Market Review

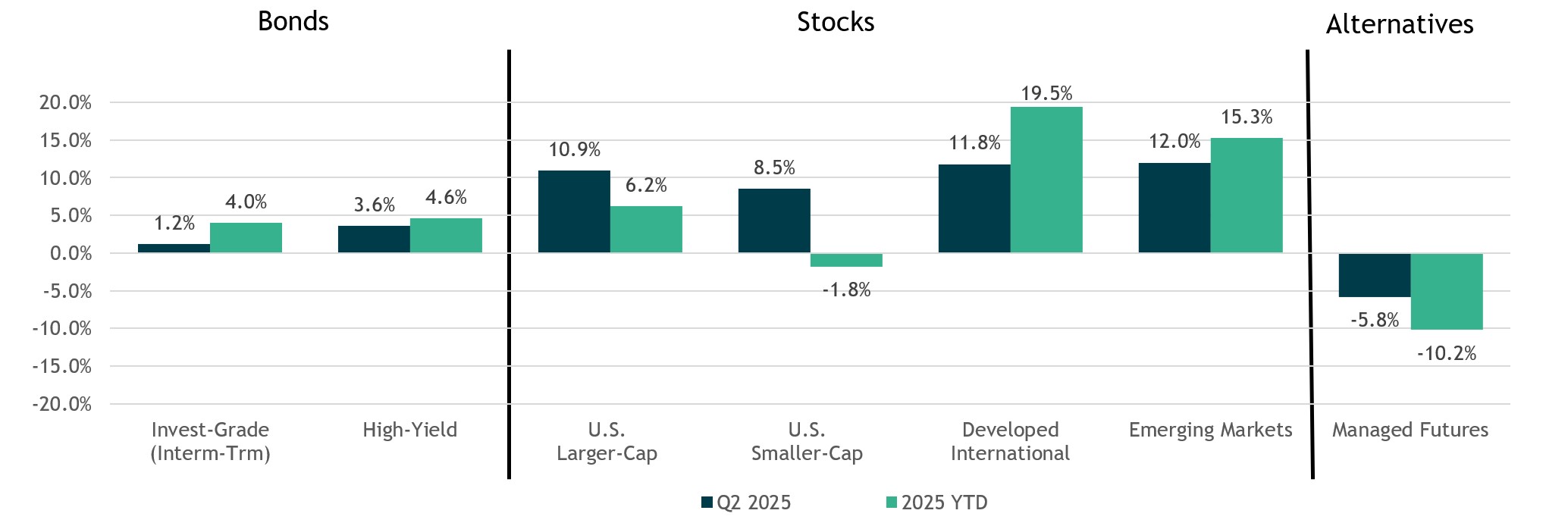

- U.S. Stocks (S&P 500 Index) rebounded strongly in the second quarter, gaining nearly 11% on the back of continued earnings strength in the technology and communications sectors. The tech heavy Russell 1k Growth Index posted even stronger returns, gaining nearly 18%, lifted by optimism around Ai-driven investment themes. Smaller cap stocks (Russell 2k index) also moved higher, gaining 8.5%.

- International stocks (MSCI EAFE) continued their run of solid performance for the year, rising nearly 12% in Q2, lifting it’s year to date return to almost 20%. International stocks have benefitted from a decline in the U.S. Dollar (DXY index), which is down nearly 11% for the year. Emerging-market stocks have also benefitted – rising 6% in Q2 bringing its total to 15.3% year to date.

