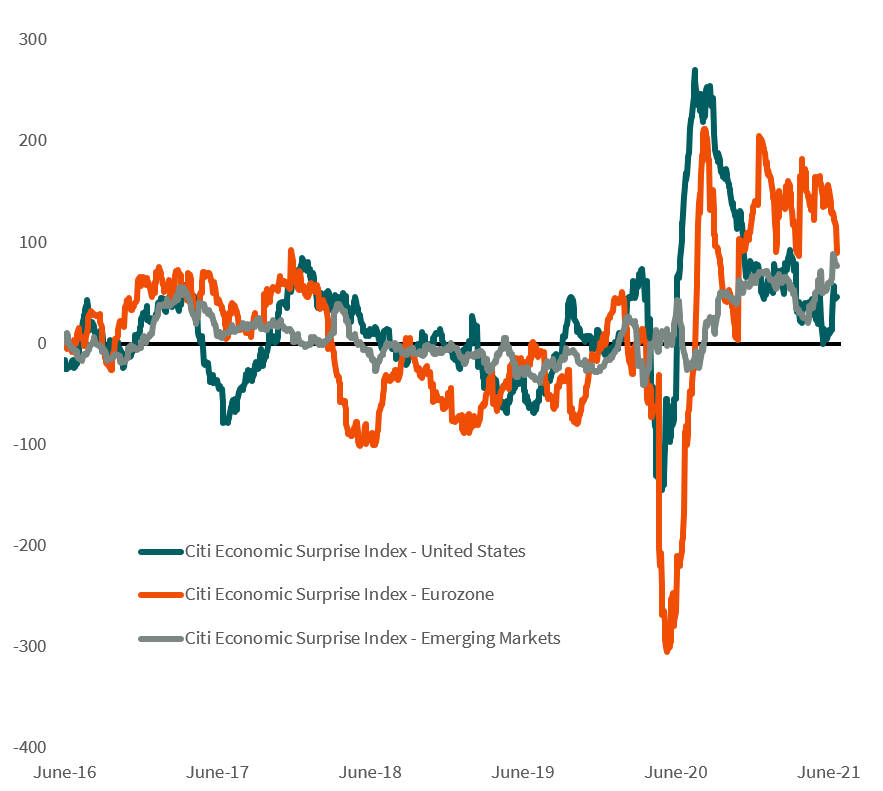

Overseas Economic Data is Surprisingly Strong

- The U.S. economy has been very strong this year, but it looks like U.S. GDP peaked in the second quarter and will decelerate going into 2022. However, global GDP growth is likely to strengthen in the second half of the year, driven by accelerating growth outside the United States.

- Overseas economic data is still surprisingly strong on the upside, as shown in the Citi Economic Surprise Indexes for Europe and Emerging Markets. Meanwhile, U.S. economic surprises have fallen sharply toward zero.

- The U.S. economy has led the global growth parade so far this year and will continue to grow at a well-above-trend rate. But the strength is now largely discounted in consensus expectations and so is probably more susceptible to a negative surprise.

