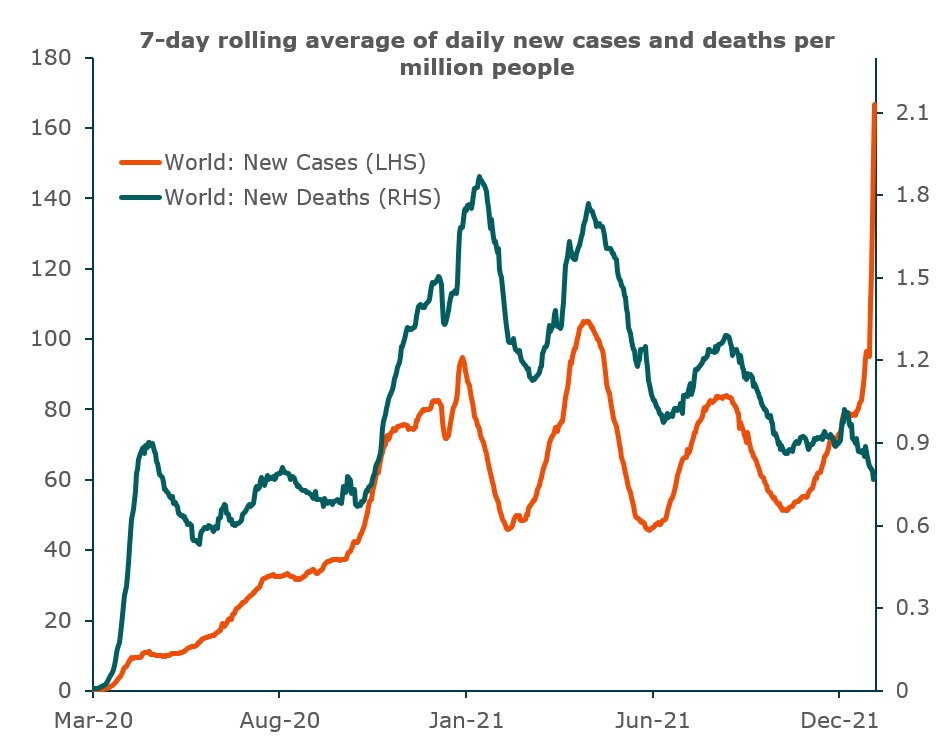

The World Faces a Fifth Wave of Covid-19 Infections, But Deaths Have Not Risen in Concert

- COVID-19 remains a key variable for the near-term (12-month) global economic and market outlook. We still believe the most likely medium-term (multiyear) base case is for continued progress against the virus and a lessening of its economic impact over time.

- Based on prior waves, we do not expect the Omicron variant to derail the economic recovery in 2022, although it looks likely to have a negative impact early in the year.

- If the pandemic recedes in 2022 as seems likely, the current supply chain disruptions, U.S. labor market anomalies, and consumer demand distortions should recede. This should both support overall economic growth and mitigate some of the inflationary pressures the U.S. and global economies experienced in 2021.

Source: Our World in Data, John Hopkins University CSSE COVID-19 Data. Data as of 12/31/2021

