25 Oct 2022

3rd Quarter Charts 2022

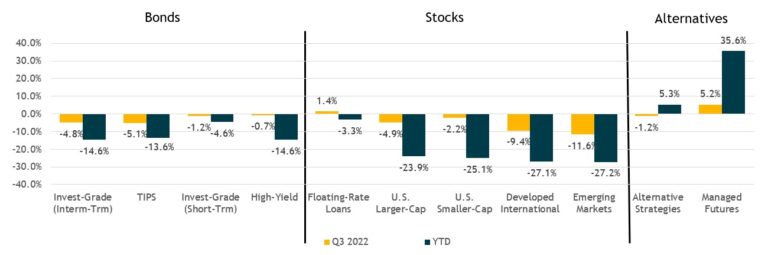

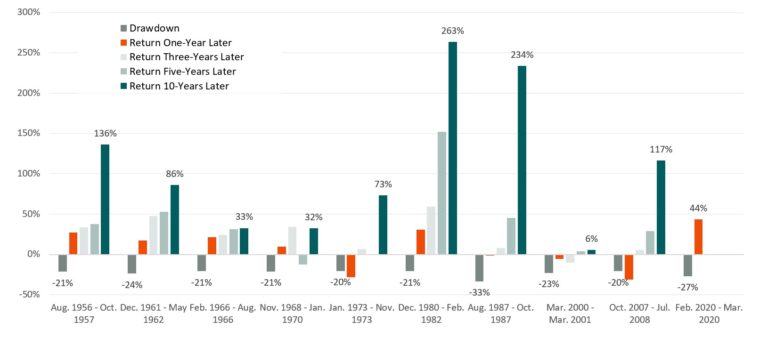

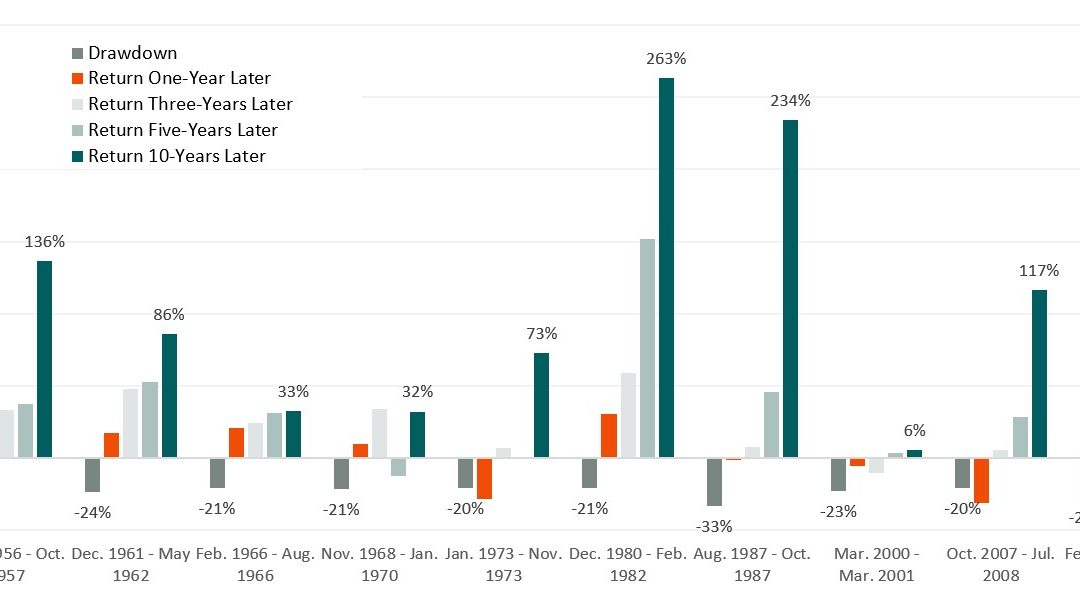

Market Review After a very difficult first half of the year, equity markets rebounded in July and August on investor hopes of an easing in inflation and a Fed pivot or pause. The reprieve was short-lived however, as stocks tumbled to fresh lows in late September amid further aggressive central bank rate hikes and statements […]

Read More22 Jul 2022

2nd Quarter Charts 2022

Market Review It’s been an extremely difficult year for investors, with equity markets falling into bear market territory (down more than 20%) and “low-risk” bond markets registering low double-digit losses. Over the past few months, the economic backdrop has worsened with sustained high inflation and slowing growth, as the Federal Reserve and other global central […]

Read More21 Jul 2022

2nd Quarter 2022 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The United States economy gained 6,469,000 net new jobs over the twelve-month period ending May 2022 for an annual employment growth rate of 4.45%. Over the past year, the arts, entertainment, recreation, accommodation, and food services industries featured both the largest job […]

Read More

Jul 21, 2022 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The United States economy gained 6,469,000 net new jobs over the twelve-month period ending May 2022 for an annual employment growth rate of 4.45%. Over the past year, the arts,...

