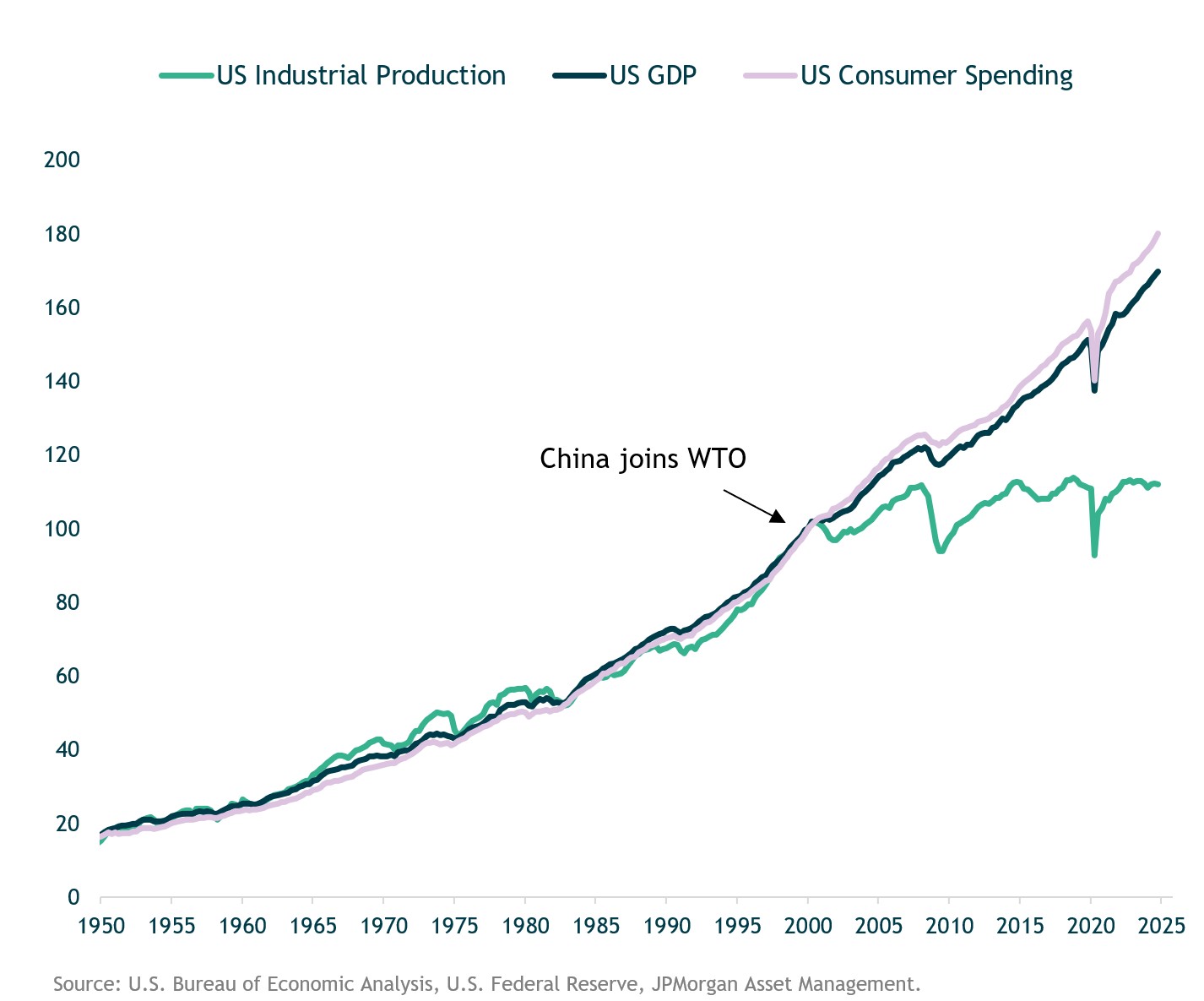

America’s Industrial Industry has Stagnated for a Quarter Century

- Over the last few decades, American manufacturing has declined in favor of lower cost manufacturing abroad.

- Free trade agreements benefit corporate profits via cheaper goods, but at the expense of the American worker as manufacturing jobs moved overseas (mainly to China).

- In a barrier-free world, it makes sense for companies to move production to countries that have a comparative advantage producing those goods.