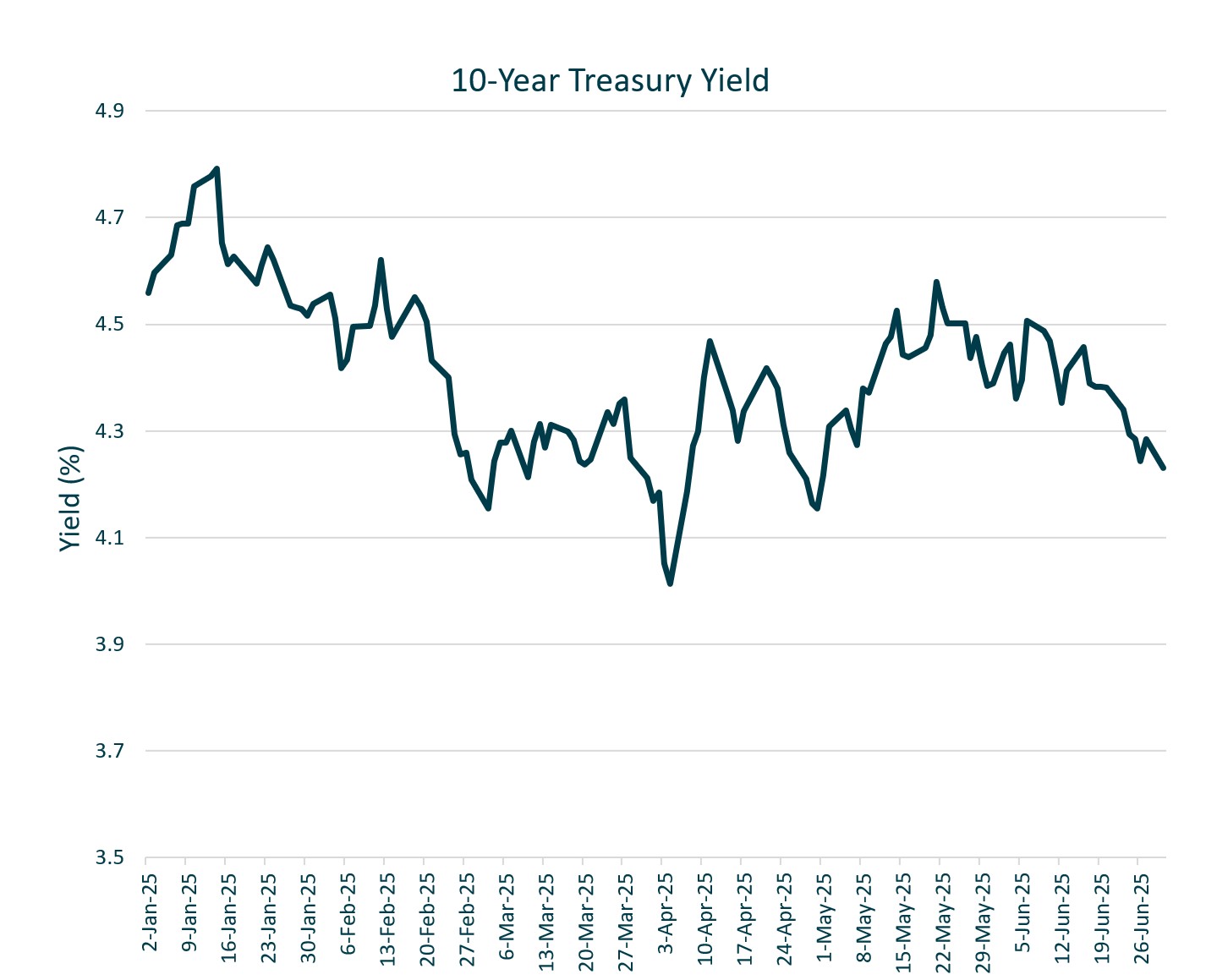

- Investment Grade Bonds (Bloomberg US Aggregate Index) delivered moderate gains in Q2, rising 1.2%. 10-year treasury yields ended the second quarter largely unchanged at 4.24% but masked massive intra-quarter volatility that saw rates range from 4% to 4.58%. Lower quality high-yield bonds (ICE BofA ML High Yield index) finished the quarter up 3.57% as investors’ appetite for risk increased.

Performance reflects index returns as follows (left to right): Bloomberg US Aggregate, ICE BofA US High Yield, S&P 500, Russell 2000, MSCI EAFE, MSCI EM, SG Trend Index. Source: Morningstar Direct. Data as of 6/30.2025.

Performance reflects index returns as follows (left to right): Bloomberg US Aggregate, ICE BofA US High Yield, S&P 500, Russell 2000, MSCI EAFE, MSCI EM, SG Trend Index. Source: Morningstar Direct. Data as of 6/30.2025.