21 Jul 2022

2nd Quarter Newsletter 2022

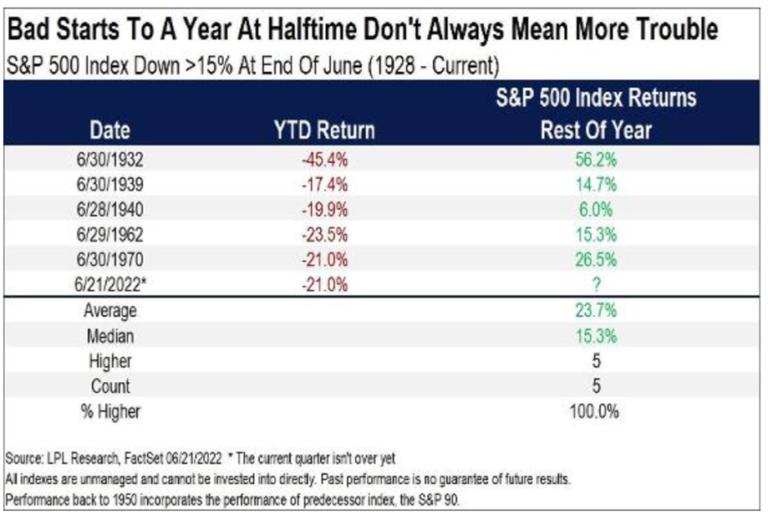

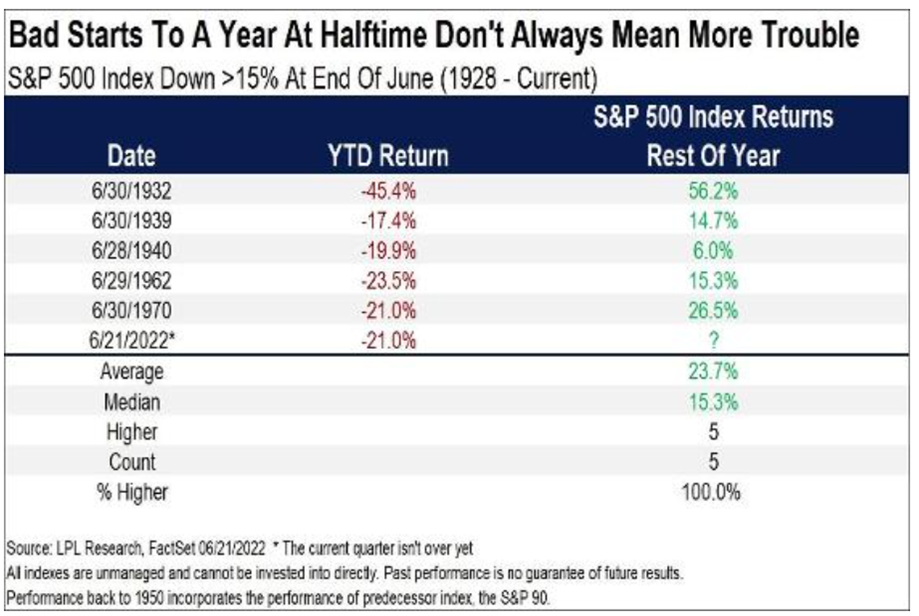

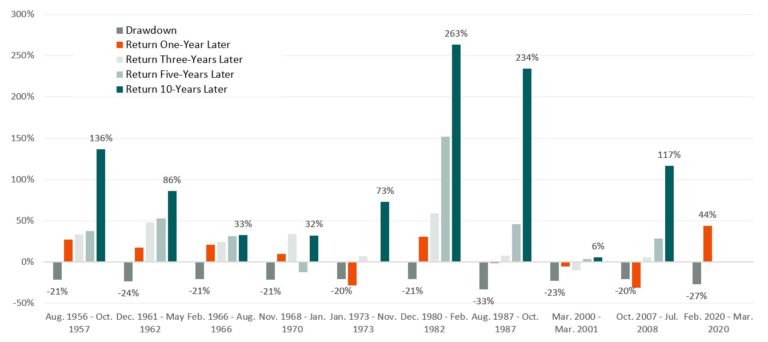

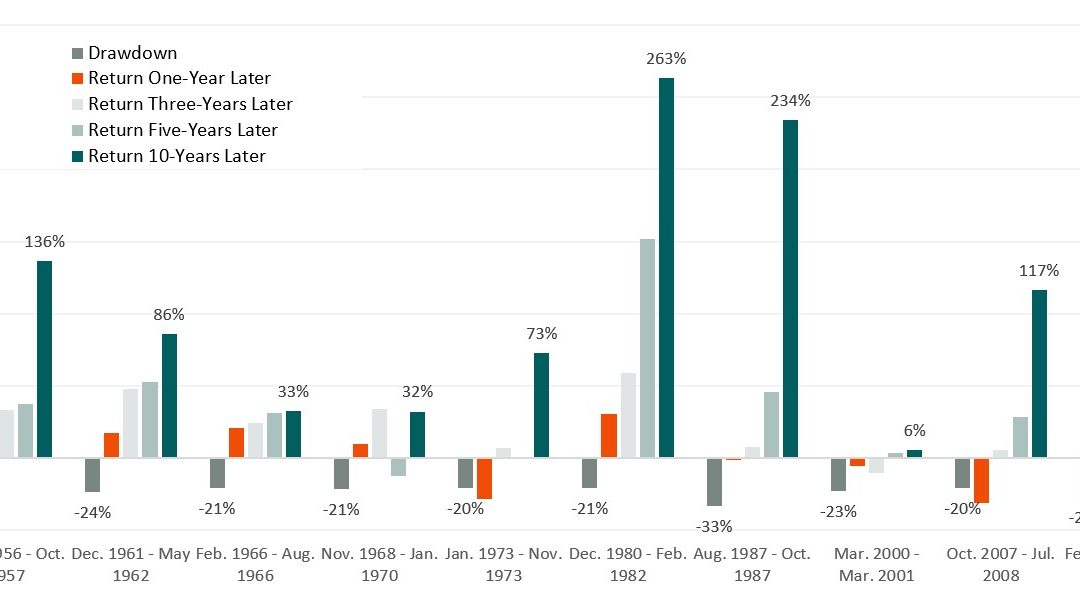

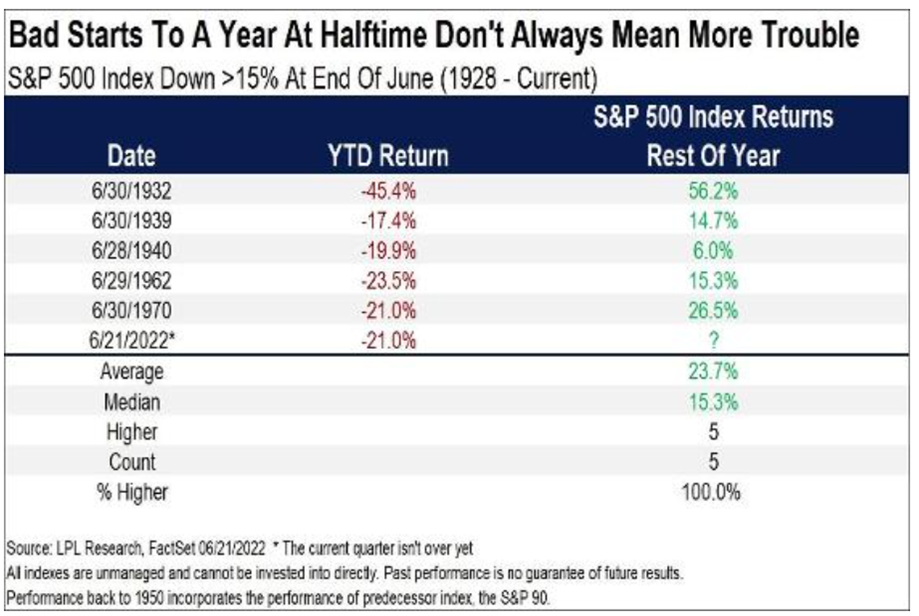

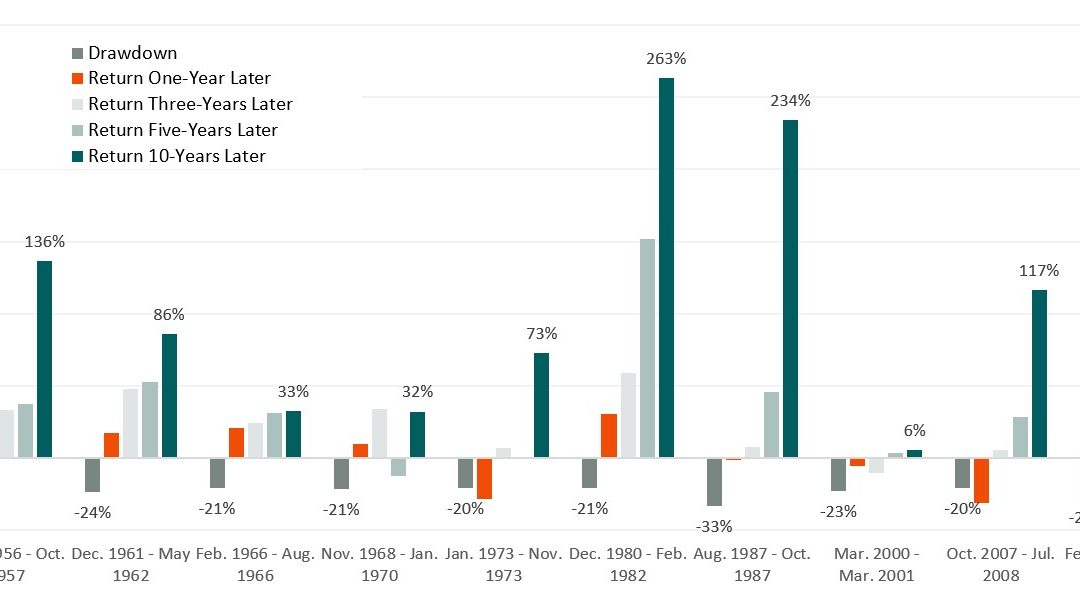

Market Recap Over the past few months, the economic backdrop has worsened with sustained high inflation, slowing growth, a tightening Federal Reserve, the continued Russian war on Ukraine, China’s zero-COVID lockdowns….and so on! Given that economic back drop, the stock and bond markets have reflected those challenges with some of the worst starts to a year […]

Read More

Jul 21, 2022 | Newsletters

Market Recap Over the past few months, the economic backdrop has worsened with sustained high inflation, slowing growth, a tightening Federal Reserve, the continued Russian war on Ukraine, China’s zero-COVID lockdowns….and so on! Given that economic back drop, the...

18 Apr 2022