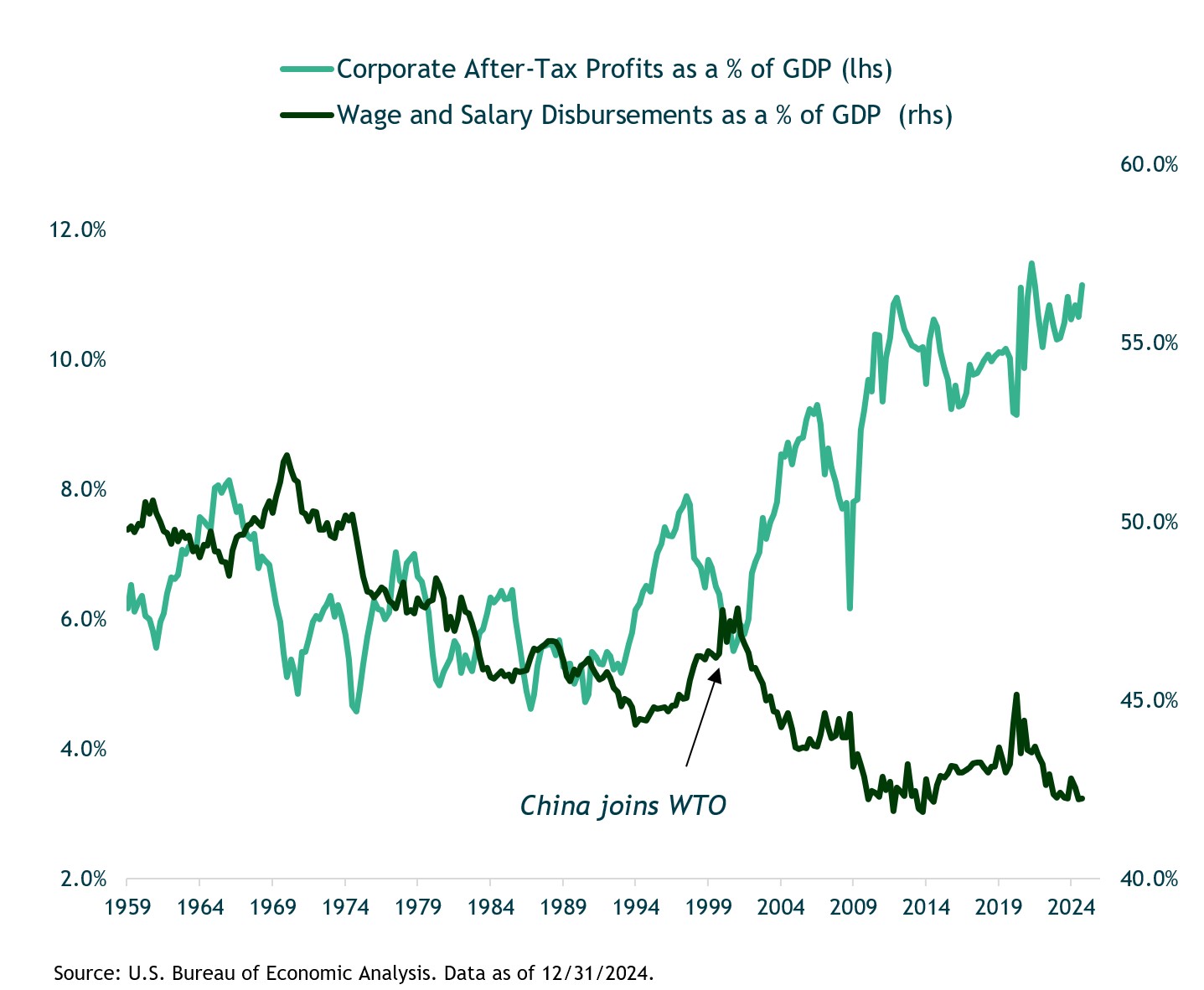

Labor’s Shrinking Share of GDP

- China’s joining of the World Trade Organization illustrates an inflection point in corporate after-tax profits vs. wage and salary disbursements as a % of GDP.

- As globalization made it easy to substitute domestic workers for cheaper foreign labor, the wages U.S. corporations paid to labor in the manufacturing sector decreased, while corporate profits increased. This helps to illustrate labor’s shrinking share of GDP.

- Trump and others in his administration view tariffs as a tool to make American manufacturing more competitive with other countries.

