24 Oct 2024

3rd Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 3rd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Overview The US economy has remained remarkably stable in the face of geopolitical uncertainty and the effects of Federal Reserve actions needed to […]

Read More

Oct 24, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Outlook for the US Economy – 3rd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Overview The US economy has remained remarkably stable in the face of geopolitical...

21 Jul 2024

2nd Quarter Charts 2024

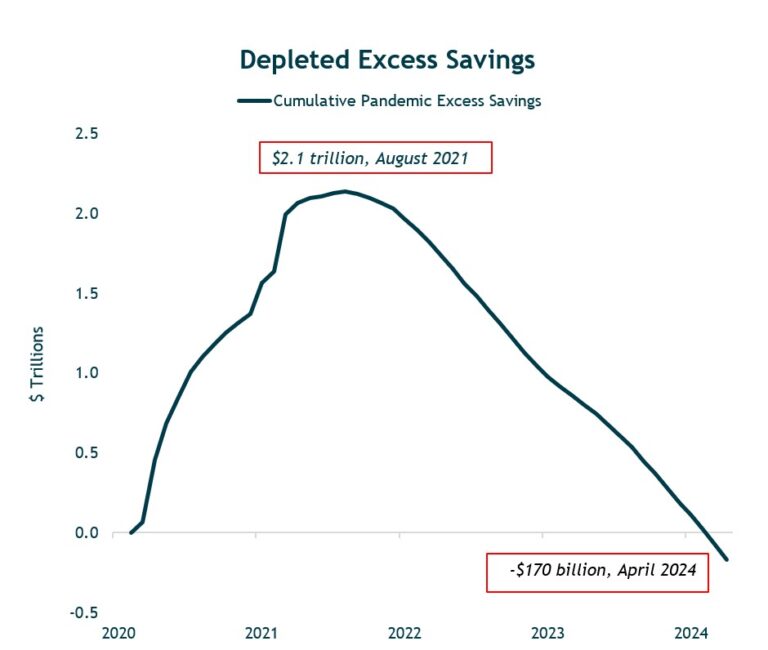

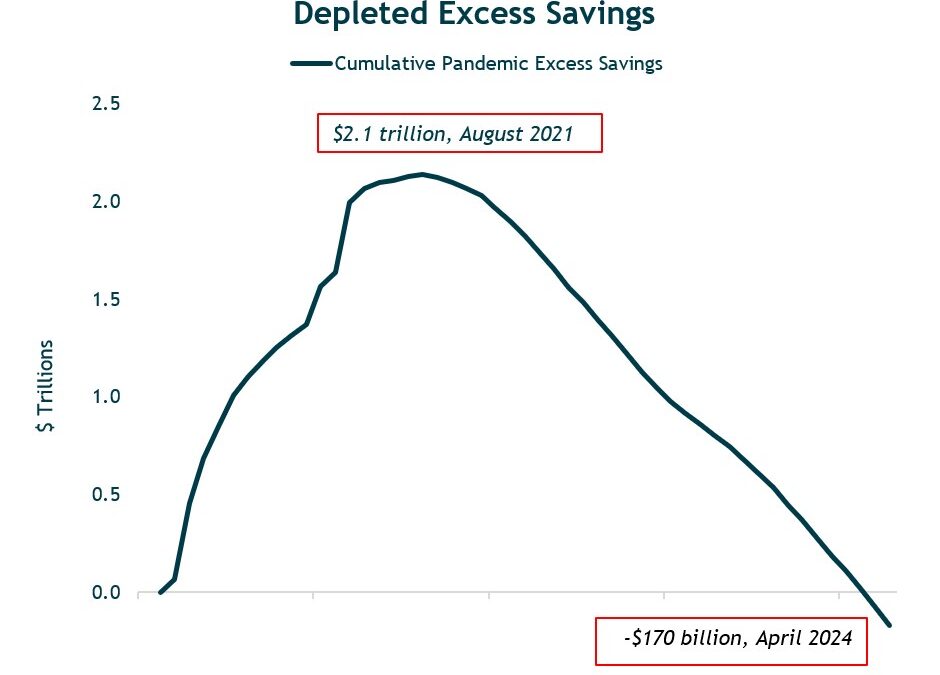

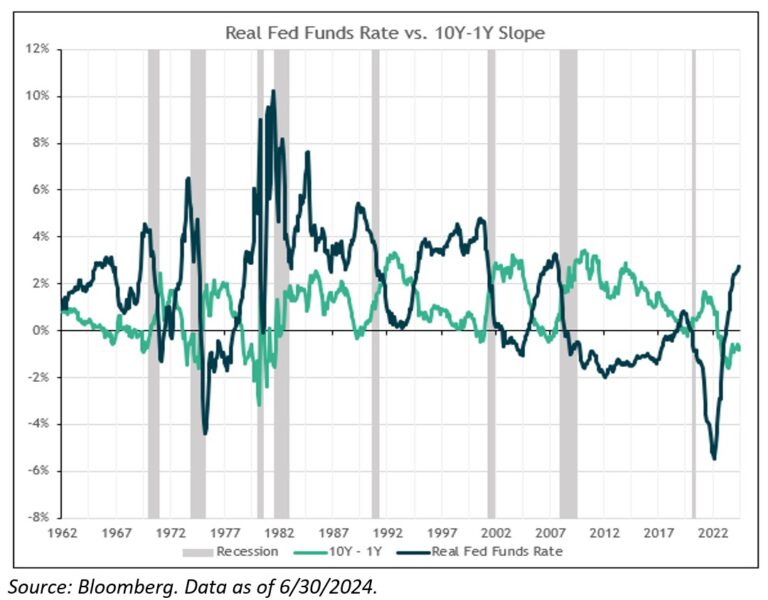

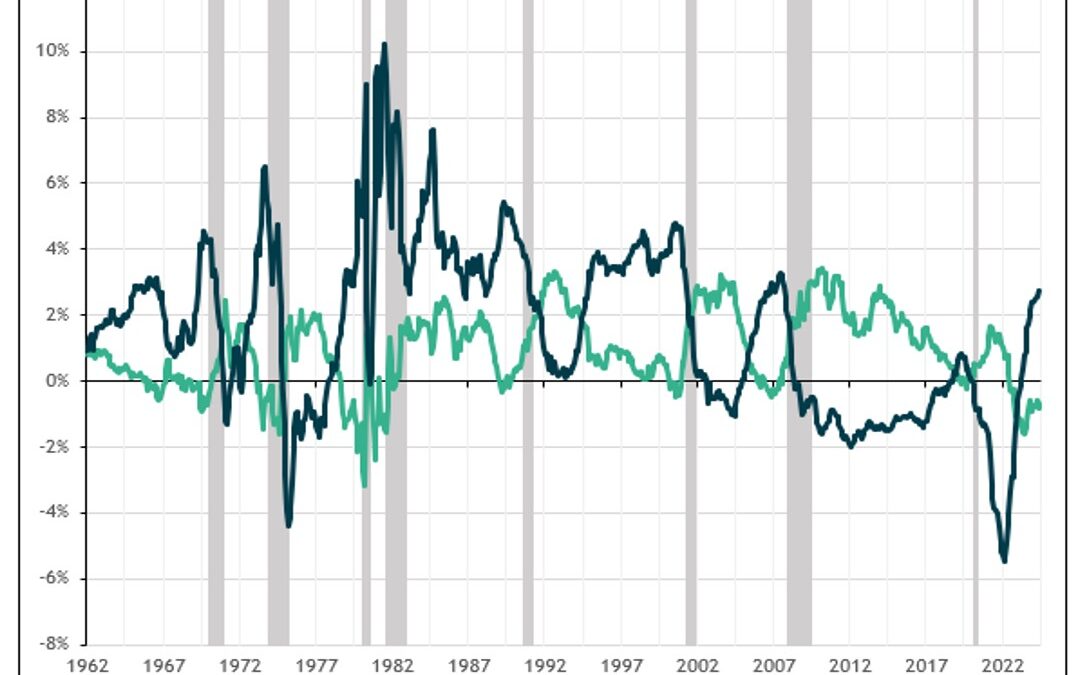

Market Review The S&P 500 Index continued to reach new highs throughout the quarter, gaining 4.3% in the three-month period. Large-cap stocks (S&P 500 Index) decidedly outperformed small-cap stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value). Overseas, results were mixed with developed international stocks (MSCI EAFE) […]

