21 Jan 2026

4th Quarter Newsletter 2025

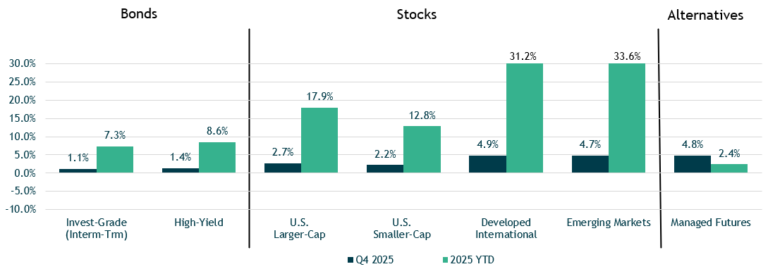

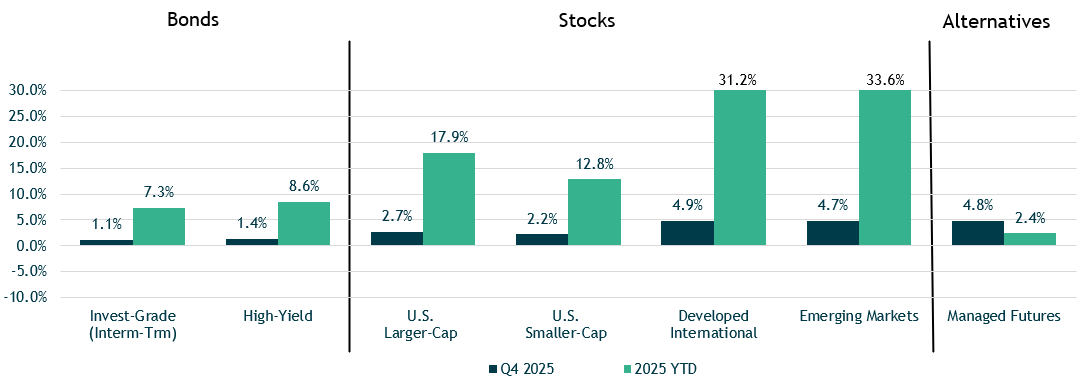

Market Recap U.S. equity markets finished the fourth quarter on solid footing, with the domestic stocks rising 2.7% and ending the year up 17.9%. Gains continued to be driven by strong corporate earnings, particularly within a concentrated few technology and artificial intelligence large-cap, growth-oriented companies. Large-cap growth stocks outpaced value (18.6% vs. 15.9% for the […]

Read More

Jan 21, 2026 | Newsletters

Market Recap U.S. equity markets finished the fourth quarter on solid footing, with the domestic stocks rising 2.7% and ending the year up 17.9%. Gains continued to be driven by strong corporate earnings, particularly within a concentrated few technology and...

