Market Recap

Global equity markets continued their ascent in the third quarter, driven by strong corporate earnings growth, artificial intelligence (AI) enthusiasm and expectations of easing monetary policy. Despite investor concerns related to a slowing economy, tariffs, and a looming government shutdown, large-cap domestic stocks gained 8.1% over the quarter, ending near an all-time high, lifting the year-to-date return to over 14.8%. Small-cap stocks had a strong quarter (up 12.4%) amid hopes that lower interest rates would benefit the asset class. Internationally, developed market stocks gained 4.8% in the quarter, lifting their year-to-date return to over 25%. Emerging markets rose 10.6% in the quarter and are now up more than 27.5% year to date. Gains overseas in the quarter were driven largely by easing global financial conditions and attractive valuations. Year to date, developed international and emerging market stocks are still outperforming domestic stocks, thanks to a roughly 10% decline in the U.S. dollar. In the U.S. fixed-income market, after holding rates steady for the first eight months of the year, the Federal Reserve resumed rate cuts in September. Against this backdrop, investment-grade core bonds finished the quarter up 2.0%.

Investment Outlook & Portfolio Positioning

Markets are always reacting to news, but today it feels even more pronounced. Every data release, policy comment, or geopolitical headline seems to carry an outsized influence on investor sentiment. Against this noisy backdrop, there are reasons for optimism. One important tailwind comes from monetary policy. The Federal Reserve’s recent rate cut, after a prolonged pause, provides a constructive backdrop for both equities and bonds. Lower rates reduce borrowing costs for consumers and corporations, potentially fueling further investment and spending. History also offers perspective. A study by J.P. Morgan found that when the Fed cuts rates with the S&P 500 within 1% of an all-time high, the index has averaged a 15% gain over the following 12 months. We will see if history repeats itself.

The consumer also remains a source of strength. The U.S. economy is primarily driven by consumption, often described as the backbone of growth. Spending has held up well across much of the economy, even after adjusting for inflation. While income and spending levels are not distributed equally, i.e., there are meaningful disparities across households, overall consumption has been supported by real wage growth that has outpaced inflation in many segments. This has enabled households to absorb higher costs without meaningfully pulling back. Balance sheets, meanwhile, remain generally healthy, the result of higher brokerage accounts and stable housing values. Corporate fundamentals add another layer of support. Earnings growth rose 11.7% in the second quarter, making it the third consecutive quarter of double-digit growth. Many companies reported expanding margins, improved efficiency, and positive forward guidance. These results provide a foundation for higher equity valuations.

Of course, risks remain. We are closely monitoring the labor market. Key indicators such as quit rates, layoff rates, and initial unemployment claims have all flatlined. We seem to be at stall speed, and conditions could shift either way, so we’re monitoring developments closely, especially the unemployment rate. Since April, job gains averaged around 53,000 per month, which aligns closely with estimates of breakeven job levels needed to keep unemployment steady. We are not yet seeing broad-based layoffs or the kind of deterioration that typically signals an outright downturn. However, deciphering the job market data is not as easy as reading the headlines. In recent years, the changes in immigration policy have led to large swings in labor supply and distorted the relationship between payroll growth and unemployment. The key point is that payroll growth can look strong when conditions are deteriorating and appear weak when the market is relatively balanced. Today’s combination of modest job growth and a stable unemployment rate suggest the labor market is slowing but not collapsing. We continue to watch the data for signs of weakness.