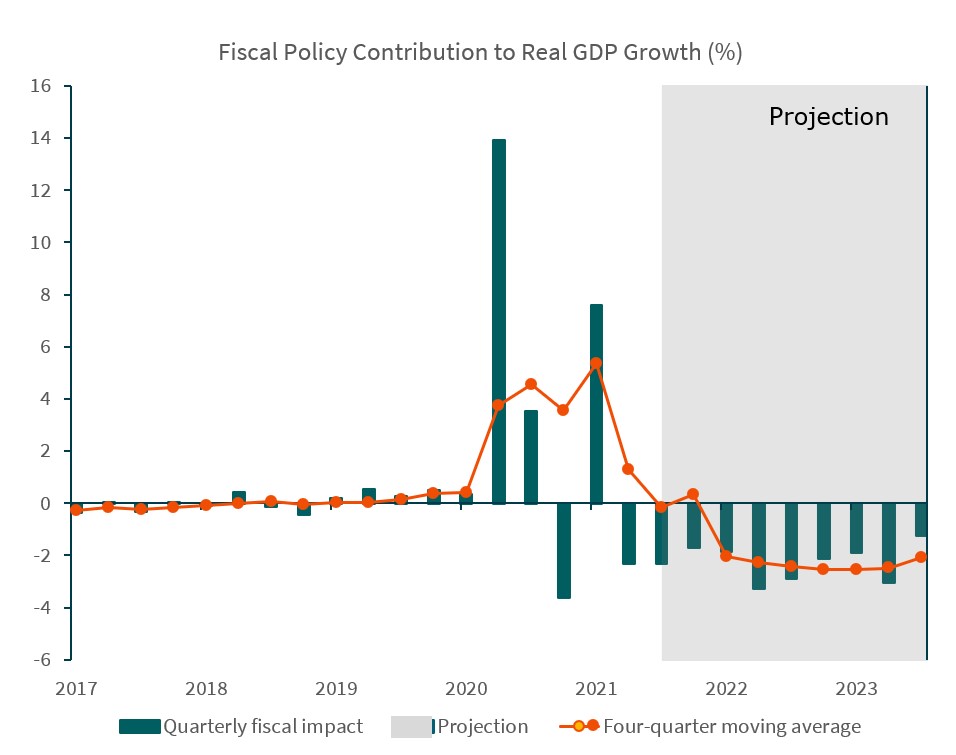

Fiscal Policy Likely to Be a Drag on U.S. GDP Growth in 2022

- Fiscal policy is set to turn from a tailwind to a headwind for U.S. GDP growth in 2022. Relative to the huge fiscal boost from 2020-2021, 2022 will see less stimulus.

- The Hutchins Center on Fiscal and Monetary Policy in Washington estimates the fiscal drag will be around 2.5% of GDP.

- Further, with the passage of the Build Back Better legislation now in doubt (as of late December), economists have started to factor in an even larger fiscal drag, reducing their forecasts for 2022 GDP growth

Source: Hutchins Center on Fiscal and Monetary Policy and Brookings Institution.

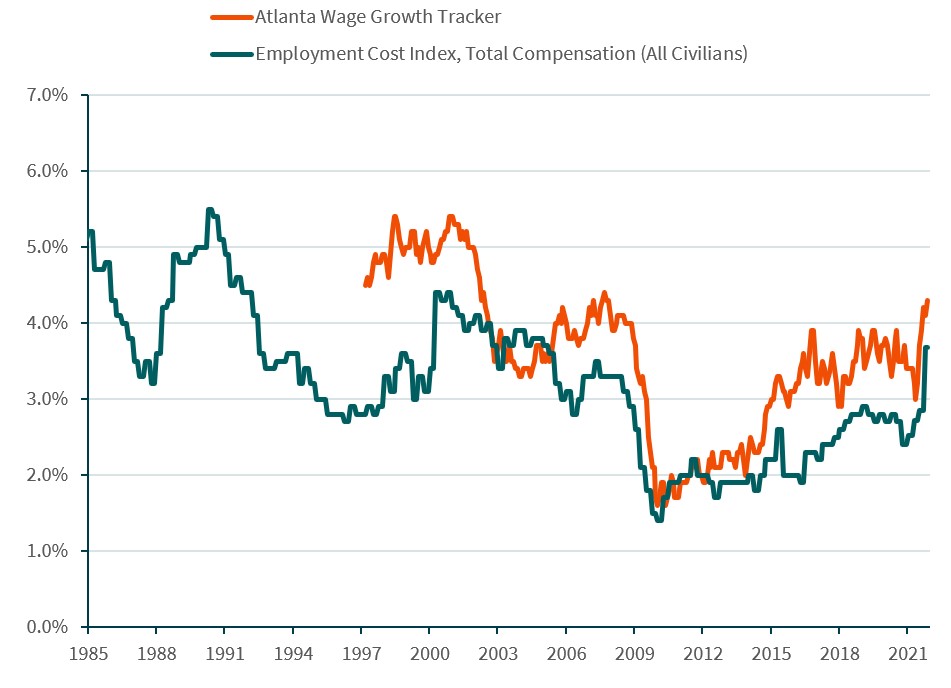

Fed Chair Powell Expressed Concern About Recent Wage Inflation Readings

- In his comments after the FOMC meeting in December, Fed chair Jerome Powell noted that core inflation has broadened beyond the industries most impacted by the pandemic and is well above the Fed’s 2% average target.

- He also cited a range of economic indicators that suggest the labor market is rapidly tightening (for example, a falling unemployment rate, rising wage growth, abundant job openings, and high employee quit rates).