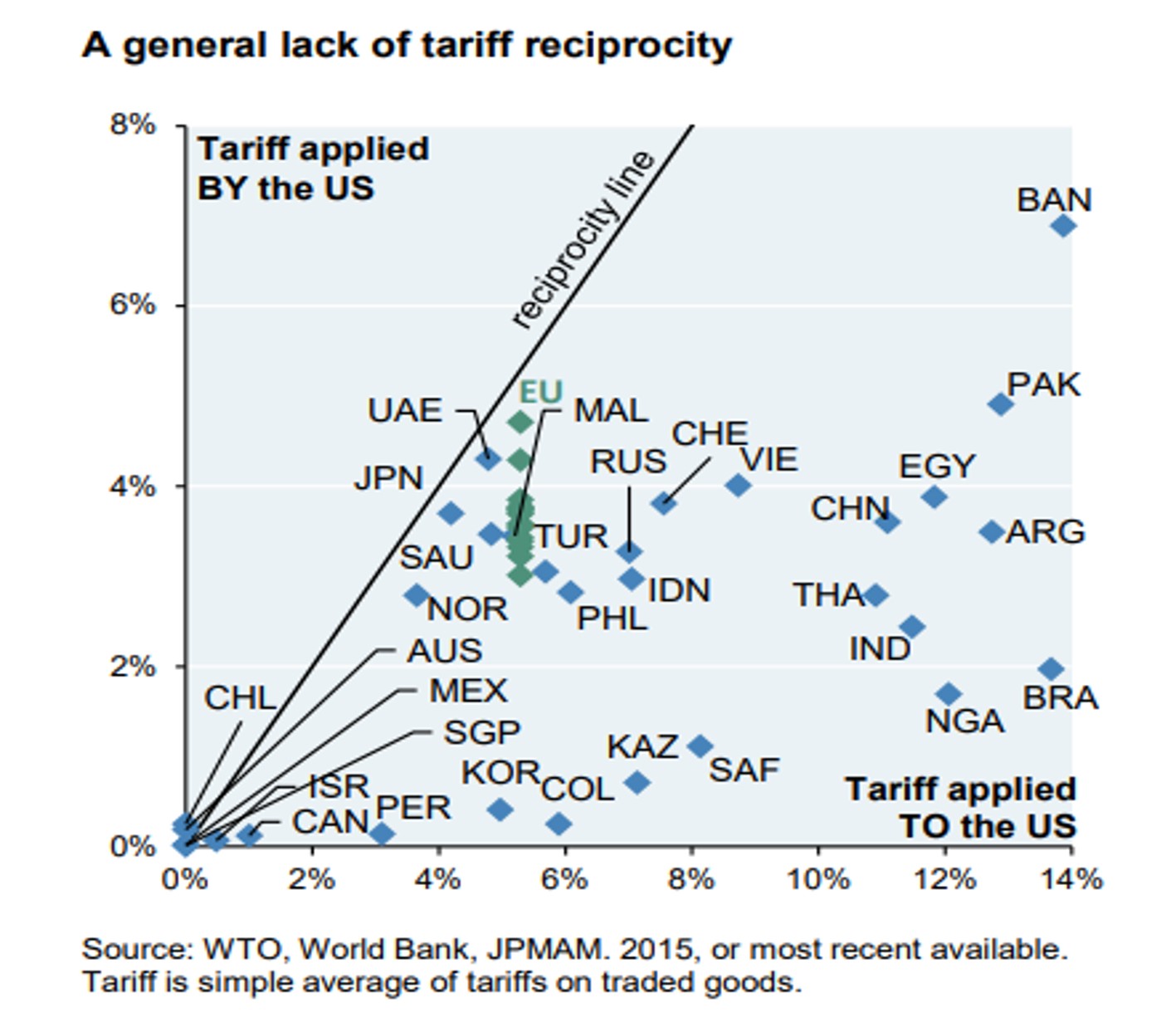

U.S. Exports Face Higher Tariffs Throughout the World

- There are certain industries of national security importance that should be reshored (e.g. parts of the healthcare supply chain), but the cost of producing low-cost retail goods would likely be too significant in the U.S.

- Tariffs are one tool to drive this return of manufacturing sectors, partly because every major trading partner of the U.S. has a tariff applied to U.S. goods that is higher than any tariff applied to their goods.

- The Trump Administration believes reciprocal tariffs are one way to enforce “fair trade” since U.S. exports face higher tariffs.

