Market Recap

After a very difficult first half of the year, equity markets rebounded in July and August on investor hopes of an easing in inflation and a Fed pivot or pause. The reprieve was short-lived however, as stocks tumbled to fresh lows in late September amid further aggressive central bank rate hikes and statements of further tightening to come. Domestic stocks dropped 4.9% for the quarter and are down 23.9% for the year. International markets fell 9.4% for the quarter and 27.1% YTD and were negatively impacted by the sharp appreciation of the dollar – the U.S. Dollar Index was up 7.1% for the quarter and a stunning 17.3% on the year, hitting a 20-year high (for US based investors, a stronger US dollar is a headwind to foreign equity returns). Investment-grade bonds didn’t avoid the carnage. The 10-year Treasury yield hit a decade high of 3.9%, causing high-quality bonds to drop 4.7% that puts these “safe-havens” down an incredible 14.6% for the year. To put these figures into historical perspective, this has been the worst start to the year for a 60% stock/40% bond portfolio going back to 1950!

Economic and Investment Outlook

The economic backdrop for the U.S. and global economy deteriorated further in the third quarter. Stubbornly high Inflation remains the key economic indicator. The Fed’s response to the sharp spike in inflation has been to aggressively raise interest rates – their only means of slowing economic activity to reduce aggregate demand and in turn bring inflation in line with their longer-term targets. This has been the catalyst for the steep declines in both stocks and bonds. While headline CPI inflation (which includes food and energy) seems to have peaked, core inflation measures have continued to rise and are far above the Fed’s 2% target. Demand-side drivers of core inflation in the U.S. have stayed stubbornly high. The good news is that many of the global supply-chain disruptions are dissipating, and general commodity prices have rolled over and declined across the board.

The Fed’s policy path of higher interest rates will eventually bring down GDP growth and increase unemployment. The odds the Fed can engineer an economic soft landing — where the U.S. economy slows sufficiently to tame inflation but does not fall into a deep recession with much higher unemployment – are challenging. The Leading Economic Index and an inverted yield curve may be predicting a recession is on the horizon. While the evidence leans towards a recession, there are still some positives supporting the economy and that may mitigate the severity of a recession if/when it happens, including a strong labor market, rising wages, and a strong US consumer.

Portfolio Positioning

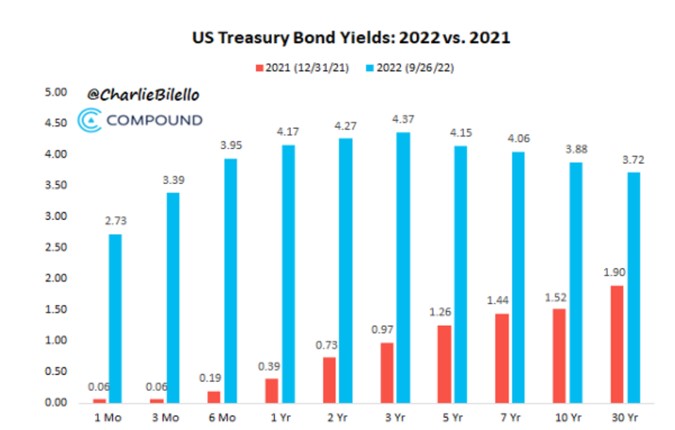

Our focus is on longer-term fundamentals and valuations, and we are not in the business of making shorter term bets on the markets. However, our analysis tells us that with this market weakness and lower valuation levels, stocks are beginning to provide opportunities for long-term investors – offering great companies at good prices. At the same time and as the chart below shows, the sharp increase in interest rates has driven bond yields up to more attractive levels – as attractive as they have been in a decade with high-quality intermediate bonds yielding 4-6%. On a combined basis, this makes the outlook for a traditional blended portfolio much more promising.

While stock and bond markets have struggled, there are sectors that have performed extremely well in this difficult environment – validating their purpose and placement in client portfolios. Specifically, alternative or non-traditional investments have benefited from the volatility in markets and produced soundly positive returns for year. In addition, the allocation to commercial real estate has also performed well as an inflation hedge and the sector continues to show favorable supply/demand characteristics. These asset classes have been valuable additions to client portfolios during historically volatile times.

Portfolio Actions

Although market declines are not an enjoyable experience, it does provide the opportunity for value-added strategic actions for clients. These include: 1) Rebalancing – the market decline has reduced embedded gains in investment positions that have long been in client portfolios. This allows us to rebalance a portfolio between overvalued and undervalued sectors or even swap out of an investment into another compelling investment in a very tax efficient manner.; 2) Tax-Loss Harvesting – swapping out of a capital loss position and move into a comparable investment. These losses could then be used to offset current capital gains or be used in the future to offset gains realized in stronger markets.; 3) Contribute Additional Funds – to take advantage of this market decline one should consider investing additional funds. Although this may be hard to do and go against human nature, this historically has been a good time invest. History shows that returns on contributions made when markets are down 20%-25%, have been roughly double the long-term average for equities even if a further decline occurs first.

Closing Thoughts

It’s been a tough year, with most investors (ourselves included) braced for possibly more to come. It could be an investment “grind” for a period of time, as we work through these real economic challenges. Although the past nine months has been anything but fun, remember that all bear markets come to an end. Patient long-term investors that stay the course and own quality investments should be rewarded overtime as the return outlook going forward continues to improve with better valuations and higher interest rates. Predicting market bottoms or dramatic market moves is very difficult, and that is what we choose to avoid with solid strategic diversification and relative tactical shifts to deliver the long-term returns required to meet client’s financial objectives.

As always, we thank you for your continued confidence and trust.

The Water Valley Investment Team