- Powell also highlighted the importance of keeping inflation expectations in check to prevent a self-fulfilling inflationary spiral, saying “There is a real risk now that inflation may be more persistent and that may be putting inflation expectations under pressure…”

Source: Federal Reserve Bank of Atlanta and Bureau of Labor Statistics. Data as of 11/30/2021.

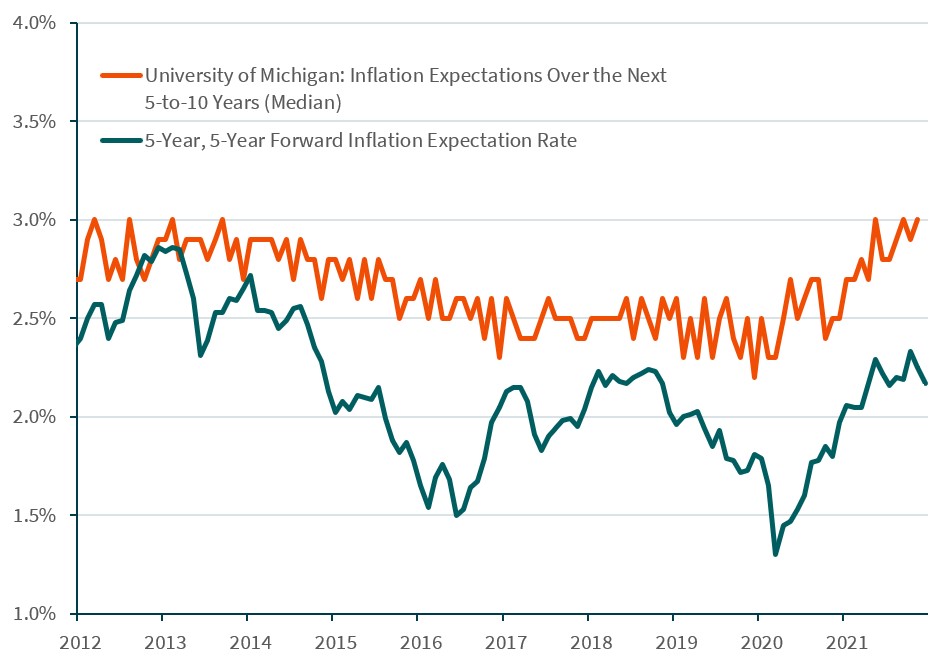

Long Term Inflation Expectations Have Risen but Remain Within the Fed’s Target Range

- While there has been a rise in longer-term inflation expectations, these expectations still remain within the Fed’s target range.

- With both its inflation and full employment mandates likely to be met, the Fed will be in position to start tightening monetary policy (raising rates and reducing their balance sheet assets) in 2022, maybe as early as March.

Source: Federal Reserve Bank of St. Louis and University of Michigan. Data as of 12/31/2021.