Source: Bloomberg. Data as of 6/22/2021

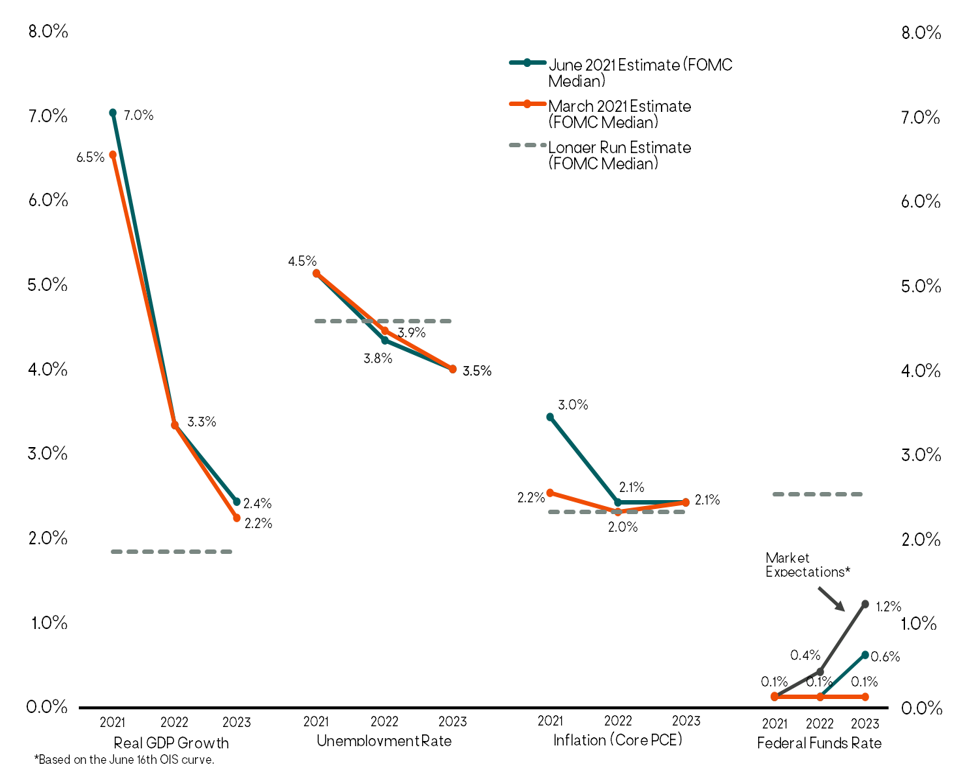

The Fed Now Expects to Start Raising Interest Rates in 2023 vs. 2024

- In a surprisingly hawkish shift, the Fed’s updated “dot plot” showing the 18 individual Federal Open Market Committee (FOMC) participants’ current expectations for future federal funds rate hikes now indicates two rate hikes in 2023, whereas at the March meeting the median dot implied the Fed wouldn’t start raising rates until at least 2024.

- We would not read too much into this. The Fed dot plots have had no accuracy in predicting what the fed funds rate actually is several years hence.

- Fed chair Powell himself said “These are, of course, individual projections. They’re not a committee forecast. They’re not a plan…There is no great forecaster of the future – so dots need to be taken with a big, big grain of salt.”