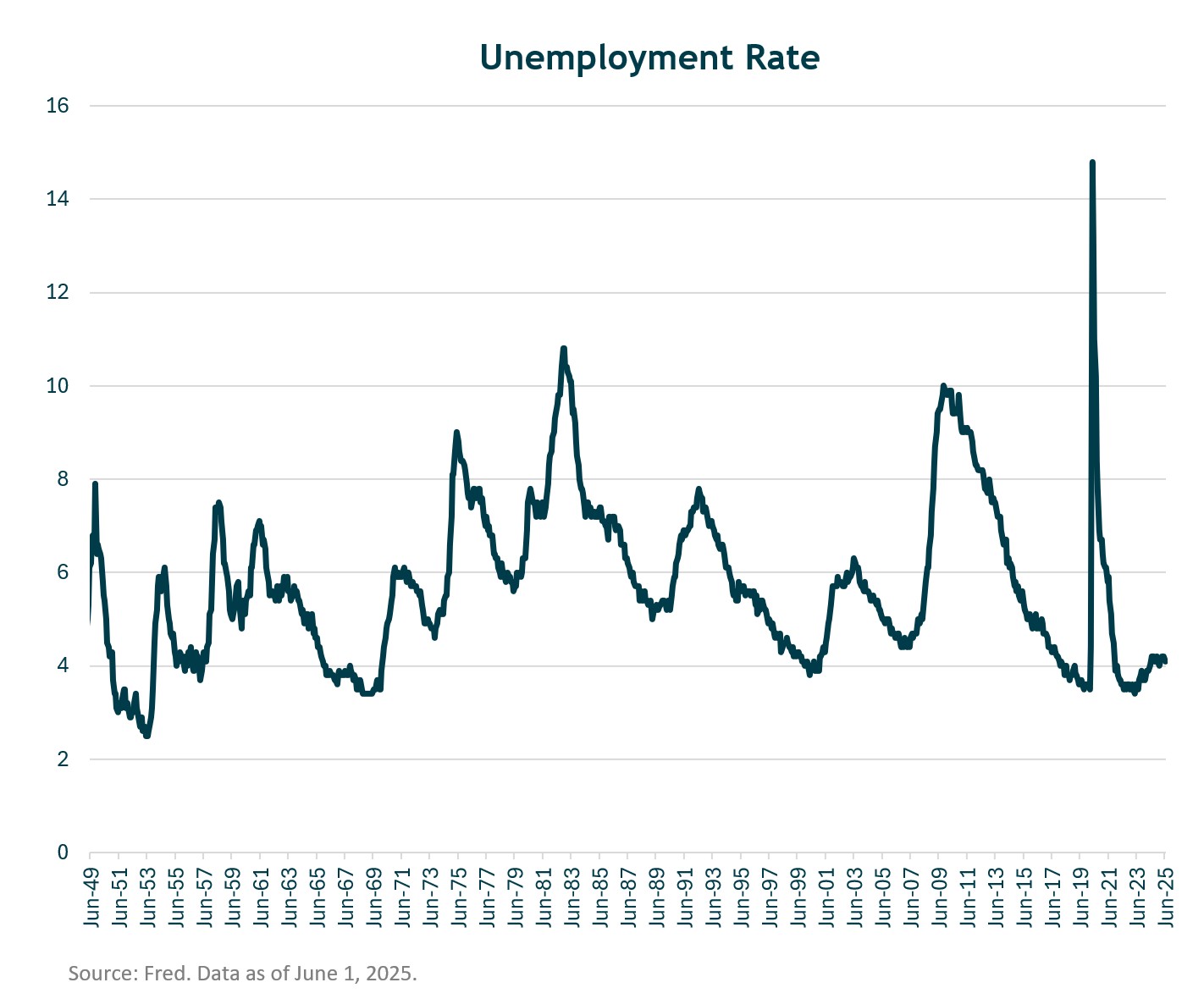

The Labor Market Remains Healthy for Now

- As for the labor market, it is showing signs of slowing and is not likely to improve meaningfully considering the rise in deportations.

- Unemployment ticked up modestly to 4.1% in June, and job openings have declined across several sectors.

- Fed officials expect unemployment to rise to 4.5% this year (from 4%) and settle at 4.4% in 2027.

- Wage growth remains above pre-pandemic trends but has decelerated, which could provide relief for the Fed’s inflation mandate in the coming quarters.

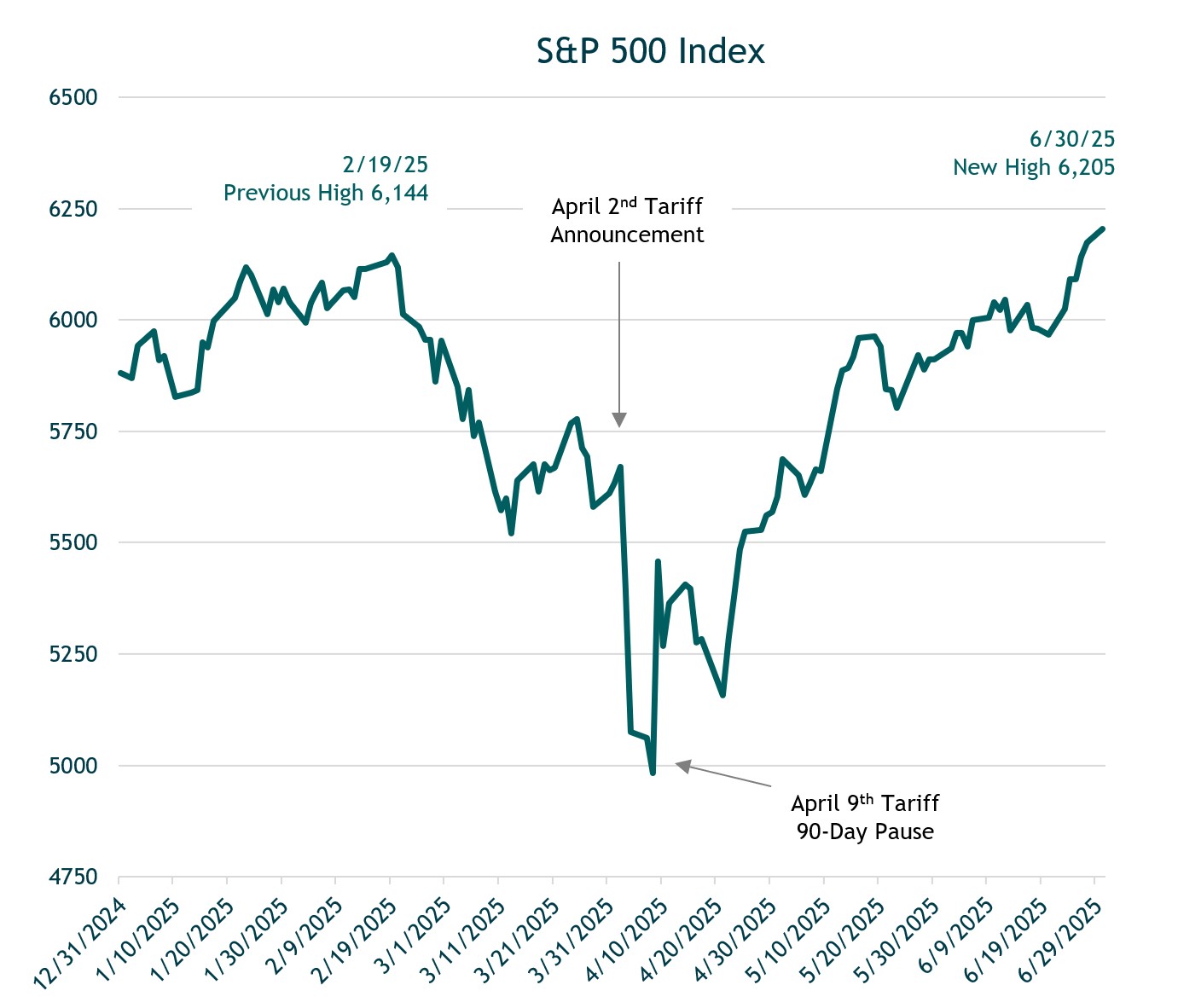

Despite Volatility the S&P 500 Ended the Quarter at a Record High

- The second quarter began with the tariff announcement on April 2nd sending equity markets sharply lower.