Read More17 Jul 2024

2nd Quarter Newsletter 2024

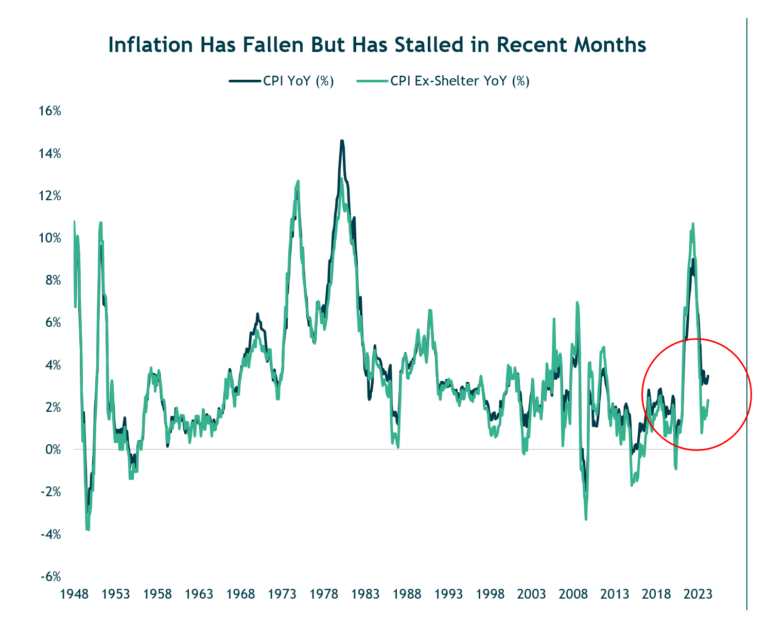

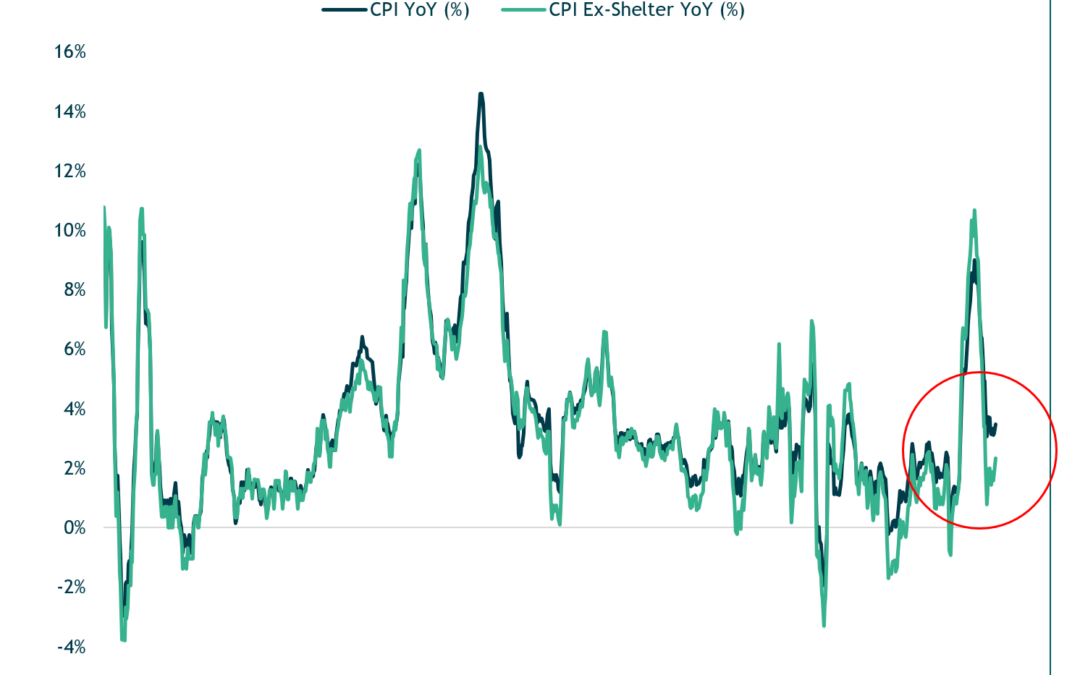

Market Recap In the second quarter of 2024, the U.S. economy remained resilient in an environment where inflation and interest rates remained higher than expectations. Tighter monetary policy was offset by accommodative fiscal policy, and a still strong US consumer. The US stock market gained nearly 4.5% in the quarter, reaching a new all-time high. […]