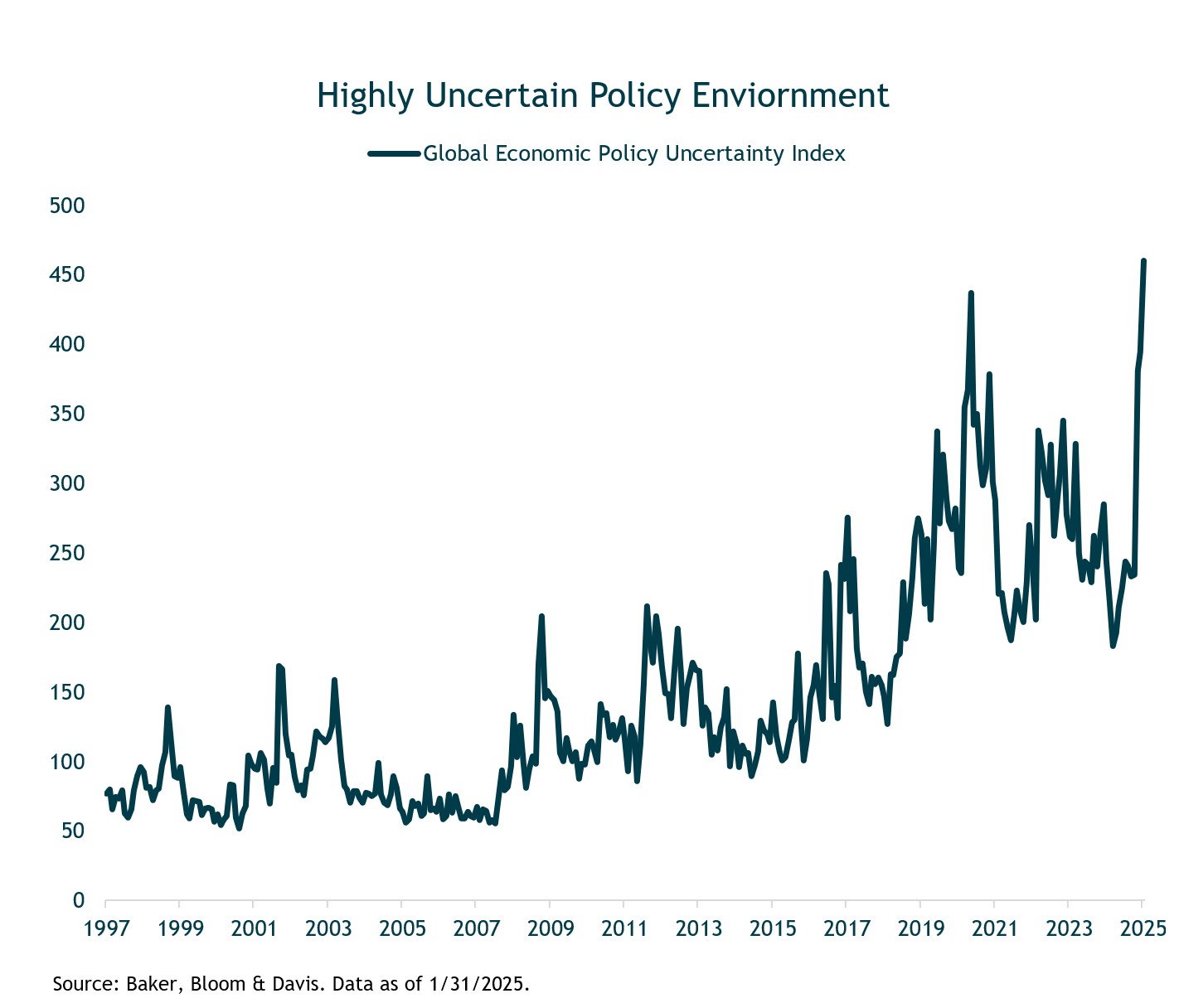

Tariffs Have Injected a Big Dose of Uncertainty Into Financial Markets

- The consistently ever-changing tariff landscape is clearly weighing on consumer sentiment adding to overall uncertainty (see chart).

- The rapidly changing policies make it difficult to keep up in real-time, and frequent reversals can make any analysis moot within hours.

- Uncertainty seems to be a tactical tool in Trump’s governance toolkit, as if to give him political leverage to achieve his desired outcome. With trade policy evolving so quickly, it often leads to more questions than answers.

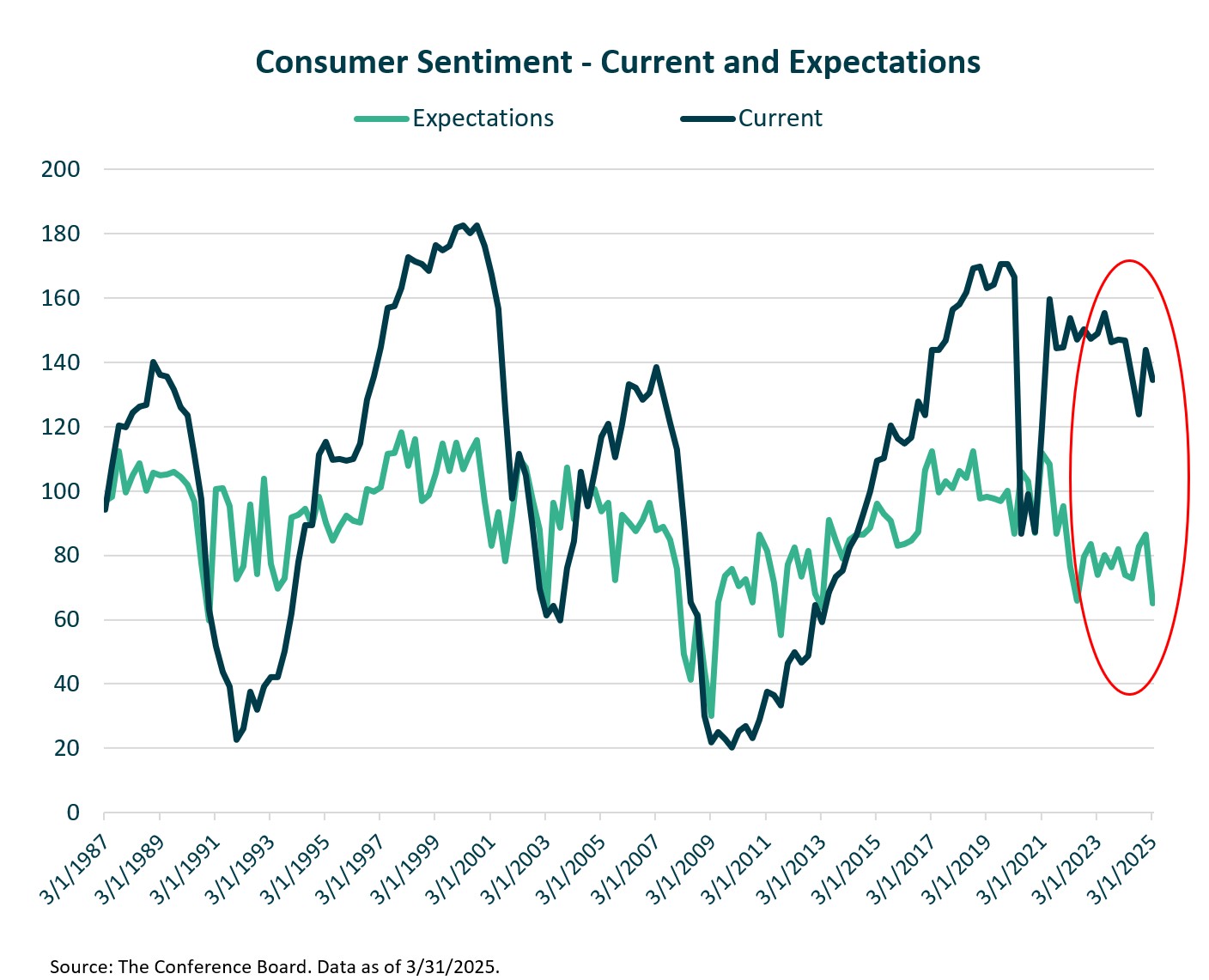

Uncertainty is Weighing on Consumer Sentiment

- Rising uncertainty among consumers and businesses acts as a significant headwind to economic growth and we are closely monitoring several factors that could lead us to become more defensive.