- The sell-off continued until April 9th when a 90-day pause on all tariffs was announced (set to expire on July 9th).

- Following the pause, the S&P 500 rallied and continued to climb over 25% to the end of June.

- By quarter end, the S&P 500 had reached a new all-time high bringing its year-to-date return to 6.2%.

Performance shown represents index returns and does not reflect fees or expenses. Indices are not directly investable. Source: S&P Global. As of 6/30/2025.

Performance shown represents index returns and does not reflect fees or expenses. Indices are not directly investable. Source: S&P Global. As of 6/30/2025.

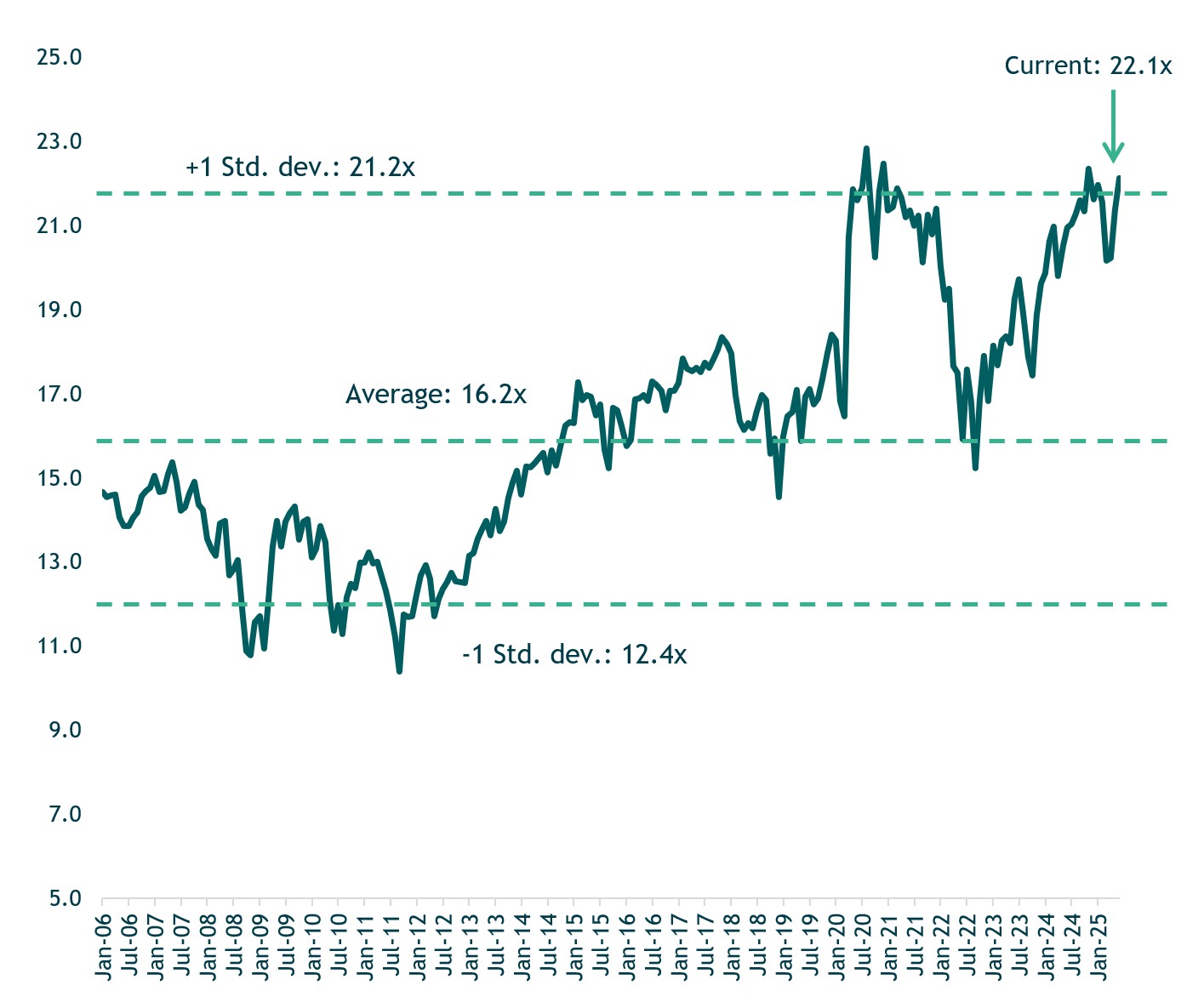

U.S. Equity Valuations Back at Expensive Levels

- U.S. equity valuations are elevated by historical standards, although that alone does not imply an imminent correction.

- The big test will be over the next two quarters, which will start to incorporate the impacts from tariffs on earnings.

- While we would not be surprised to see pullbacks, we believe the combination of fiscal stimulus and potential lower interest rates could continue to drive the market even higher.

