19 Oct 2021

Quarter 3, 2021 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President Overview The $3.5 trillion (or more) federal spending proposal now under consideration has some worthy components, but on the whole it is concerning. It’s too large and expensive, and funding it would cause negative dynamic responses through the economy. Here’s a brief overview. Federal Debt The US […]

Read More

Oct 19, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President Overview The $3.5 trillion (or more) federal spending proposal now under consideration has some worthy components, but on the whole it is concerning. It’s too large and expensive, and funding it would cause negative dynamic...

19 Oct 2021

3rd Quarter Newsletter 2021

Market Recap A September slump put a slight pause on the global equity bull market, but domestic stocks were still able to manage slight gains for the third quarter finishing up just 0.6%. Results were not as good for overseas stocks, as foreign developed stocks were down 0.4% and emerging market stocks declined 8.1%. The […]

Read More

Oct 19, 2021 | Newsletters

Market Recap A September slump put a slight pause on the global equity bull market, but domestic stocks were still able to manage slight gains for the third quarter finishing up just 0.6%. Results were not as good for overseas stocks, as foreign developed stocks were...

27 Jul 2021

2nd Quarter Charts 2021

Overseas Economic Data is Surprisingly Strong The U.S. economy has been very strong this year, but it looks like U.S. GDP peaked in the second quarter and will decelerate going into 2022. However, global GDP growth is likely to strengthen in the second half of the year, driven by accelerating growth outside the United States. […]

Read More14 Jul 2021

2nd Quarter Newsletter 2021

Market Recap Equities around the globe continued to surge in the second quarter. The U.S. and developed international markets led the way, with the U.S. stock market gaining 8.5% and developed international stocks rising 5.7%. Emerging-market stocks trailed in terms of progress on the COVID-19 front and in turn rose by a more modest 4.9%. […]

Read More

Jul 14, 2021 | Newsletters

Market Recap Equities around the globe continued to surge in the second quarter. The U.S. and developed international markets led the way, with the U.S. stock market gaining 8.5% and developed international stocks rising 5.7%. Emerging-market stocks trailed in terms...

