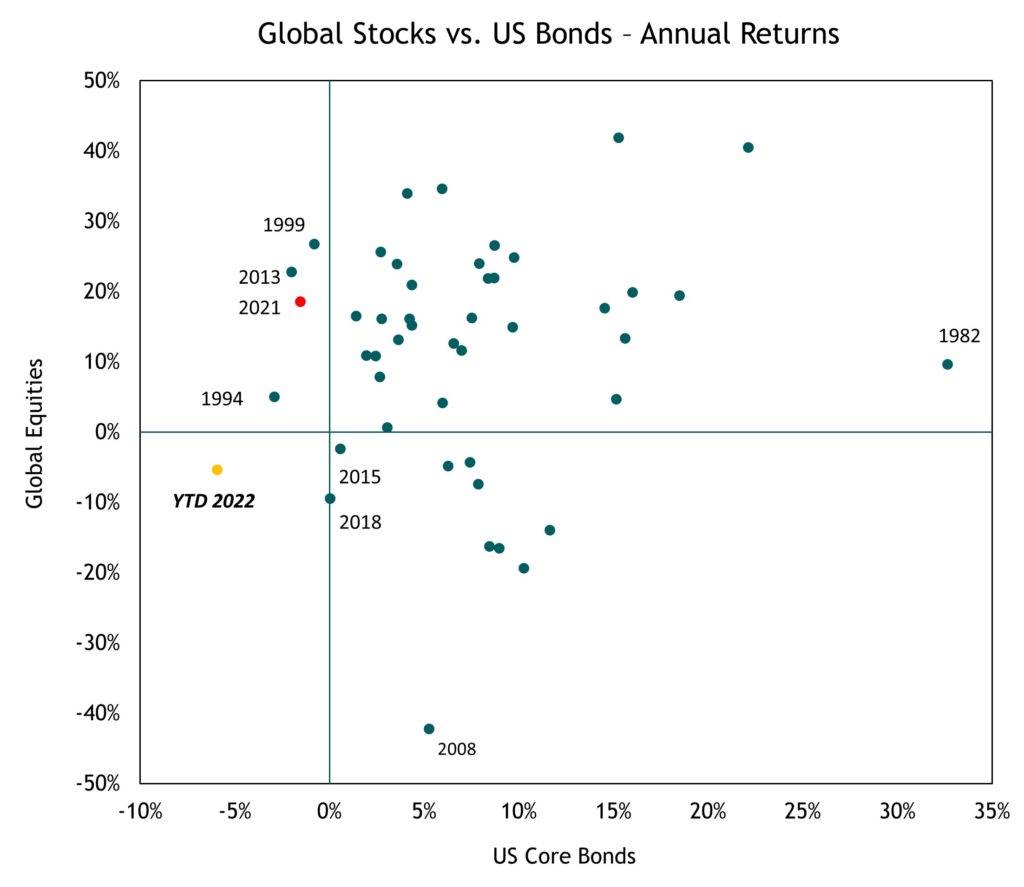

Q1 2022 Was a Historically Challenging Period for Stocks and Bonds

- Global stocks and US core bonds are both down year to date as markets digest higher inflation, rising interest rates, and geopolitical uncertainty

- As we’ve discussed for some time, rising inflation and rising interest rates creates challenges for both stocks and bonds, and in turn, for a portfolio comprised only (or largely) of core bonds and stocks. Diversification into other asset classes, market segments, and alternative strategies can be particularly valuable in such an environment.

Global Equities represented by the MSCI World from 1977 through 1987 and the MSCI ACWI from 1988 through 2022. US Core Bonds represented by the Bloomberg US Agg Bond. Source: Morningstar Direct. Data as of 3/31/2022.

