21 Jul 2024

2nd Quarter Charts 2024

Market Review The S&P 500 Index continued to reach new highs throughout the quarter, gaining 4.3% in the three-month period. Large-cap stocks (S&P 500 Index) decidedly outperformed small-cap stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value). Overseas, results were mixed with developed international stocks (MSCI EAFE) […]

Read More01 May 2024

1st Quarter Charts 2024

Market Review The S&P 500 Index continued to reach new highs throughout the quarter, gaining 10.6% in the three-month period. Large-cap stocks (S&P 500 Index) decidedly outperformed small-cap stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value). Developed International and emerging-market stocks also posted gains but did […]

Read More25 Jan 2024

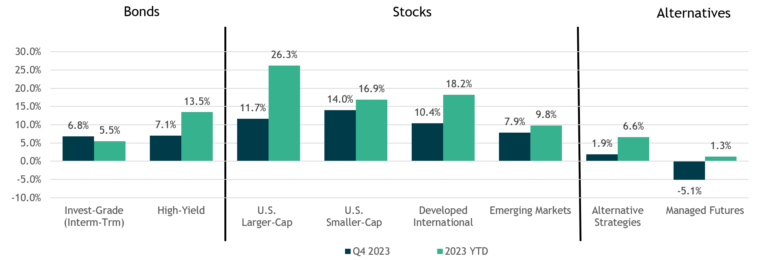

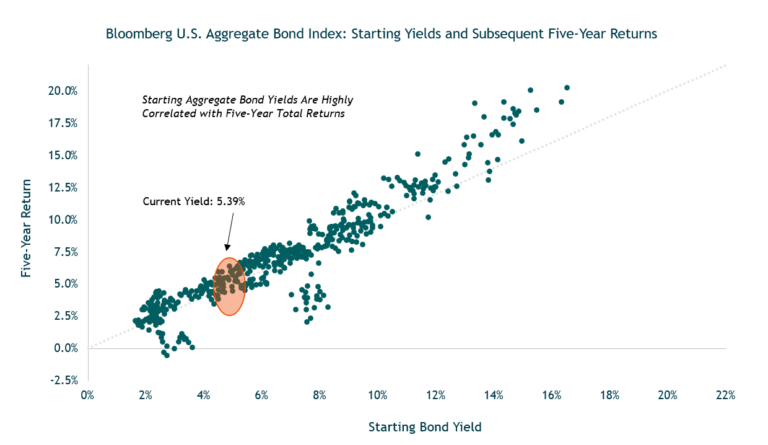

4th Quarter Charts 2023

Market Review Aided by a powerful year-end rally, U.S. stocks (S&P 500 Index) jumped nearly 12% in Q4 to finish up 26% for the year, and end within a whisper of its all-time high. Smaller-cap stocks (Russell 2000 Index), which lagged their larger counterparts for most of the year, also rallied sharply in the fourth […]

Read More18 Oct 2023

3rd Quarter Charts 2023

Market Review The S&P 500 reached a 2023 high at the end of July, but from its intra-quarter high the index declined 6.3% through the end of September. Smaller-cap stocks (Russell 2000) also had momentum early in the quarter but changed course and ended the quarter down 5.1%. Within foreign markets, developed international stocks (MSCI […]

Read More26 Apr 2023

1st Quarter Charts 2023

Market Review Despite the stress in the banking system, including the second-largest bank failure in U.S. history (Silicon Valley Bank), global equity markets held up remarkably well in March and posted solid returns for the quarter. The S&P 500 gained 7.5% in the quarter, while developed international stocks did a bit better, up 8.5%; emerging […]

Read More25 Oct 2022

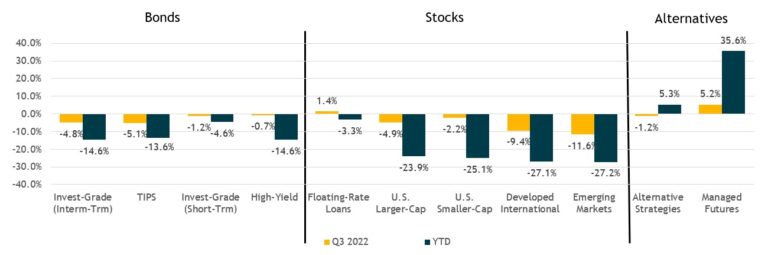

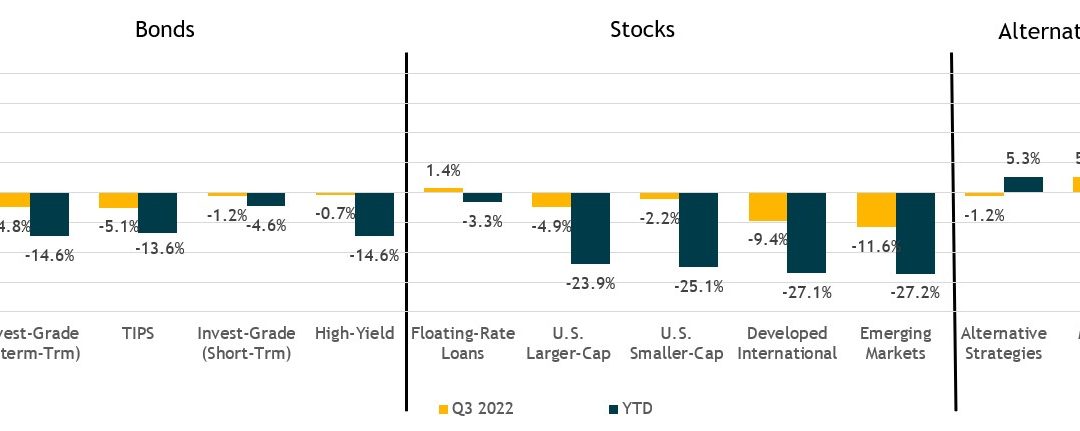

3rd Quarter Charts 2022

Market Review After a very difficult first half of the year, equity markets rebounded in July and August on investor hopes of an easing in inflation and a Fed pivot or pause. The reprieve was short-lived however, as stocks tumbled to fresh lows in late September amid further aggressive central bank rate hikes and statements […]

Read More