14 Jul 2021

Quarter 2, 2021 | Outlook for the US Economy by Dr. Ray Perryman

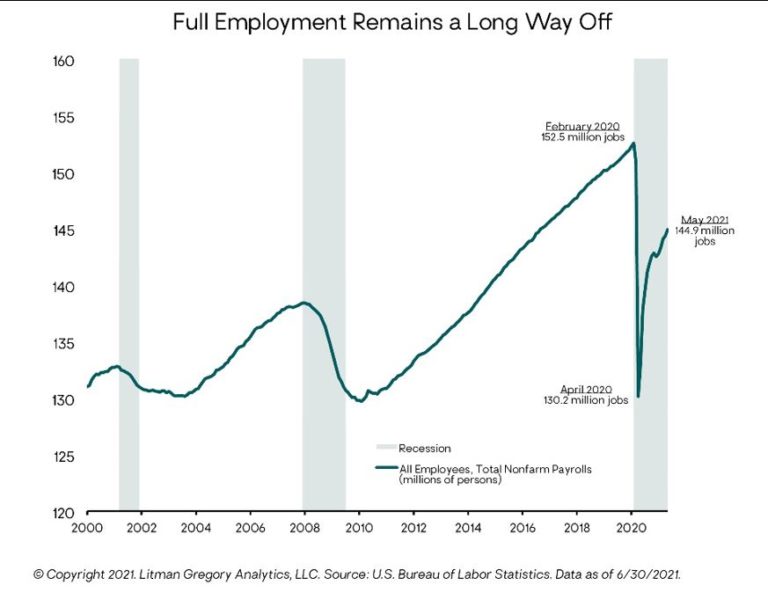

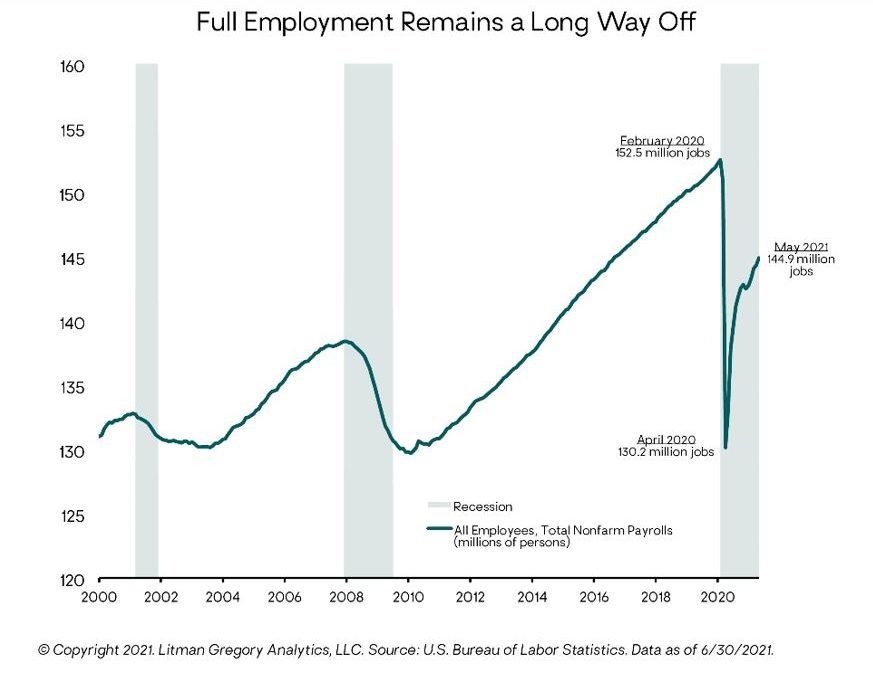

By M. Ray Perryman, PhD, CEO and President Overview Overview – June saw a strong acceleration in the pace of recovery in the job market. Total nonfarm payroll employment in the US rose by 850,000 according to the US Bureau of Labor Statistics, and more than 1.7 million jobs have been gained in the last […]

Read More

Jul 14, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President Overview Overview – June saw a strong acceleration in the pace of recovery in the job market. Total nonfarm payroll employment in the US rose by 850,000 according to the US Bureau of Labor Statistics, and more than 1.7...

01 Apr 2021

Quarter 1, 2021 | Outlook for the US Economy by Dr. Ray Perryman

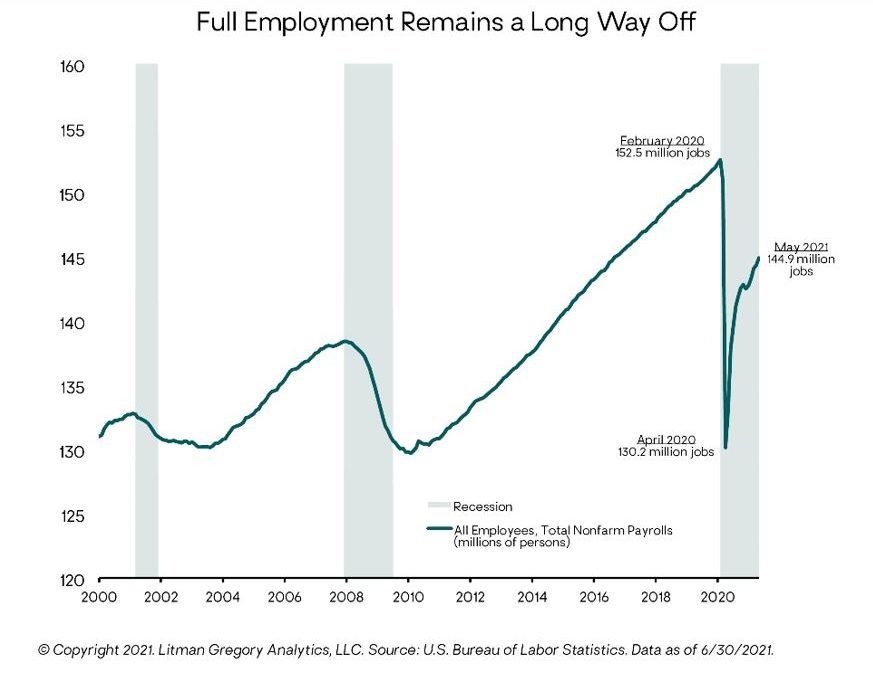

By M. Ray Perryman, PhD, CEO and President Overview –In March, the US economy added 916,000 jobs, led by gains in leisure and hospitality, education, and construction. The unemployment rate fell to 6.0% and the number of unemployed persons dropped to 9.7 million. Overall, the economy is in a much better place than the lows […]

Read More

Apr 1, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President Overview -In March, the US economy added 916,000 jobs, led by gains in leisure and hospitality, education, and construction. The unemployment rate fell to 6.0% and the number of unemployed persons dropped to 9.7 million....

31 Mar 2021

1st Quarter Newsletter 2021

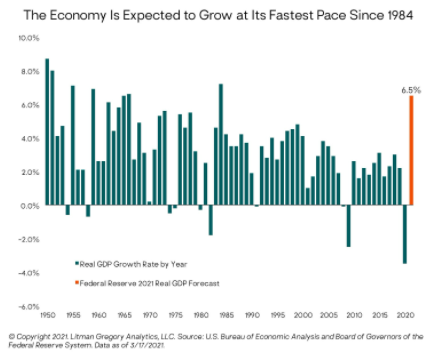

Market Recap Global stocks continued to power upward this quarter from their pandemic bear market low on March 23, 2020. The U.S. stock market gained 6.3% and international stocks gained 4.5%. The U.S. stock market is now up an astonishing 80.6%, since the bottom and its best one-year trailing return since the 1930s. Clearly, it […]

Read More

Mar 31, 2021 | Newsletters

Market Recap Global stocks continued to power upward this quarter from their pandemic bear market low on March 23, 2020. The U.S. stock market gained 6.3% and international stocks gained 4.5%. The U.S. stock market is now up an astonishing 80.6%, since the bottom and...

