Market Review

- U.S. Stocks (S&P 500 Index) continued to grind higher thanks to strength in corporate earnings. U.S. large cap stocks gained 2.7% in the quarter—bringing their calendar year gain to 17.9%. Returns continue to be driven by stocks in the tech sector, lifted by the optimism around Ai-driven investment themes. U.S. small cap stocks had a positive quarter (up 2.2%) but finished 2025 with returns lower than their large-cap counterpart.

- International stocks meaningfully outperformed the U.S. for the first time in years. Developed market stocks (MSCI EAFE) gained 4.9% in the quarter, bringing the year-to-date return to 31.2%. Emerging markets rose 4.7% (MSCI EM) in the quarter, lifting the year’s return to 33.6%. The decline of the U.S. dollar (down 9.4% in 2025) during the year proved to be a meaningful tailwind for foreign assets.

- The Federal Reserve resumed rate cuts in September and ended up cutting rates for the third time in December. The Fed funds rate now stands at 3.5%-3.75%. Along the Treasury curve, short rates fell in line with the Fed cuts, but the longer-end was mostly unchanged in the quarter. Investment-grade core bonds (Bloomberg US Aggregate Bond Index) finished the quarter up 1.1%, while high-yield bonds were up 1.3% (ICE BofA US High Yield).

Performance reflects index returns as follows (left to right): Bloomberg US Aggregate, ICE BofA US High Yield, S&P 500, Russell 2000, MSCI EAFE, MSCI EM, SG Trend Index. Source: Morningstar Direct. Data as of 12/31/2025.

Uncertainty and Volatility Spike Around April’s Tariff Announcement

- Stock and bond volatility jumped to multi-year highs following President Trump’s announcement of punitive tariffs against many countries.

- Volatility measures trended lower in the second half of 2025 and are back to levels historically associated with more stable and optimistic markets.

- Markets are now pricing in more upbeat times, which improves investor confidence but leaves risk assets more susceptible to negative news.

Source: Bloomberg LP. Data as of 12/31/2025.

LEI Has Been Signaling a Recession for a Couple Years

- Reliable recession indicators— such as the inverted yield curve, LEI and Sahm Rule—have all signaled that a recession was imminent.

- Recessionary LEI levels have been more representative of an industrial slowdown rather than a broad-based economic slowdown.

Source: Bloomberg LP. Data as of 12/31/2025.

The Fed Cut Has to Balance Downside in the Labor Market with Inflation

- Nonfarm payrolls have surprised to the downside as the labor market continues to cool.

- Employment growth has slowed in recent months but is not yet collapsing.

- The labor market continues to cool as the imbalance between job openings and labor supply is closed.

Source: U.S. Bureau of Labor Statistics. Data as of 12/31/2025.

As Housing Inflation Cools, It Should Help Cap Headline Inflation

- Shelter inflation has drifted meaningfully lower since post-pandemic highs. The housing component makes up nearly one-third of CPI.

- As past housing inflation figures drop of out CPI calculation, this should work to lower headline inflation.

- The Trump Administrations desire to revive the housing market could stabilize or even increase this inflation component.

Source: U.S. Bureau of Labor Statistics. Data as 11/30/2025.

Strategists Forecasting High-Single Digit Returns for the S&P 500 in 2026

- Upside surprises in earnings expectations helped drive returns higher in 2025, most sell-side strategists expect earnings growth to remain resilient in 2026.

- S&P 500 return estimates for 2026 are comprised of strong double-digit earnings growth while price multiples compress marginally.

Source: Bloomberg LP. Data as of 12/30/2025. Only includes strategist estimates made in December 2025.

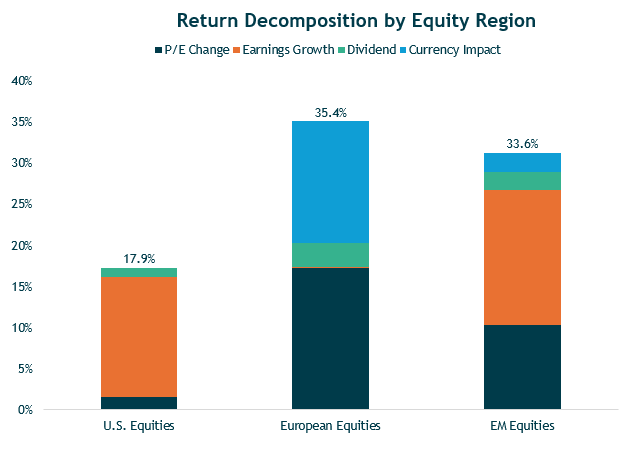

Foreign Equity Returns Were a Highlight in 2025

- Foreign equities surged in 2025 as investors cheered increased fiscal spending in Europe and domestic policies in the U.S. had investors rethink their dollar exposure.

- The U.S. dollar fell over 9% in 2025—providing a nice kicker on top of already strong foreign equity returns.

- European equities saw their 2025 return mostly driven by a falling U.S. dollar and improved sentiment (i.e., higher P/E multiple).