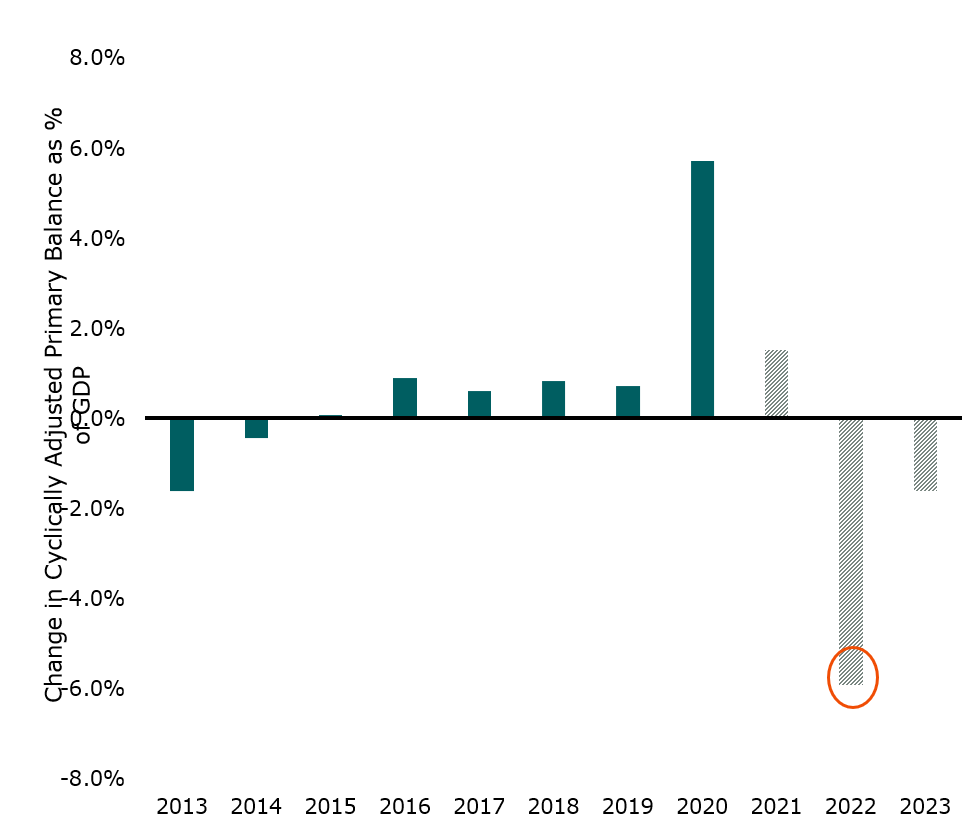

U.S. Fiscal Policy Will Become a Headwind to Economic Growth

- Markets have been paying closer attention to inflation lately, with the big question being whether the recent surge in U.S. consumer prices is transitory or a macroeconomic “regime change” to a high-inflation environment.

- As pandemic programs begin to expire in the latter half of 2021 into 2022, the U.S. economy will shift from getting a large fiscal boost to facing a meaningful fiscal drag – a negative impact on GDP growth.

Source: IMF. Data as of 5/31/2021

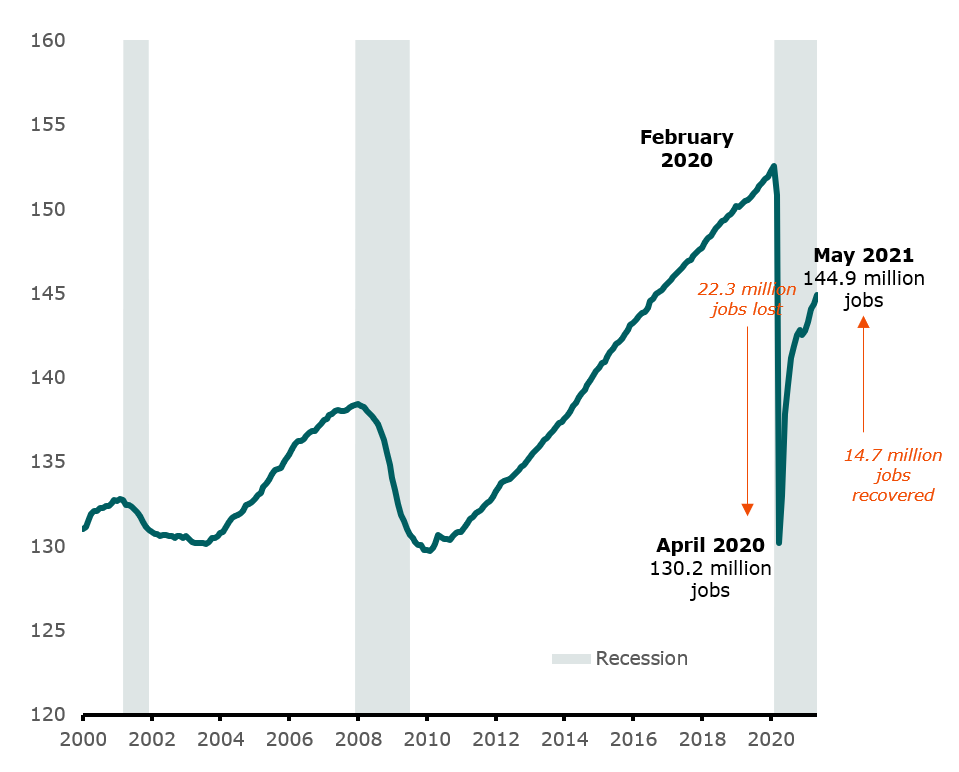

Full Employment Remains a Long Way Off

- The labor market shows evidence that the recent surge in inflation is likely to be largely transitory. The U.S. economy still appears to have significant slack before aggregate demand would start overwhelming the economy’s productive capacity (the supply side), leading to the economic “overheating” that could cause significant, sustained, and broad-based inflation.