01 Jan 2021

Quarter 4, 2020 | Outlook for the US Economy by Dr. Ray Perryman

By M. Ray Perryman, PhD, CEO and President of The Perryman Group Overview – With COVID-19 vaccination programs ongoing and effective treatments better understood, a new normal should be possible at some point in 2021. There are myriad challenges, but the path is beginning to emerge. Employment – One key issue for 2021 is the […]

Read More

Jan 1, 2021 | Newsletters

By M. Ray Perryman, PhD, CEO and President of The Perryman Group Overview – With COVID-19 vaccination programs ongoing and effective treatments better understood, a new normal should be possible at some point in 2021. There are myriad challenges, but the path is...

31 Dec 2020

4th Quarter Newsletter 2020

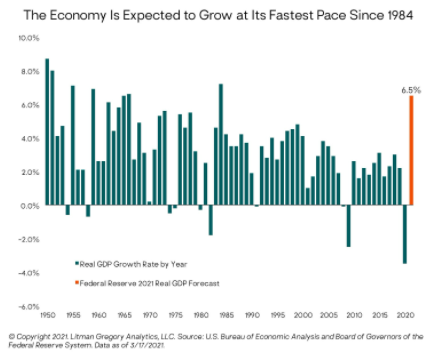

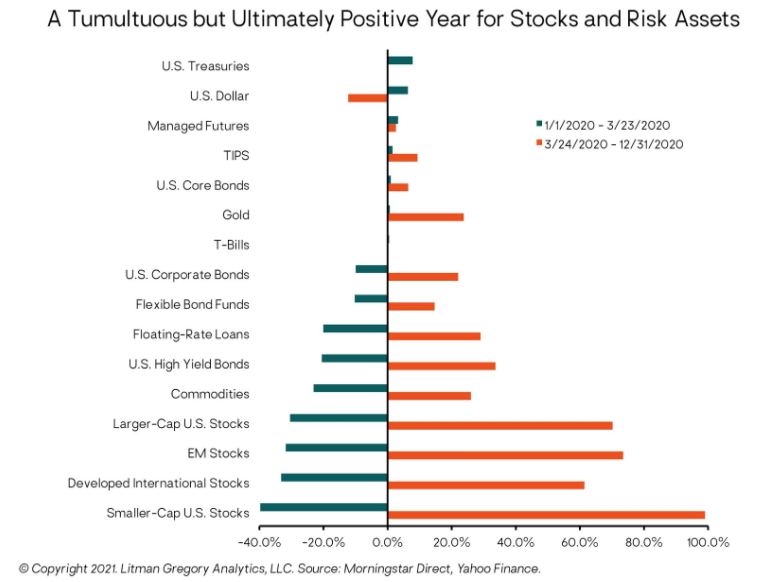

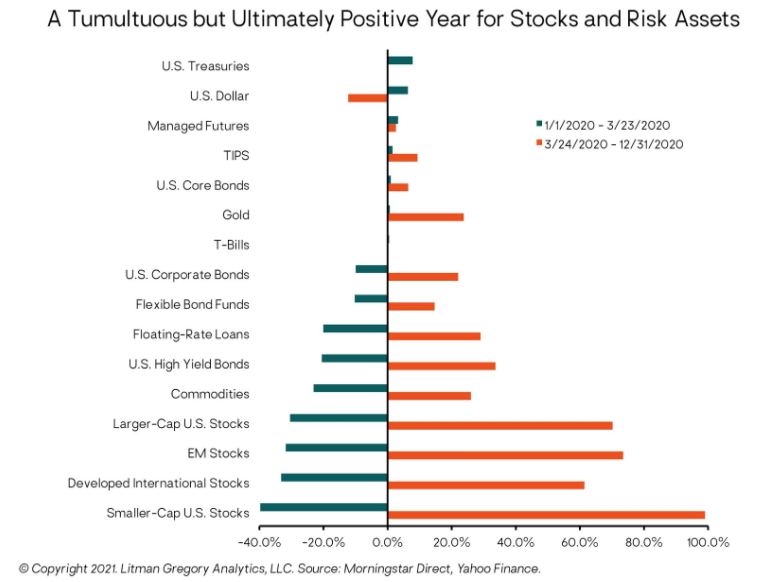

Investment Commentary – In our first quarter 2020 letter back in April, which feels like an eternity ago, we recognized that we were living through an incredible period of history. The pandemic weighed heavily on us then, as it does today. But this quarter, we look back at what we’ve endured and lay out our […]

Read More

Dec 31, 2020 | Newsletters

Investment Commentary – In our first quarter 2020 letter back in April, which feels like an eternity ago, we recognized that we were living through an incredible period of history. The pandemic weighed heavily on us then, as it does today. But this quarter, we...

01 Oct 2020

3rd Quarter Charts 2020

Asset Class Returns The S&P 500 is Highly Concentrated at the Top The outperformance of FANMAG stocks means concentration within the index has soared to record highs. The top 10 stocks in the S&P 500 make up a record 28% of the total market cap of the index. The top names in the index have […]

Read More