21 Jan 2026

4th Quarter 2025 | Outlook for the US Economy by Dr. Ray Perryman

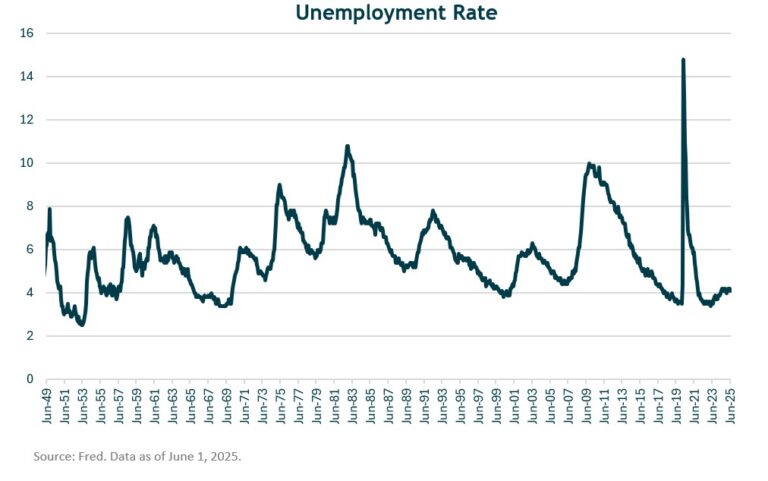

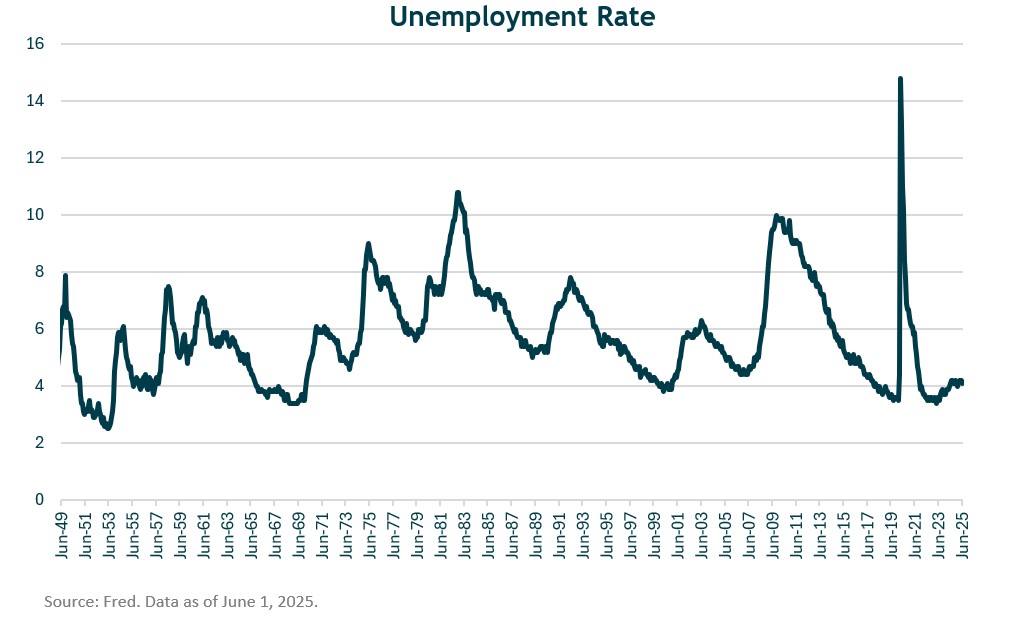

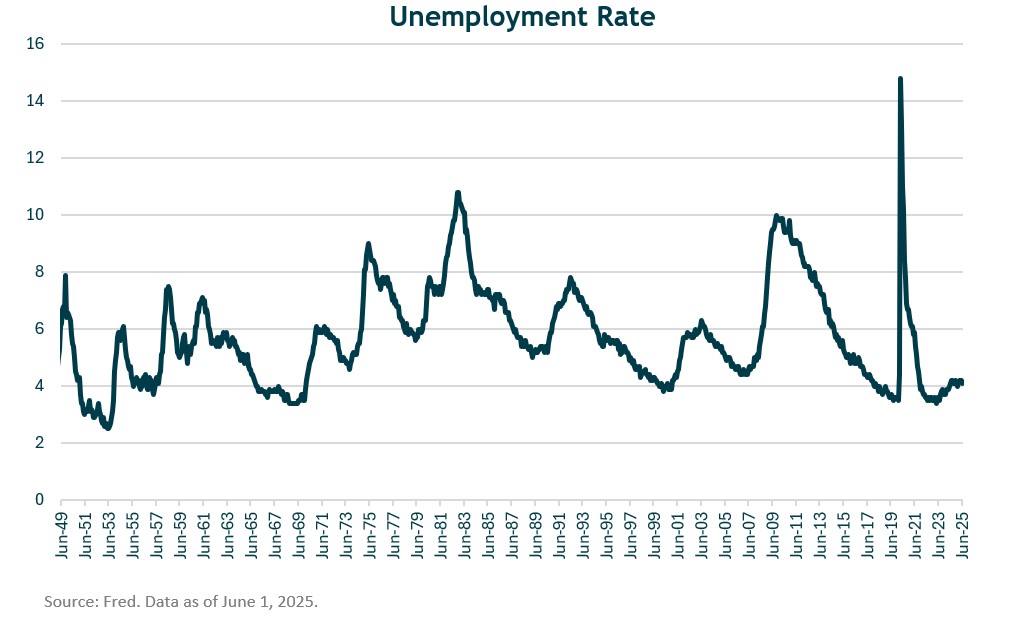

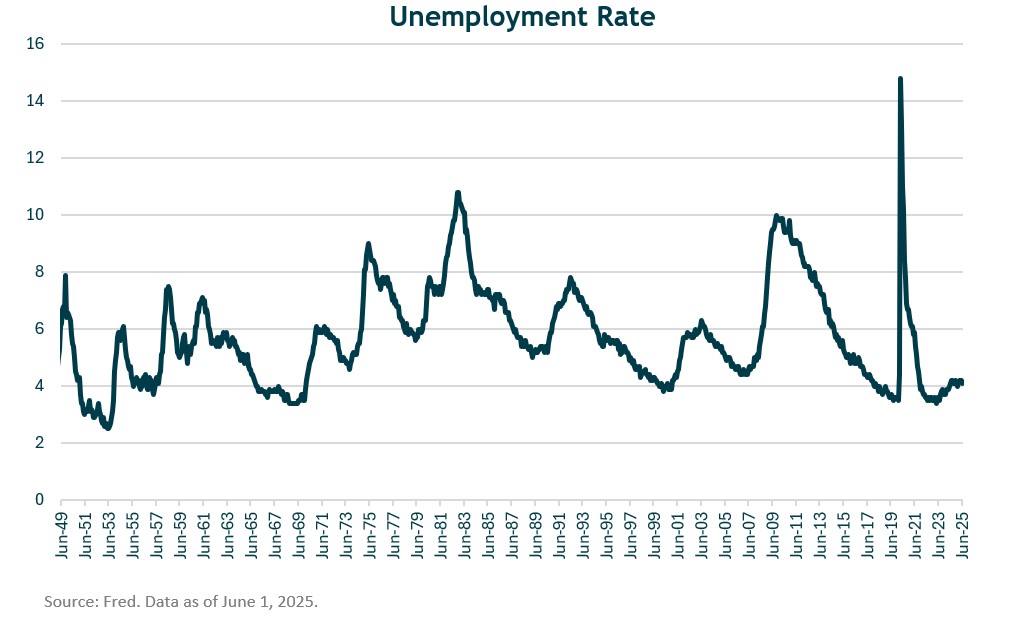

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 4th Quarter 2025 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment Job growth across the US economy has slowed significantly in recent months, and performance has been notably uneven across industries. Just 525,000 […]

Read More

Jan 21, 2026 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 4th Quarter 2025 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment Job growth across the US economy has slowed significantly in recent months, and...

