17 Oct 2023

3rd Quarter Newsletter 2023

Market Recap The U.S. stock market reached a 2023 high at the end of July before selling off 7.5% through August and September to finish the quarter down 3.3%. Year-to-date the market still remains up a solid 13%. Smaller-cap stocks also had momentum early in the quarter but changed course and ended the quarter down […]

Read More

Oct 17, 2023 | Newsletters

Market Recap The U.S. stock market reached a 2023 high at the end of July before selling off 7.5% through August and September to finish the quarter down 3.3%. Year-to-date the market still remains up a solid 13%. Smaller-cap stocks also had momentum early in the...

25 Jul 2023

2nd Quarter Newsletter 2023

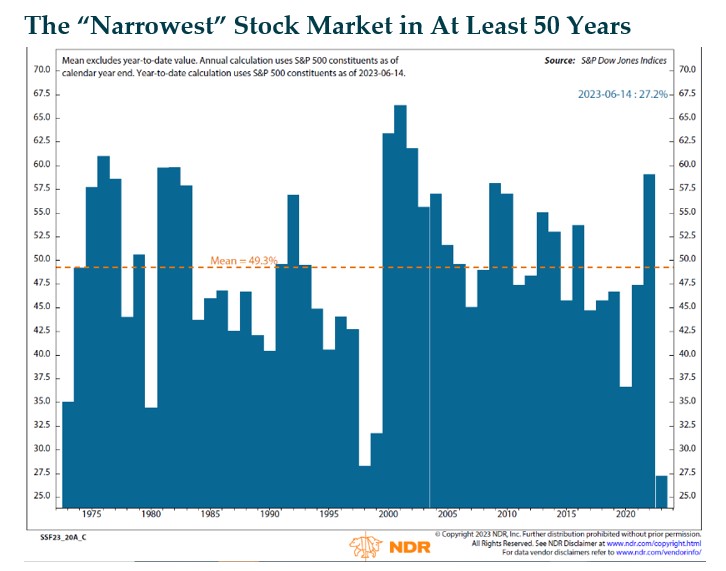

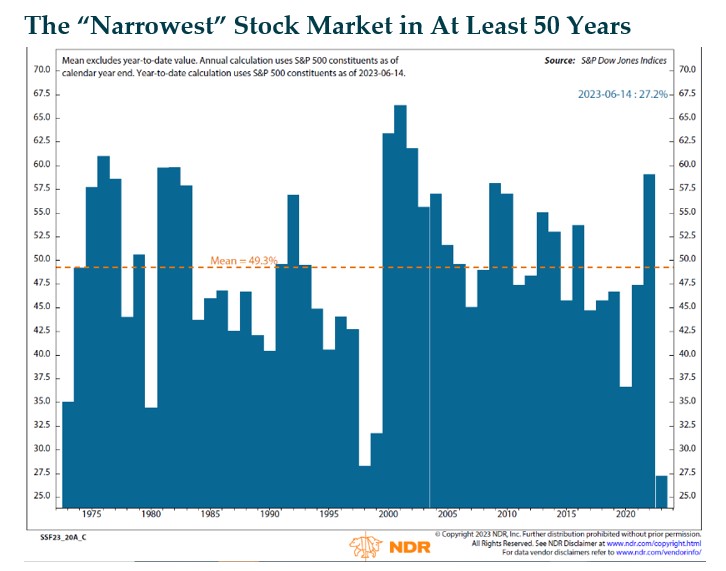

Market Recap Global equities continued to rally in the second quarter, led by surging U.S. mega-cap technology stocks, particularly anything related to Artificial Intelligence (AI). Domestic stocks gained 6.6% in June and 8.7% in the second quarter, driving its year-to-date return to 16.9% overall. Outside the U.S., developed international stocks are up 11.7% for the […]

Read More

Jul 25, 2023 | Newsletters

Market Recap Global equities continued to rally in the second quarter, led by surging U.S. mega-cap technology stocks, particularly anything related to Artificial Intelligence (AI). Domestic stocks gained 6.6% in June and 8.7% in the second quarter, driving its...

15 May 2023

1st Quarter Newsletter 2023

Market Recap Despite the stress in the banking system, including the failure of Silicon Valley Bank, global equity markets held up remarkably well and posted solid returns for the quarter. The domestic stock market gained 7.5% in the first quarter. Developed international stocks did a bit better, rising 8.5% for the quarter and emerging markets […]

Read More

May 15, 2023 | Newsletters

Market Recap Despite the stress in the banking system, including the failure of Silicon Valley Bank, global equity markets held up remarkably well and posted solid returns for the quarter. The domestic stock market gained 7.5% in the first quarter. Developed...

