Market Review

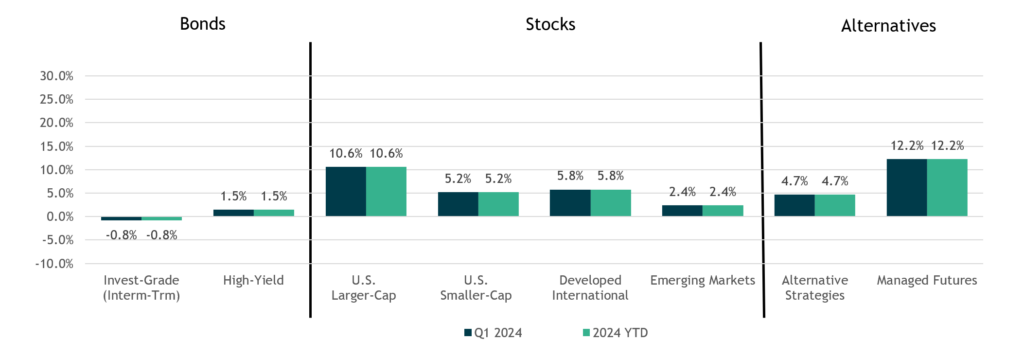

- The S&P 500 Index continued to reach new highs throughout the quarter, gaining 10.6% in the three-month period. Large-cap stocks (S&P 500 Index) decidedly outperformed small-cap stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value).

- Developed International and emerging-market stocks also posted gains but did not keep pace with the U.S. market. Developed International stocks (MSCI EAFE) gained 5.8%, while emerging-market stocks (MSCI EM Index) posted a 2.4% return.

- In the bond markets, returns were mixed. The benchmark 10-year Treasury yield rose from 3.88% to 4.20% resulting in a small decline of -0.80% for the interest-rate sensitive Bloomberg US Aggregate Bond Index. Credit performed relatively well in the quarter, as high-yield bonds (ICE BofA High Yield Index) rose nearly 1.5%.

- Managed Futures (SG Trend Index) got off to a strong start in the first quarter, gaining 12.2%, keeping pace with the S&P 500 Index (+10.6%) and handily beating the Bloomberg Aggregate Bond Index (-0.8%).

Performance reflects index returns as follows (left to right): Bloomberg US Aggregate, ICE BofA US High Yield, S&P 500, Russell 2000, MSCI EAFE, MSCI EM, Morningstar US Fund Multistrategy Index, SG Trend Index. Source: Morningstar Direct. Data as of 3/31/2024.

