14 Jul 2021

Quarter 2, 2021 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President Overview Overview – June saw a strong acceleration in the pace of recovery in the job market. Total nonfarm payroll employment in the US rose by 850,000 according to the US Bureau of Labor Statistics, and more than 1.7 million jobs have been gained in the last […]

Read More

Jul 14, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President Overview Overview – June saw a strong acceleration in the pace of recovery in the job market. Total nonfarm payroll employment in the US rose by 850,000 according to the US Bureau of Labor Statistics, and more than 1.7...

01 Apr 2021

Quarter 1, 2021 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President Overview –In March, the US economy added 916,000 jobs, led by gains in leisure and hospitality, education, and construction. The unemployment rate fell to 6.0% and the number of unemployed persons dropped to 9.7 million. Overall, the economy is in a much better place than the lows […]

Read More

Apr 1, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President Overview -In March, the US economy added 916,000 jobs, led by gains in leisure and hospitality, education, and construction. The unemployment rate fell to 6.0% and the number of unemployed persons dropped to 9.7 million....

31 Mar 2021

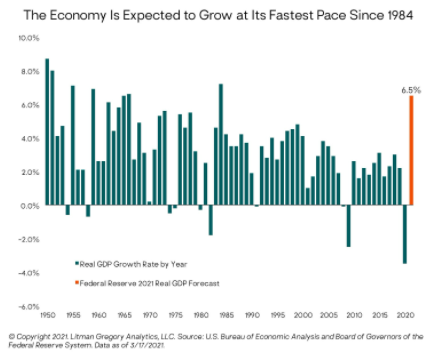

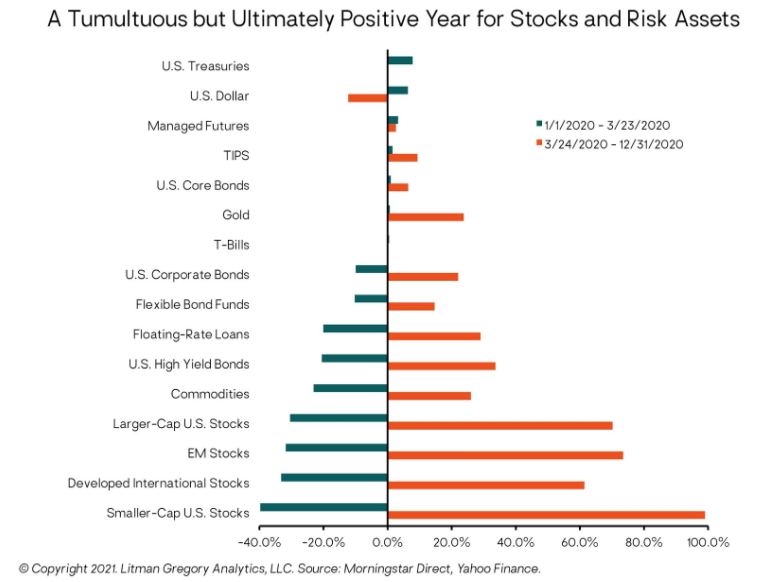

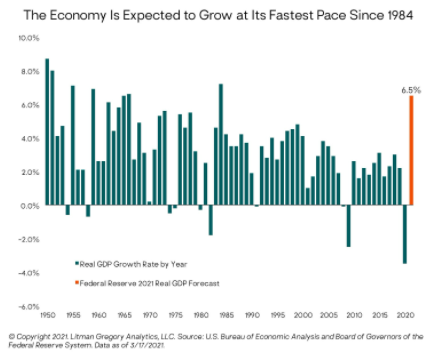

1st Quarter Newsletter 2021

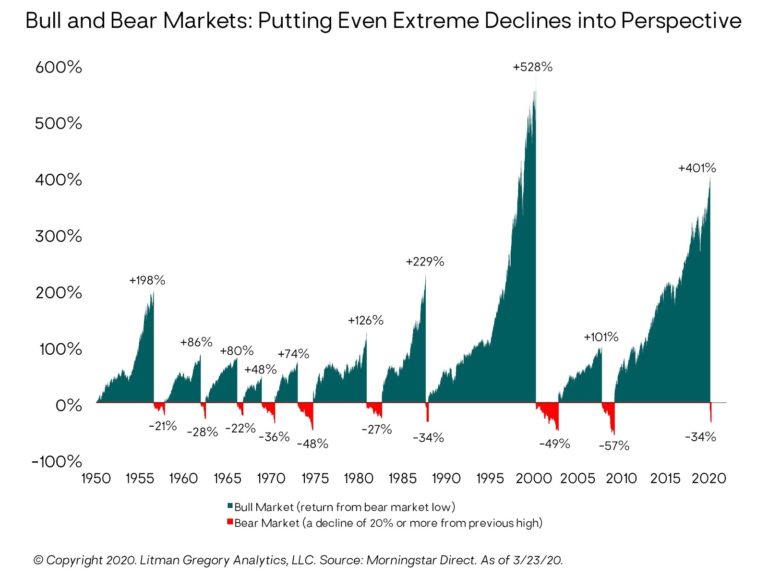

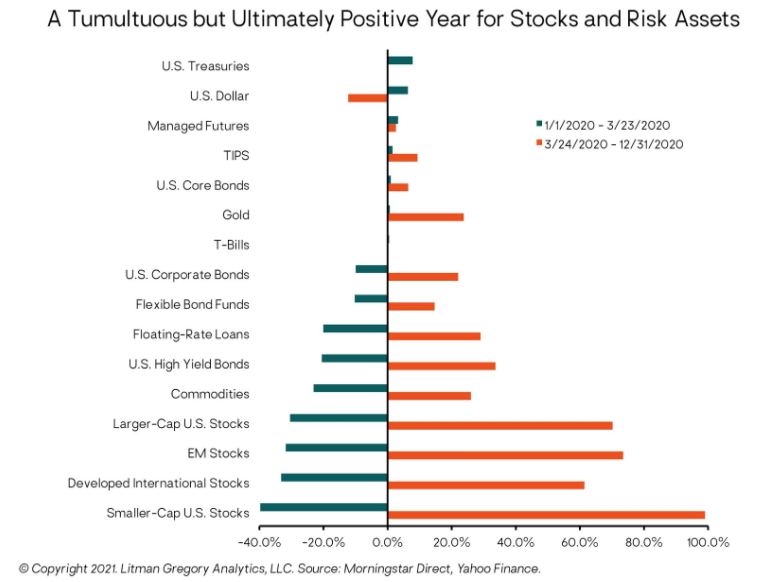