- Specifically, there are some soft data points such as consumer confidence that have weakened materially. Consumers drive about 70% of U.S. economic activity, making their sentiment an important factor to monitor.

- Right now, current sentiment is holding up, but it’s no surprise that it has weakened a bit amid today’s uncertainty. When both current and future expectations fall together, it signals broad pessimism, often leading to reduced spending and slower economic growth.

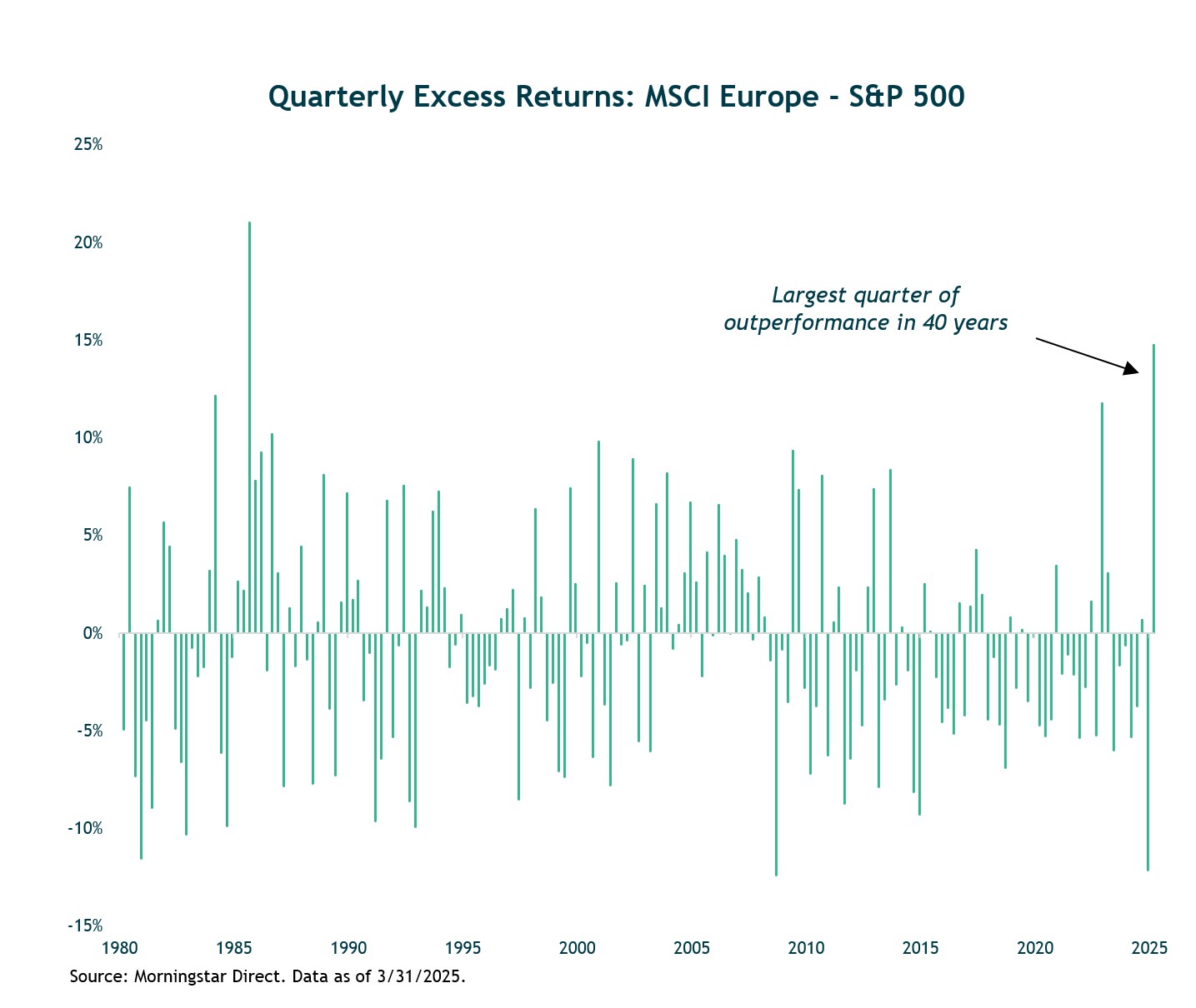

Diversification Works: European Stocks Were a Bright Spot in Q1 2025

- While we’re seeing headwinds in the U.S., we’re getting some good news in other parts of the world. European stocks have been a bright spot this year, significantly outperforming U.S. stocks – their widest quarterly outperformance gap versus U.S. stocks in 40 years.

- Fiscal stimulus, particularly from Europe’s largest economies in Germany and France, increased defense spending, and accommodative monetary policy could stimulate economic activity and bolster equity markets.

