Market Recap

What a difference a year makes. In 2022, high inflation and the Fed’s commitment to tame it, led to sharply rising interest rates and negative returns for both stocks and bonds. In 2023, much to the surprise of many forecasters, global stock and bond markets ignored widespread expectations that we were headed for a recession and were able to shake off a host of uncertainties to post strong gains for the year. Aided by a powerful year-end rally, large-cap U.S. stocks finished up 26% for the year and ended within a whisper of its all-time high. Smaller-cap stocks lagged their larger counterparts for most of the year, also rallied sharply in the fourth quarter (+14%) to end the year with a respectable gain of 17%. Developed international and emerging-market stocks also posted solid gains, finishing the year up 18% and 10%, respectfully. Bonds also rallied sharply in the fourth quarter aided by a significant drop in Treasury yields. The benchmark 10-year Treasury yield declined a massive 100bps in the fourth quarter. Interestingly, despite massive intra-year volatility, the 10-year Treasury yield ended the year exactly where it started. For the year, domestic core bonds finished up 5.5%.

Investment Outlook and Portfolio Positioning

Looking ahead to 2024, all eyes will continue to be on the Fed. When will the Fed start to cut rates? Will the Fed cut rates enough to meet the markets’ lofty expectations? While these questions will be in focus, other factors may also influence markets. Geopolitical risk, the U.S. presidential election, inflation, and record federal debt levels becoming an issue will likely fill the headlines and all could be sources of volatility. From an economic perspective, we enter the year expecting an economic slowdown to unfold as we move deeper into 2024, as the ramifications of the Fed tightening’s are felt. With regards to inflation, it has fallen significantly, but the last mile of the inflation battle, getting from 3.5% down to the goal of 2.0%, could be challenging.

Since the Fed started their aggressive tightening cycle, the debate has been about the odds of a “soft landing” or “hard landing” for the economy. In other words, would the Fed be able to thread the monetary policy needle and raise interest rates enough to stamp out inflation, but not so high it slams the brakes on the economy and tips it into recession. Instead of a simultaneous and broad-based decline in economic activity, we’ve observed specific industries struggling with isolated declines over time, while the broad economy has managed to stay afloat. Indeed, the most anticipated recession ever has yet to happen. Many economists now expect it to happen in the second half of this year. With various sectors of the economy experiencing contractions at different times over the last few years, we would anticipate more of a mild slowdown, not a deep economic downturn across sectors. But of course, we will be closely monitoring corporate earnings, labor statistics, and financial conditions to best assess the ultimate type of “landing.” There is growing consensus that a “soft landing” may occur in the U.S. in 2024, and we are not ruling that out, especially if the Fed cuts rates sooner than later. That said, we recognize that soft landings are quite uncommon, occurring only four times in the last 75 years.

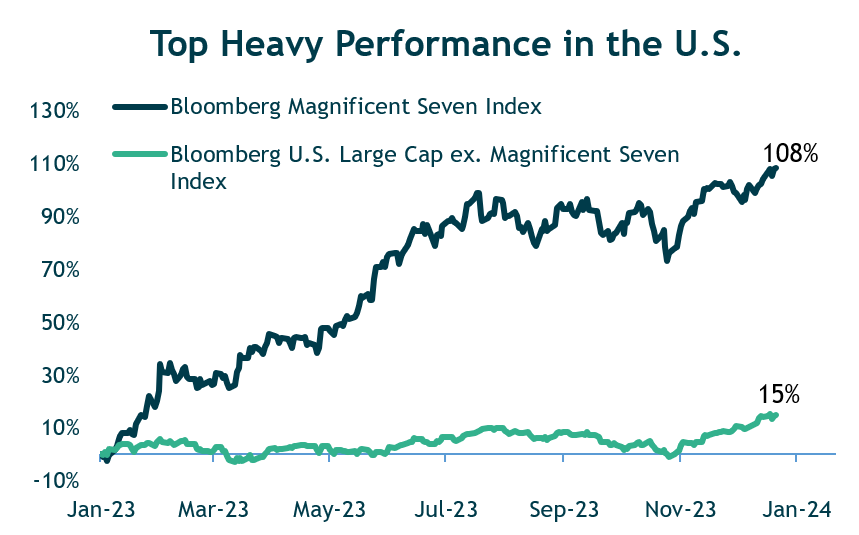

Within the U.S. stock market, performance in 2023 was driven by the handful of mega-cap growth stocks, dubbed the “Magnificent 7” (Apple, Microsoft, Nvidia, Facebook, Alphabet, Netflix, Amazon). These stocks had an average return in excess of 100% for 2023 and now represent a combined market weight of more than 28%. However, much of the return in these stocks was driven by expanding valuation multiples leaving them expensive relative to the broader market.

With the market confident that interest rates have reached their cyclical peak, we also saw a shift in market leadership with equity gains broadening out beyond the “Magnificent 7.” As seen in the chart above, the remaining 493 stocks in the S&P 500 index rallied 15% to end the year. We believe the recent broadening out of equity performance has the potential to persist over the course of 2024, and we could see areas of the market that have significantly lagged perform much better. For example, small-cap stocks beat large-cap stocks and value stocks outperformed growth stocks late in the year. We anticipate rebalancing portfolios away from the big winners of 2023 and towards higher quality, more attractively valued strategies that could perform well in periods of heightened volatility or an economic slowdown.

Our overall equity allocation continues have exposure to an unloved segment of the market – foreign stocks. Heading into 2024, the valuation discount for international stocks versus the U.S. is the widest it’s been in decades. The U.S. stock market now trades at nearly 20x forward earnings while international stocks remain close to 13x. All else equal, lower starting valuations imply better long-term expected returns and provide more of a valuation cushion should multiples contract in a stock market sell-off. We remain positive on core bonds, as investors continue to benefit from higher starting yields. Core bonds are currently yielding 5-6%, which is above the current 3.1% inflation level, so bonds are providing a positive real (after-inflation) yield. Finally, we believe bonds will provide downside mitigation in the event of a recession/market decline.

Closing Thoughts

We think it is quite possible that 2024 will be a year where investors again enjoy some of the classic underpinnings of investing, where stocks and bonds are less correlated and provide diversification benefits to portfolios. This was not the case in 2022 and 2023, when stocks and bonds both declined meaningfully and then posted gains. While there are likely to be bouts of volatility, these inevitably create opportunities. Currently, we see opportunities within the stock market, particularly as we expect a broadening out into areas of the market that have lagged. Within fixed income, we believe that rates are attractive and have peaked, but may be stubborn in their trend lower given the massive amount of government bond supply to fund the federal deficit. In this environment we continue to take advantage of the inverted yield curve, capturing higher yields from shorter-term securities, while also benefiting from more attractive yields across the bond market. Thank you for your continued trust and confidence and wish you all a blessed New Year!

The Water Valley Investment Team