- At the end of May, there were still nearly 8 million fewer jobs compared to February 2020. If we were to extend the pre-pandemic employment trend to account for labor force growth over time, it would take until early 2024 to reach the extended trendline assuming the economy adds 500,000 jobs per month.

Source: U.S. Bureau of Labor Statistics. Data as of 5/31/2021

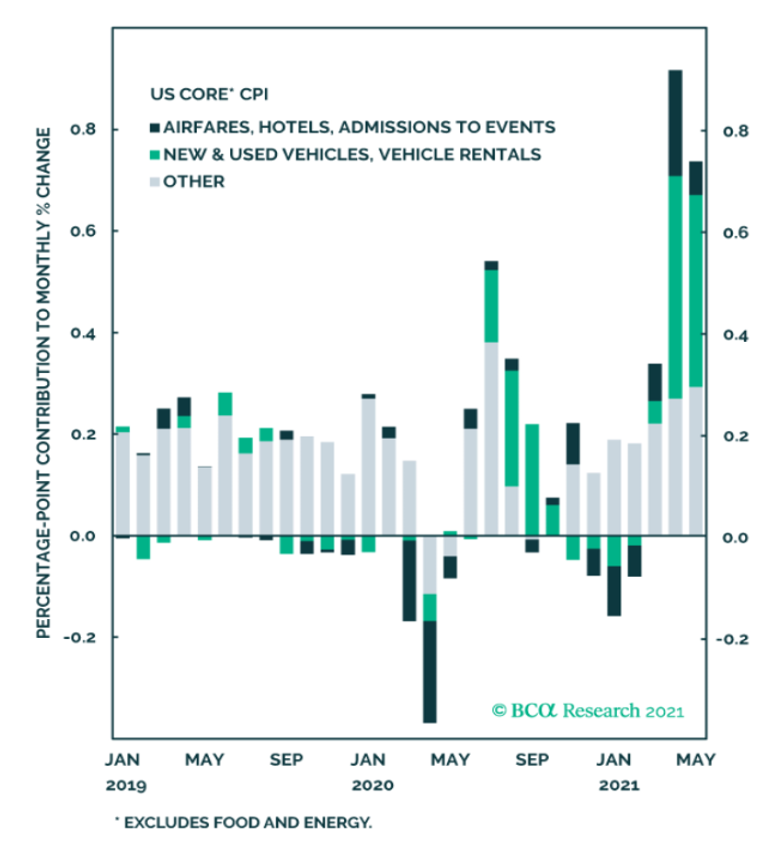

Pandemic-Affected Prices Are Pushing Up Overall CPI

- While inflation expectations are well within longer-term ranges, there is no question that recent CPI inflation numbers have been surprisingly high.

- A closer look reveals that more than half of the monthly increases in core CPI in April and May are explained by (1) higher vehicle prices (largely due to semiconductor chip shortages constraining new auto production and causing spiking demand for used cars), plus (2) the sharp rebound in the prices of travel and leisure services most deeply hurt by the pandemic (airfares, hotels, and public events).

- Fundamental supply and demand analysis suggests these segments are very unlikely to see sustained, material price increases as post-pandemic economic life normalizes over the coming months. That said, it’s possible that supply shortages and bottlenecks don’t resolve as quickly as expected.

