17 Jul 2024

2nd Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 2nd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment While still expanding, the US economy is showing definitive signs of slowing. Unemployment rates and the number of […]

Read More

Jul 17, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 2nd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment While still expanding, the US economy is...

01 May 2024

1st Quarter Newsletter 2024

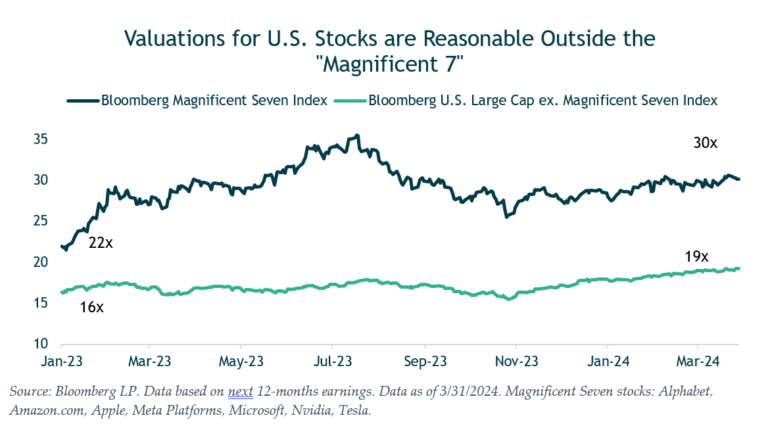

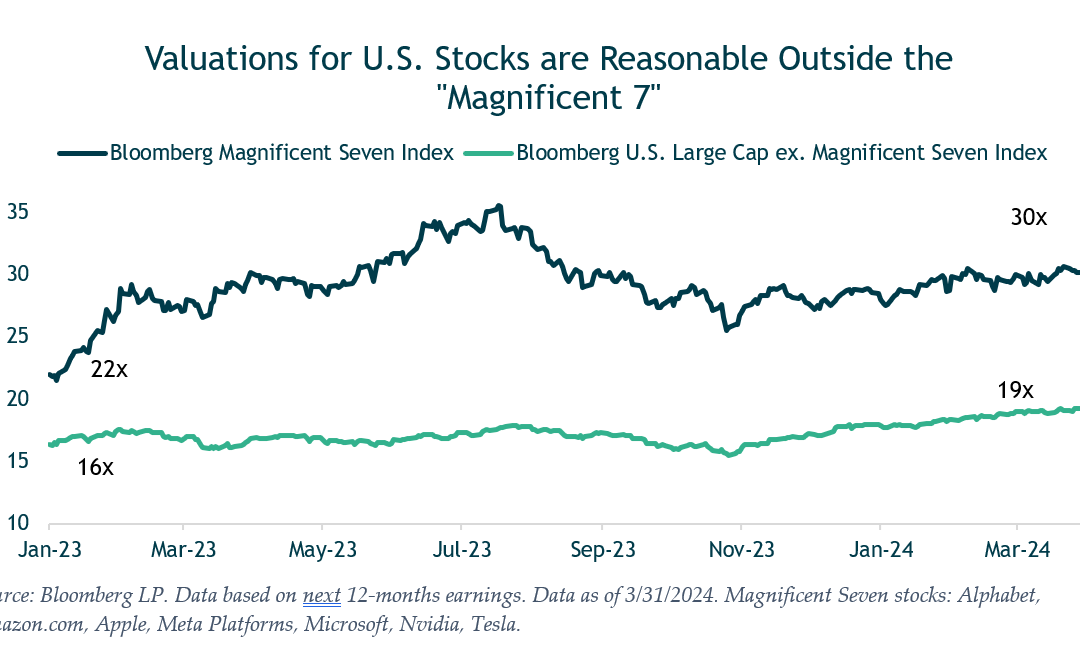

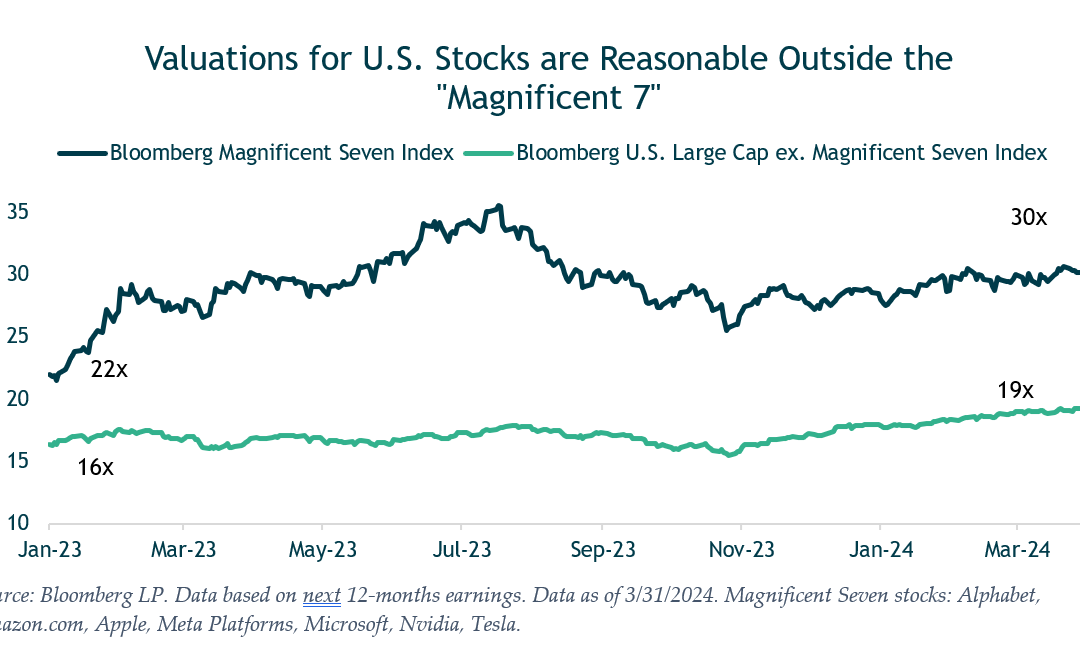

Market Recap In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings, and a convergence of market participants’ aggressive forecast of rate cuts with the Fed’s own projections. These factors […]

Read More

May 1, 2024 | Newsletters

Market Recap In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings,...

01 May 2024

1st Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 1st Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The US economy continues to defy the expectations of many, gaining jobs at a surprising pace given the […]

Read More

May 1, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 1st Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The US economy continues to defy the...

