Market Recap

A September slump put a slight pause on the global equity bull market, but domestic stocks were still able to manage slight gains for the third quarter finishing up just 0.6%. Results were not as good for overseas stocks, as foreign developed stocks were down 0.4% and emerging market stocks declined 8.1%. The culprit behind emerging-market stocks’ poor recent showing is China (more on this below). China was by far the worst-performing stock market in the third quarter, down 18.2%. Chinese stocks comprise roughly 35% of the emerging markets stock index. Meanwhile, within the broad U.S. market, smaller-company stocks and growth stocks beat value stocks for the second straight quarter, with sector performances reflecting a somewhat more risk-averse investor mindset, consistent with the COVID-19-related economic growth slowdown during the quarter.

In the bond markets, core bond returns were essentially flat and yields were little changed for the quarter. But it was a roller-coaster ride, with the 10-year Treasury yield plunging below 1.2% in early August, and then shooting back up in the last two weeks of September. Credit-sensitive bond segments outperformed core bonds, and for the year to date, core bonds are now down 1.6%, while high-yield bonds and floating-rate loans are up 4.6% and 4.4%, respectively.

China – A new concern that emerged in the third quarter is around the excessive borrowing in China’s property sector and within Evergrande Group, one of the country’s largest property developers. Moreover, this has come amidst other regulatory crackdowns in China (such as in the for-profit education industry). We have followed these events closely as part of our ongoing research on China and emerging markets. Thus far we are of the view that these risks will be contained, and therefore we are not currently contemplating any changes to our portfolio positioning. Ultimately the reality in investing is that information like the problems facing Evergrande is quickly priced in (and more often over-priced in).

So, the question is whether this is a shorter-term disruption or whether it is revealing a more fundamental long-term change that deserves to impact our long-term risk and return assumptions. This question is the focus of our analysis.

A catalyst for the Evergrande-related turmoil is the Chinese government’s steps to rein in speculation that they believe is leading housing to become increasingly unaffordable, which is contrary to their long-term sustainability goals, such as reducing inequality. This in turn is surfacing issues related to excessive leverage in the property sector that have built over many years. We are focused on understanding how large the problem is and whether China will manage this adjustment well.

At present, we share the widely held view that a Lehman-like disruption locally in China or globally is unlikely. (The 2008 collapse of Lehman Brothers set off a negative chain reaction in the financial sector.) For one, we don’t see the same feedback loop between China’s property sector and the global economy. In addition, Chinese citizens have a lot of wealth tied up in property, so it is in the government’s interest to avoid a chaotic wave of defaults and the government has the means to stabilize the financial system since it is the majority owner. A more orderly restructuring still seems the more likely scenario.

Investment Outlook

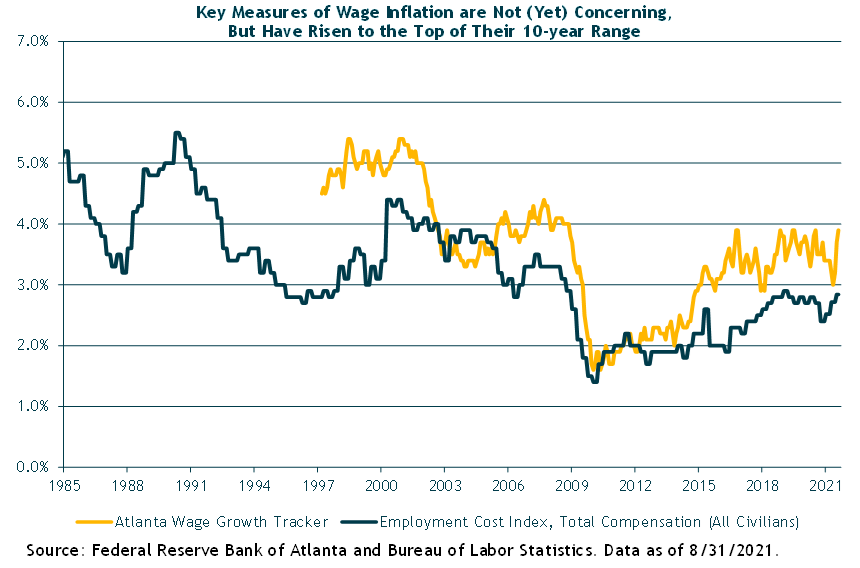

The pressing question continues to be whether higher inflation is more likely a transitory effect of COVID-19 and supply-chain disruptions or the start of a new regime where higher wages and inflation create a damaging inflationary spiral? We do expect higher inflation in the years ahead and are satisfied that our current portfolio positioning, which includes flexible credit strategies, liquid alternatives, emerging markets and real estate, is appropriate to combat higher levels of inflation. We will continue to monitor inflation closely and adjust our views and positioning as needed.

Our base case for the next several years remains relatively sanguine, as we expect the economic and earnings growth cycle, interest rates, and government policy to remain broadly supportive of equities and other risk-asset markets. However, our analysis also suggests we should be prepared for an extended period of lower absolute investment returns—certainly much lower for U.S. stocks and core bonds than the last five to ten years. Both mathematically and economically, it is extremely unlikely, if not impossible, to repeat over the next five to ten years, given where we are now starting from in terms of yields, profit margins, and earnings growth.

Meanwhile, expected returns for non-U.S. equities—emerging market equities in particular—remain attractive, which is the primary reason for our tactical overweight to them. But as we experienced with emerging market stocks in the third quarter, equity investors should be prepared for a bumpy ride. It is also the case that a lot of bearish sentiment has been priced into emerging-market stocks; in fact, some of our managers are seeing potential long-term return opportunities emerge in China and the short-term pain could result in new opportunities. We remain comfortable with our current emerging-markets allocation after taking into account the risks we see in China, along with the diversification benefits and long-term return potential it brings. That said, we will continue with our analysis and if we conclude the impact is likely to be long term versus temporary, we will factor that into our portfolio positioning.

Closing Thoughts

As always, we thank you for your trust, and we welcome questions you may have about the investment landscape or your portfolio. Please see the additional economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team