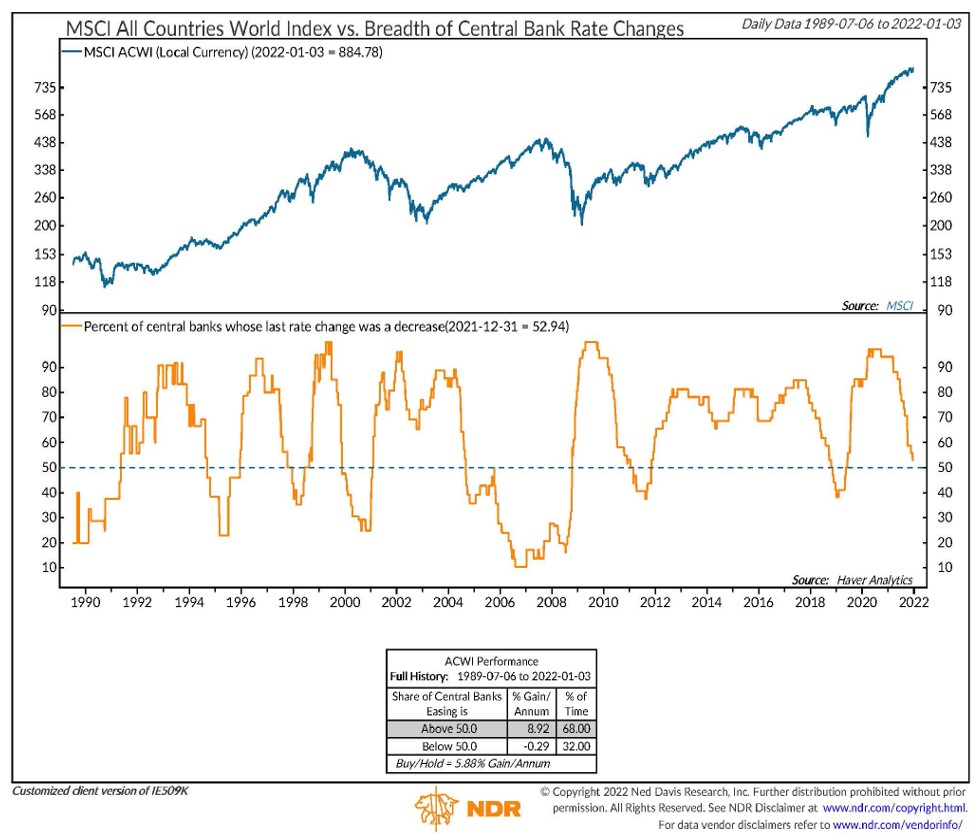

Other Central Banks Have Already Started Raising Interest Rates

- One year ago, over 90% of central banks’ last rate change was a decrease. Now that number is approaching 50%, indicating nearly half of all global central banks have already started raising interest rates.

- Notable exceptions are the European Central Bank (ECB) and the Bank of Japan (BoJ), both of which have signaled no intention to tighten any time soon given the state of their economies.

- Importantly, China’s central bank (PBoC) has begun to modestly loosen policy – cutting rates and banks’ reserve requirement ratio – in response to weak economic data. This will likely accelerate in 2022, although it’s unlikely to be of the magnitude seen in response to China’s previous cyclical slowdowns in 2008, 2012, 2015, and 2020.

Source: Ned Davis Research. Data as of 1/3/2022.

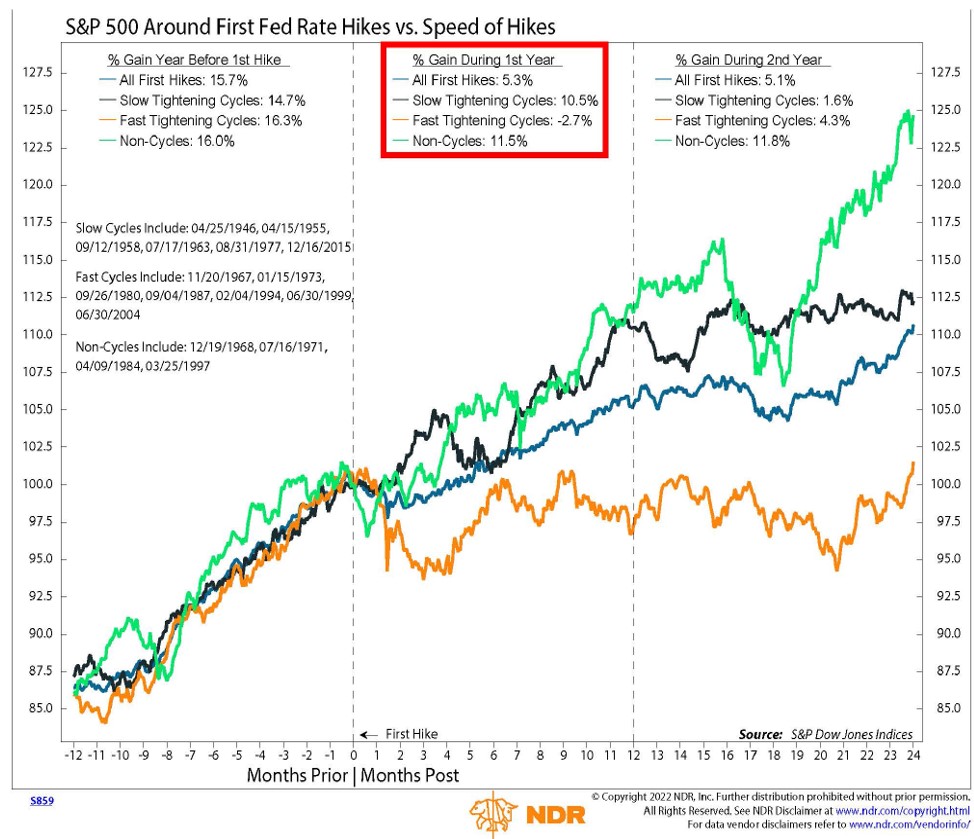

U.S. Monetary Policy Will Tighten in 2022, but Should Still Remain Supportive of Risk Assets

.