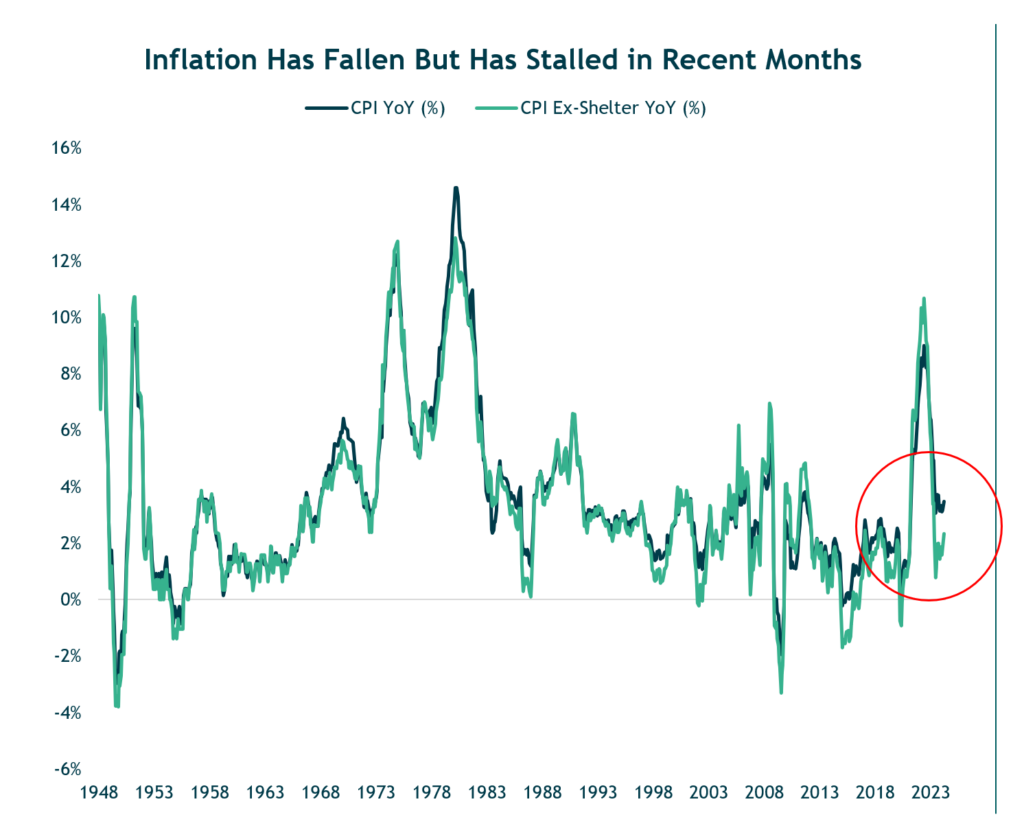

Inflation Continues to Moderate but Remains Above the Fed’s 2% Target

- CPI inflation has declined but remains above the Fed’s stated 2% target.

- More recently, the decline in inflation has stalled raising questions whether the Fed will be able to cut rates as expected.

Source: U.S. Bureau of Labor Statistics. Data as of 3/31/2024.