Forward price-to-earnings ratio divides a current price by its estimated earnings per share (EPS) for the next 12 months. Source: Bloomberg. As of 6/30/2025

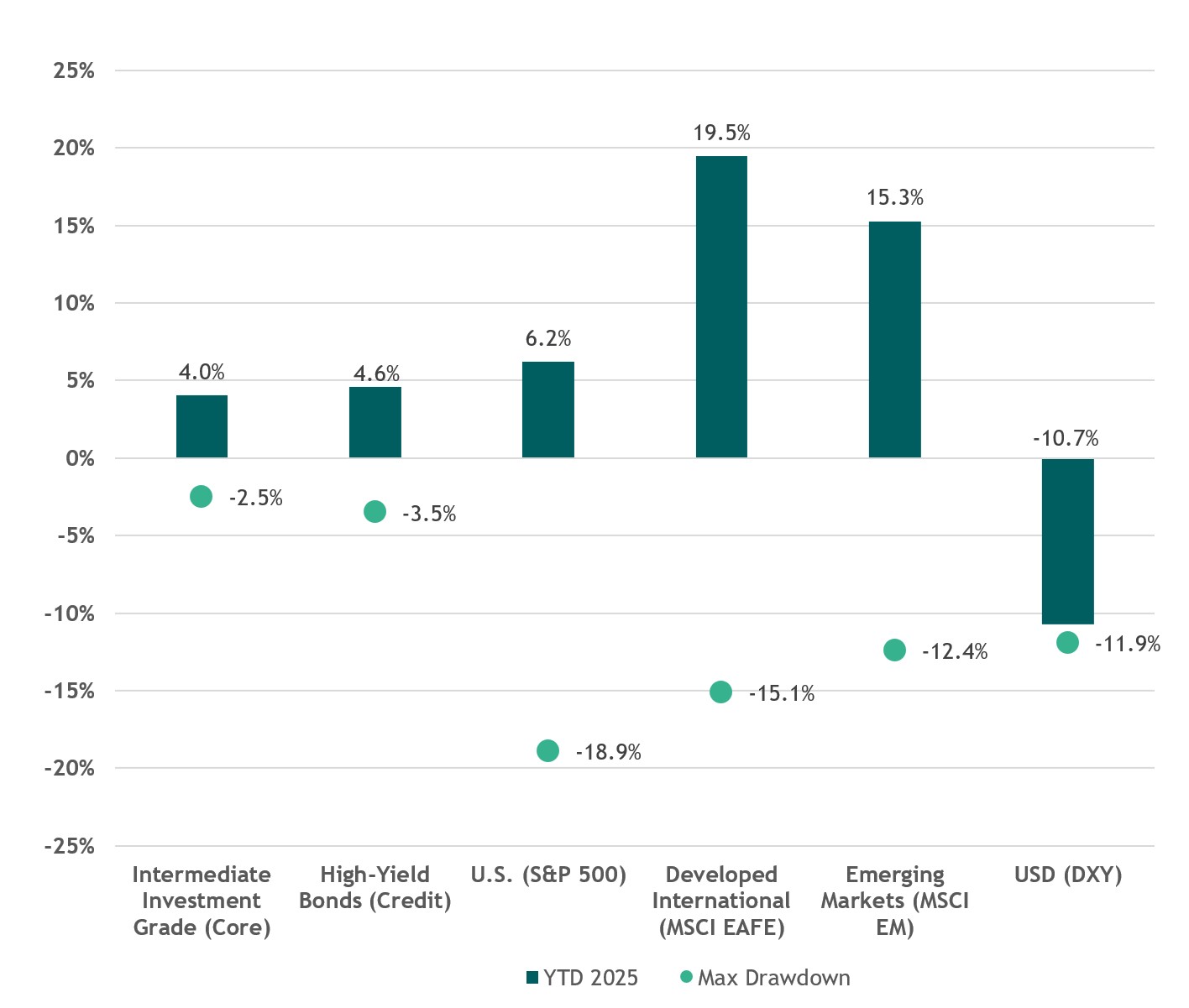

Diversification Has Benefitted Portfolios During a Volatile First Half of 2025

- Portfolios benefited from global diversification in a very volatile first half of the year.

- International equities outperformed U.S. by wide margins in part due to a falling U.S. dollar.

- Fixed income also generated solid returns and importantly, provided stability when risk assets were down.

Maximum drawdown for equities calculated using price return and reflects largest peak to trough drawdown during the year. Source: Bloomberg, FactSet. As of 6/30/2025. Performance reflects index returns as follows (left to right): Bloomberg US Aggregate, ICE BofA US High Yield, S&P 500, Russell 2000, MSCI EAFE, MSCI EM, SG Trend Index. Source: Morningstar Direct. Data as of 6/30.2025.