- Emerging-markets experienced strong earnings growth in 2025, which help boost returns in-excess of 30%.

Source: Bloomberg LP. Data as of 12/31/2025.

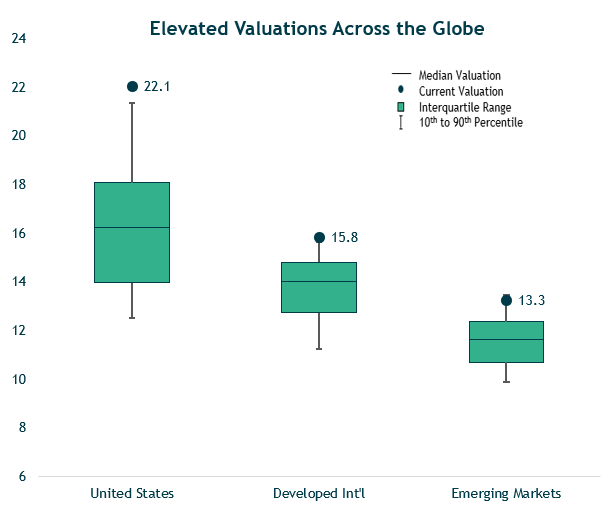

Foreign Equity Valuations Still Attractive Relative the U.S.

- Developed international and emerging-market stock have outperformed the U.S. in 2025.

- Valuations remain heady across the globe—but relative value can be found overseas.

- We remain diversified with strategic equity allocations across the U.S., developed international, and emerging markets.

Forward price-to-earnings ratio divides a current price by its estimated earnings per share (EPS) for the next 12 months. Source: Bloomberg LP. Data from 1/1/2006 to 12/31/2025.

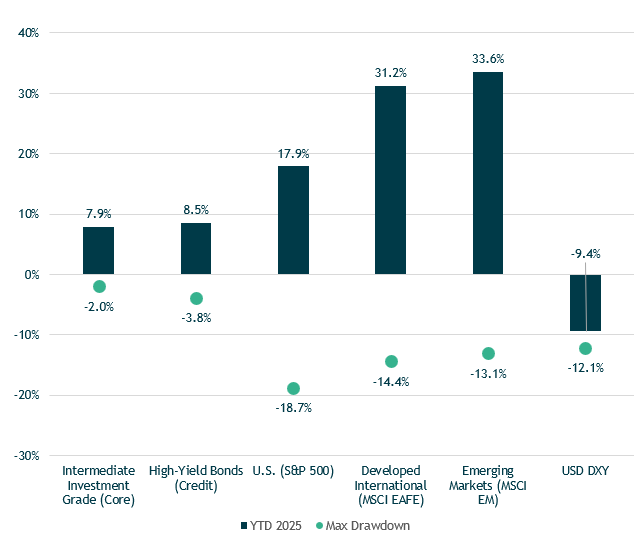

Diversification Has Benefitted Portfolios This Year

- Portfolios benefited from global diversification despite a very volatile first half of the year.

- International equities outperformed U.S. by wide margins in part due to a falling U.S. dollar.

- Fixed income also generated solid returns and importantly, provided stability when risk assets were down early in the year.

Maximum drawdown for equities calculated using price return and reflects largest peak to trough drawdown during the year. Source: Bloomberg, FactSet. As of 12/31/2025. Performance reflects index returns as follows (left to right): Bloomberg US Aggregate, ICE BofA US High Yield, S&P 500, Russell 2000, MSCI EAFE, MSCI EM, SG Trend Index. Source: Morningstar Direct. Data as of 12/31/2025.

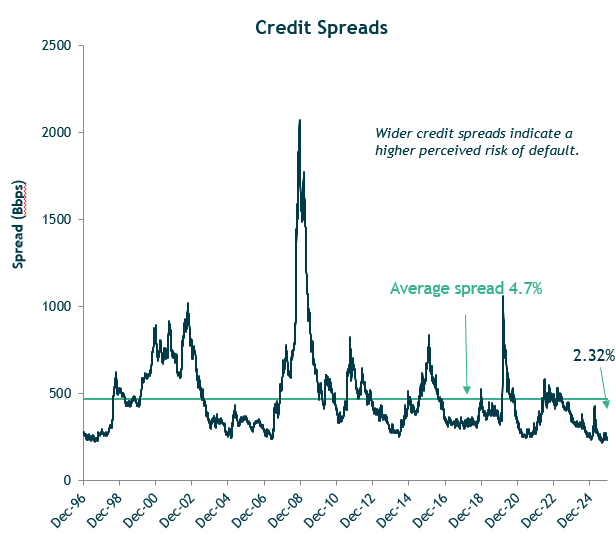

Credit Spreads Suggest Company Fundamentals Remain Healthy

- Credit markets remain strong, with investment grade and high-yield spreads tightening further, underscoring strong corporate fundamentals and demand for yield.

- We continue to like credit – over the past several years, many companies have delivered, extended maturities, and improved balance sheet quality, leaving them in a stronger position to withstand higher rates and slower economic growth.

Source: Bloomberg. As of 12/31/2025.