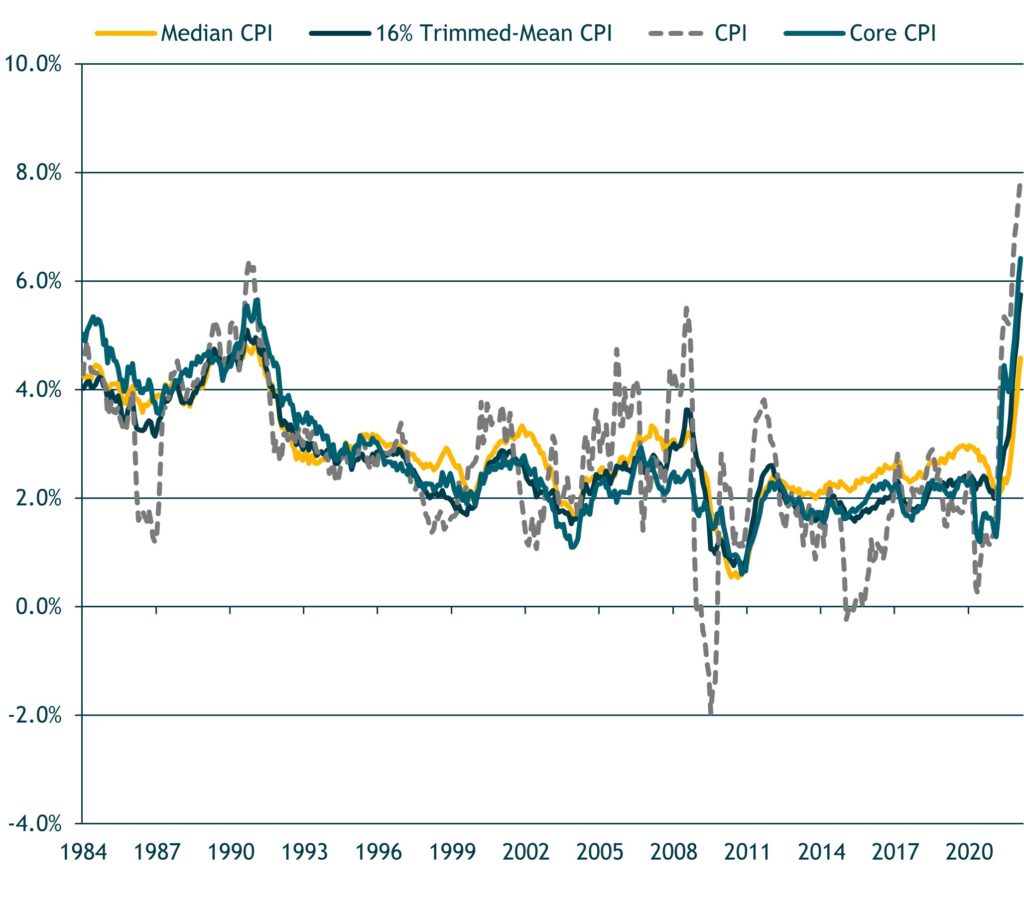

All Measures of Inflation Are Now Well Above the Fed’s 2% Target

- Inflation readings in the U.S. have gotten worse over the past three months, as can be seen across any number of inflation measures: core, median, trimmed mean – take your pick.

- While these broad measures of inflation may indicate rising prices for all goods and services, the price increases are not affecting all sectors of the economy equally. In fact, some of the inflation we are experiencing (e.g., consumer durables) should be transitory as supply/demand imbalanced normalize.

Source: Federal Reserve Bank of Cleveland and U.S. Bureau of Labor Statistics. Data as of 2/28/2022. See disclosures for information on inflation calculations/definitions.