21 Jan 2026

4th Quarter Charts 2025

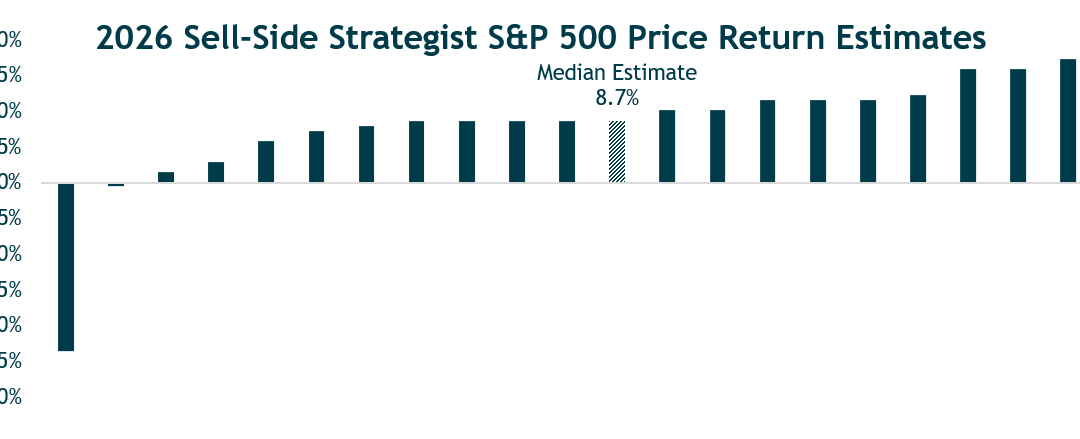

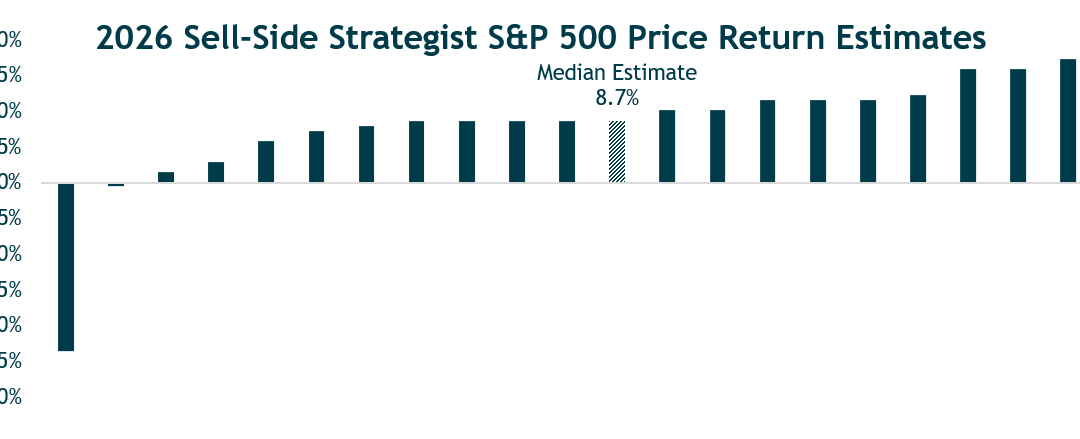

Market Review U.S. Stocks (S&P 500 Index) continued to grind higher thanks to strength in corporate earnings. U.S. large cap stocks gained 2.7% in the quarter—bringing their calendar year gain to 17.9%. Returns continue to be driven by stocks in the tech sector, lifted by the optimism around Ai-driven investment themes. U.S. small cap stocks […]

Read More20 Oct 2025

3rd Quarter Newsletter 2025

Market Recap Global equity markets continued their ascent in the third quarter, driven by strong corporate earnings growth, artificial intelligence (AI) enthusiasm and expectations of easing monetary policy. Despite investor concerns related to a slowing economy, tariffs, and a looming government shutdown, large-cap domestic stocks gained 8.1% over the quarter, ending near an all-time high, […]

Read More

Oct 20, 2025 | Newsletters

Market Recap Global equity markets continued their ascent in the third quarter, driven by strong corporate earnings growth, artificial intelligence (AI) enthusiasm and expectations of easing monetary policy. Despite investor concerns related to a slowing economy,...

20 Oct 2025

3rd Quarter 2025 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 3rd Quarter 2025 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment Although total non-farm employment has changed little since April, looking over the past 12 months (ending in August), some 1.34 million net new […]

Read More

Oct 20, 2025 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 3rd Quarter 2025 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment Although total non-farm employment has changed little since April, looking over...