Source: Ned Davis Research.

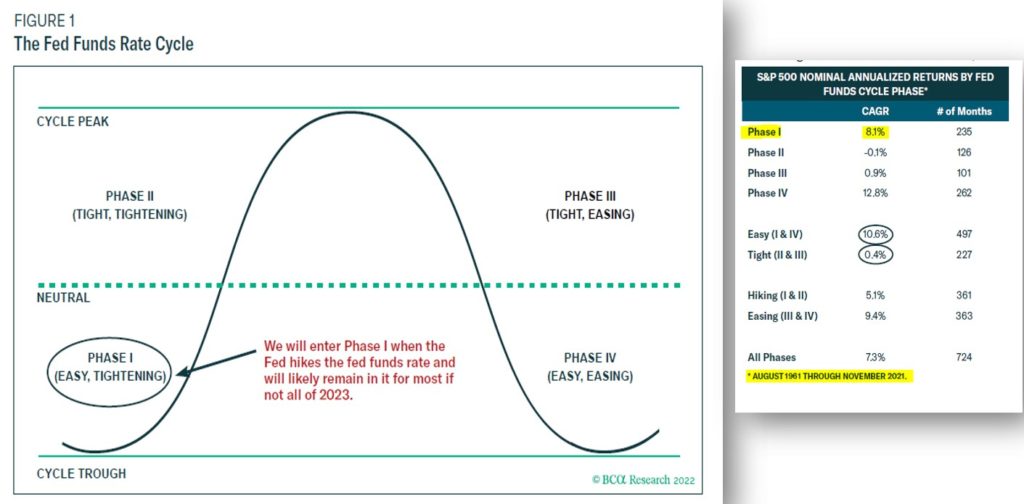

Fed Monetary Policy Phases: ‘Accommodative but Tightening’ can Still Be good for U.S. Stocks

Source: BCA Research

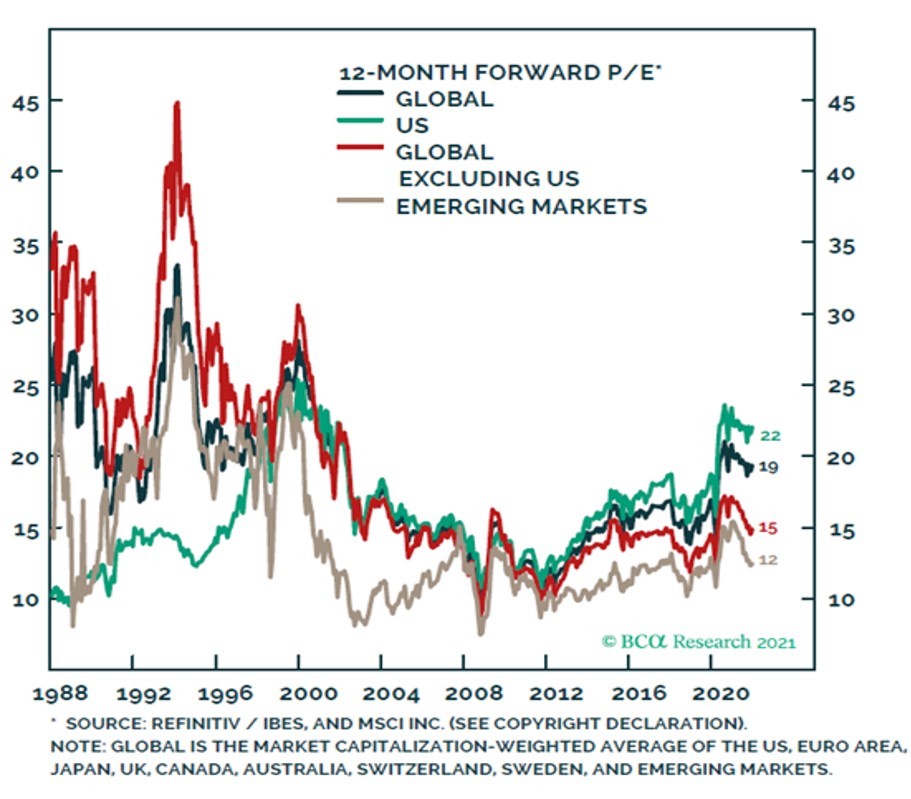

Absolute and Relative Valuations Favor Foreign Stocks

- We expect international and EM stock markets to outperform the S&P 500, due to their (1) higher cyclical sensitivity to global economic growth, (2) their larger potential for earnings acceleration and positive earnings surprises after lagging U.S. stocks the past several years, and (3) their much lower starting equity market valuations.