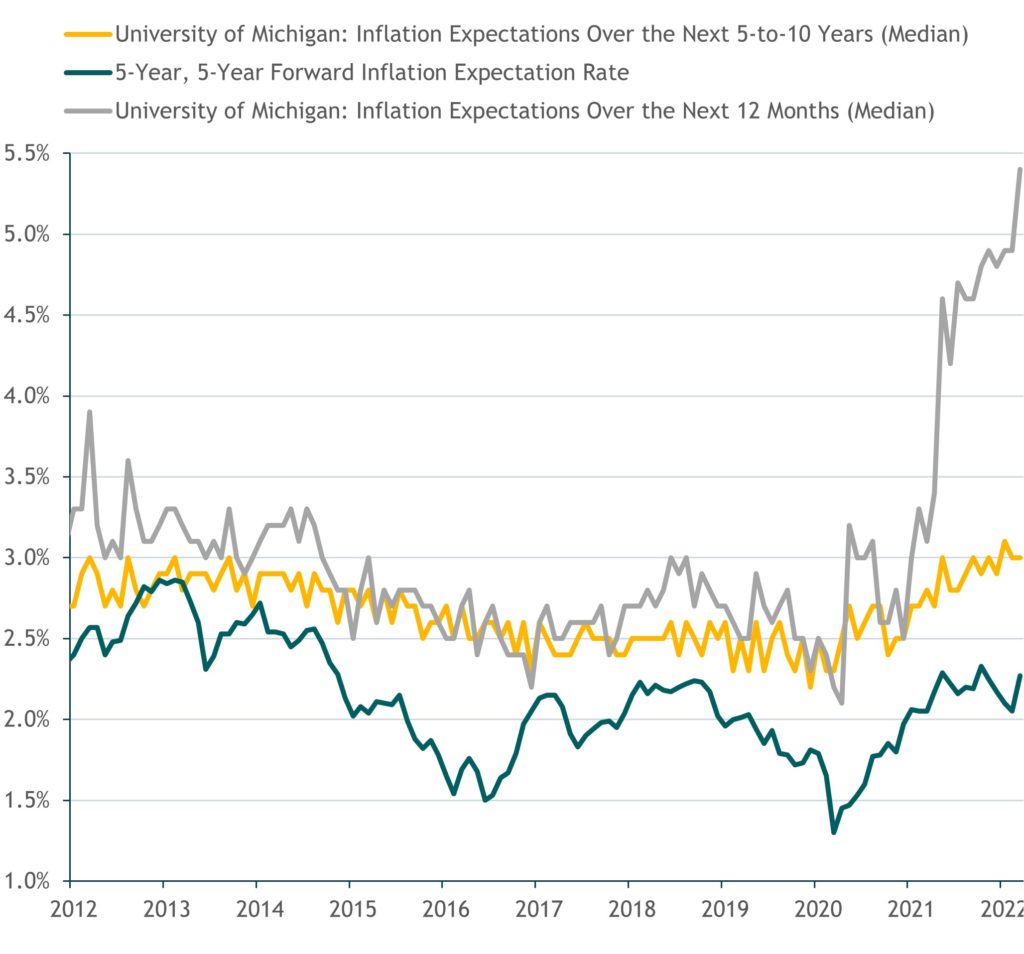

Short-Term Inflation Expectations Are Sharply Higher, But Longer-Term Expectations Remain In the Fed’s Target Range (So Far)

- While short-term inflation expectations have spiked, longer-term inflation expectations remain mostly “anchored” in a range consistent with the Fed’s 2% long-term core inflation target.

- Should the longer-term measures move higher, we’d expect the Fed to accelerate its tightening pace.

Source: Federal Reserve Bank of St. Louis and University of Michigan. Data as of 3/31/2022.