1st Quarter 2022 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The United States economy gained 6,838,000 net new jobs over the twelve-month period ending February 2022 for an annual employment growth rate of 4.81%. Over the past year, the leisure and hospitality industries featured both the largest job gains (2,179,700 net new […]

Read More

Apr 18, 2022 | Newsletters

By M. Ray Perryman, PhD, CEO and President – The Perryman Group Overview The United States economy gained 6,838,000 net new jobs over the twelve-month period ending February 2022 for an annual employment growth rate of 4.81%. Over the past year, the leisure and...

18 Apr 2022

1st Quarter Newsletter 2022

Market Recap A lot has happened since our year-end letter, with the biggest macro event being Russia’s brutal invasion of Ukraine. While the human impact has been devastating and tragic, our job here is to focus here on the economic and financial market impact of this event…..and it was a rough first quarter across the […]

Read More

Apr 18, 2022 | Newsletters

Market Recap A lot has happened since our year-end letter, with the biggest macro event being Russia’s brutal invasion of Ukraine. While the human impact has been devastating and tragic, our job here is to focus here on the economic and financial market impact of this...

17 Apr 2022

1st Quarter Charts 2022

Q1 2022 Was a Historically Challenging Period for Stocks and Bonds Global stocks and US core bonds are both down year to date as markets digest higher inflation, rising interest rates, and geopolitical uncertainty As we’ve discussed for some time, rising inflation and rising interest rates creates challenges for both stocks and bonds, and in […]

Read More07 Feb 2022

4th Quarter Newsletter 2021

Market Recap It’s been another remarkable year for domestic stocks, with large-cap U.S. stocks returning a stunning 28.7% as a handful of large-cap tech stocks dominated the market returns as the average stock struggled. This sector meaningfully outperformed U.S. small-cap stocks which were up 14.8%, developed international stocks up 11.3%, and emerging-market stocks down 2.5% […]

Read More

Feb 7, 2022 | Newsletters

Market Recap It’s been another remarkable year for domestic stocks, with large-cap U.S. stocks returning a stunning 28.7% as a handful of large-cap tech stocks dominated the market returns as the average stock struggled. This sector meaningfully outperformed U.S....