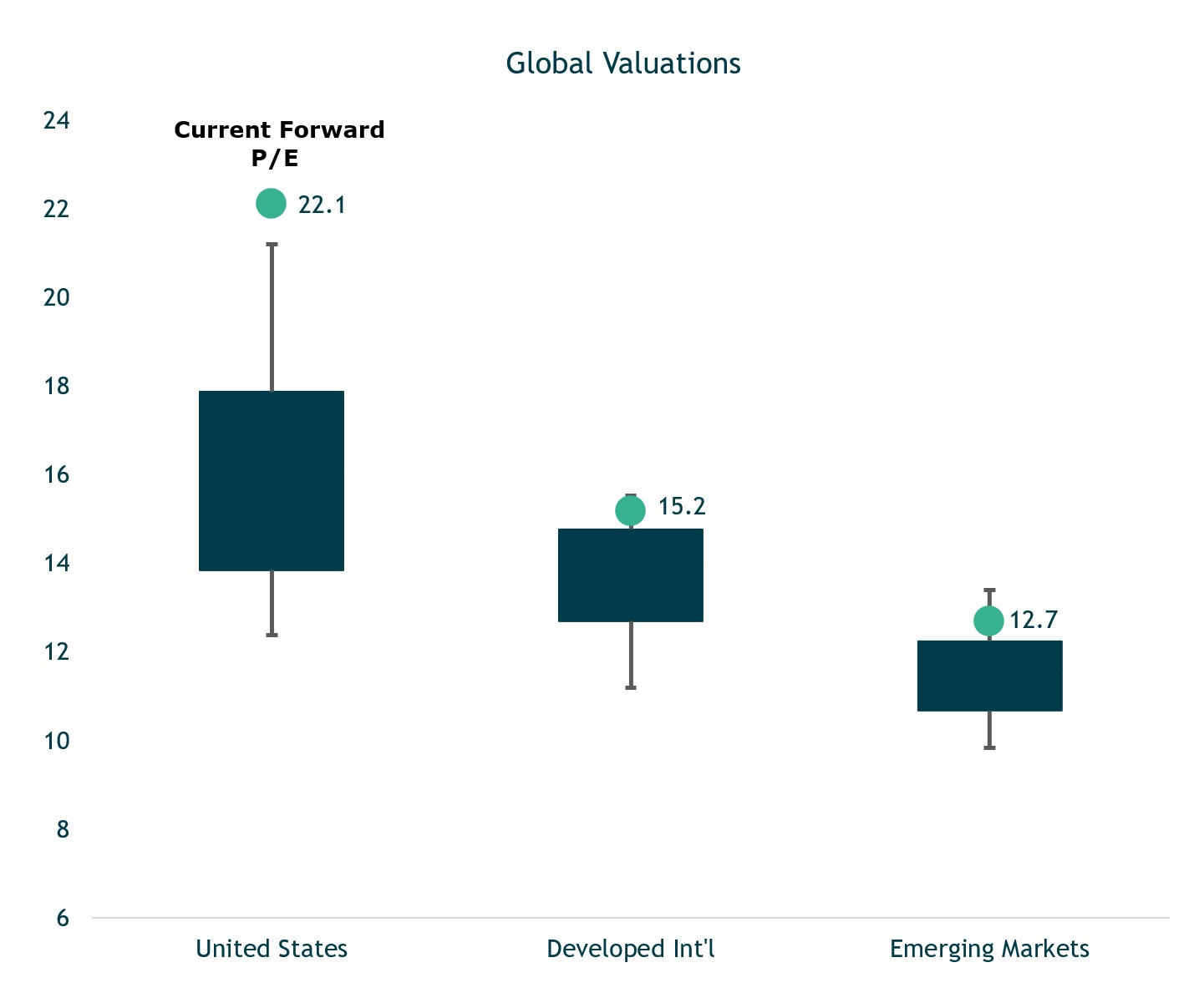

Equity Valuations More Attractive Outside the U.S.

- International equity markets have the advantage of modestly cheaper valuations, particularly after the multiyear run by U.S.

- We remain diversified with strategic equity allocations across the U.S., developed international, and emerging markets

Forward price-to-earnings ratio divides a current price by its estimated earnings per share (EPS) for the next 12 months. Source: Bloomberg LP. Data from 1/1/2006 to 06/30/2025.