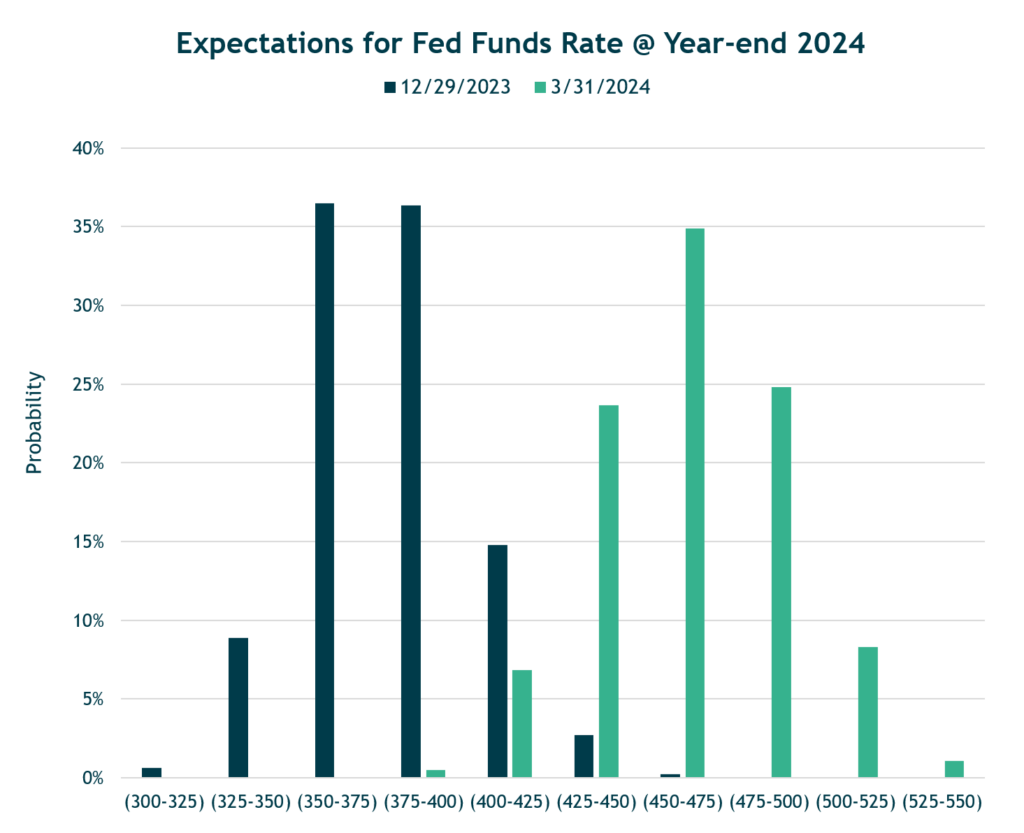

The Markets Expectations for Interest Rate Cuts Have Shifted Dramatically

- At the beginning of the year, the market priced in a greater than 70% chance the Fed would cut rates to 3.5% to 4% (blue bars) by the end of 2024. As of March, expectations are now concentrated in a range of 4.25% to 5% (green bars).

- Stronger than expected economic growth combined with inflation above the Fed’s preferred 2% target have changed the markets expectation for rate cuts.

- Our expectation is that the Fed will cut by 25bps in June, with two more cuts later in the year.

Source: Federal Reserve. Data as of 3/31/2024.

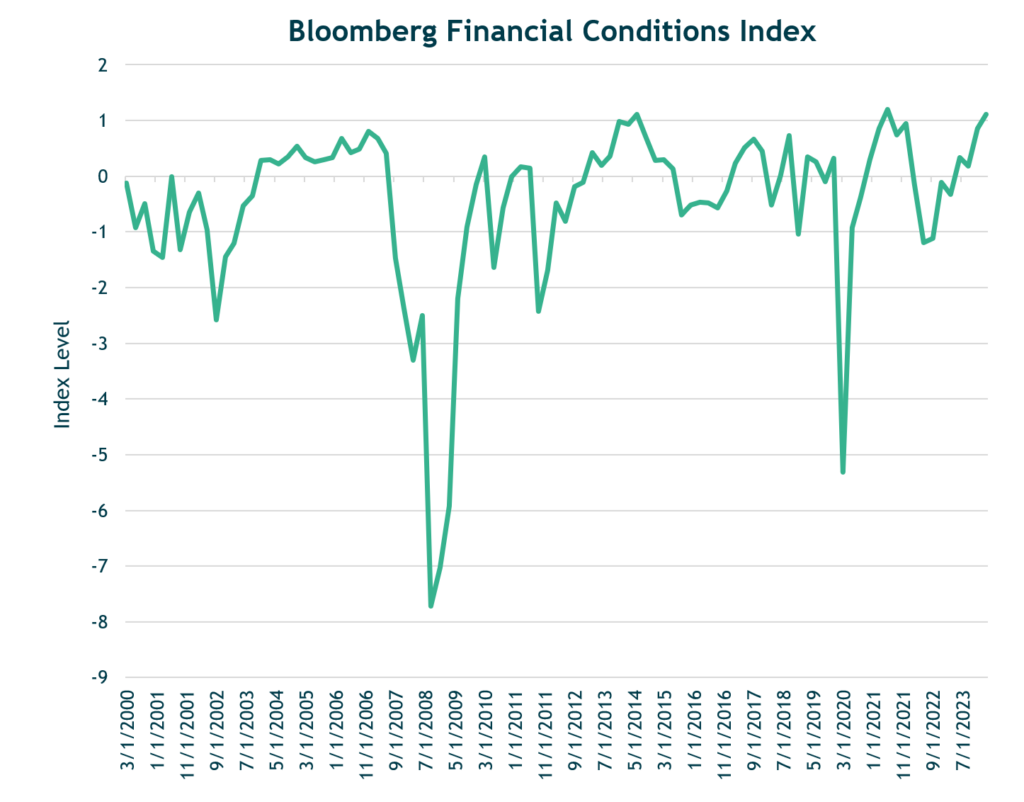

Financial Conditions at Most Accommodative Level in Four Years

- The Bloomberg Financial Conditions Index represents a comprehensive array of risk indicators including interest rates, credit spreads, equity market performance, and currency movements.