25 Jan 2024

4th Quarter Newsletter 2023

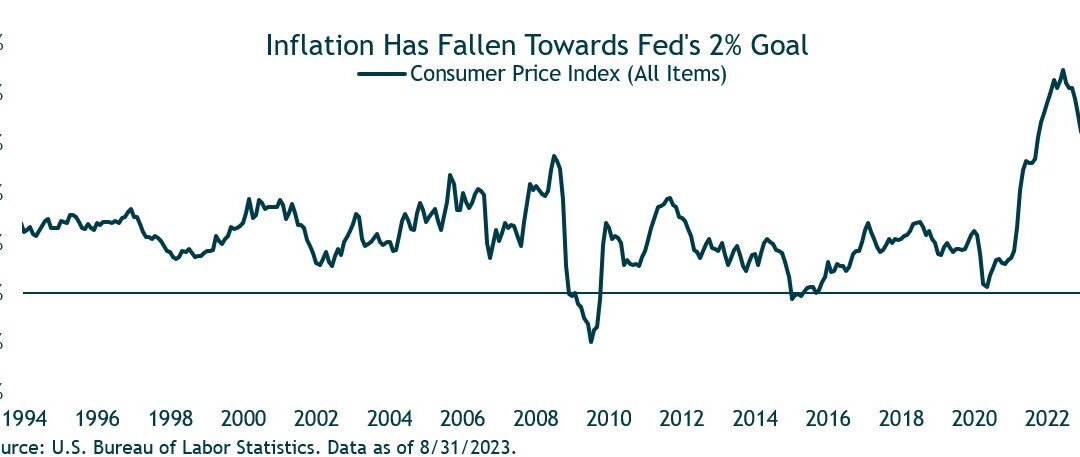

Market Recap What a difference a year makes. In 2022, high inflation and the Fed’s commitment to tame it, led to sharply rising interest rates and negative returns for both stocks and bonds. In 2023, much to the surprise of many forecasters, global stock and bond markets ignored widespread expectations that we were headed for […]

Read More

Jan 25, 2024 | Newsletters

Market Recap What a difference a year makes. In 2022, high inflation and the Fed’s commitment to tame it, led to sharply rising interest rates and negative returns for both stocks and bonds. In 2023, much to the surprise of many forecasters, global stock and bond...

25 Jan 2024

4th Quarter 2023 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 4th Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy added almost 2.9 million net new jobs during the twelve-month period ending December 2023 for an annual employment […]

Read More

Jan 25, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 4th Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy added almost 2.9 million net new jobs...

17 Oct 2023

3rd Quarter 2023 | Outlook for the US Economy by Dr. Ray Perryman

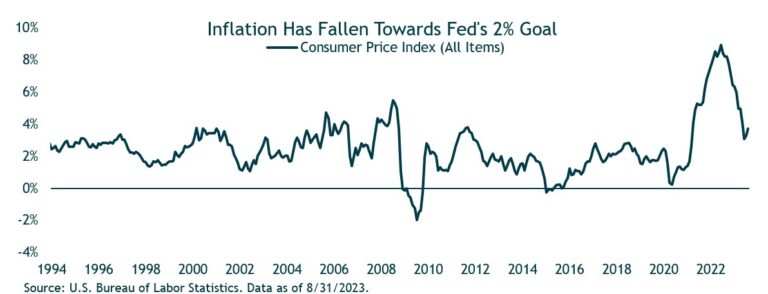

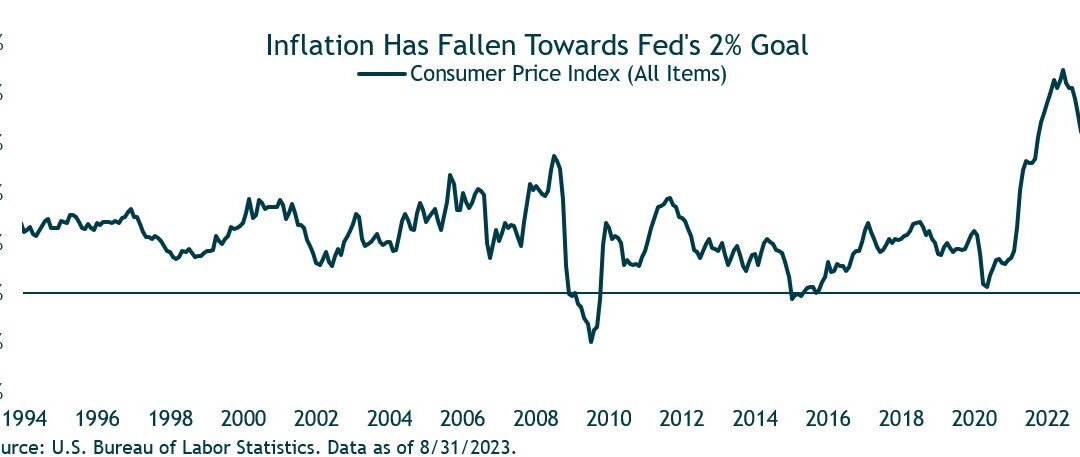

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 3rd Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Inflation/Interest Rates The Federal Reserve has been taking action to slow inflation, including raising interest rates at a historically rapid pace. Even though […]

Read More

Oct 17, 2023 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 3rd Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Inflation/Interest Rates The Federal Reserve has been taking action to...