Market Recap Global stocks continued to power upward this quarter from their pandemic bear market low on March 23, 2020. The U.S. stock market gained 6.3% and international stocks gained 4.5%. The U.S. stock market is now up an astonishing 80.6%, since the bottom and its best one-year trailing return since the 1930s. Clearly, it […]

Read More

Mar 31, 2021 | Newsletters

Market Recap Global stocks continued to power upward this quarter from their pandemic bear market low on March 23, 2020. The U.S. stock market gained 6.3% and international stocks gained 4.5%. The U.S. stock market is now up an astonishing 80.6%, since the bottom and...

01 Jan 2021

Quarter 4, 2020 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President of The Perryman Group Overview – With COVID-19 vaccination programs ongoing and effective treatments better understood, a new normal should be possible at some point in 2021. There are myriad challenges, but the path is beginning to emerge. Employment – One key issue for 2021 is the […]

Read More

Jan 1, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President of The Perryman Group Overview – With COVID-19 vaccination programs ongoing and effective treatments better understood, a new normal should be possible at some point in 2021. There are myriad challenges, but the path is...

31 Dec 2020

4th Quarter Newsletter 2020

Investment Commentary – In our first quarter 2020 letter back in April, which feels like an eternity ago, we recognized that we were living through an incredible period of history. The pandemic weighed heavily on us then, as it does today. But this quarter, we look back at what we’ve endured and lay out our […]