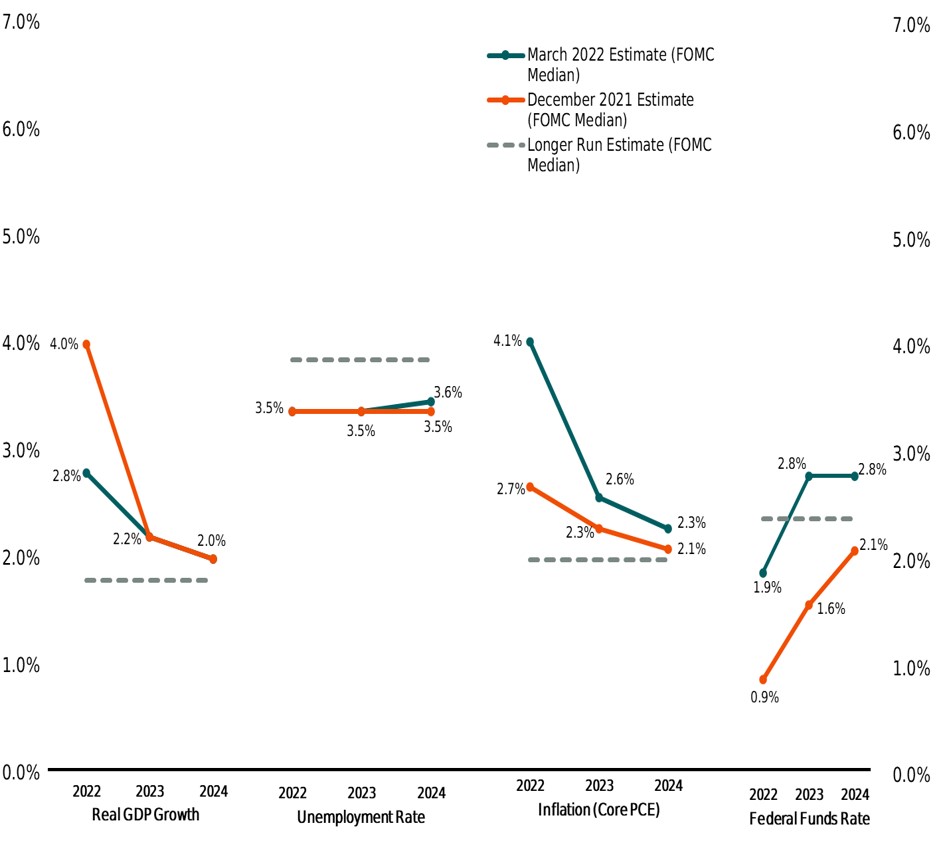

The Fed is Now Anticipating Seven Rate Hikes This Year to Combat High Inflation

- The Fed has finally begun to raise interest rates (the fed funds policy rate), starting with a 25-basis point (0.25%) increase at the March FOMC meeting.

- As we can see in this chart, the Fed is now expecting a much sharper increase in the fed funds rate in 2022 and 2023 compared to their previous meeting in December: 1.9% (2022) and 2.8% (2023) vs. 0.9% and 1.6% respectively.

- In his post-FOMC meeting comments, Fed chair Jerome Powell clearly stated that fighting inflation is the Fed’s focus, now that the labor market has reached maximum employment. “We need to get rates back up to a more neutral level as quickly as we practicably can and then move beyond neutral if it turns out to be appropriate,” he said.

Source: Board of Governors of the Federal Reserve System. Data as of 3/16/2022.

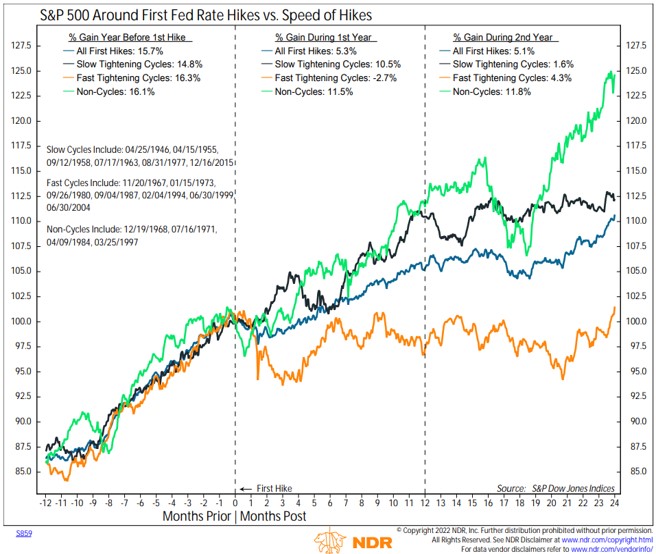

Fast tightening Cycles Have Historically Been Bad News for Stocks

- Just a few months ago, the consensus was for the Fed to begin slowly raising rates in 2022. Now the Fed has signaled its intention to raise rates at every Fed meeting, with possibly one or more 50 basis point rate hikes, and to also begin reducing its balance sheet.

- These actions would clearly qualify as a “fast” Fed tightening cycle under NDR’s definition. As the orange line shows, historically this has been bad news for stocks.

Source: Ned Davis Research. Data as of 3/30/2022.