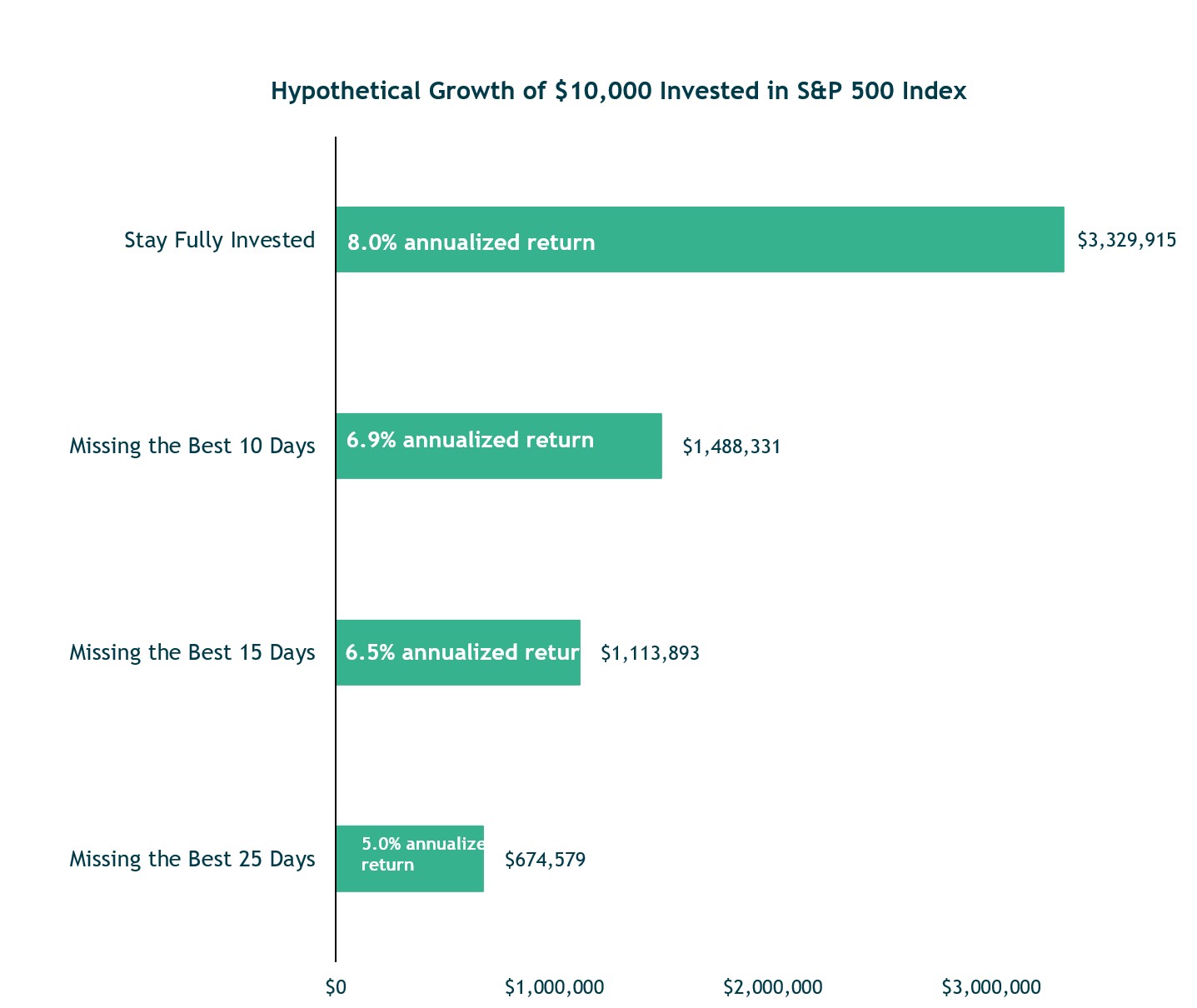

Stay Invested: Missing Top Performing Days Can Hurt Returns

- During periods of heightened volatility, we find it valuable not to overreact to the latest headline that could tempt investors to sell their equity exposure.

- Historically, stock market corrections recover within a few months, and investors who stay the course often benefit as markets rebound.

- As illustrated in the chart, panic selling during risk-off markets can be a significant drag on long-term returns.

Source: Morningstar Direct. Data shown 1/1/1950 through 3/31/2025.