Read More

Dec 31, 2020 | Newsletters

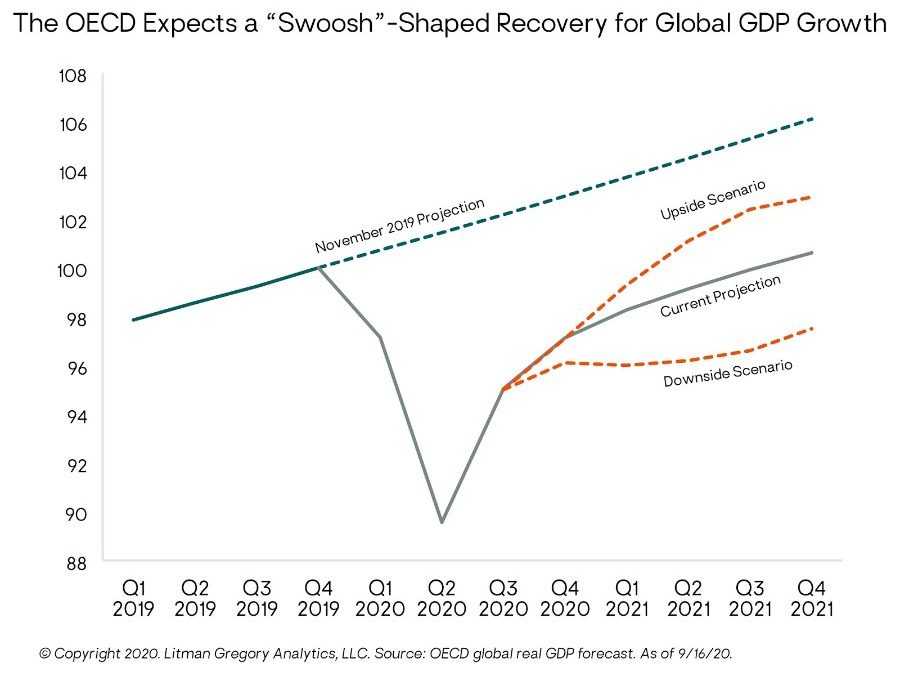

Investment Commentary – In our first quarter 2020 letter back in April, which feels like an eternity ago, we recognized that we were living through an incredible period of history. The pandemic weighed heavily on us then, as it does today. But this quarter, we...

01 Oct 2020

3rd Quarter Charts 2020

Asset Class Returns The S&P 500 is Highly Concentrated at the Top The outperformance of FANMAG stocks means concentration within the index has soared to record highs. The top 10 stocks in the S&P 500 make up a record 28% of the total market cap of the index. The top names in the index have […]

Read More30 Sep 2020

3rd Quarter Newsletter 2020

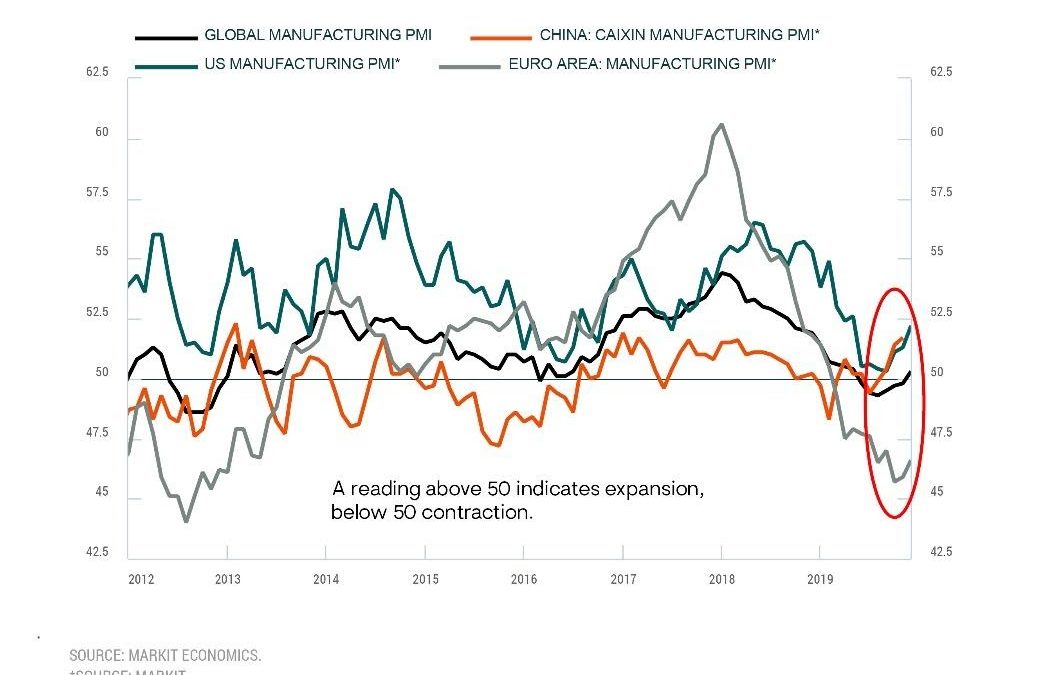

Investment Commentary – Despite some choppiness in September, equity investors were treated to solid gains during the third quarter. The broader stock market rose 8.9% in the quarter and has recovered most of its losses for the year. Developed international stocks gained 6.0% this quarter and emerging-market stocks returned 10.2%. Both groups still trail U.S. […]