- The index is designed to provide insights into the ease or difficulty with which businesses and consumers can access financing and credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms.

- This indicator has reached one of the highest levels in the past four years.

Source: Bloomberg. Data as of 3/31/2024

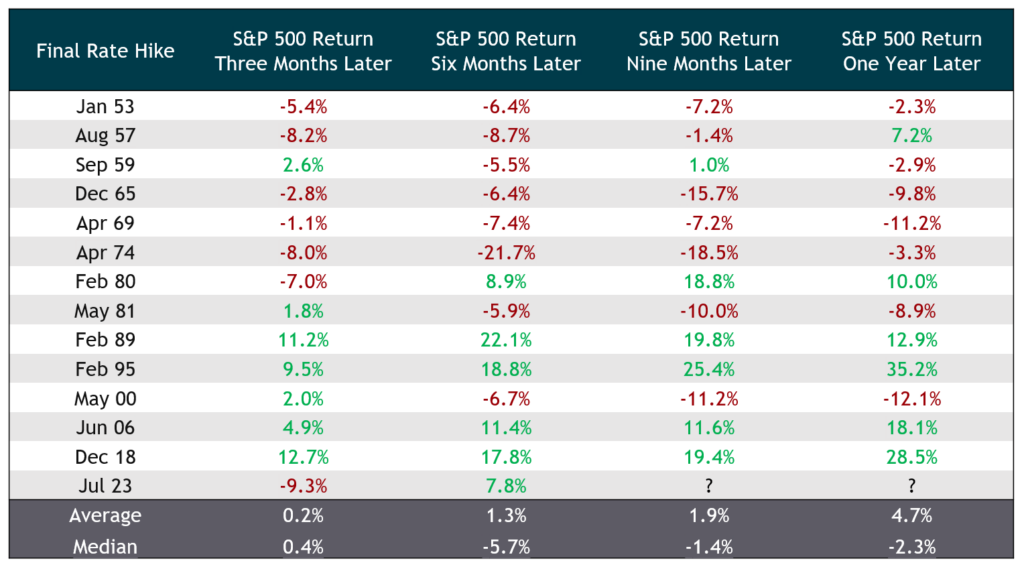

Following a Fed Tightening Cycle Equity Returns Have Generally Been Positive in Lower Inflation Environments

- When inflation is not elevated, the Fed can move to a more accommodative stance much sooner, which has generally been positive for equities. This can be seen in the post 1980’s in terms of the much shorter time between the final rate hike and the subsequent rate cut.

- Most of the negative outcomes occurred during bouts of elevated inflation (particularly through the 60’s and 70’s). Because of higher inflation, the Fed will typically maintain a more restrictive policy – i.e., it will take them longer to pivot and cut rates (higher for longer).

Source: iM Global Partner and Board of Governors of the Federal Reserve System. Data as of 3/31/2024. S&P 500 Index price returns shown.