Source: BCA Research. Data as of 5/31/2021

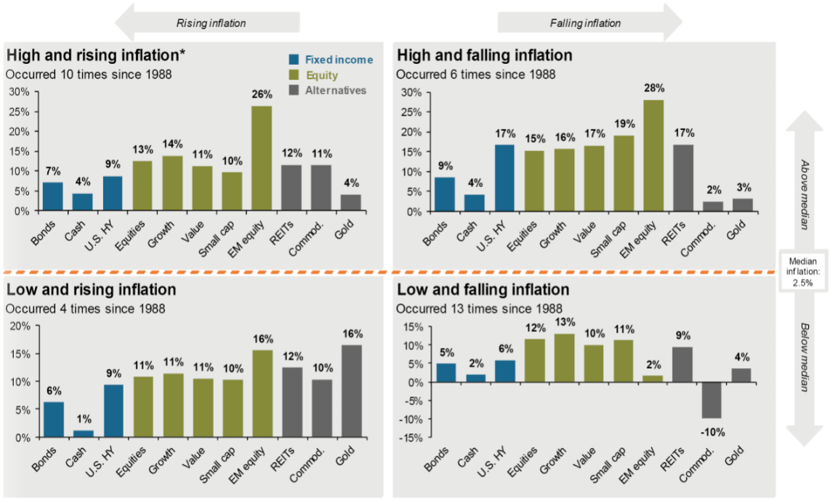

Returns in Different Inflation Environments

.