Read More

Sep 30, 2020 | Newsletters

Investment Commentary – Despite some choppiness in September, equity investors were treated to solid gains during the third quarter. The broader stock market rose 8.9% in the quarter and has recovered most of its losses for the year. Developed international...

30 Jun 2020

2nd Quarter Newsletter 2020

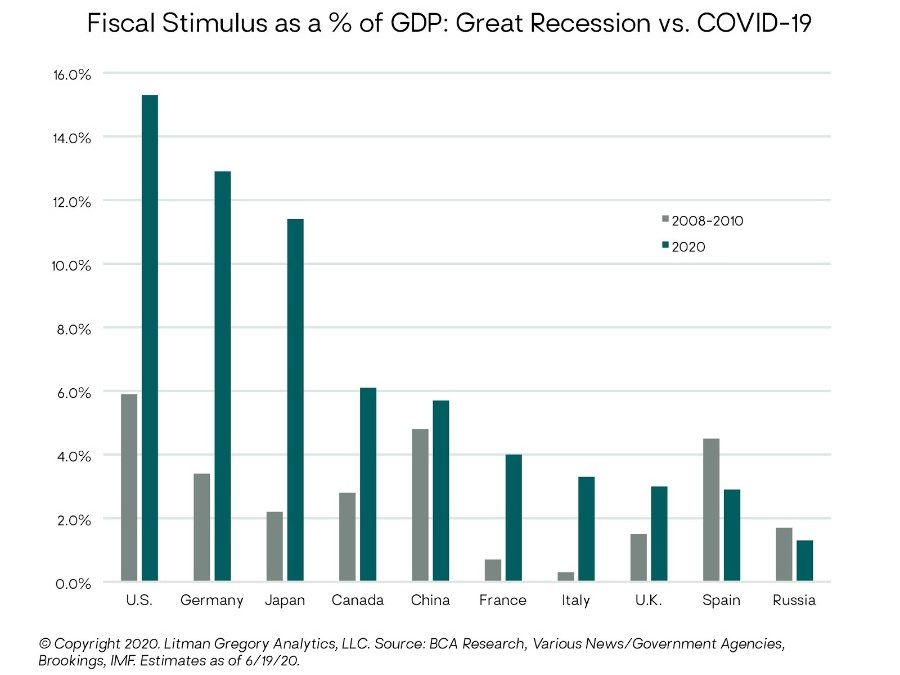

Investment Commentary – For most of the second quarter, financial markets seemed to defy grim economic news, the continued spread of COVID-19, and worldwide protests against racial inequality. Global equities performed strongly for the quarter and rewarded investors who remained invested. From the March 23 low, the U.S. equity market soared 40%, recording its best […]

Read More

Jun 30, 2020 | Newsletters

Investment Commentary – For most of the second quarter, financial markets seemed to defy grim economic news, the continued spread of COVID-19, and worldwide protests against racial inequality. Global equities performed strongly for the quarter and rewarded...

31 Mar 2020

1st Quarter Newsletter 2020

Investment Commentary – We are living through an extraordinary period in history that none of us will ever forget. The impact on our families, communities, and country has been profound. While several weeks ago we had reason for cautious optimism The United States and world are now facing the dual threats of a health crisis […]

Read More

Mar 31, 2020 | Newsletters

Investment Commentary – We are living through an extraordinary period in history that none of us will ever forget. The impact on our families, communities, and country has been profound. While several weeks ago we had reason for cautious optimism The United...