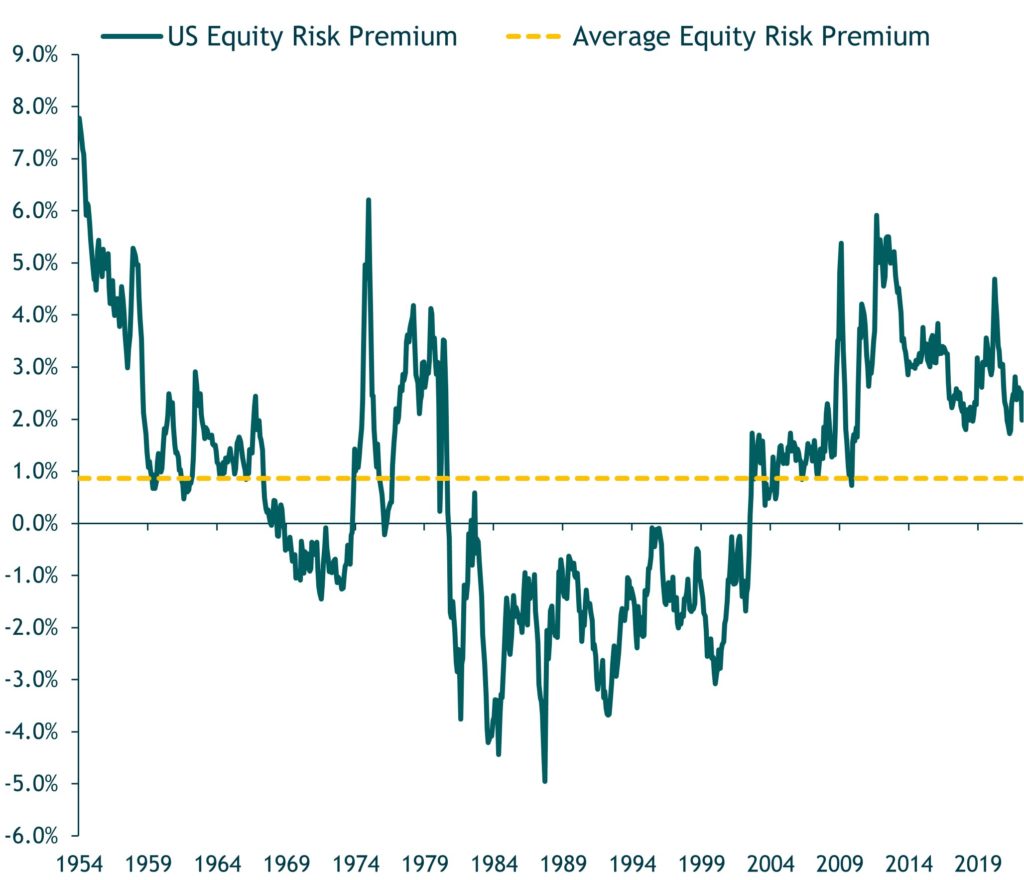

U.S. Stocks Remain Attractive Relative to Bonds

- Relative to still-low (but not as low) bond yields, U.S. stocks are still attractive. The current U.S. equity risk premium, which is the excess return riskier stocks earn compared to less-risky bonds, remains higher than the historical average – this should provide some support for U.S. stocks over the near-term.

.

Source: Bloomberg and Board of Governors of the Federal Reserve System. Data as of 3/30/2022.