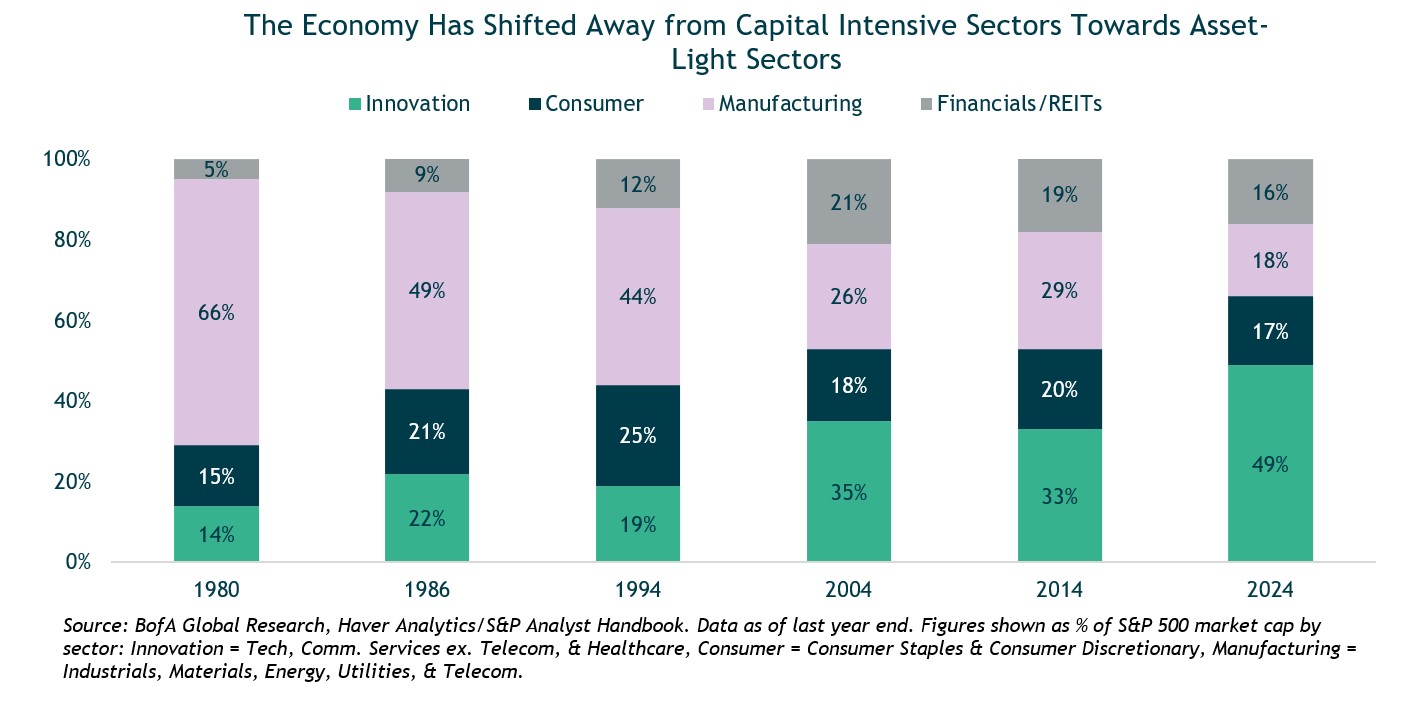

Valuations are also a concern of ours, as U.S. stocks reached new all-time highs in September. Naturally, current price levels raise the question of valuation – are stocks too expensive and should we take risk off the table? Today, the U.S. stock market trades at roughly 26x trailing 12-month earnings compared to a long-term average of 17.8x. These elevated levels are not lost on us, and they remain a critical factor we monitor closely. Yet context matters, as the market has traded above its long-term average for most of the past 25 years. A higher fair-value multiple seems to be warranted given structural changes in the U.S. economy and the composition of the U.S. equity market. Today’s economy looks very different than in the past decades. Back then, capital-intensive industries with lower margins and higher reinvestment needs dominated the market. As shown in the chart below, technology and service-oriented companies, which require less capital and earn higher margins, represent a much larger share of the U.S. equity market. In 1980, capital-intensive businesses made up 65% of the stock market, while asset-light firms were less than 15%. Today, roughly half of the index is represented by innovation-driven companies, while manufacturing has shrunk below 20%. Higher valuations may be warranted versus the past, but we will continue to monitor for excesses and a possible lowering of exposure.

Another area of concern, with both return potential and potential excesses, is in the AI buildout. We see here today some similarities to the dot.com bubble of 2000. The Internet at that time was full of life-changing potential, growth, etc., but also extreme valuations and capital outlays. In today’s AI era, the tech companies involved are much more profitable and financially healthy. However, hundreds of billions of dollars are being spent, often in the form of vendor financing and the circular flow of funds. Then one must consider the enormous demand of electricity to power the projected data center buildout. Some low capital intensive and high margin tech companies may become high capital intensive and lower margin companies. It seems apparent that AI will be here to stay, but there will be fallout with individual winners and losers. Our position is to maintain exposure to this growth area through our equity holdings, but something to monitor as we keep the exposure prudent given the risks involved.

Within bond markets, after holding rates steady for the first eight months of the year, the Federal Reserve resumed rate cuts in September. The Fed stated the cut was “risk management,” taking a more cautious stance toward slowing growth and softening labor conditions. Yet the path forward remains far from certain. While the Fed emphasizes data dependency and balancing the risks of inflation versus economic growth, markets are pricing in a more aggressive easing trajectory. In our view, today’s environment suggests maintaining flexibility, emphasizing credit selectivity, and closely monitoring economic data that will shape market expectations. We continue to invest with higher-yielding, flexible bond vehicles run by experienced teams with broad opportunity sets. At the same time, we’re maintaining meaningful exposure with core investment grade bonds, given attractive starting yields and potential downside protection. It tends to be our view that rates in general, especially on the longer end, may stay elevated longer given stubborn inflation and the dis-concerning level of ever-increasing government debt.

Closing Thoughts

We enter the final quarter of the year with both opportunity and uncertainty. Equities are supported by resilient earnings, healthy consumer demand, and a more accommodative Fed, yet valuations remain elevated, and policy debates loom large. In fixed income, tight spreads reflect strong corporate fundamentals even as fiscal pressures and policy divergence create risks at the long end of the curve. Labor markets are softening but not collapsing, reinforcing the view that growth is slowing rather than outright stalling. This is a moment to stay disciplined. We continue to maintain diversified portfolios, balancing risk and opportunities, and positioning to benefit from long-term secular trends while staying alert to evolving macro and policy risks.

We appreciate your trust and support. Please find enclosed the economic newsletter from Dr. Ray Perryman.

The Water Valley Investment Team