20 Oct 2025

3rd Quarter Charts 2025

Market Review U.S. Stocks (S&P 500 Index) continued to climb the wall of worry in the third quarter, gaining over 8%. Returns continue to be driven by stocks in the tech sector, lifted by the optimism around Ai-driven investment themes. The rally extended to U.S. small cap stocks (Russell 2000), which ended the quarter up […]

Read More21 Jul 2025

2nd Quarter Newsletter 2025

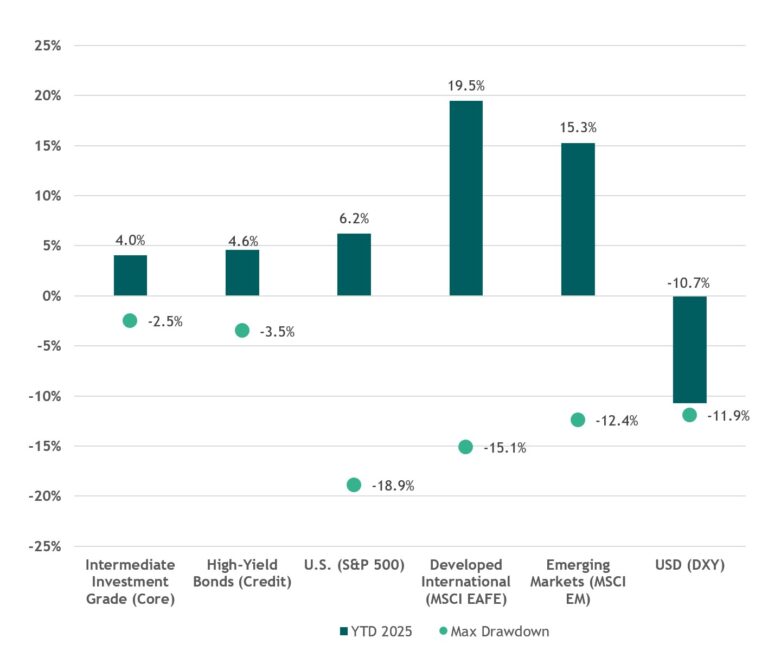

Market Recap In the second quarter of 2025, global markets faced a complex mix of encouraging economic data, ongoing geopolitical uncertainty, and evolving global central bank policies. Nonetheless, the U.S. stocks posted a strong gain, reaching a new all-time high, and fixed-income markets were positive across most segments. The broader domestic market gained 10.9% in […]

Read More

Jul 21, 2025 | Newsletters

Market Recap In the second quarter of 2025, global markets faced a complex mix of encouraging economic data, ongoing geopolitical uncertainty, and evolving global central bank policies. Nonetheless, the U.S. stocks posted a strong gain, reaching a new all-time high,...

21 Jul 2025

2nd Quarter 2025 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 2nd Quarter 2025 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy gained 1.753 million net new jobs over the twelve-month period ending June 2025 for an annual employment growth […]

Read More

Jul 21, 2025 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 2nd Quarter 2025 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy gained 1.753 million net new jobs over the...