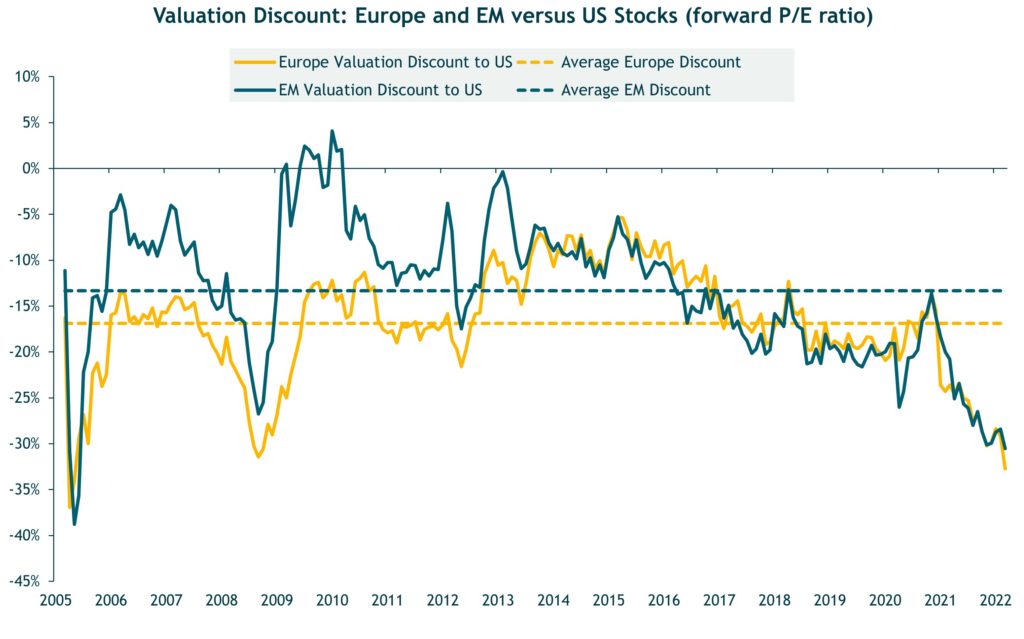

Europe and EM Stocks are Selling at Steep Discounts vs. U.S. Stocks

Source: Bloomberg. Data as of 3/30/2022.

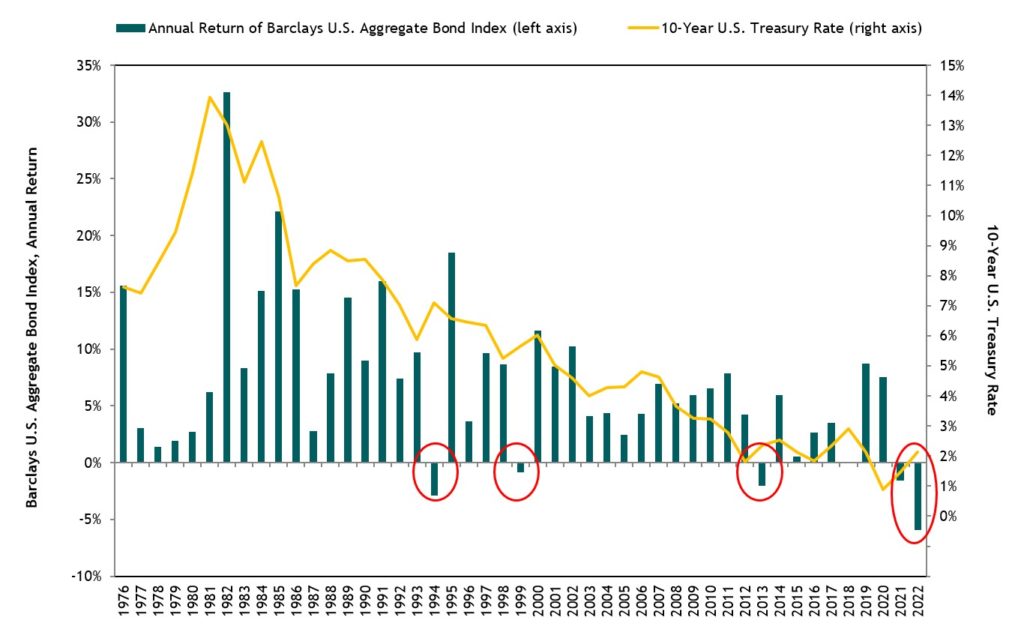

Historical Perspective of This Year’s Bond Market Sell-Off

Source: Morningstar / Federal Reserve. Data as of 3/31/2022.