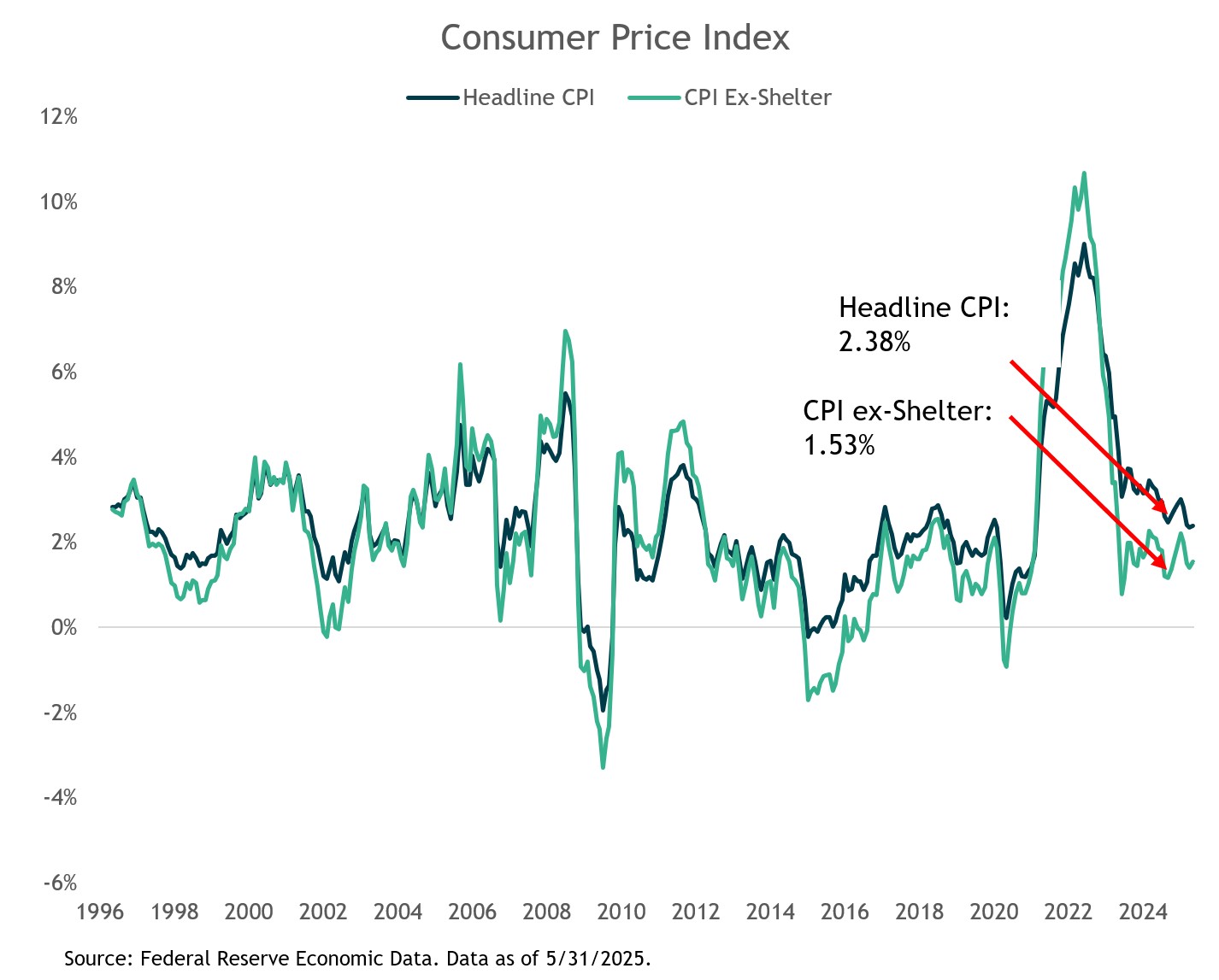

Long-Term Inflation Remains Under Control

- Our view is that inflation, from a structural perspective, remains under control.

- Viewing the components of inflation, the only area of concerns is services, specifically shelter.

- In contrast, both durable and non-durable goods have been flat to deflationary since 2022.

- While tariffs may temporarily push inflation higher, the Fed is likely to look through these shorter-term effects and focus on the underlying structural picture, which we think remains benign.

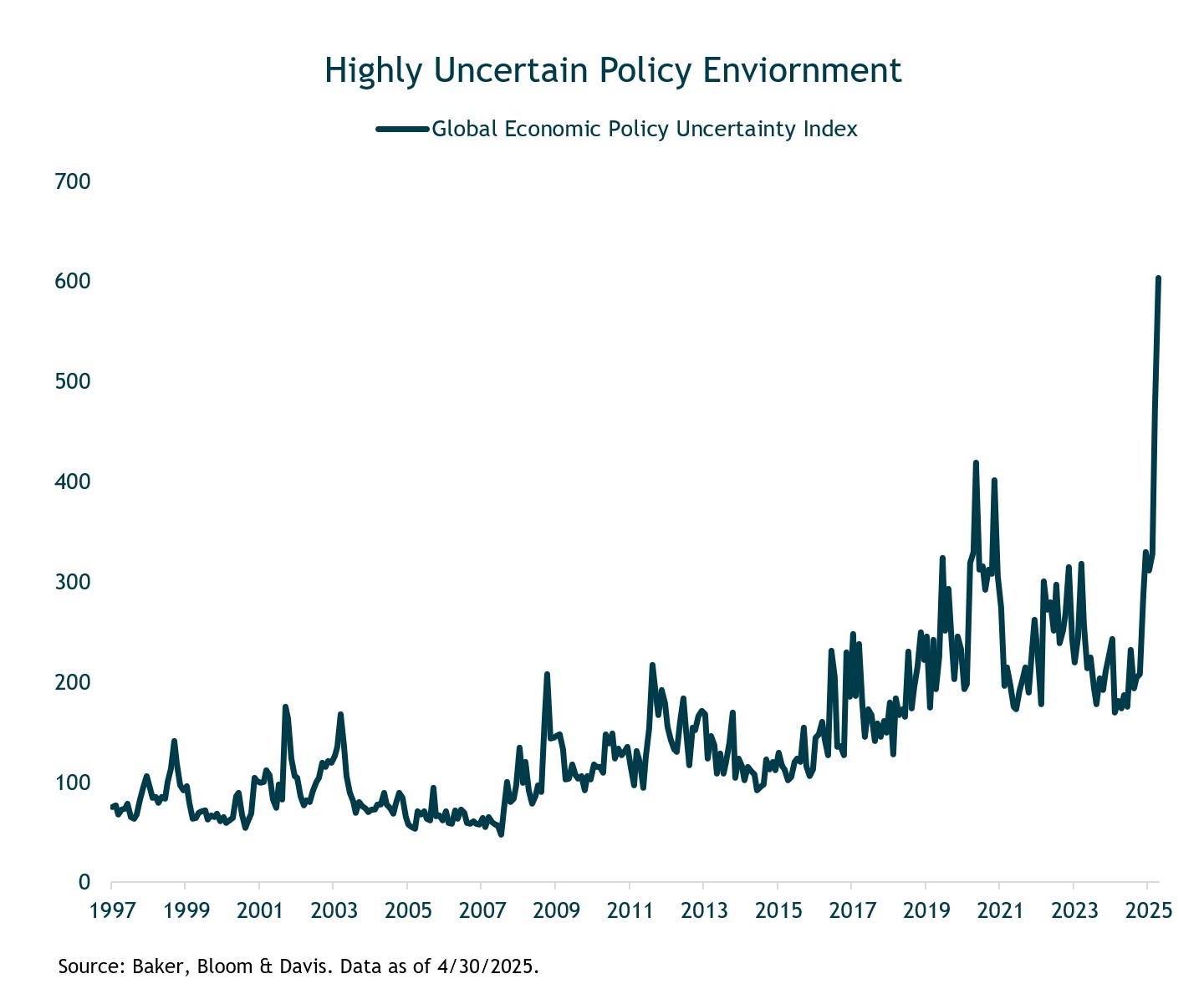

Tariffs Have Injected a Big Dose of Uncertainty Into Financial Markets

- The consistently ever-changing tariff landscape is clearly weighing on consumer sentiment adding to overall uncertainty (see chart).