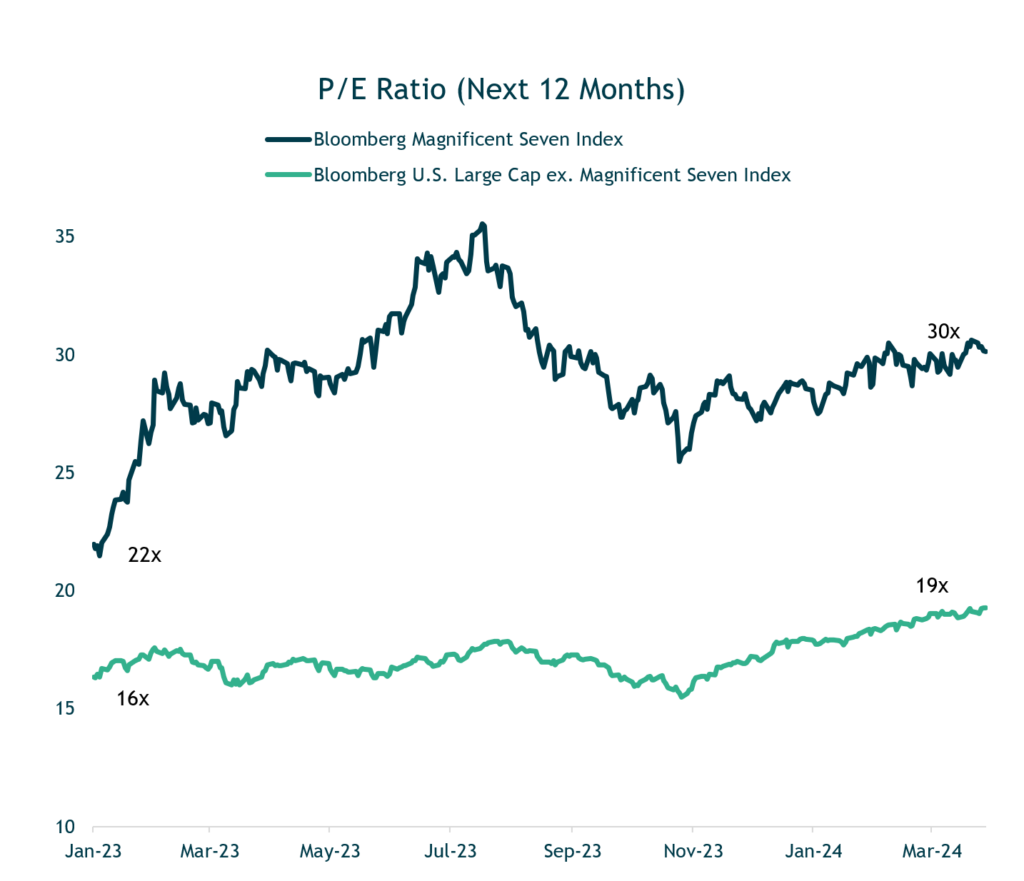

We Expect the Rally in U.S. Stocks to Broaden Out Beyond Large Cap Growth

- We believe the recent broadening out of equity performance has the potential to persist over the course of 2024.

- In March, we rebalanced our U.S. equity allocation to increase exposure towards higher-quality, more attractively valued strategies that we believe can perform well in periods of heightened volatility or an economic slowdown.

Source: Bloomberg LP, iM Global Partner. Chart concept courtesy of BCA Research. Shaded regions are NBER-defined recessions. Data as of 3/31/2024

