Market Recap

The U.S. stock market reached a 2023 high at the end of July before selling off 7.5% through August and September to finish the quarter down 3.3%. Year-to-date the market still remains up a solid 13%. Smaller-cap stocks also had momentum early in the quarter but changed course and ended the quarter down 5.1%, though are still positive 2.5% year-to-date. Within foreign markets, developed international stocks declined 4.1% in the quarter yet remain up just over 7% year-to-date. Emerging market stocks fell 2.9%, bringing down their year-to-date return to just under 2%. The U.S. dollar climbed over 3% during the quarter, resulting in a headwind for foreign stock returns. In bond markets, the 10-year Treasury yield climbed nearly 70bps in the quarter, ending the period at 4.59% – the highest point since before the financial crisis in 2008. As a result, core bonds fell sharply, declining 3.2% over the quarter.

The “Magnificent Seven” Continue to Power U.S. Equity Returns – With virtually all segments of the stock market posting gains this year through September, one might think that we’re in the midst of a broad-based rally. However, stock gains have remained unusually narrow, with the largest stocks companies leading the way. These seven stocks – Amazon, Tesla, Apple, Microsoft, NVIDIA, Alphabet (Google) and Meta (Facebook) – have increased collectively more than 80% this year, while the remaining 493 largest stocks are basically flat. As a result of their massive outperformance, the “Magnificent Seven” have a combined $10.7 trillion market cap and constitute more than 30% of the market. This level of concentration at the top of the U.S. market exceeds what was witnessed in the tech bubble of early 2000’s. We must travel all the way back to the early 1970’s (remember the “Nifty Fifty”?) to see a market as concentrated as it is today.

Investment Outlook and Portfolio Positioning

From a macroeconomic perspective, the big question remains whether the U.S. economy can avoid recession or not, and the timing if it does occur. It goes without saying that the answer will likely lead to meaningfully different market outcomes. If the Fed can manage to slow the economy while avoiding recession, we would expect to see the market’s gains broaden out beyond the large-cap technology-related sectors. Conversely, if the Fed’s monetary tightening cycle leads to recession, it would likely lead to broader-based declines. There are reasons to be cautious – our base-case is for a mild recession looking out to 2024. We have seen one of the quickest and sharpest tightening cycles in history, and lending standards have tightened considerably. Both factors create recessionary conditions, particularly as the Fed has a history of raising rates too far, tipping the economy into recession. Since 1931, there have been 19 hiking cycles and in only three instances did the economy avoid a recession.

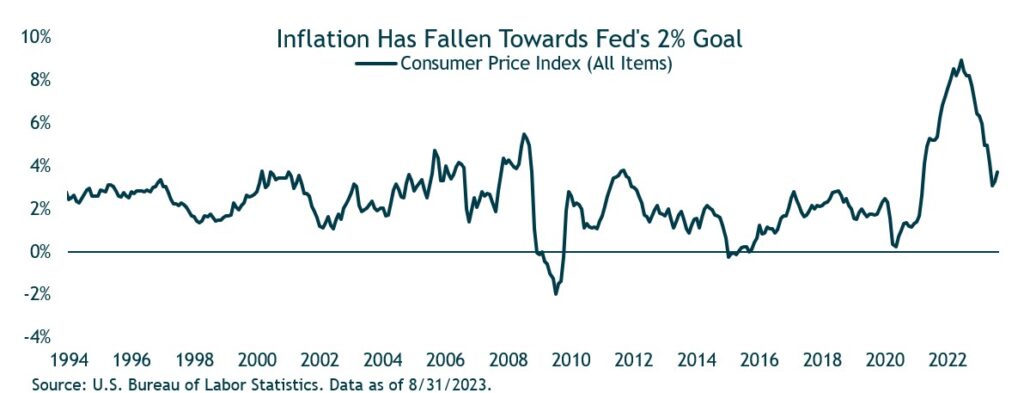

However, on the positive side, if the economy falls into recession, we believe it will be relatively mild. One consideration is that the economy has been experiencing a “rolling recession” where slowdowns are spread across industries over time, dampening the impact compared to a recession when industries experience a simultaneous slowdown all at once. For example, housing has already experienced a slowdown and detracted from GDP for several consecutive quarters. In the tech sector, layoffs have already occurred. Finally, a counterintuitive point is that this recession has been so widely anticipated for so long now, it may actually reduce the risk of a deep recession. The press has termed this the “most-anticipated recession ever.” Amid all this built-up anticipation, some companies have already laid off workers and slowed hiring. These corporate moves help loosen the labor markets and potentially ease inflationary pressures. Speaking of inflation, it has come down meaningfully from its June 2022 high of 9.1%, thanks in part to the Federal Reserve’s rapid rate hikes. The chart below illustrates year-over-year inflation data, which recently declined to 3.7%, and suggests the Fed’s policy has been working and inflation should continue to fall. However, having inflation ultimately down to the Fed goal of 2% could take time and be a challenge.

At this point, it is clear the rate-hike regime is close to an end and the Fed is making headway on inflation. The aggressive hiking cycle that started roughly 18 months ago was finally put on pause in late-July. Since March 2022, the Federal Reserve increased rates from zero to a target level of 5.25%-5.5%. The rise in interest rates has taken a bite out of bond returns, which have suffered steep losses over the past couple of years. The silver lining is that looking forward, interest rates ended the quarter at levels not seen in nearly 20 years. Core bonds ended the quarter yielding 5-6%, while non-traditional flexible bond vehicles yielded 7-8%. We remain positive on bonds given their combination of healthy fundamentals, attractive yields, and the downside protection they provide in the event of a recession.

Historically, stock market returns over the next 12 months following a pause in a tightening cycle are mixed. Today, inflation remains elevated but, on a path downwards. Of note, however, since the day of the Fed’s latest rate hike, the stock market is down 7.5%. This may be a signal that the market expects inflation to persist and for the Fed to maintain interest rates “higher for longer.” Within our portfolios, we maintain significant exposure to U.S. stocks overall and hold many of the mega cap tech stocks mentioned in this commentary through funds and ETFs. However, given the strong performance of the “Magnificent Seven,” we believe they are trading at expensive valuations. That said, other parts of the U.S. stock market are more reasonably valued, so we remain diversified across styles (i.e., growth, value, blend) and market caps (larger and smaller cap stocks) to take advantage of those opportunities. We continue to find foreign stocks attractive as they are less expensive than the U.S., setting them up for attractive expected returns. Finally, we continue to have exposure to alternative strategies that include managed futures and real estate, which have historically been a solid hedge and able to generate positive returns during periods of stock/bond losses.

Closing Thoughts

Despite the solid investment returns this year (possibly stealing some from future returns), we believe there will be headwinds over the next year given a tightening Fed, stubborn inflation, possible recession, etc. However, as we extend our time horizon over the next five years, we see reason for optimism. Within the U.S. stock market there are companies and sectors that are reasonably priced, and the fixed-income landscape is also attractive, thanks to higher yields. We also see strong total return potential from international and emerging market stock markets, given their attractive relative and absolute valuations. We are investors not short-term market traders. By maintaining a disciplined and balanced investment approach, we are well-positioned to weather the inevitable market storms and capitalize on the opportunities that are sure to arise. Thank you for your continued trust and confidence. Please find the enclosed economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team