Source: JP Morgan Asset Management. Data as of 5/31/2021

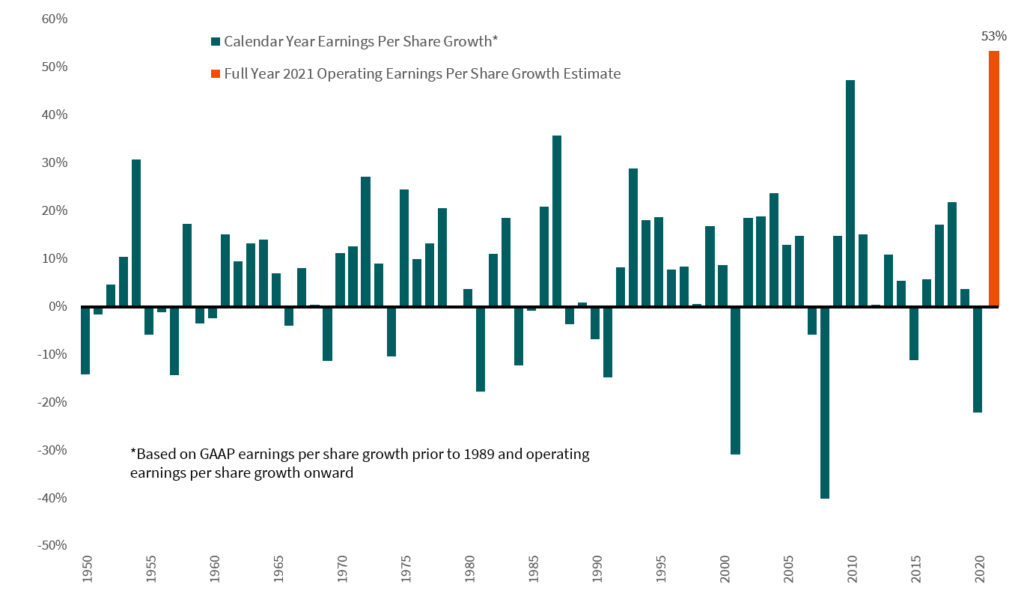

S&P 500 Earnings Growth Is Expected to Be Extremely Strong This Year

Source: Morningstar Direct. Data as of 6/30/2021

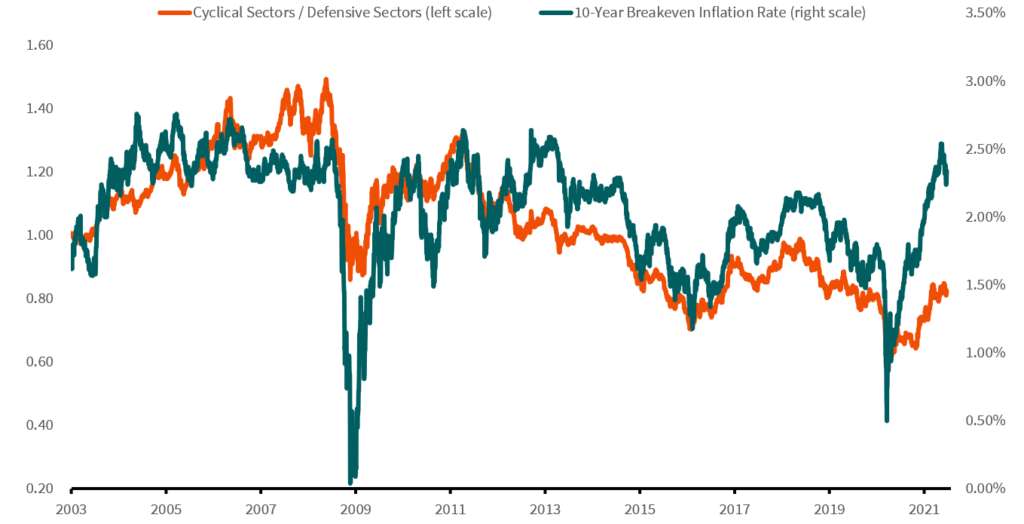

Cyclical Stocks Have Outperformed Defensive Stocks as U.S. Breakeven Inflation Has Rebounded