21 Jul 2025

2nd Quarter Charts 2025

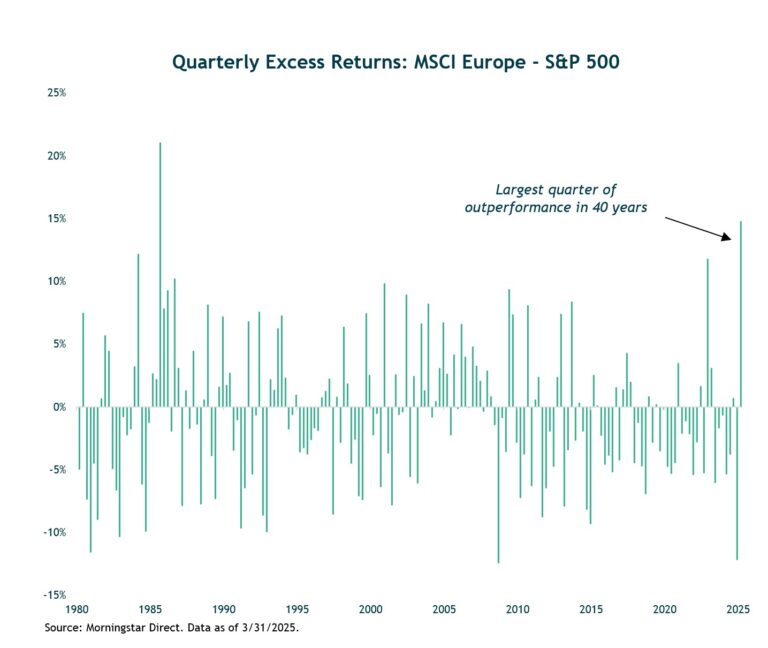

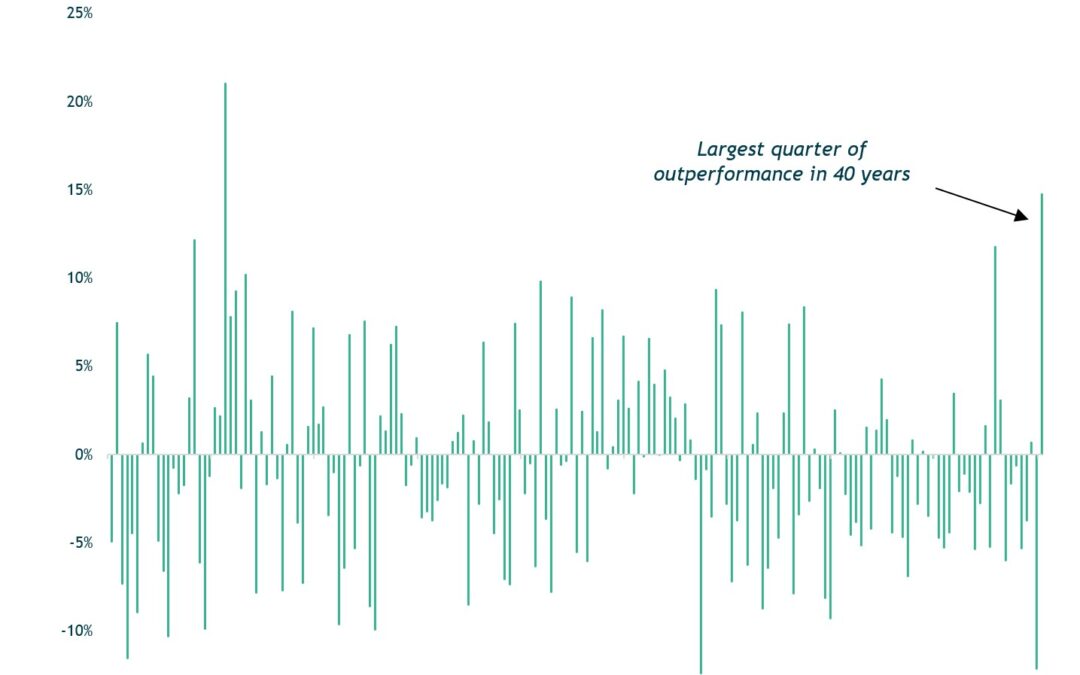

Market Review U.S. Stocks (S&P 500 Index) rebounded strongly in the second quarter, gaining nearly 11% on the back of continued earnings strength in the technology and communications sectors. The tech heavy Russell 1k Growth Index posted even stronger returns, gaining nearly 18%, lifted by optimism around Ai-driven investment themes. Smaller cap stocks (Russell 2k […]

Read More25 Apr 2025

1st Quarter Charts 2025

America’s Industrial Industry has Stagnated for a Quarter Century Over the last few decades, American manufacturing has declined in favor of lower cost manufacturing abroad. Free trade agreements benefit corporate profits via cheaper goods, but at the expense of the American worker as manufacturing jobs moved overseas (mainly to China). In a barrier-free world, it […]

Read More