- The rapidly changing policies make it difficult to keep up in real-time, and frequent reversals can make any analysis moot within hours.

- Uncertainty seems to be a tactical tool in Trump’s governance toolkit, as if to give him political leverage to achieve his desired outcome. With trade policy evolving so quickly, it often leads to more questions than answers.

Treasury Yields Remain Elevated as Future Rate Cuts are Uncertain

- Longer-term interest rates remain volatile as investors react to persistent inflation pressure and changing tariff policies.

- The 10-year treasure yield has held steady above 4.2% as markets reassess the timing and magnitude of potential Fed rate cuts.

- The Fed continues to balance inflation risks with signs of slowing growth.

Source: Bloomberg Data as of June 30, 2025

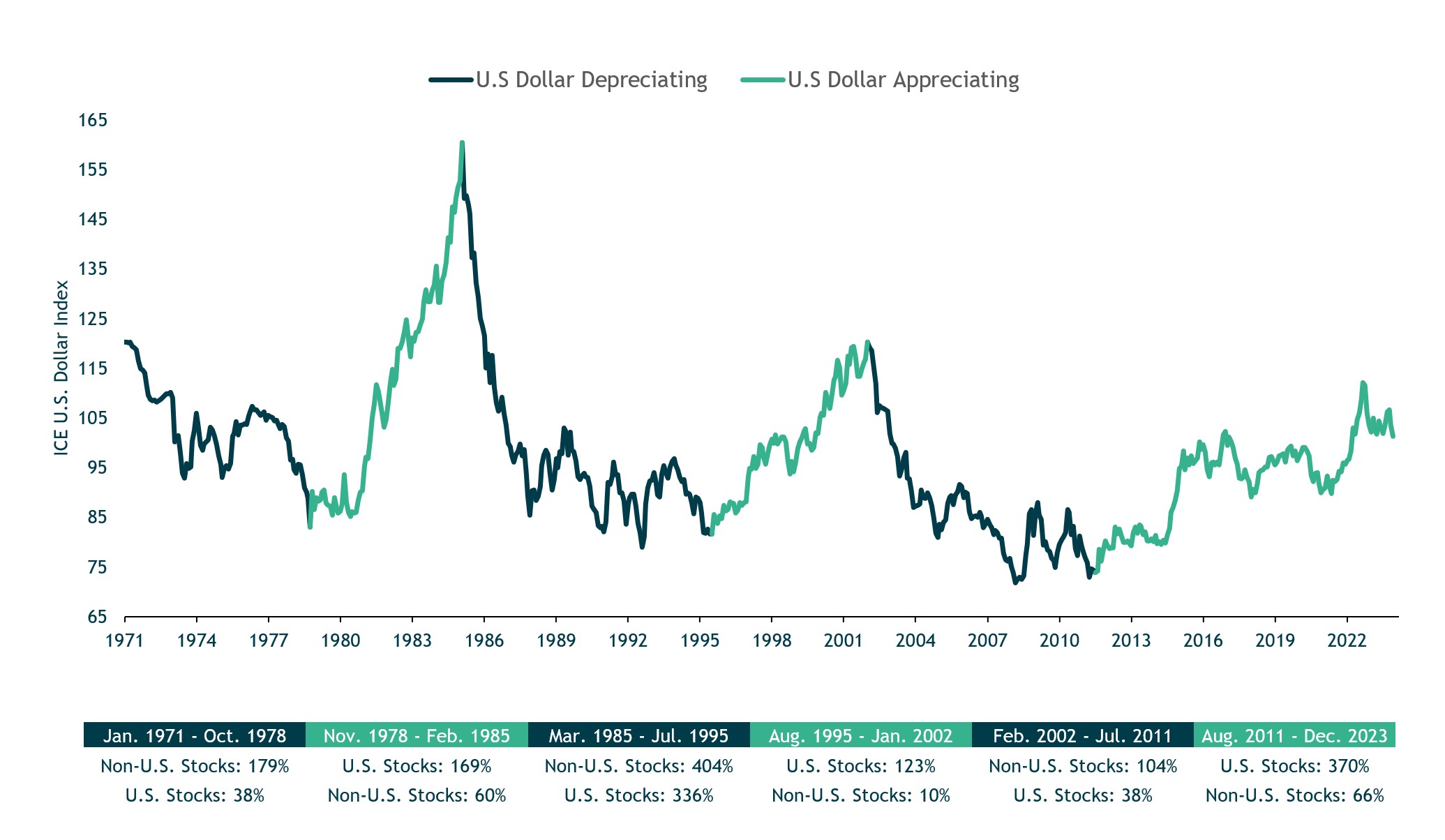

A Weaker U.S. Dollar Has Historically Provided a Tailwind to Foreign Stocks

Source: Bloomberg LP and Morningstar Direct. Data as of 12/31/2023. Annualized returns in U.S. Dollars. U.S. Stocks: S&P 500. Non-U.S. Stocks: MSCI World ex. U.S. Index.