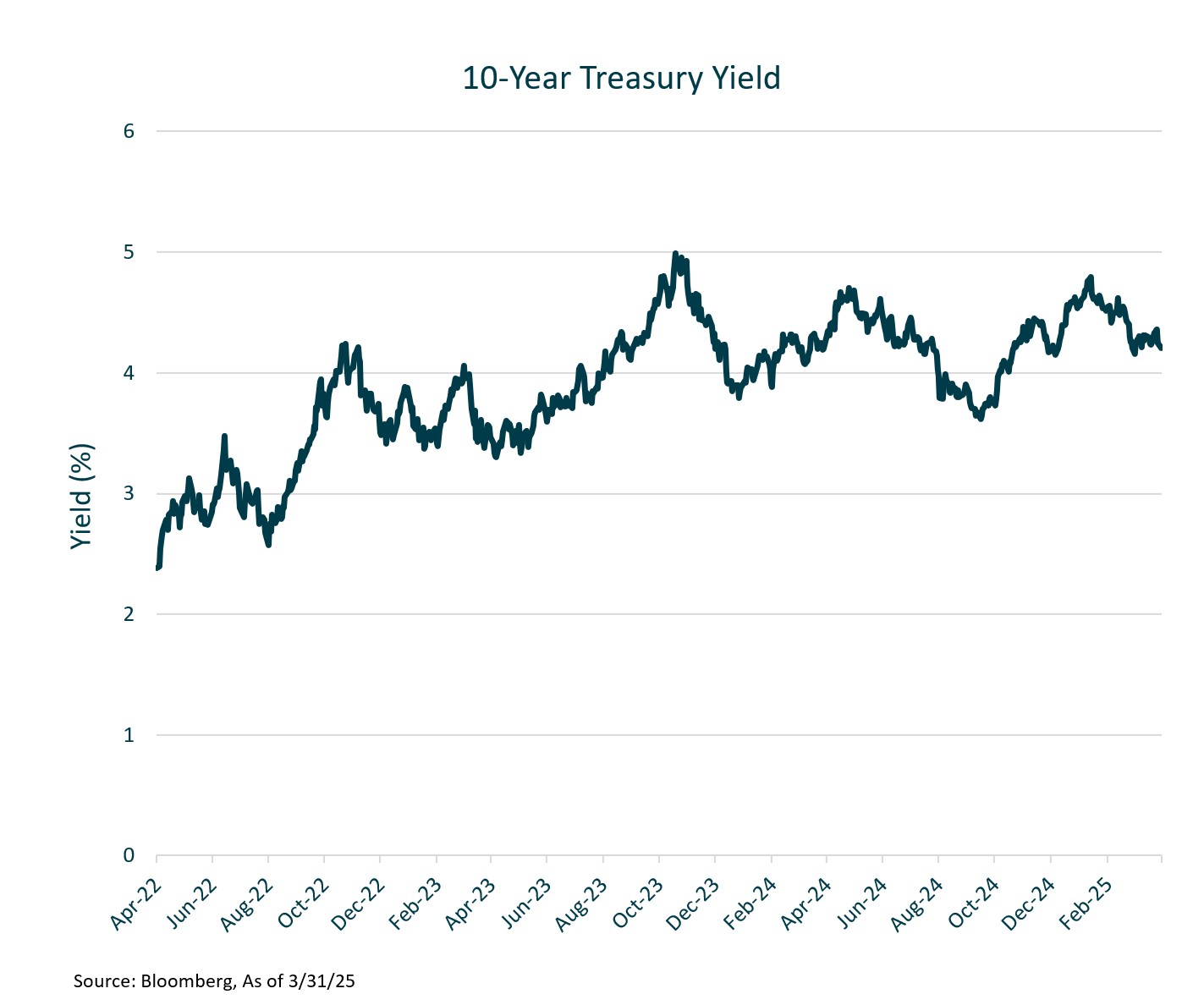

Treasury Yields Remain Elevated as Future Rate Cuts are Uncertain

- Longer-term interest rates remain volatile as investors react to persistent inflation pressure and changing tariff policies.

- The 10-year treasure yield has held steady above 4.2% as markets reassess the timing and magnitude of potential Fed rate cuts.

- The Fed continues to balance inflation risks with signs of slowing growth.