- As such, we see the likelihood for strong returns to foreign markets from both improving fundamentals (cyclical earnings rebound) and, as investor sentiment improves, higher valuations (price-to-earnings multiples) over the coming year(s).

Source: BCA Research

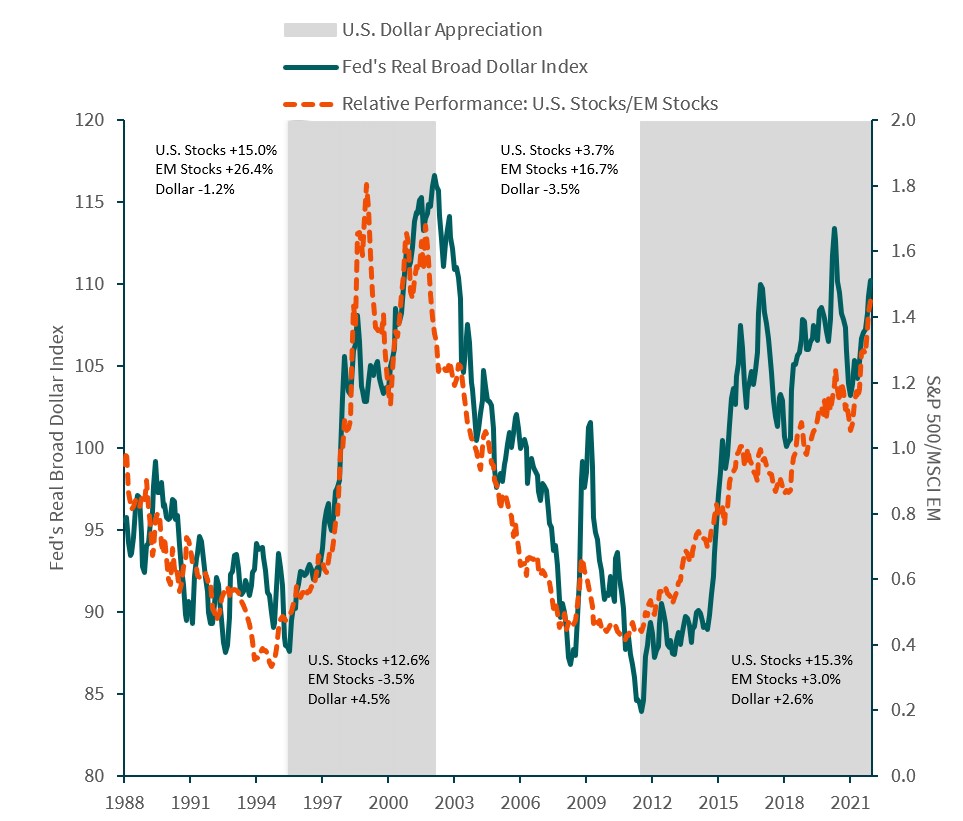

The U.S. Dollar Is a Key Variable for EM Equity Returns Over Time

Source: Board of Governors of the Federal Reserve System and Morningstar Direct. Data as of 12/31/2021. Returns are annualized.