15 May 2023

1st Quarter 2023 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 1st Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy gained 4,349,000 net new jobs over the twelve-month period ending February 2023 for an annual employment growth […]

Read More

May 15, 2023 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 1st Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy gained 4,349,000 net new jobs over...

21 Jan 2023

4th Quarter Newsletter 2022

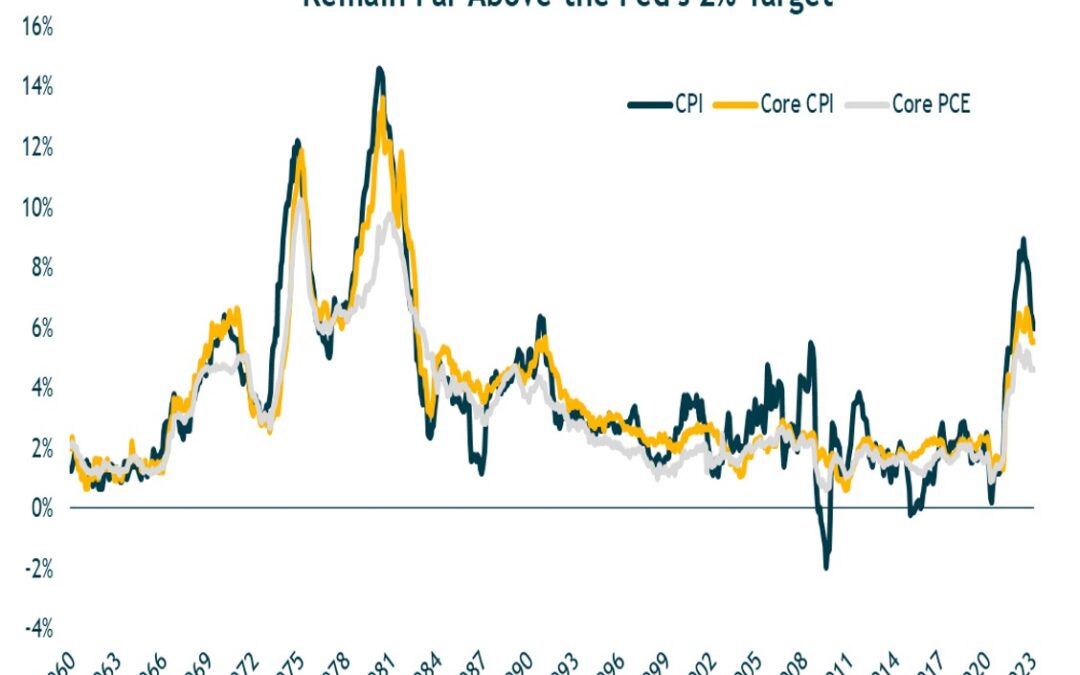

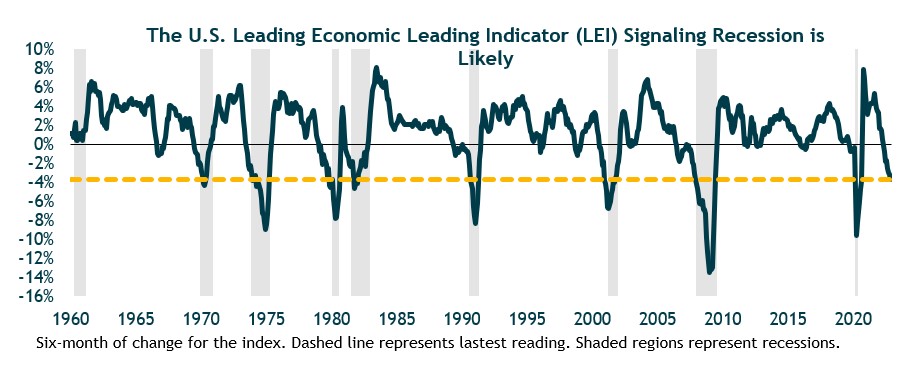

Market Recap An extremely difficult year in the financial markets ended with a thud for U.S. stocks. Following a solid early fourth quarter rally, domestic stocks slumped in December and closed out the year with an 18.1% loss, its largest annual decline since 2008. Developed international stocks were down 14.5%, while emerging market stocks were […]

Read More

Jan 21, 2023 | Newsletters

Market Recap An extremely difficult year in the financial markets ended with a thud for U.S. stocks. Following a solid early fourth quarter rally, domestic stocks slumped in December and closed out the year with an 18.1% loss, its largest annual decline since 2008....

20 Jan 2023

4th Quarter 2022 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 4th Quarter 2022 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy gained 4,419,000 net new jobs over the twelve-month period ending December 2022 for an annual employment growth […]

Read More

Jan 20, 2023 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 4th Quarter 2022 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy gained 4,419,000 net new jobs over the...