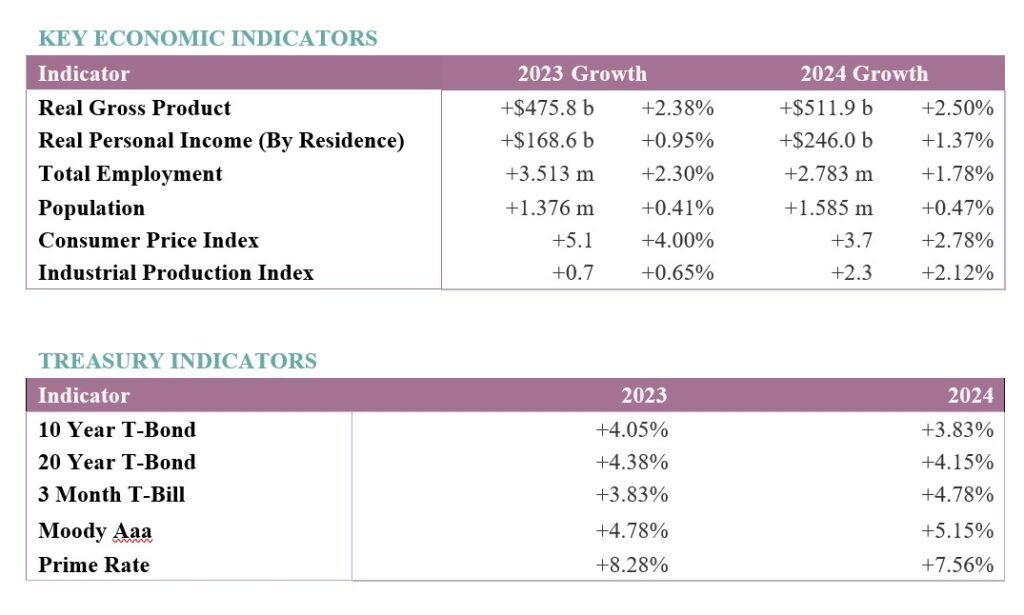

The Perryman Group’s most recent projections indicate real gross product is expected to expand by +2.38% this year on a year-over-year basis, with +2.50% growth in 2024. Job gains are projected to be over 3.5 million through 2023, with an increase of almost 2.8 million next year.

About Dr. M. Ray Perryman and the Perryman Group

About Dr. M. Ray Perryman and the Perryman Group

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com). He also serves as Institute Distinguished Professor of Economic Theory and Method at the International Institute for Advanced Studies.