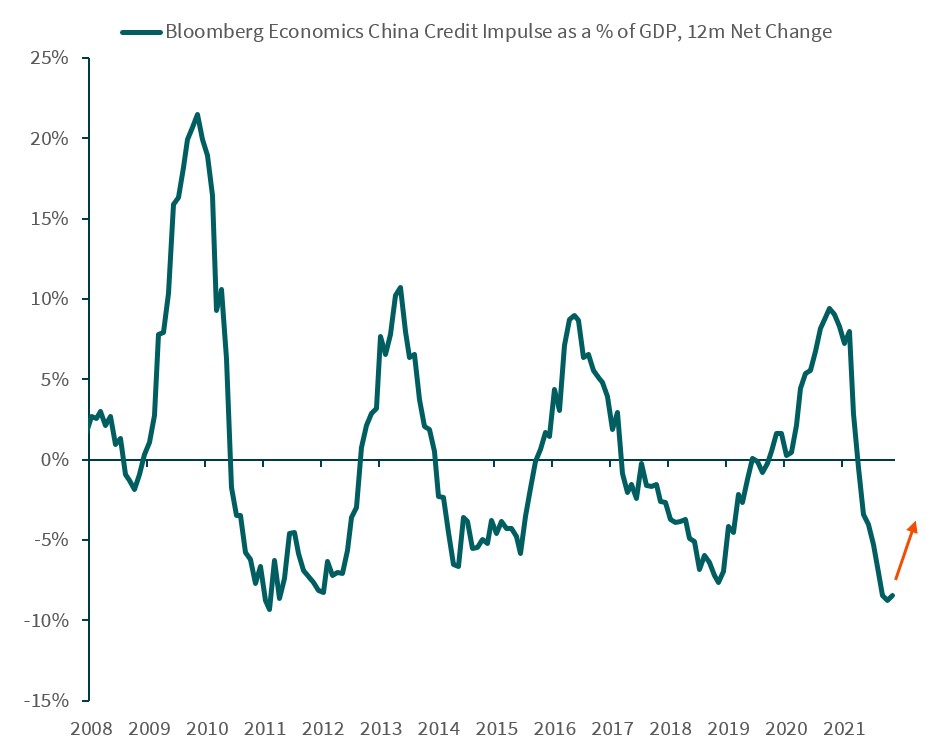

Will China’s Government Policy Loosen and Credit Impulse Turn Upward in 2022?

- A key driver for EM equities is the performance of China’s economy and stock market. One widely followed indicator for China’s economy is the China credit impulse, which measures the change in newly issued public and private credit (the flow of credit) as a percentage of GDP.

- The chart shows there have been four distinct credit cycles over the past 12 years. The credit impulse recently reached historically low levels, but indications are the Chinese authorities are starting to loosen credit again. While not likely to reach levels seen in prior cycles, as China is focused on slower but more sustainable GDP growth, it is still likely to be sufficient to spark a turnaround in the economy and equity market.

Source: Bloomberg. Data as of 11/30/2021

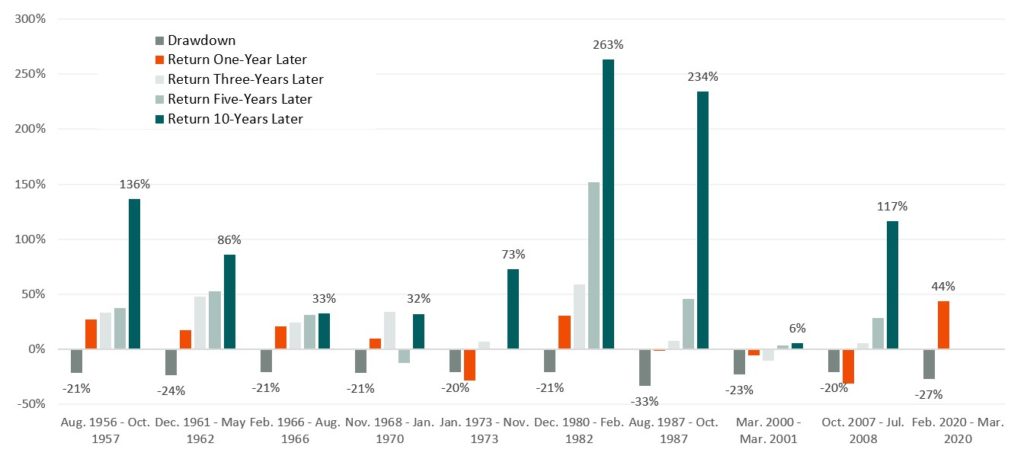

What Happens After Bear Market Declines

- Historically, market declines are followed by market strength and typically grow stronger the longer the time period measured.

- This observation speaks to the importance of viewing investments over a long-time horizon.

- Note that some of the five- and 10-year performance shown in the chart overlap periods, but the results reflect what an investor experienced following the 20%-plus market drop.

Bear Market (decline of 20% of more from previous high). Source: Morningstar Direct.