07 Feb 2022

Quarter 4, 2021 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President Overview The US economy continues to improve, with the pace of recovery linked to the pattern in COVID-19 cases. The virus and measures to slow its spread caused the disappearance of well over 22 million US jobs in just two months back in March and April of […]

Read More

Feb 7, 2022 | Newsletters

By M. Ray Perryman, PhD, CEO and President Overview The US economy continues to improve, with the pace of recovery linked to the pattern in COVID-19 cases. The virus and measures to slow its spread caused the disappearance of well over 22 million US jobs in just two...

07 Feb 2022

4th Quarter Charts 2021

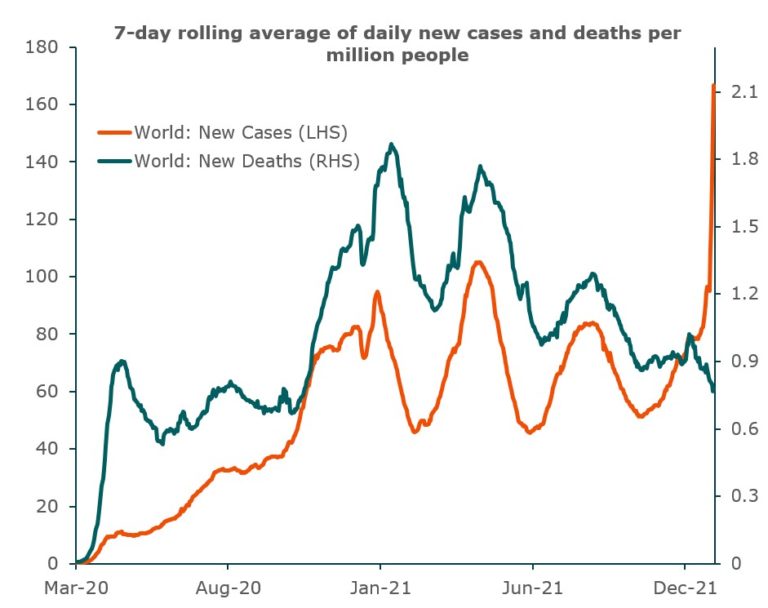

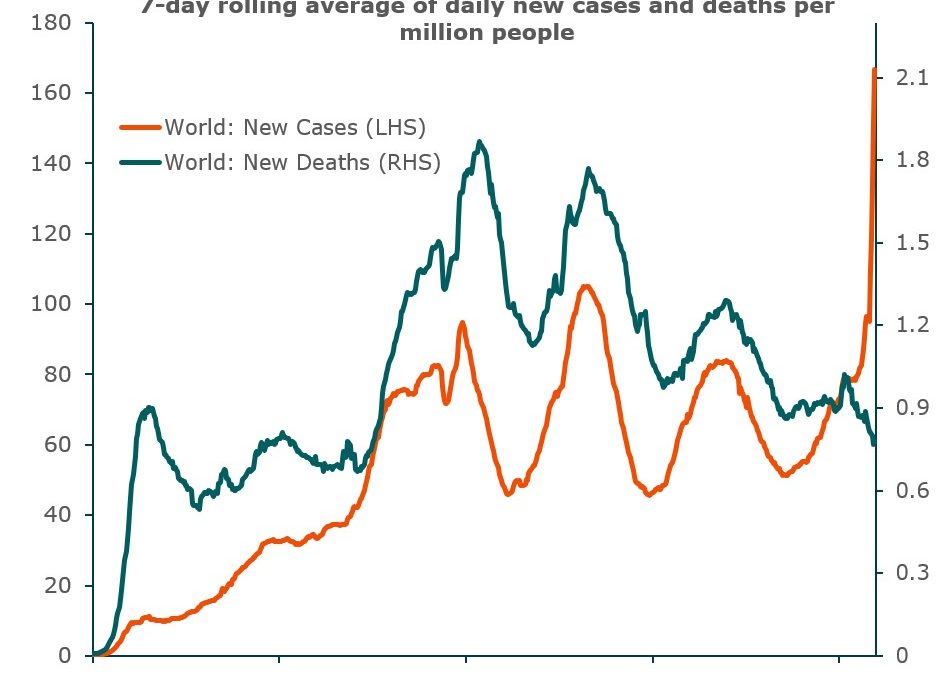

The World Faces a Fifth Wave of Covid-19 Infections, But Deaths Have Not Risen in Concert COVID-19 remains a key variable for the near-term (12-month) global economic and market outlook. We still believe the most likely medium-term (multiyear) base case is for continued progress against the virus and a lessening of its economic impact over […]

Read More