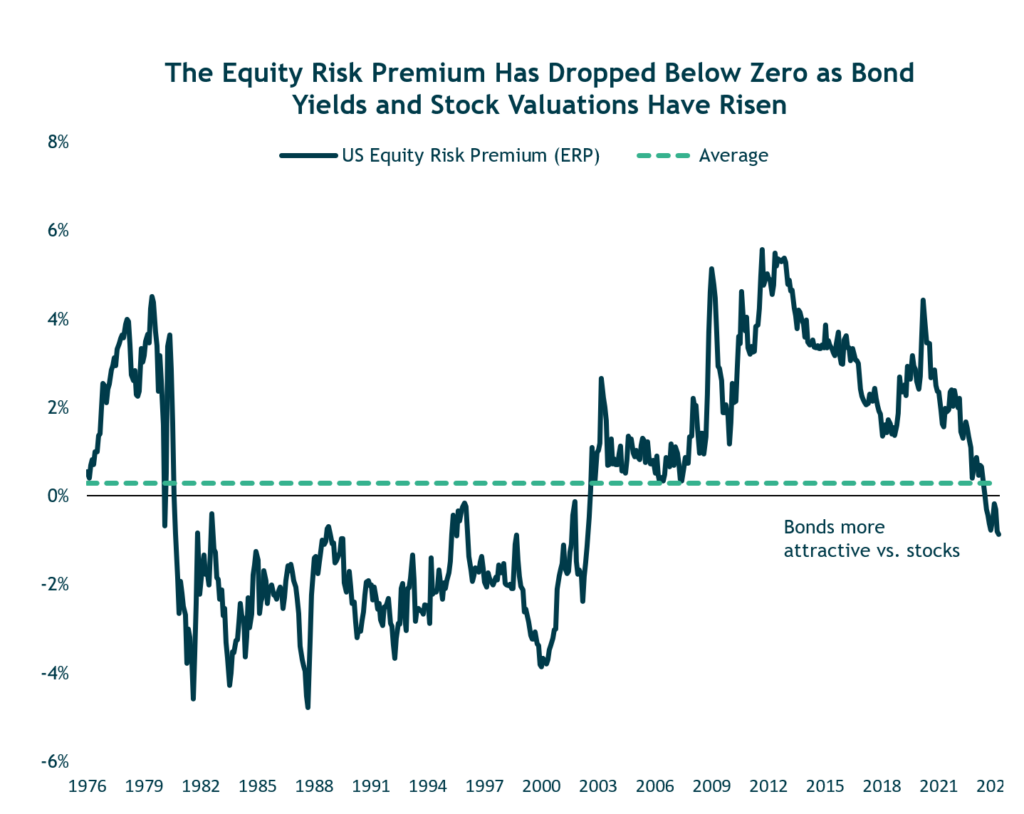

Bonds are More Attractive Relative to Stocks Given Higher Bond Yields and Expensive U.S. Stock Valuations

- Higher core bond yields along with higher stock market valuations have made U.S. Core Bonds more attractive compared to U.S. Stocks. This relationship is known as the “equity risk premium” (ERP).

- The equity risk premium has now fallen to a level that is below the average versus the past 20-plus years.

- To revert to a more normal, i.e., higher, equity risk premium will require either a decline in equity valuations, lower bond yields, or some combination of the two.

Source: Bloomberg LP and Robert J. Shiller. Data as of 3/31/2024. Equity Risk Premium defined as S&P 500 earnings yield (E/P) minus yield to worst of the Bloomberg US Aggregate Bond Index Bloomberg LP. Data as of 12/31/2023.

Corporate Earnings Growth is Poised to Rebound in 2024

- In the U.S., low double-digit earnings growth is the current consensus expectation for 2024, while emerging-markets have a current consensus estimate in the high double-digits.

- Emerging-markets earnings have yet to recover following their contraction in 2022, the main culprit being China. A strong earnings recovery was expected following the removal of their zero-COVID policy, and while China’s economy has stabilized it has not recovered as expected.

- While economic optimism in China has taken a significant hit and Chinese consumer confidence is depressed, low equity valuations set the table for positive surprises on incrementally better news.

Source: Yardeni Research. Data as of 12/26/2023.