Read More

Jul 17, 2024 | Newsletters

Market Recap In the second quarter of 2024, the U.S. economy remained resilient in an environment where inflation and interest rates remained higher than expectations. Tighter monetary policy was offset by accommodative fiscal policy, and a still strong US consumer....

17 Jul 2024

2nd Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 2nd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment While still expanding, the US economy is showing definitive signs of slowing. Unemployment rates and the number of […]

Read More

Jul 17, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 2nd Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment While still expanding, the US economy is...

01 May 2024

1st Quarter Newsletter 2024

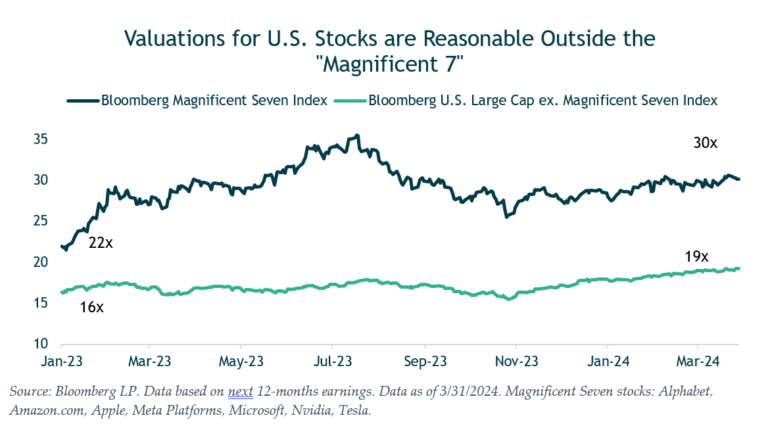

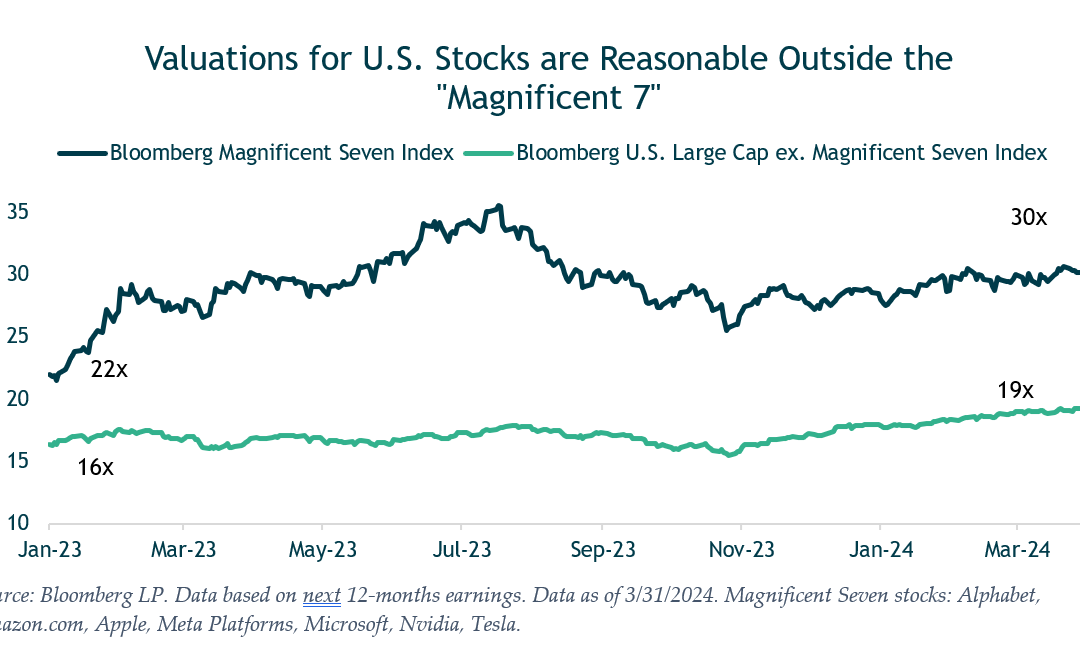

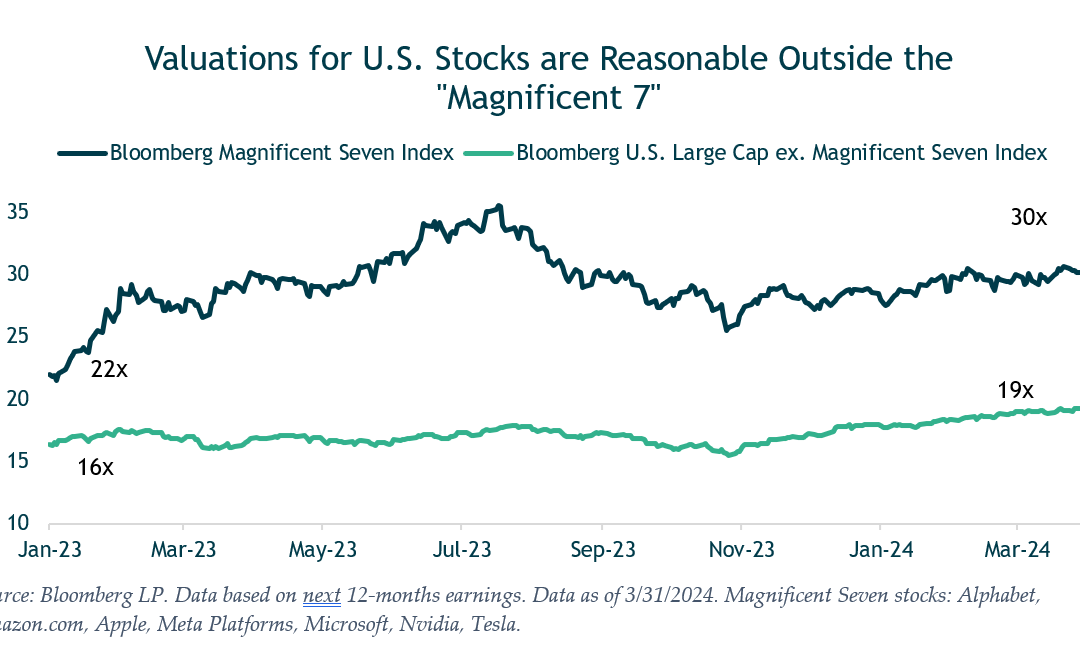

Market Recap In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings, and a convergence of market participants’ aggressive forecast of rate cuts with the Fed’s own projections. These factors […]

Read More

May 1, 2024 | Newsletters

Market Recap In the first three months of 2024, the U.S. economy remained resilient despite short-term interest rates sitting near 20-year highs. Noteworthy in the quarter was the continuing robustness in the labor market, stronger-than-anticipated corporate earnings,...

01 May 2024

1st Quarter 2024 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 1st Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The US economy continues to defy the expectations of many, gaining jobs at a surprising pace given the […]

Read More

May 1, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The Perryman Group Outlook for the US Economy – 1st Quarter 2024 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The US economy continues to defy the...

01 May 2024

1st Quarter Charts 2024

Market Review The S&P 500 Index continued to reach new highs throughout the quarter, gaining 10.6% in the three-month period. Large-cap stocks (S&P 500 Index) decidedly outperformed small-cap stocks (Russell 2000 Index), and growth stocks (Russell 1000 Growth) again beat value stocks (Russell 1000 Value). Developed International and emerging-market stocks also posted gains but did […]