31 Dec 2019

4th Quarter Newsletter 2019

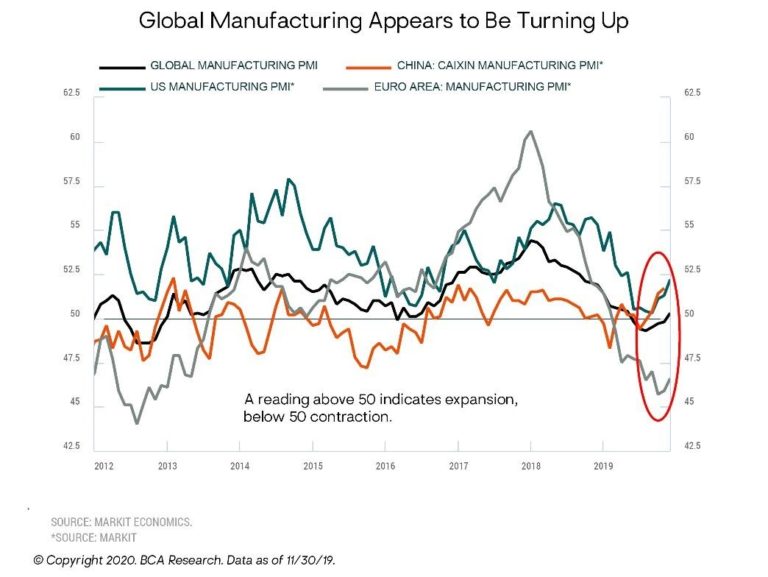

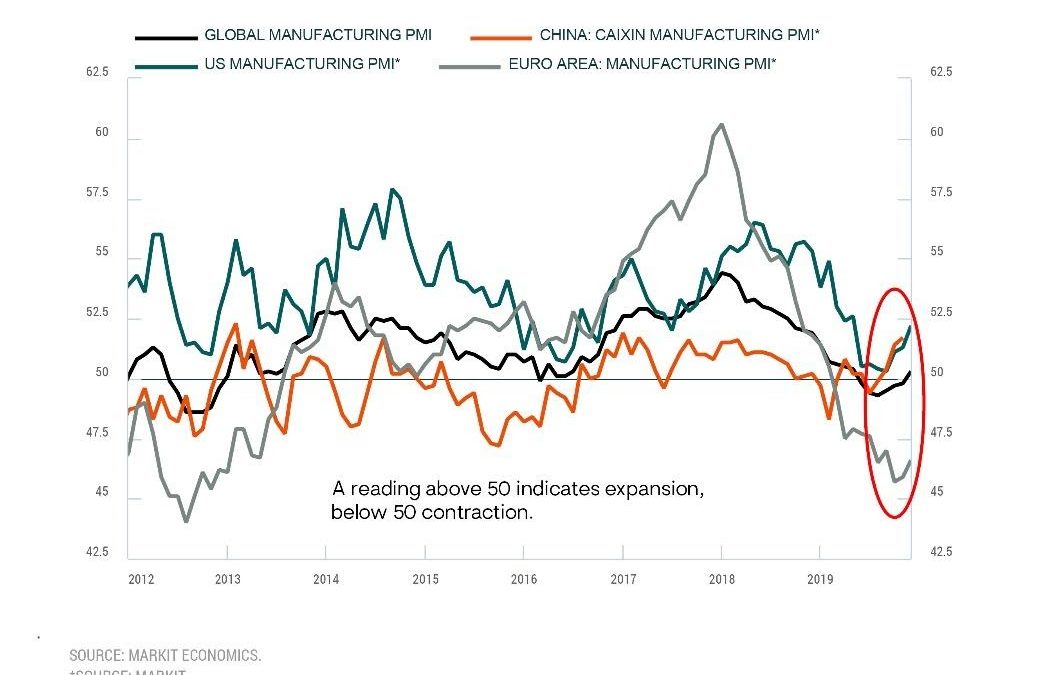

Market and Performance Recap – Our portfolios generated strong returns over 2019, a bullish year for nearly all financial markets. The positive broad-based returns marked a dramatic and welcome turnaround from 2018, a year in which nearly all asset classes faltered. This year’s surprising returns and march toward all-time highs were fueled by a U-turn […]

Read More

Dec 31, 2019 | Newsletters

Market and Performance Recap – Our portfolios generated strong returns over 2019, a bullish year for nearly all financial markets. The positive broad-based returns marked a dramatic and welcome turnaround from 2018, a year in which nearly all asset classes...