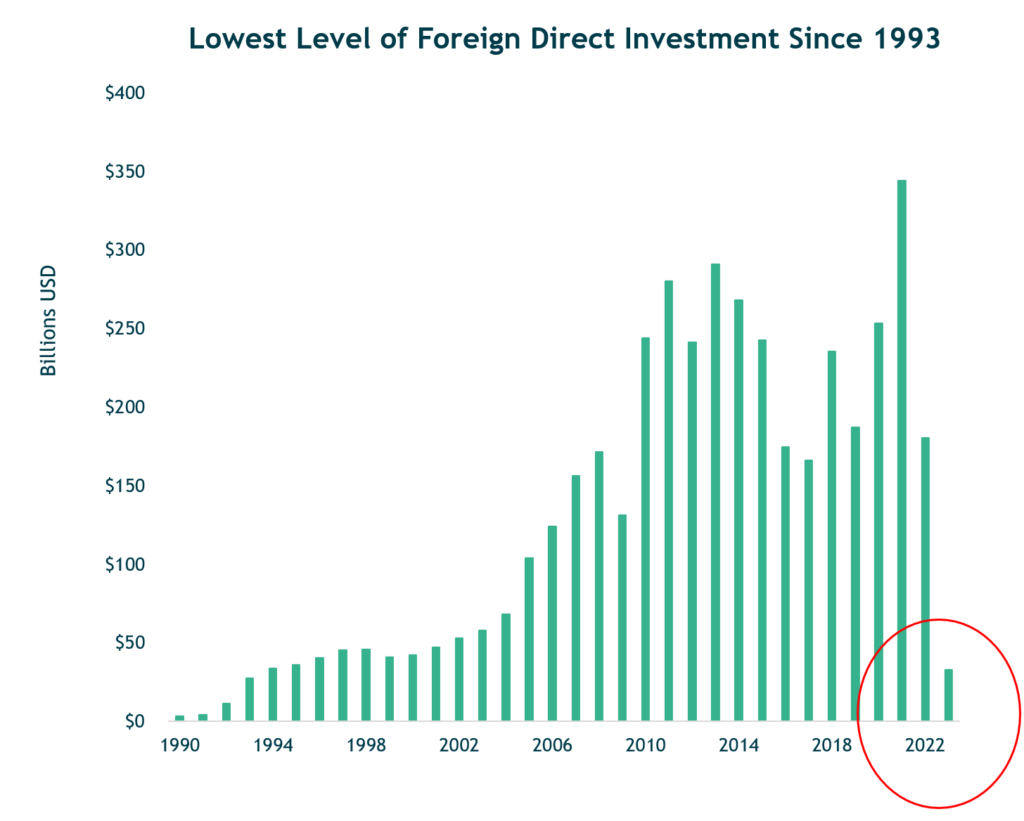

Foreign Investment in China has Fallen Off a Cliff

- Another headwind facing the Chinese economy is the decoupling trend of recent years. Foreign direct investment into China has fallen off a cliff and was at 30-year lows last year.

- The trade war between China and the U.S. kicked off in 2018 under President Trump but has not eased up under President Biden. Tariffs were not rolled back under Biden—instead the pressure was turned up and targeted sanctions on next generation technology has only intensified.

Source: World Bank. Data as of 2/21/2024.

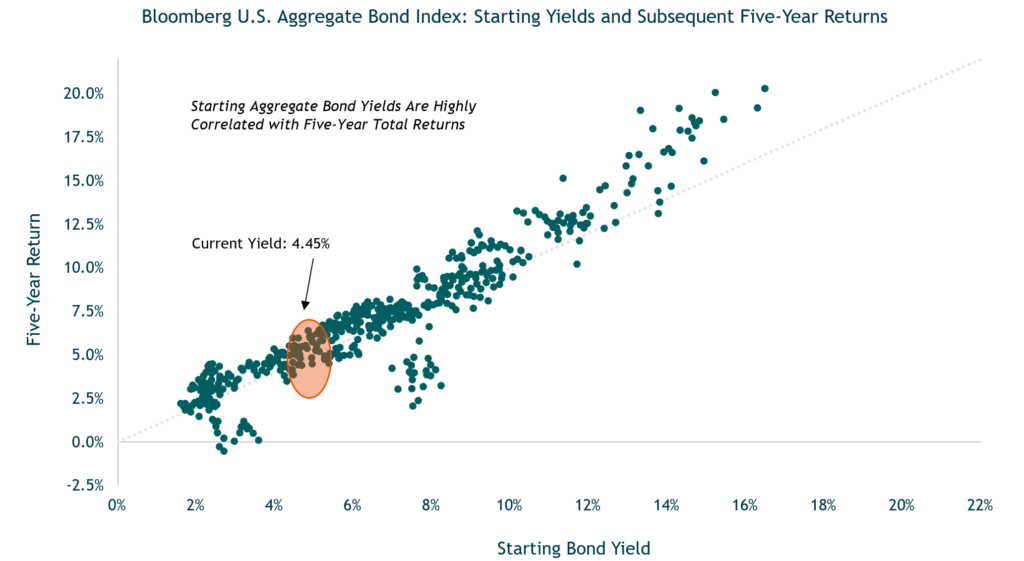

Starting Bond Yields are Highly Correlated With 5-Year Total Returns

Source: Bloomberg LP. Data as of 3/31/2024

Source: Bloomberg LP. Data as of 3/31/2024