Read More25 Jan 2024

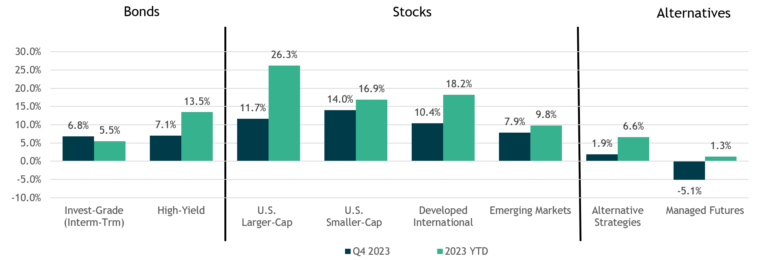

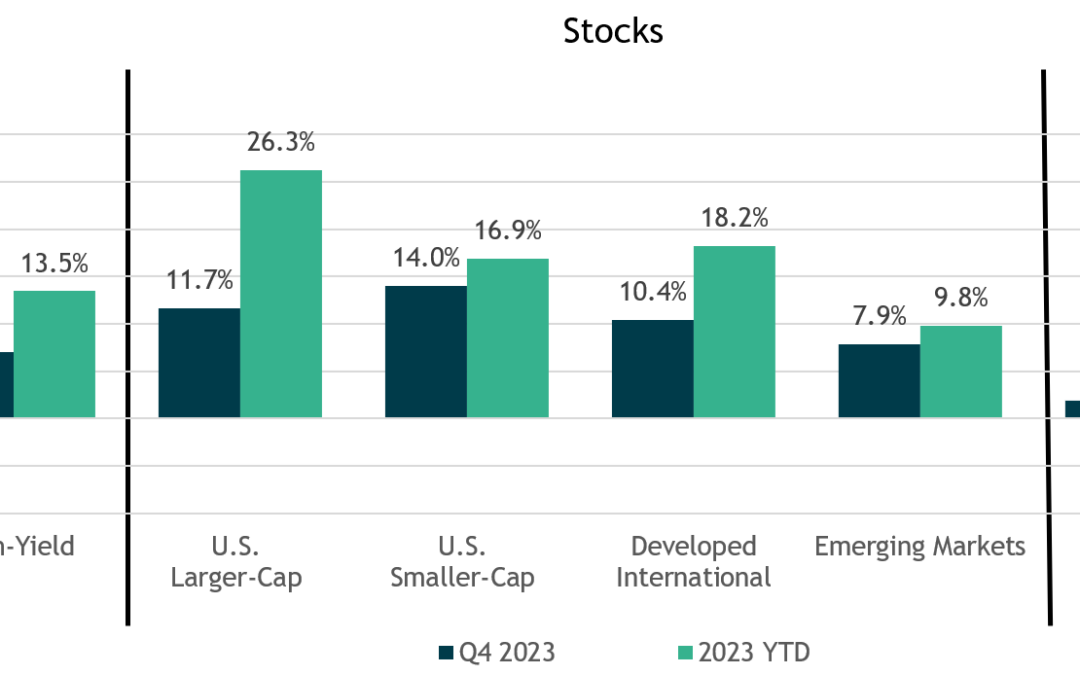

4th Quarter Charts 2023

Market Review Aided by a powerful year-end rally, U.S. stocks (S&P 500 Index) jumped nearly 12% in Q4 to finish up 26% for the year, and end within a whisper of its all-time high. Smaller-cap stocks (Russell 2000 Index), which lagged their larger counterparts for most of the year, also rallied sharply in the fourth […]