Source: Morningstar Direct. Data as of 6/30/202

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

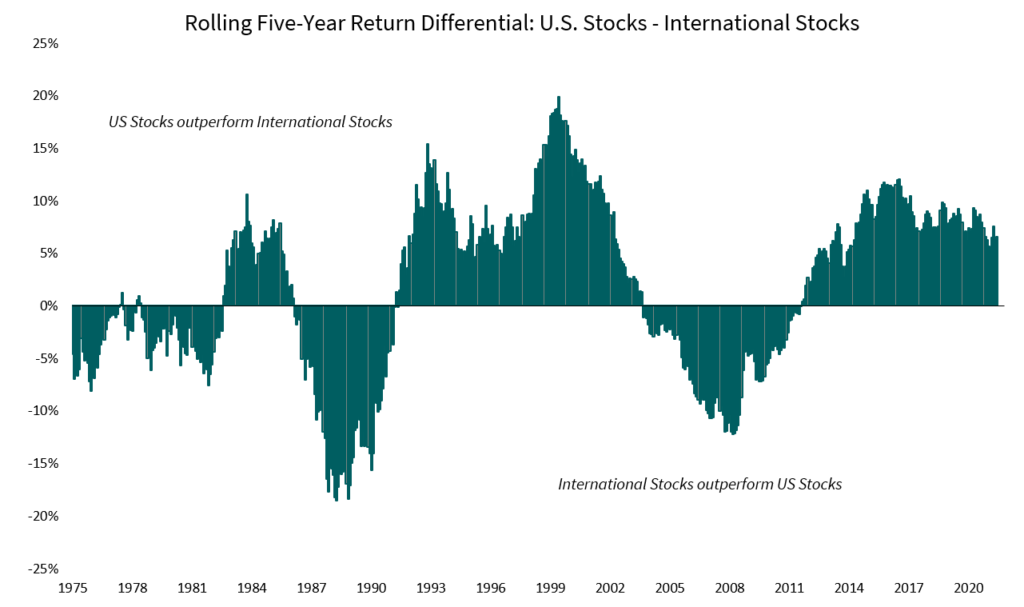

A Rebound In Global Growth Should Favor International Stocks

Source: Morningstar Direct. Data as of 6/30/2021

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

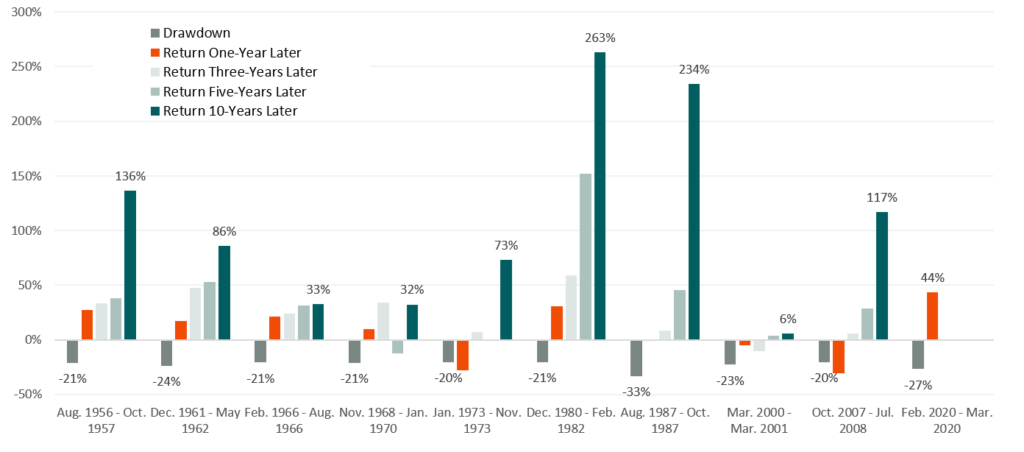

What Happens After Bear Market Declines

- Historically, market declines are followed by market strength and typically grow stronger the longer the time period measured.

- This observation speaks to the importance of viewing investments over a long-time horizon.

- Note that some of the five- and 10-year performance shown in the chart overlap periods, but the results reflect what an investor experienced following the 20%-plus market drop.

Bear Market (decline of 20% of more from previous high). Source: Morningstar Direct

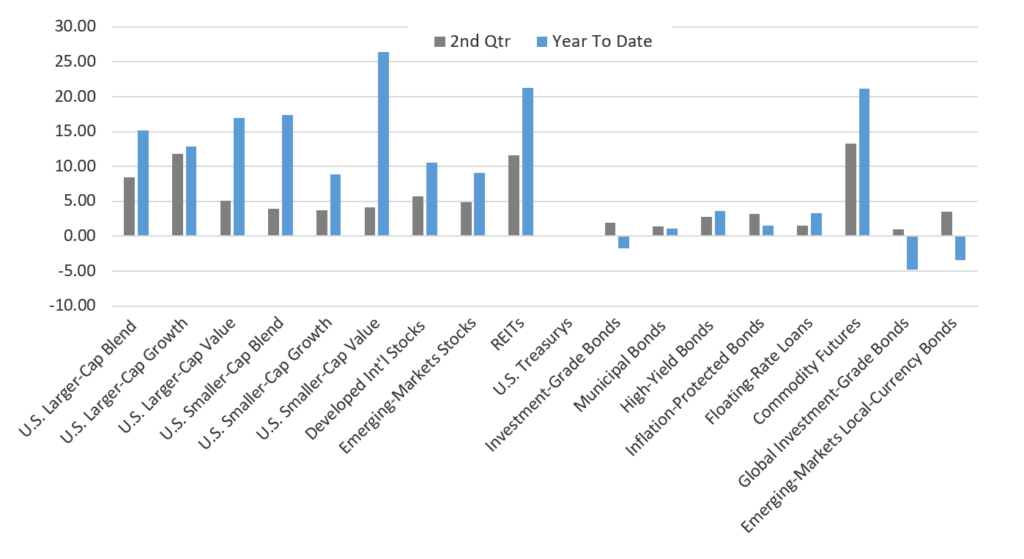

Asset Class Returns

Source: Morningstar. Data as of 6/30/2021