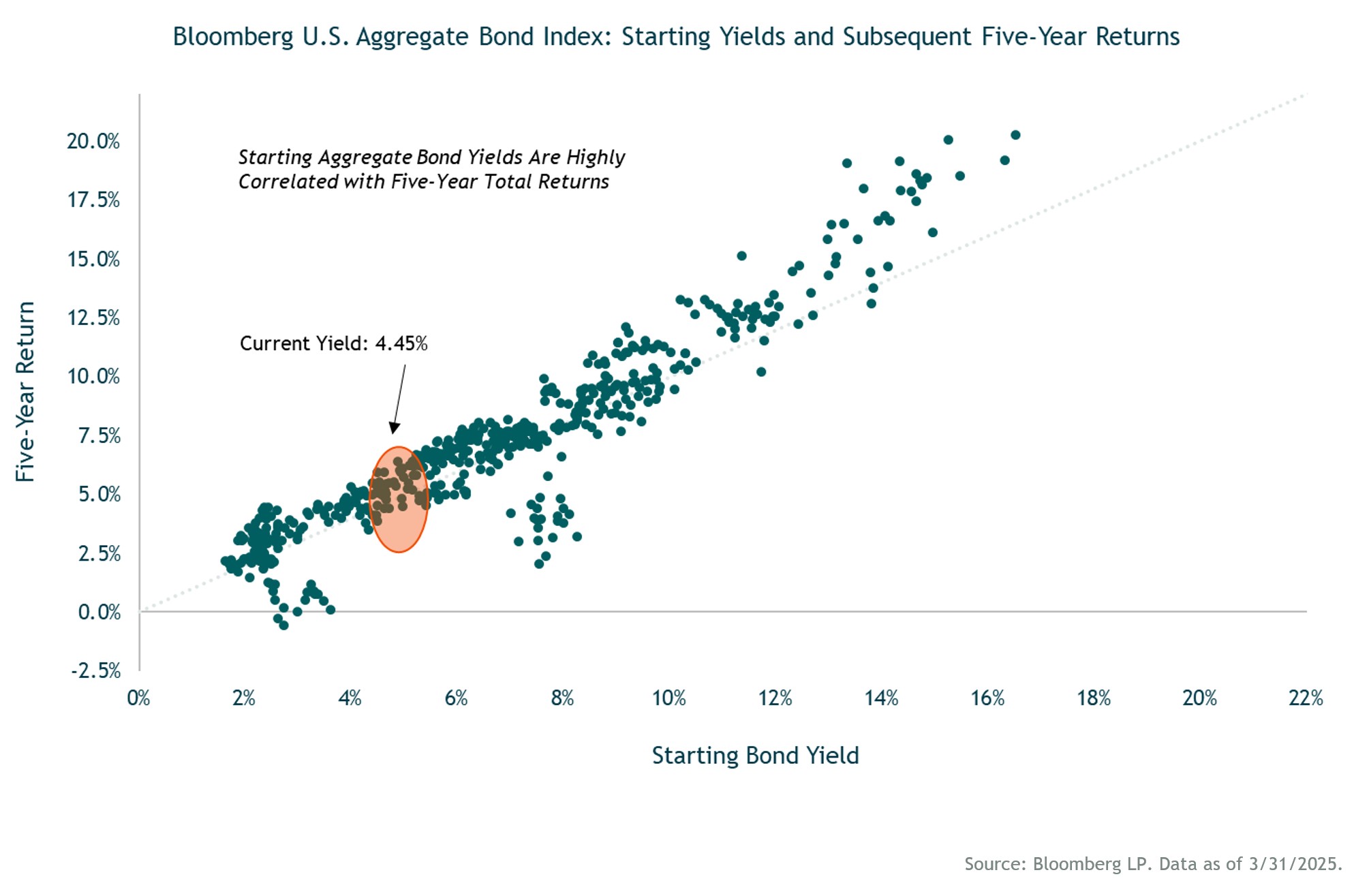

Starting Bond Yields are Highly Correlated With 5-Year Total Retur

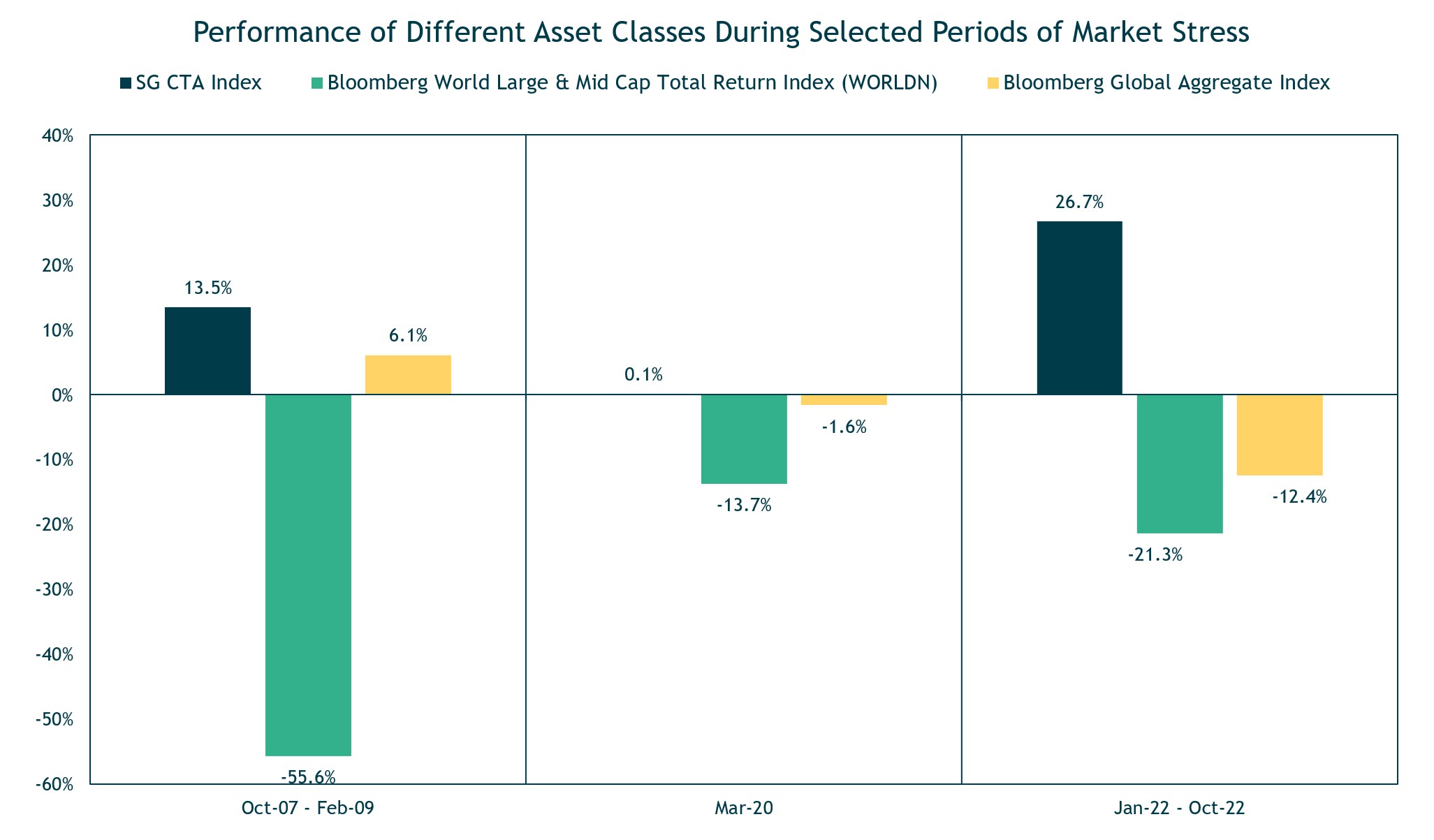

Managed Futures: Uncorrelated Performance When you Need it

Source: Bloomberg. Data as of 3/31/2025. PAST RESULTS ARE NOT INDICITAVE OF FUTURE RESULTS