Read More25 Jan 2024

4th Quarter Newsletter 2023

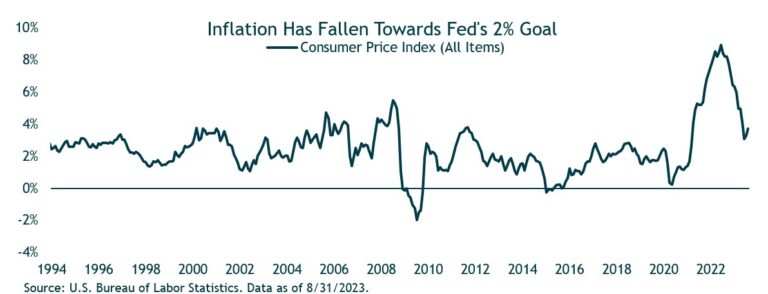

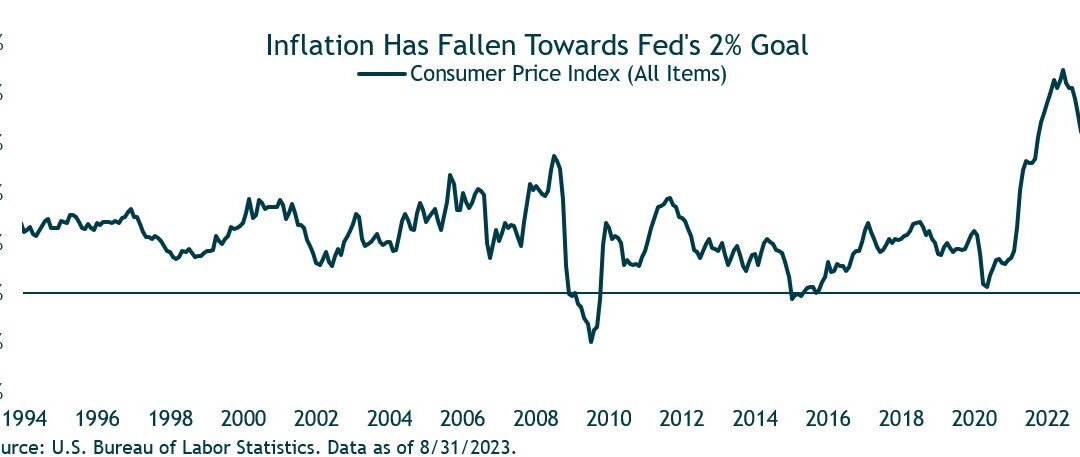

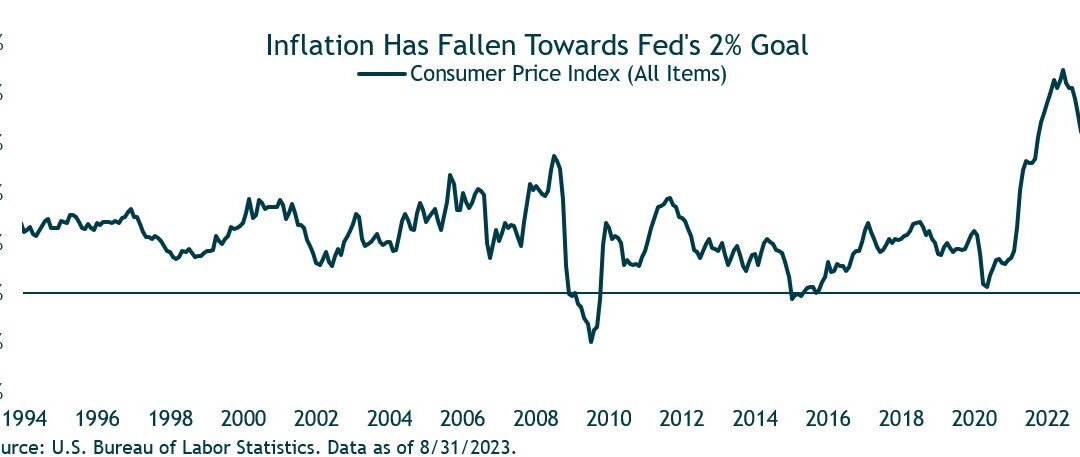

Market Recap What a difference a year makes. In 2022, high inflation and the Fed’s commitment to tame it, led to sharply rising interest rates and negative returns for both stocks and bonds. In 2023, much to the surprise of many forecasters, global stock and bond markets ignored widespread expectations that we were headed for […]

Read More

Jan 25, 2024 | Newsletters

Market Recap What a difference a year makes. In 2022, high inflation and the Fed’s commitment to tame it, led to sharply rising interest rates and negative returns for both stocks and bonds. In 2023, much to the surprise of many forecasters, global stock and bond...

25 Jan 2024

4th Quarter 2023 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 4th Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy added almost 2.9 million net new jobs during the twelve-month period ending December 2023 for an annual employment […]

Read More

Jan 25, 2024 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview Outlook for the US Economy – 4th Quarter 2023 By M. Ray Perryman, PhD, CEO and President The Perryman Group Employment The United States economy added almost 2.9 million net new jobs...