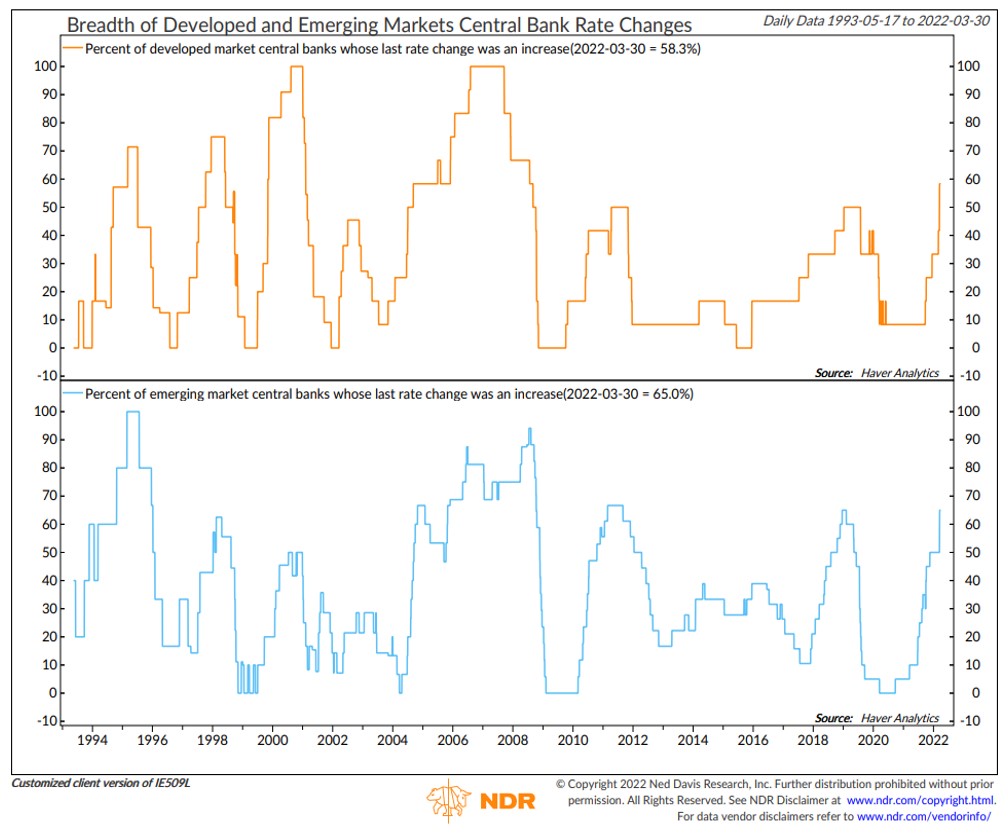

Most Global Central Banks Are Now Tightening Monetary Policy

Source: Ned Davis Research. Data as of 3/30/2022.

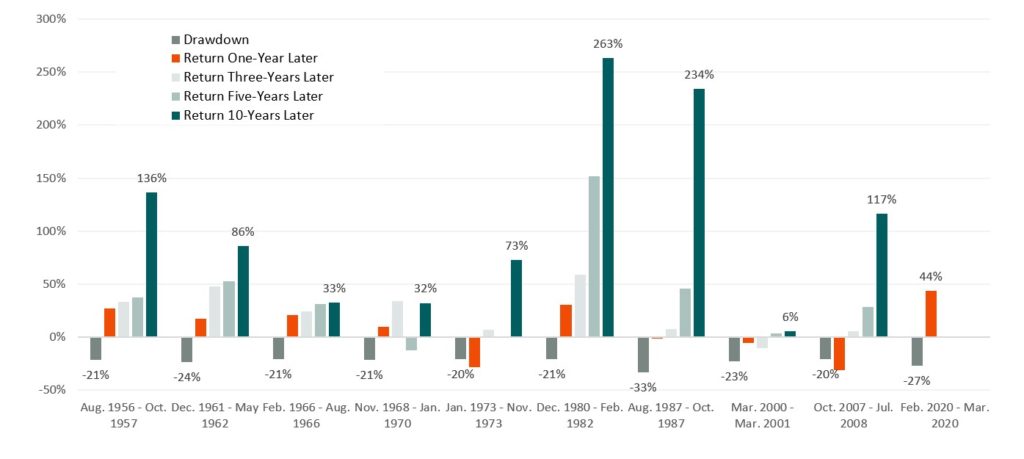

What Happens After Bear Market Declines

- Historically, market declines are followed by market strength and typically grow stronger the longer the time period measured.

- This observation speaks to the importance of viewing investments over a long-time horizon.

- Note that some of the five- and 10-year performance shown in the chart overlap periods, but the results reflect what an investor experienced following the 20%-plus market drop.

Bear Market (decline of 20% of more from previous high). Source: Morningstar Direct.