By M. Ray Perryman, PhD, CEO and President – The Perryman Group

Overview

Outlook for the US Economy – 4th Quarter 2022

By M. Ray Perryman, PhD, CEO and President

The Perryman Group

Employment

The United States economy gained 4,419,000 net new jobs over the twelve-month period ending December 2022 for an annual employment growth rate of 2.94%. Over the past year, the arts, entertainment, recreation, accommodation, and food services industries featured both the largest job gains (961,500 net new jobs) and the fastest job growth in percentage terms (an impressive 6.49%). Jobs were up across the board, with all industries reporting gains from December 2021 to December 2022. The nation’s seasonally adjusted unemployment rate in November was 3.63%, down 0.85 percentage points from a year prior.

Worker shortages will linger through 2023 and well beyond, though slower economic expansion will temporarily reduce the need for workers in some industries. The underlying demographic factors behind tight labor markets, however, are not going anywhere.

Inflation/Interest Rates

While inflation remains high, it has slowed for six consecutive months. The Federal Reserve has indicated willingness to stay the course, pushing up interest rates and tightening policy. Even though the rate of price increases is diminishing, it remains well above the Fed’s current target level of 2%. Part of the problem is that secondary effects such as wage increases are contributing to inflationary pressure, and, though much of the pandemic largesse has been dissipated, trillions are still being spent by the federal government. The coming year will likely bring some ongoing relief, but a few more interest rate hikes are virtually inevitable.

Other effects of higher interest rates are rippling through the housing and equities markets. Housing starts are dropping, and prices are falling significantly in some areas. Another contributing factor is changes in remote work patterns, with a number of companies asking employees to return to the office (thereby shifting location patterns and the resultant housing demand). Higher mortgage rates piled on to other shifts will cause notable declines in a few regions. In addition, last year was the worst for the stock market since the Great Recession (though the drop was notably larger in 2008).

Economy

Reshoring and nearshoring will continue to drive corporate decisions and investments. Supply chain and other pandemic-related issues (including shutdowns) are causing a change in thinking by many corporations, and we will likely see firms invest in manufacturing facilities in North America to insulate themselves from future problems. Rising geopolitical tensions are also contributing to this trend. Relatedly, inventory balances are edging more toward “just in case” rather than “just in time,” thus stimulating additional production.

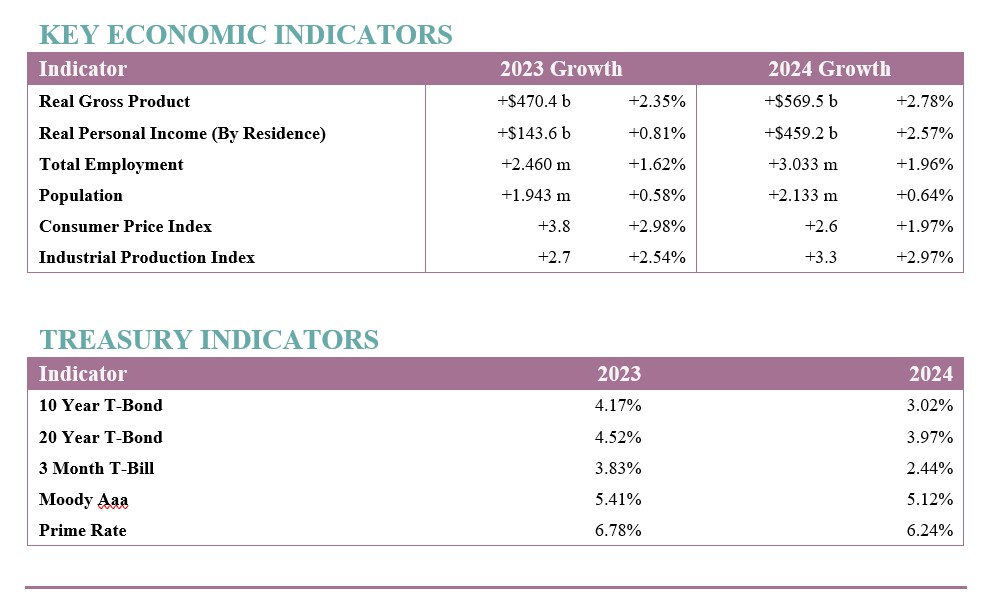

Uncertainty remains high, the economy is definitely slowing, and many analysts are predicting a recession. Nonetheless, there are signals of improvement in key factors shaping potential economic growth. At this point, slower growth and possibly some brief retrenching may occur, but a major or protracted downturn is less likely. The Perryman Group’s most recent projections indicate real gross product is expected to expand by +2.35% in 2023 on a year-over-year basis, with +2.78% growth in 2024. Job gains are projected to be 2.460 million through 2023, with an increase of 3.033 million next year.

About Dr. M. Ray Perryman and the Perryman Group

About Dr. M. Ray Perryman and the Perryman Group

Dr. M. Ray Perryman is President and Chief Executive Officer of The Perryman Group (www.perrymangroup.com). He also serves as Institute Distinguished Professor of Economic Theory and Method at the International Institute for Advanced Studies.